Hawaii Separation and Property Settlement Agreement

Description

How to fill out Separation And Property Settlement Agreement?

US Legal Forms - one of the most significant libraries of legitimate varieties in the United States - delivers a wide array of legitimate papers layouts you may obtain or printing. Using the website, you may get 1000s of varieties for organization and person reasons, categorized by types, says, or search phrases.You will find the most up-to-date variations of varieties just like the Hawaii Separation and Property Settlement Agreement in seconds.

If you currently have a registration, log in and obtain Hawaii Separation and Property Settlement Agreement in the US Legal Forms local library. The Down load switch will appear on each type you view. You have accessibility to all in the past downloaded varieties from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, listed here are basic guidelines to help you started:

- Be sure to have picked the right type to your area/region. Go through the Preview switch to review the form`s information. Look at the type description to actually have chosen the right type.

- In case the type doesn`t match your demands, make use of the Lookup field at the top of the monitor to discover the one who does.

- When you are happy with the form, confirm your selection by clicking the Purchase now switch. Then, choose the pricing strategy you prefer and provide your credentials to sign up to have an bank account.

- Procedure the financial transaction. Utilize your charge card or PayPal bank account to perform the financial transaction.

- Choose the structure and obtain the form on your system.

- Make alterations. Fill out, modify and printing and signal the downloaded Hawaii Separation and Property Settlement Agreement.

Each and every format you added to your money lacks an expiry day and is also the one you have permanently. So, in order to obtain or printing one more version, just check out the My Forms segment and click on on the type you need.

Get access to the Hawaii Separation and Property Settlement Agreement with US Legal Forms, probably the most extensive local library of legitimate papers layouts. Use 1000s of skilled and condition-certain layouts that meet up with your business or person requirements and demands.

Form popularity

FAQ

Grounds for divorce But it's important to know that even without their consent or agreement, a divorce can be granted when based on 5 years separation if: Your ex-partner won't cooperate or disagrees. You don't have an address for your spouse, but you have evidence that you have done your utmost to find them.

In fact, employers count on this occurring. For a variety of reasons ? despite their position of power and general reluctance to provide a generous severance package ? many employers will nevertheless negotiate.

