This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

Hawaii Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

Finding the right legal document template can be challenging.

Naturally, there are numerous templates available online, but how do you obtain the legal form you need? Utilize the US Legal Forms website.

The service offers a vast array of templates, such as the Hawaii Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse, suitable for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

US Legal Forms is the premier repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click the Acquire button to locate the Hawaii Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse.

- Use your account to review the legal forms you have previously purchased.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure that you have selected the correct form for your state/region.

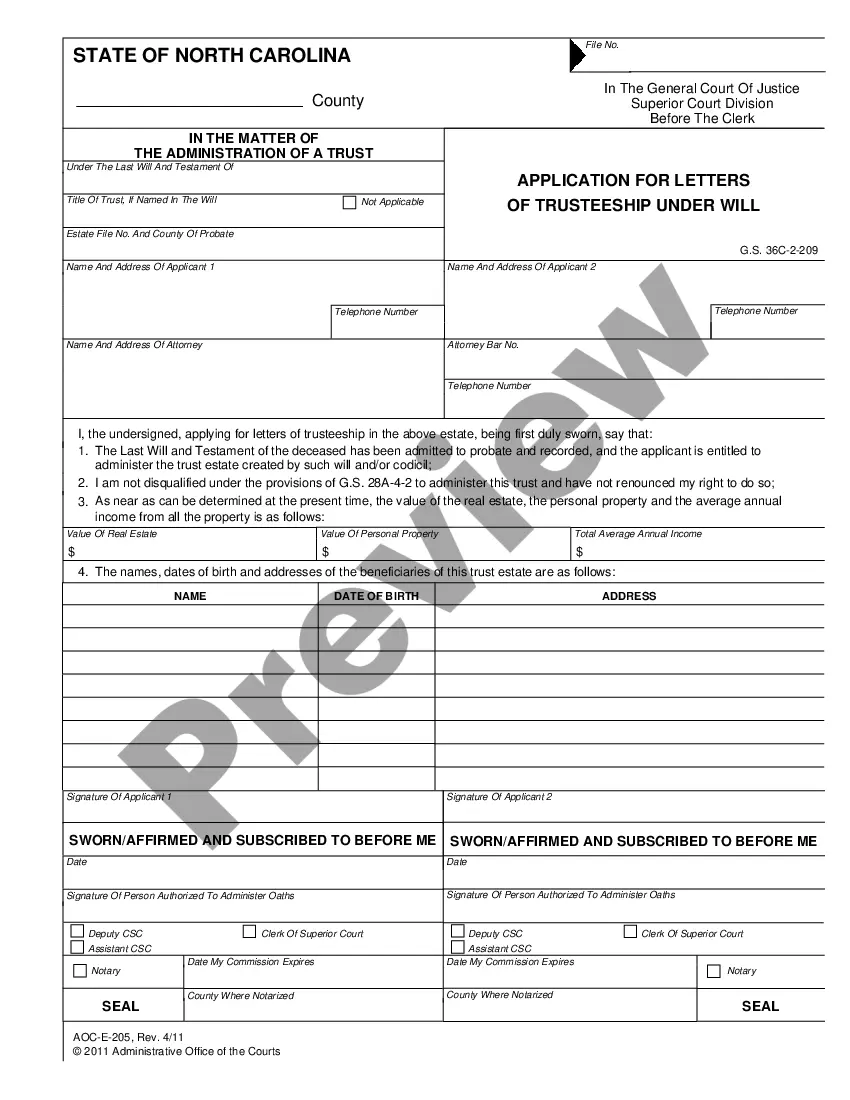

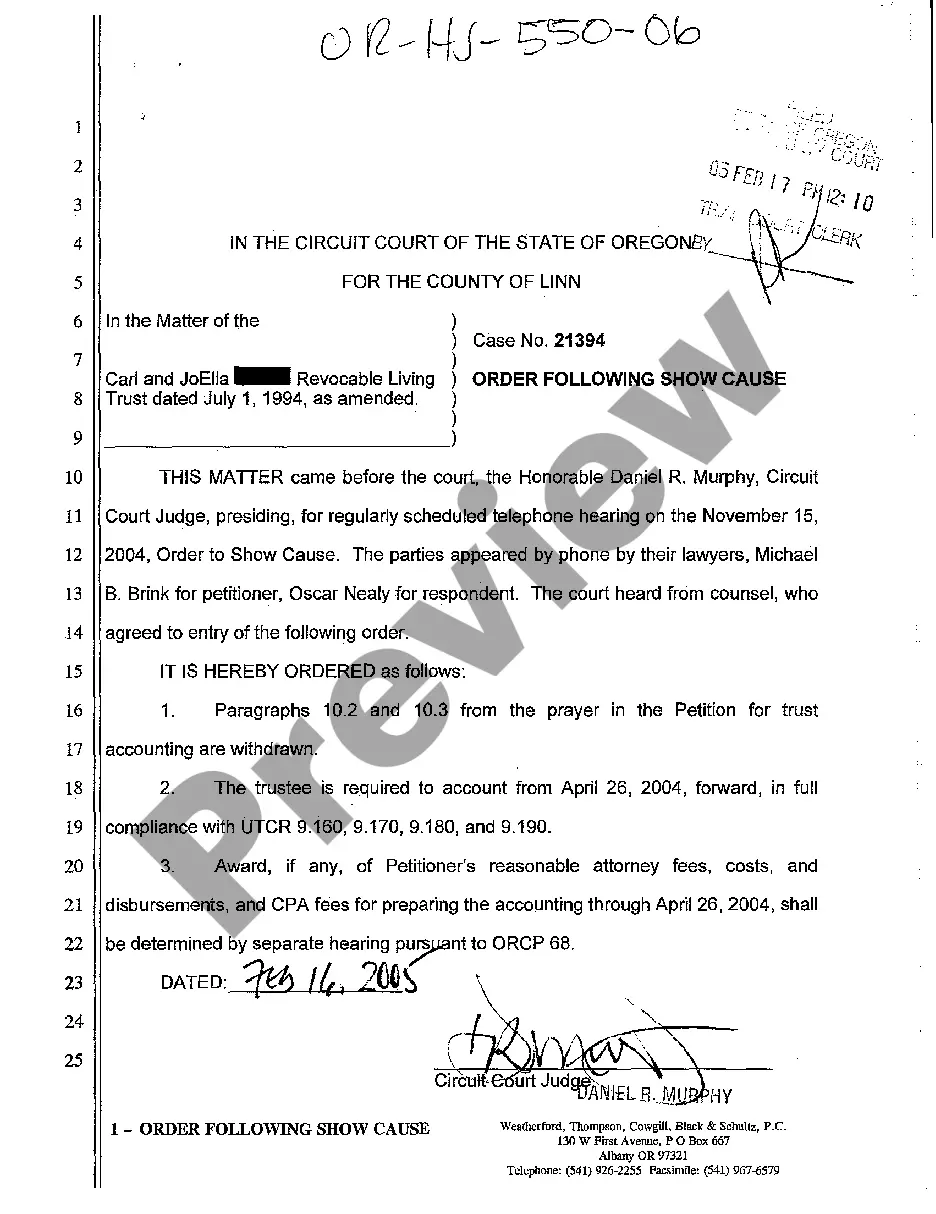

- You can view the form using the Preview button and read the form details to confirm it is the right one for you.

- If the form doesn't suit your requirements, utilize the Search feature to find the appropriate form.

- Once you are confident that the form is correct, click the Buy now button to obtain the form.

- Choose your pricing plan and enter the required information.

- Create your account and finalize your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the obtained Hawaii Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse.

Form popularity

FAQ

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

The manner in which title is held in Texas does not determine ownership. Separate property can also be transformed into community property under much simpler circumstances. If you add your spouse's name to the title of an asset after you marry them, it becomes community property.

Wives: A wife is entitled to an equal share of her husband's property like other entitled heirs. If there are no sharers, she has full right to the entire property. A married Hindu woman is the sole owner and manager of her assets whether earned, inherited or gifted.

How to Make a DisclaimerPut the disclaimer in writing.Deliver the disclaimer to the person in control of the estateusually the executor or trustee.Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Marital assets are property that you earn, purchase or otherwise acquire during the marriage. A separate asset can become marital property if you mix it existing marital assets or otherwise use it for the benefit of the household.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

When property is owned jointly with someone other than a spouse, the entire property is included in the estate of the first to die, unless the other owner can show that he or she contributed enough to acquire a share of the property. This can have adverse estate tax consequences.

A qualified disclaimer is a refusal to accept property that meets the provisions set forth in the Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing for the property or interest in property to be treated as an entity that has never been received.

Accordingly, of a disclaimer of assets into a bypass trust is contemplated, the trust should not contain provisions for a special power of appointment.