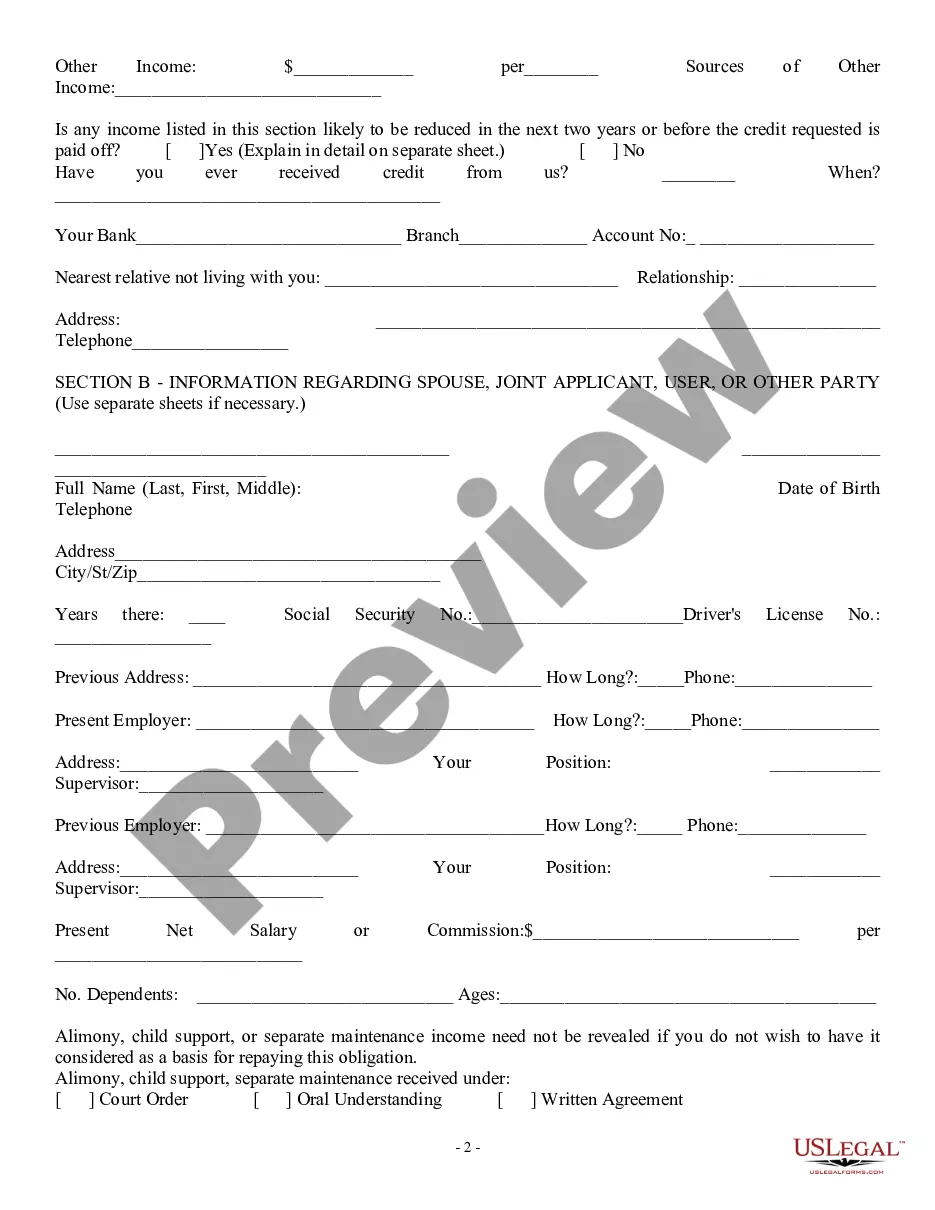

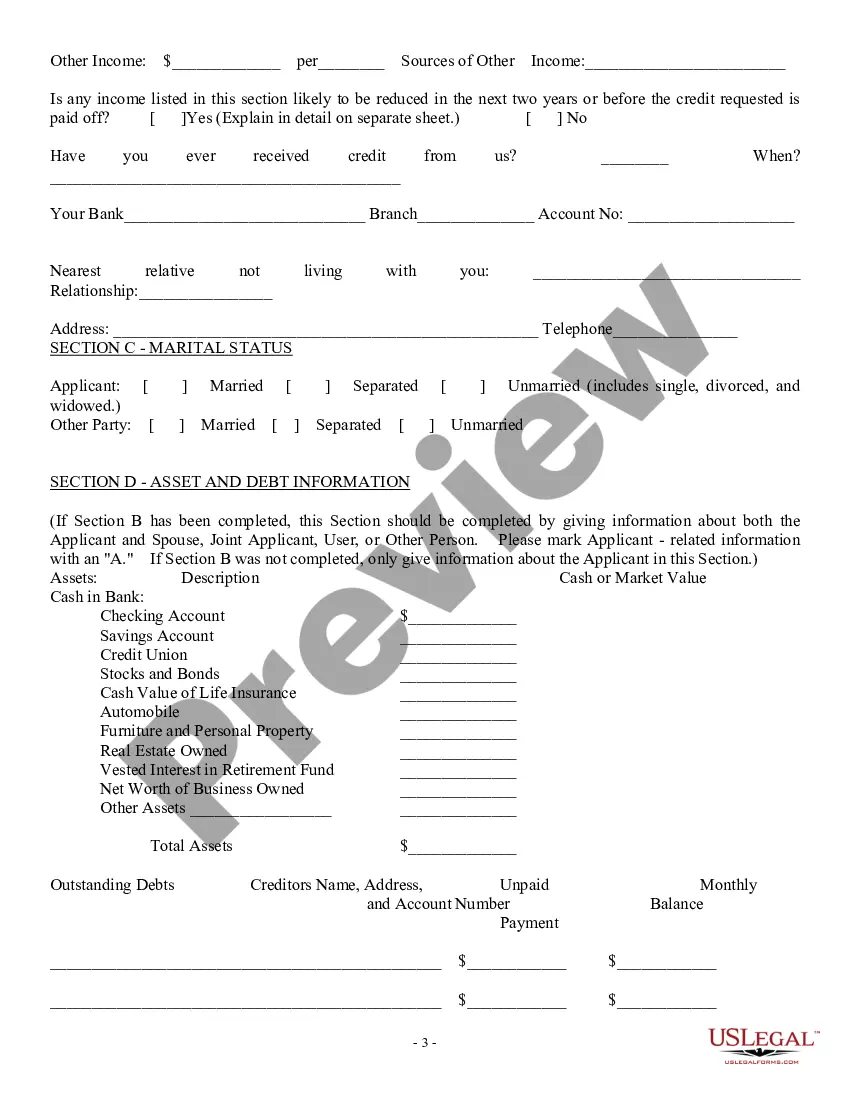

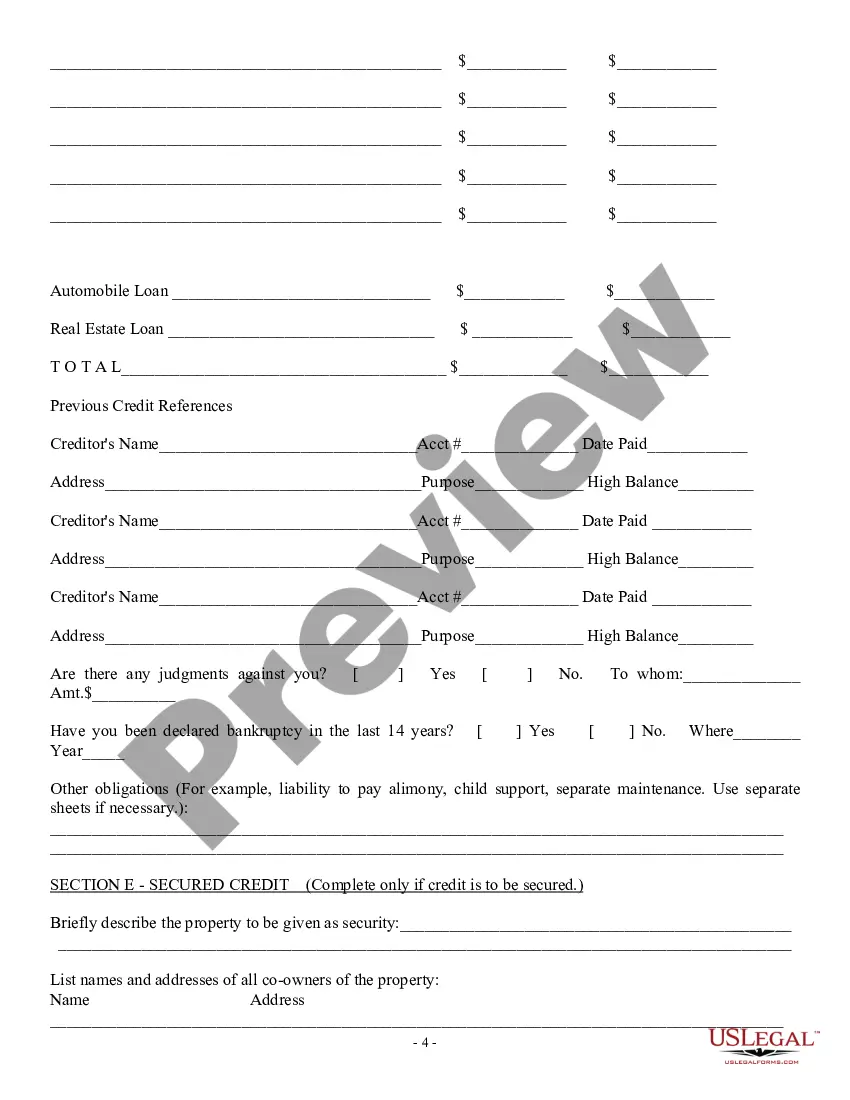

The Hawaii Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions of a personal loan offered to residents of Hawaii. This document is essential for borrowers to understand their rights and obligations when applying for a personal loan from a lending institution in the state. Hawaii Consumer Loan Application: The Hawaii Consumer Loan Application is a standardized form that borrowers complete when applying for a personal loan in Hawaii. This application collects essential information about the borrower, including personal details, employment information, income, expenses, and any existing debts. Lenders require this application to assess the borrower's eligibility and creditworthiness. Personal Loan Agreement: The Personal Loan Agreement is a binding contract between the lender and the borrower, which specifies the terms and conditions of the loan. It covers various aspects of the loan, such as the loan amount, interest rate, repayment terms, late fees, and other fees or charges. Both parties must agree to these terms before the loan is disbursed. Types of Hawaii Consumer Loan Application — Personal Loan Agreement: 1. Secured Personal Loan Agreement: A secured personal loan agreement is one in which the borrower provides collateral to secure the loan. Collateral can include assets such as a home, car, or other valuable property. If the borrower fails to repay the loan, the lender can seize the collateral to recover the balance owed. 2. Unsecured Personal Loan Agreement: An unsecured personal loan agreement does not require collateral. This type of loan agreement is typically granted based on the borrower's creditworthiness, income, and employment history. As