A Hawaii irrevocable letter of credit is a financial tool widely used in international trade, providing a secure payment mechanism between a buyer and seller. It serves as a guarantee from a bank to the beneficiary (the seller) that the payment will be made as long as the specified documents and terms are met. This ensures protection for both parties involved in the transaction. There are several types of Hawaii irrevocable letters of credit, including: 1. Commercial Letter of Credit: This type is commonly used in trade transactions to guarantee payment for the purchase of goods or services. It ensures that the buyer's bank will make the payment on behalf of the buyer upon presentation of required shipping documents. 2. Standby Letter of Credit: This type acts as a backup plan or safety net in case the buyer fails to fulfill their payment obligations. If the seller (beneficiary) can prove non-payment or default by the buyer, they can draw on the standby letter of credit, and the bank will make the payment. 3. Revolving Letter of Credit: Unlike other types, a revolving letter of credit allows the buyer to make multiple draw downs within a specified period or for a set amount. It is useful for businesses that have ongoing trade relationships, as it eliminates the need to open separate letters of credit for each transaction. 4. Back-to-Back Letter of Credit: This type involves two independent letters of credit. The first letter of credit serves as collateral for the second, enabling an intermediary to make use of the credit they received from the buyer. It is commonly used when an intermediary is involved in a trade transaction. Hawaii irrevocable letters of credit play a vital role in international trade, ensuring secure and smooth transactions while minimizing financial risks for both buyers and sellers. These instruments provide confidence to exporters, especially small businesses, allowing them to engage in global trade with reduced concerns about payment defaults. It is important to carefully understand the specific terms and conditions of the chosen type of letter of credit to ensure its proper utilization and minimize any potential complications.

Hawaii Irrevocable Letter of Credit

Description

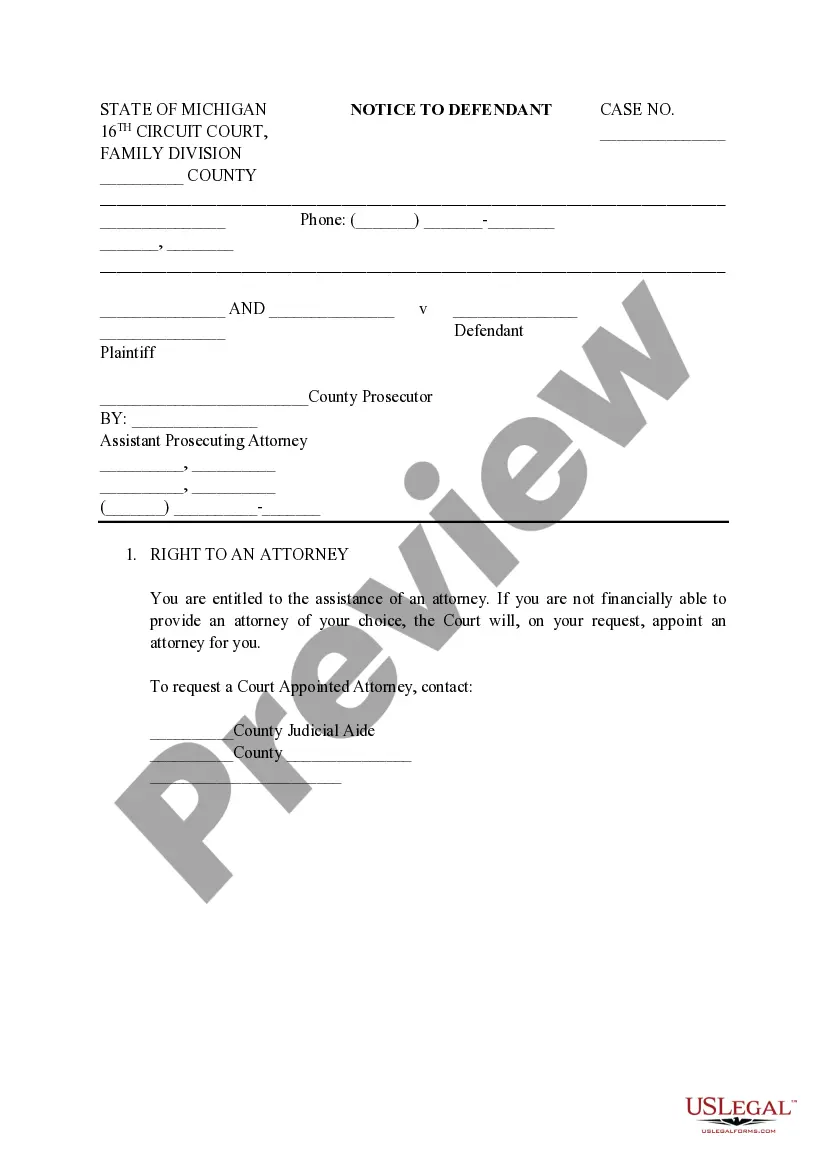

How to fill out Hawaii Irrevocable Letter Of Credit?

Are you currently in a position that you need papers for sometimes enterprise or person uses virtually every time? There are a variety of legitimate papers layouts accessible on the Internet, but finding types you can trust is not effortless. US Legal Forms provides 1000s of develop layouts, like the Hawaii Irrevocable Letter of Credit, that are created in order to meet federal and state requirements.

Should you be presently knowledgeable about US Legal Forms internet site and get an account, merely log in. Next, you can download the Hawaii Irrevocable Letter of Credit format.

Should you not have an accounts and wish to start using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for that appropriate area/area.

- Make use of the Review button to review the shape.

- Read the description to actually have selected the right develop.

- In case the develop is not what you`re seeking, use the Search industry to obtain the develop that meets your needs and requirements.

- When you find the appropriate develop, simply click Purchase now.

- Select the costs strategy you desire, submit the required information to generate your money, and buy the transaction utilizing your PayPal or bank card.

- Choose a convenient data file format and download your backup.

Discover every one of the papers layouts you may have purchased in the My Forms food list. You may get a more backup of Hawaii Irrevocable Letter of Credit at any time, if required. Just click the essential develop to download or printing the papers format.

Use US Legal Forms, one of the most extensive collection of legitimate kinds, to save lots of time and prevent errors. The service provides appropriately produced legitimate papers layouts which can be used for a selection of uses. Make an account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

Irrevocable LC at sight guarantees payment to the seller in return for the goods and services rendered by the seller. There's no significant difference in an LC or irrevocable LC at sight except that the latter is the quickest way to make the payment, i.e. within 5-10 days of meeting the requirements of the contract.

(a) "Irrevocable letter of credit" (ILC), as used in this clause, means a written commitment by a federally insured financial institution to pay all or part of a stated amount of money, until the expiration date of the letter, upon presentation by the Government (the beneficiary) of a written demand therefor.

What Are the Benefits of Using an Irrevocable Letter of Credit for Buyers? Buyers benefit from the assurance that payment will only be made upon proper documentation and compliance. An ILOC reduces the risk of non-performance by the seller and provides a level of security in international trade transactions.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.

(a) "Irrevocable letter of credit" (ILC), as used in this clause, means a written commitment by a federally insured financial institution to pay all or part of a stated amount of money, until the expiration date of the letter, upon presentation by the Government (the beneficiary) of a written demand therefor.

Irrevocable LC at sight guarantees payment to the seller in return for the goods and services rendered by the seller. There's no significant difference in an LC or irrevocable LC at sight except that the latter is the quickest way to make the payment, i.e. within 5-10 days of meeting the requirements of the contract.