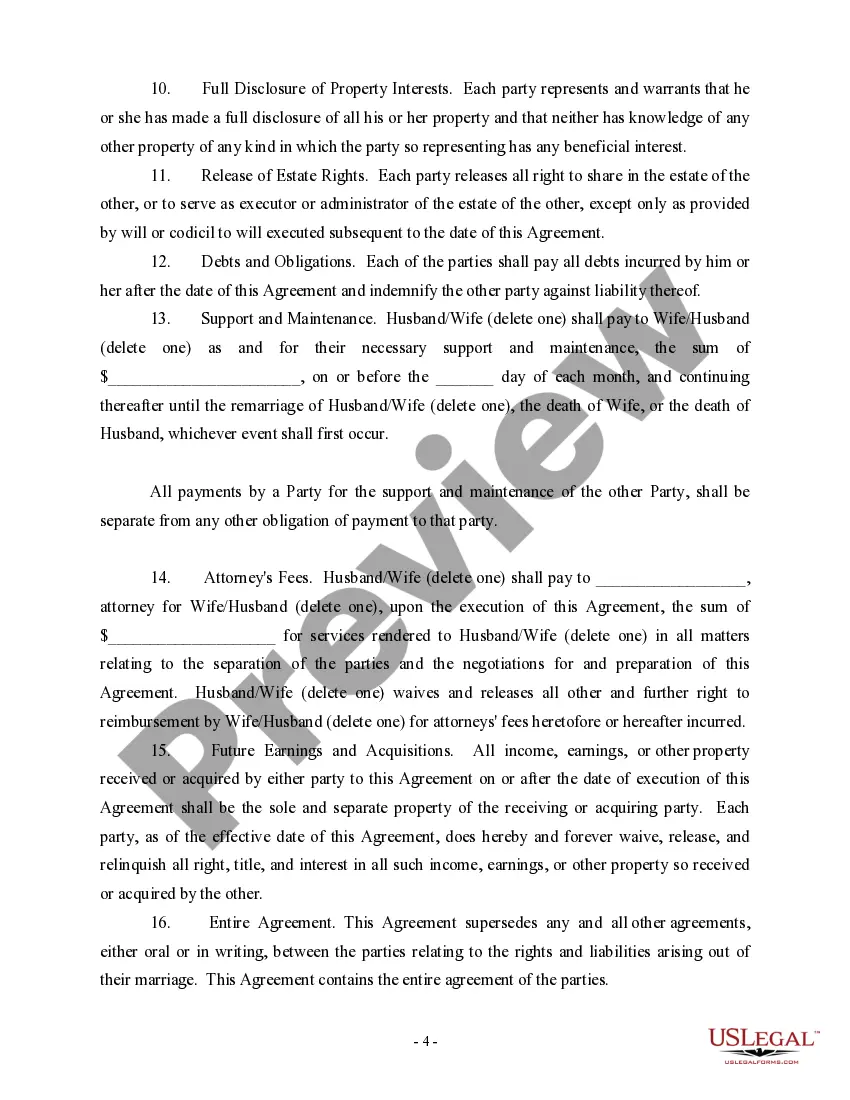

Hawaii is not a community property state, which means the judge will decide how property is divided on the basis of the skills and employability of each spouse, any special medical (or other financial) needs, and the value of unpaid work such as raising children and maintaining the home, for instance.