there is no collateral involved, lenders often charge higher interest rates for unsecured personal loans to mitigate the risk. 3. Fixed-Rate Personal Loan Agreement: In a fixed-rate personal loan agreement, the interest rate remains the same throughout the loan term. This allows borrowers to have a predictable repayment plan, as the monthly payments remain consistent. Fixed-rate personal loans are popular among individuals who prefer stability and want to avoid any surprises in their loan repayments. 4. Variable-Rate Personal Loan Agreement: Unlike fixed-rate personal loans, variable-rate personal loan agreements have an interest rate that can fluctuate over time. The interest rate is usually tied to a benchmark, such as the prime rate or the LIBOR (London Interbank Offered Rate). Variable-rate personal loans may offer lower initial interest rates but can rise or fall based on market conditions. 5. Payday Loan Agreement: A payday loan agreement is a short-term personal loan in which the borrower borrows a small amount of money with the promise to repay it on their next payday. Payday loans often come with high interest rates and fees. It's important to note that payday loans should be used as a last resort due to their potential for trapping borrowers in a cycle of debt. The Hawaii Consumer Loan Application — Personal Loan Agreement is a crucial document that protects both the borrower and the lender. It ensures transparency and provides clarity regarding the loan terms, helping borrowers make informed decisions while accessing financial assistance for various purposes.

Hawaii Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Hawaii Consumer Loan Application - Personal Loan Agreement?

