The Hawaii Venture Capital Finder's Fee Agreement is a legal document that outlines the terms and conditions under which a finder's fee will be paid to an individual or firm for connecting entrepreneurs and start-up companies with potential venture capital investors in Hawaii. This agreement is crucial in facilitating the growth of Hawaii's entrepreneurial ecosystem by incentivizing individuals and organizations to identify and refer high-potential investment opportunities to venture capitalists. Key terms that may be present in the Hawaii Venture Capital Finder's Fee Agreement include: 1. Compensation: The agreement specifies the details of the compensation to be paid to the finder for their services in identifying and introducing the entrepreneurs or start-up companies to the venture capitalists. The compensation may be in the form of a percentage of the investment made or a fixed amount. 2. Exclusivity: This clause may outline if the finder has an exclusive right to introduce potential investment opportunities to a particular venture capitalist. It highlights the exclusivity of the agreement and ensures that the finder is the sole and primary source for connecting entrepreneurs with that specific investor. 3. Confidentiality: To protect the sensitive information about the entrepreneurs, start-up companies, valuation, or any other confidential details shared during the process, a confidentiality clause is often included. This provision prohibits the finder from disclosing any proprietary information to third parties without prior consent. 4. Termination: The agreement might detail the circumstances under which the contract can be terminated, either by mutual agreement or due to violations of the terms and conditions set forth in the agreement. It also specifies the notice period required for termination. 5. Representations and Warranties: This section establishes the assurances made by both parties regarding their authority, eligibility, and ability to enter into the agreement. It ensures that the finder has the necessary license, expertise, and resources to perform their duties, while the venture capitalist warrants their ability and willingness to invest in potential opportunities. Types of Hawaii Venture Capital Finder's Fee Agreements may include: a. Individual Finder's Fee Agreement: In this type of agreement, an individual acts as a finder, independently sourcing and referring investment opportunities to venture capitalists for a fee. b. Firm-Client Finder's Fee Agreement: This agreement is made between a finder firm and its client, typically a start-up, where the firm is engaged to identify potential venture capital investors for the client and negotiate the terms of an investment. c. Exclusive Finder's Fee Agreement: This specific type of agreement grants exclusivity to the finder, allowing them to connect one venture capitalist with multiple entrepreneurs or start-up companies in Hawaii. The exclusivity ensures that the finder has the sole right to introduce investment opportunities to that particular venture capitalist.

Hawaii Venture Capital Finder's Fee Agreement

Description

How to fill out Hawaii Venture Capital Finder's Fee Agreement?

If you need to complete, acquire, or printing authorized file templates, use US Legal Forms, the biggest selection of authorized forms, which can be found online. Make use of the site`s simple and easy hassle-free look for to find the files you will need. Various templates for business and individual functions are sorted by types and suggests, or search phrases. Use US Legal Forms to find the Hawaii Venture Capital Finder's Fee Agreement with a couple of clicks.

If you are previously a US Legal Forms buyer, log in to your account and click the Download option to get the Hawaii Venture Capital Finder's Fee Agreement. Also you can entry forms you earlier downloaded inside the My Forms tab of your account.

If you use US Legal Forms initially, refer to the instructions below:

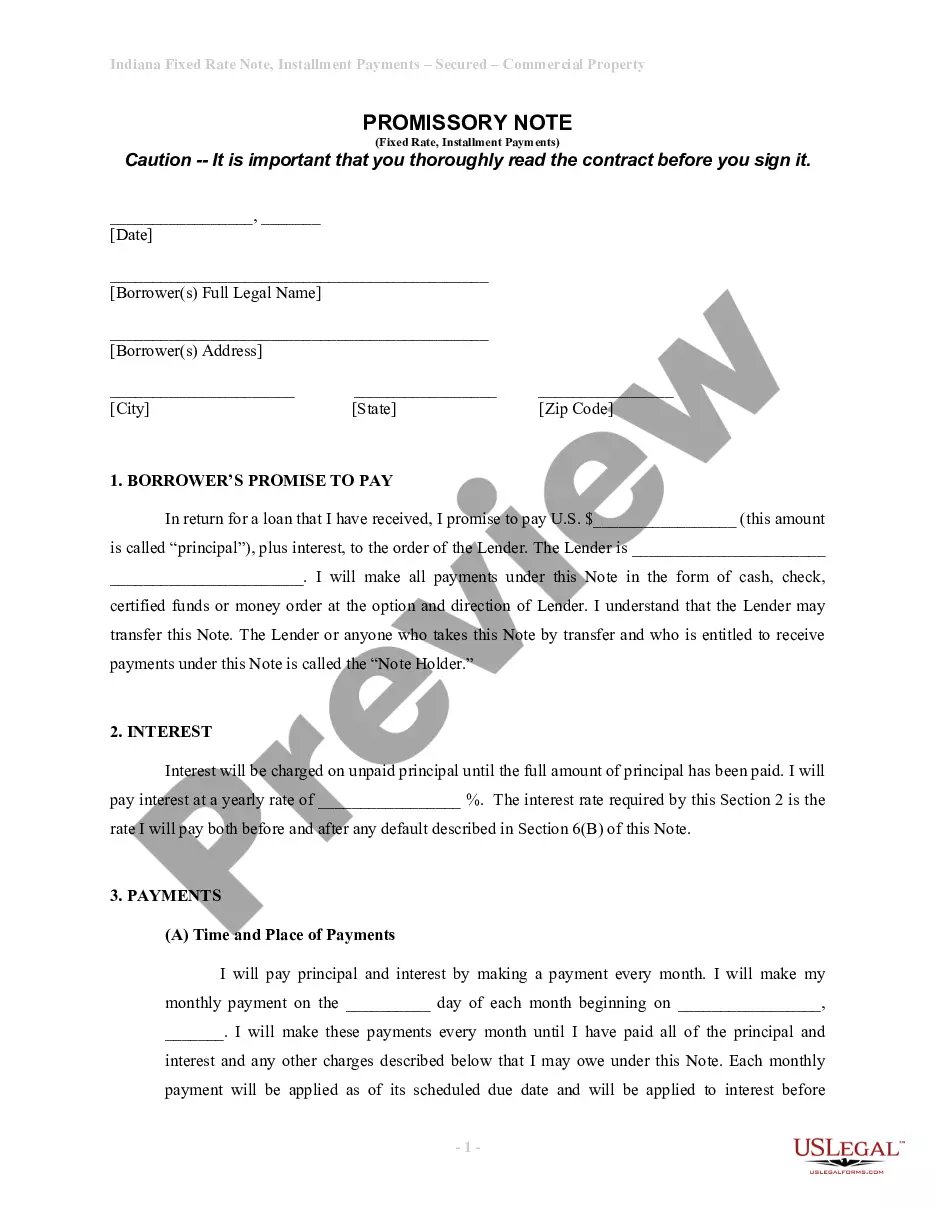

- Step 1. Be sure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Make use of the Review option to look over the form`s articles. Never forget about to learn the explanation.

- Step 3. If you are unhappy with all the type, make use of the Research discipline at the top of the display to find other versions in the authorized type format.

- Step 4. When you have discovered the shape you will need, go through the Buy now option. Opt for the prices prepare you favor and put your accreditations to register to have an account.

- Step 5. Approach the purchase. You should use your bank card or PayPal account to accomplish the purchase.

- Step 6. Pick the format in the authorized type and acquire it on the device.

- Step 7. Complete, edit and printing or sign the Hawaii Venture Capital Finder's Fee Agreement.

Each authorized file format you buy is yours eternally. You have acces to each and every type you downloaded in your acccount. Click on the My Forms portion and choose a type to printing or acquire yet again.

Remain competitive and acquire, and printing the Hawaii Venture Capital Finder's Fee Agreement with US Legal Forms. There are thousands of professional and express-specific forms you can utilize for your business or individual requirements.