Hawaii Miller Trust Forms for Assisted Living are legal documents specifically designed to help individuals qualify for Medicaid assistance while residing in assisted living facilities in Hawaii. These forms are instrumental in enabling individuals with excess income to meet the income eligibility criteria imposed by Medicaid for assisted living care. The concept of a Miller Trust, also known as a Qualified Income Trust (QIT), is derived from federal Medicaid regulations. Medicaid is a government program that provides healthcare coverage for low-income individuals, including long-term care services. However, when it comes to assisted living, Medicaid imposes income limits to determine eligibility. These income limits typically vary from state to state and change annually. In Hawaii, individuals who wish to qualify for Medicaid assistance but have income that exceeds the Medicaid limits can utilize a Hawaii Miller Trust. This trust essentially acts as a mechanism to redirect excess income into a separate trust account. Once the income is redirected, it is no longer considered as personal income for Medicaid eligibility purposes. Instead, it is counted as a contribution to the cost of care paid by the trust. There are a few different types of Hawaii Miller Trust Forms for Assisted Living, including: 1. Hawaii Miller Trust Agreement: This is the main document that establishes the trust and outlines its terms and conditions. It specifies how the trust will be managed, who the beneficiaries are, and how the income will be distributed to cover the cost of care. 2. Hawaii Miller Trust Beneficiary Designation Form: This form is used to designate the individual who will benefit from the funds in the Miller Trust. The beneficiary is typically the Medicaid applicant themselves, but in some cases, a spouse or a disabled child may be designated. 3. Hawaii Miller Trust Financial Disclosure Form: This form requires the applicant to disclose all sources of income and assets to ensure compliance with Medicaid guidelines. It helps to assess the individual's financial situation and determine the amount of excess income that needs to be redirected into the Miller Trust. 4. Hawaii Miller Trust Distribution Request Form: Once the Miller Trust is established, this form is used to request distributions from the trust account to pay for the individual's care expenses in the assisted living facility. These are the primary forms associated with Hawaii Miller Trusts for Assisted Living. It is important to consult with an elder law attorney or a Medicaid planning professional to ensure the correct completion of these forms and to navigate the complexities of Medicaid eligibility and Miller Trust requirements in Hawaii.

Hawaii Miller Trust Forms for Assisted Living

Description

How to fill out Hawaii Miller Trust Forms For Assisted Living?

Are you presently in a position in which you require files for sometimes enterprise or individual uses just about every time? There are a variety of legal document templates available on the Internet, but finding types you can rely isn`t simple. US Legal Forms provides a huge number of kind templates, like the Hawaii Miller Trust Forms for Assisted Living, that are composed to fulfill state and federal demands.

Should you be already informed about US Legal Forms internet site and also have your account, basically log in. Next, you may acquire the Hawaii Miller Trust Forms for Assisted Living template.

If you do not have an bank account and want to start using US Legal Forms, abide by these steps:

- Find the kind you will need and ensure it is to the proper city/region.

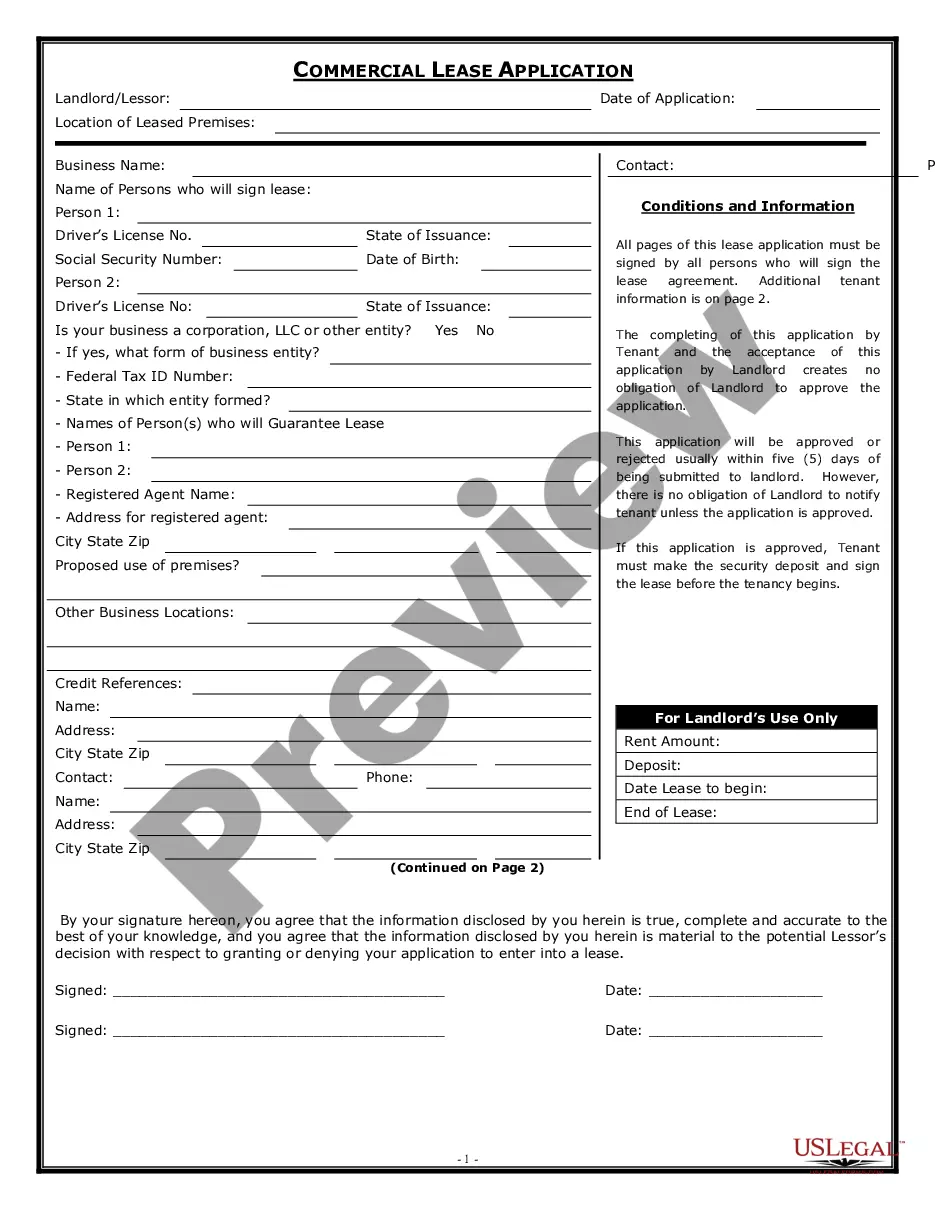

- Make use of the Review button to examine the form.

- Browse the description to ensure that you have chosen the correct kind.

- In case the kind isn`t what you are trying to find, take advantage of the Lookup area to obtain the kind that meets your requirements and demands.

- Whenever you find the proper kind, simply click Buy now.

- Choose the pricing program you would like, complete the desired information to create your money, and buy the transaction using your PayPal or bank card.

- Select a practical data file formatting and acquire your version.

Find all the document templates you may have bought in the My Forms food selection. You can get a more version of Hawaii Miller Trust Forms for Assisted Living at any time, if needed. Just click on the essential kind to acquire or print the document template.

Use US Legal Forms, the most substantial selection of legal forms, in order to save time and stay away from faults. The assistance provides skillfully manufactured legal document templates that you can use for a selection of uses. Produce your account on US Legal Forms and begin creating your lifestyle a little easier.