You can spend hrs on the web trying to find the legal papers design which fits the state and federal specifications you require. US Legal Forms gives thousands of legal kinds that are reviewed by specialists. You can actually download or print out the Hawaii Consumer Loan Application - Personal Loan Agreement from your support.

If you have a US Legal Forms profile, you can log in and then click the Acquire button. Following that, you can total, modify, print out, or indicator the Hawaii Consumer Loan Application - Personal Loan Agreement. Each legal papers design you acquire is yours eternally. To acquire an additional backup associated with a acquired type, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms website the first time, stick to the straightforward recommendations below:

- First, make sure that you have selected the proper papers design for the state/metropolis of your choice. Read the type explanation to ensure you have selected the correct type. If readily available, make use of the Review button to search throughout the papers design as well.

- In order to discover an additional variation of the type, make use of the Look for industry to obtain the design that meets your requirements and specifications.

- When you have found the design you would like, simply click Get now to move forward.

- Pick the pricing prepare you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal profile to fund the legal type.

- Pick the structure of the papers and download it to your system.

- Make modifications to your papers if required. You can total, modify and indicator and print out Hawaii Consumer Loan Application - Personal Loan Agreement.

Acquire and print out thousands of papers templates using the US Legal Forms web site, which offers the largest variety of legal kinds. Use expert and express-particular templates to handle your small business or individual requires.