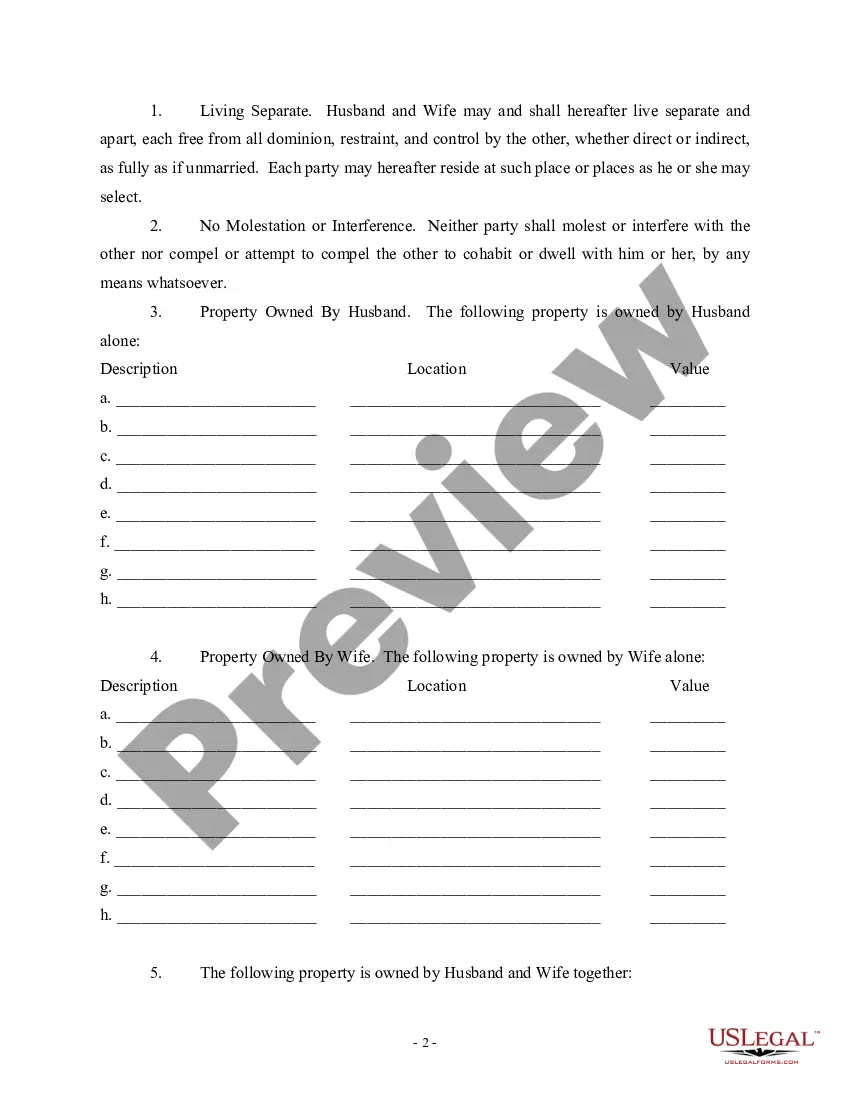

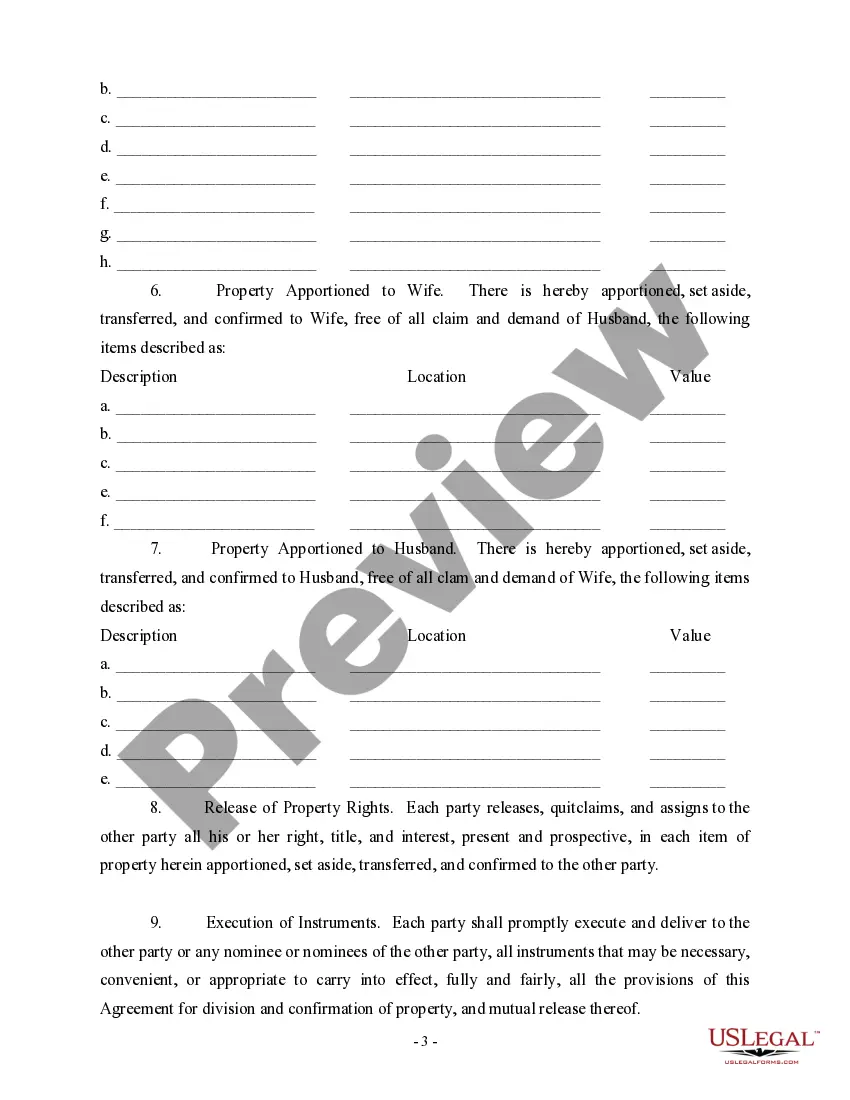

A marital separation agreement, also known as a property settlement agreement, is a written contract dividing your property, spelling out your rights, and settling problems such as alimony and custody.

Separation agreement. n. an agreement between two married people who have agreed to live apart for an unspecified period of time, perhaps forever.

While the state of Hawaii recognizes legal separations, this is a process completely different from the divorce process. In some states, a separation can be one of several steps along the path to divorce, but in Hawaii these are completely different paths.

The Court will divide marital assets and debts based on equity, or fairness, not necessary equally, although in most cases the Court decides that it is equitable to divide all marital assets and debts equally.