This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

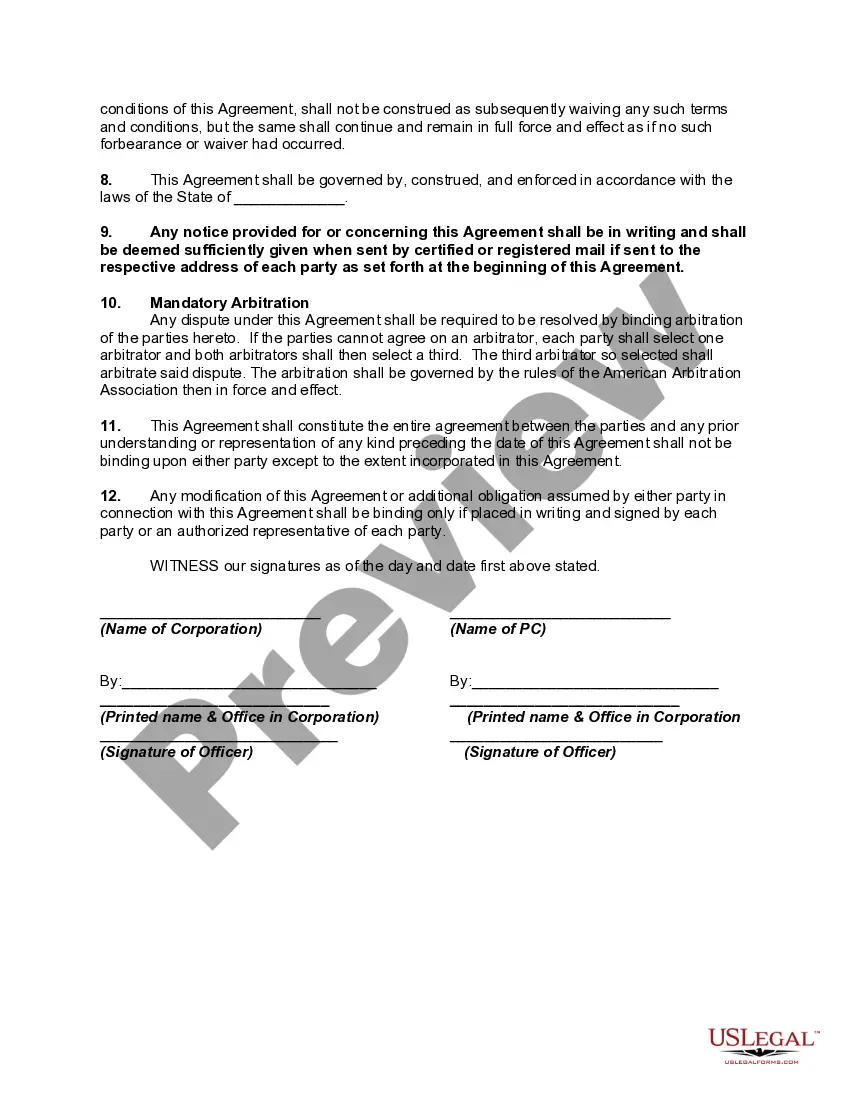

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

Locating the appropriate sanctioned document template can be a challenge.

Certainly, there are many templates available online, but how can you find the official document you need.

Utilize the US Legal Forms website, which provides a vast array of templates, such as the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals Unable to Afford Healthcare, which are suitable for both business and personal purposes.

First, ensure you have selected the correct form for your locality. You can review the document by using the Review button and read the document description to confirm it's suitable for your needs.

- All the documents are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals Unable to Afford Healthcare.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents tab in your account to get another copy of the necessary documents.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

In Hawaii, General Excise (GE) tax returns must usually be filed annually, quarterly, or monthly based on your gross income. Generally, organizations with larger gross incomes are required to file more frequently. Understanding your tax obligations as an organization involved in the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare is essential to ensure compliance and focus on your mission.

In Hawaii, a nonprofit corporation must have at least three directors on its board. These directors cannot all be related to each other, as this can lead to conflicts of interest. When establishing your board, consider how the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare might benefit from a diverse and committed board, fostering broad perspectives.

The 33% rule for nonprofits refers to a general guideline ensuring that at least one-third of an organization’s board members have no financial ties to the organization. This policy aims to maintain transparency and mitigate conflicts of interest. In the context of the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, adhering to this rule can strengthen your partnerships and trust within the community.

A domestic nonprofit corporation is an organization that operates in the state where it was formed. It does not distribute profits to members but focuses on promoting charitable, educational, or other non-profit goals. Incorporating under the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare can enhance your credibility and support the mission of helping underserved populations.

To start an S Corporation in Hawaii, begin by forming a corporation through the Department of Commerce and Consumer Affairs. You must then file Form 2553 with the IRS to elect S Corporation status. It’s crucial to understand how the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare can impact your structure and operations, especially if your corporation collaborates with non-profit entities.

Starting a non-profit in Hawaii involves several steps. First, you need to choose a name for your organization that complies with state regulations. After that, you should file articles of incorporation with the Hawaii Department of Commerce and Consumer Affairs. Additionally, consider utilizing the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, as it can facilitate beneficial partnerships for your organization.

The No Surprise Billing Act in Washington State protects patients from unexpected medical bills, particularly in emergency situations. This legislation ensures that patients receive clear information about their coverage and potential costs before they receive care. By incorporating principles from the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, healthcare providers can align their practices to avoid surprises for patients while delivering quality care. Understanding this act is vital for both patients and providers alike.

In Washington State, the income limit for medical assistance varies by program and household size. Generally, the limits aim to ensure accessible healthcare for low-income residents. Those interested can reference the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare for solutions tailored towards financially challenged populations. This agreement can help organizations provide necessary healthcare services within the state’s guidelines.

In Missouri, non-physicians may not directly own a medical practice due to state regulations. However, there are ways for non-physicians to be involved in healthcare business entities. For instance, the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare offers a framework that supports collaboration between different entities. This agreement ensures compliance while expanding access to healthcare services.

The corporate practice of medicine varies by state, with some allowing it under specific conditions while others completely ban it. States like California and Texas have stringent rules that prevent non-physician ownership. To navigate these complexities, using a platform like uslegalforms can guide you in drafting compliant agreements, such as the Hawaii Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare.