Almost every state has special statutory methods for the administration of insolvent estates. These statutes vary widely from one jurisdiction to another. Creditors of an insolvent estate generally have greater rights than creditors of solvent estates. For example, each creditor may have the right to be heard in opposition to claims of other creditors against the estate. If a creditor's opposition is successful, he or she thereby increases the amount available to pay his or her own claim.

Claims of creditors against an insolvent estate are general be paid pro rata. It is a breach of duty for a representative of an insolvent estate to prefer some creditors over others of the same class. Of course, if statutory preferences or priorities exist, payment of claims must be made accordingly.

Some jurisdictions do not have special statutory methods for the administration of insolvent estates. Some have statutory provisions only on particular phases of administration, for example, provisions prescribing the order in which debts of an insolvent estate are to be paid. Accordingly, in many cases the forms in other divisions of this title may be used, with appropriate modifications, in the administration of such an estate.

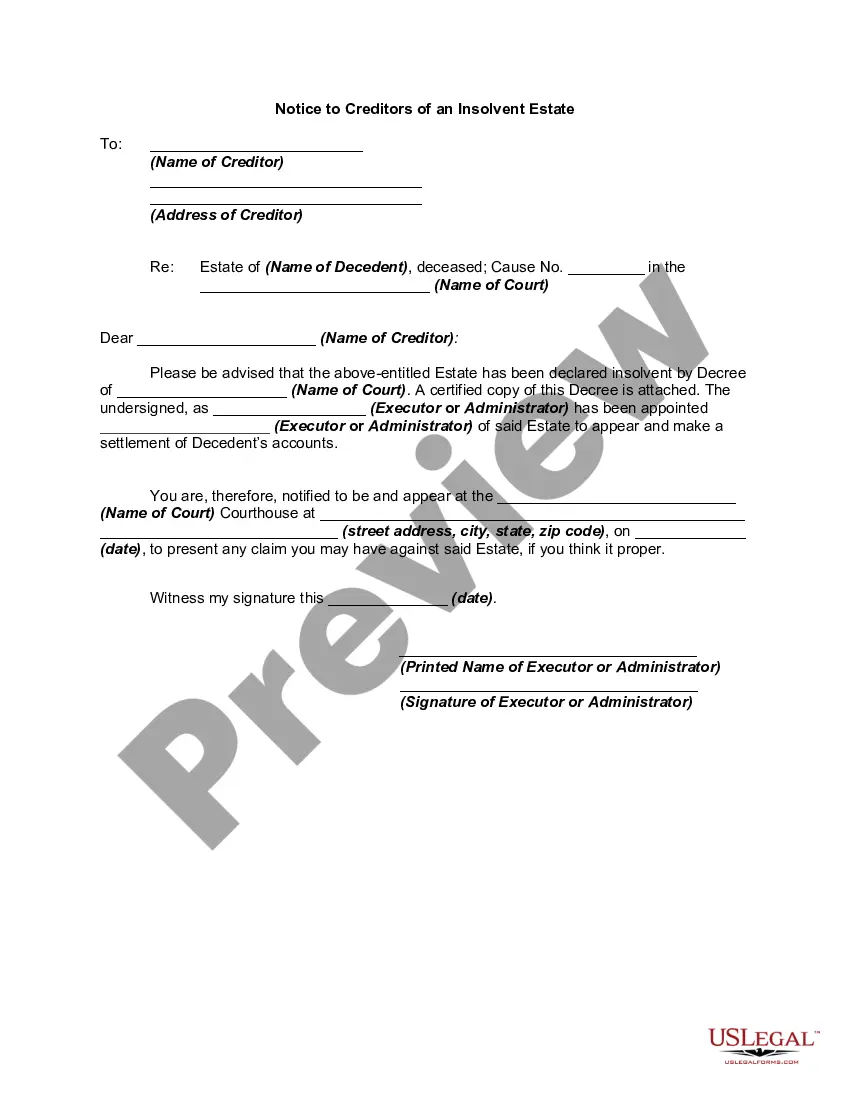

Title: Hawaii Notice to Creditors of an Insolvent Estate: A Comprehensive Guide Introduction: In Hawaii, when an estate is deemed insolvent, it means that the deceased individual's liabilities exceed the value of their assets. To address the distribution of the remaining estate, the court issues a Notice to Creditors of an Insolvent Estate. In this article, we will delve into the details of what this notice entails, its purpose, and the different types related to it. 1. What is a Notice to Creditors of an Insolvent Estate? — A Notice to Creditors of an Insolvent Estate is a legally required document filed in probate court to inform all potential creditors of the deceased's estate that they must file their claims within a specified timeframe. — This notice safeguards the deceased's estate by ensuring fair distribution among creditors and prevents any fraudulent claims. 2. Purpose of the Notice: — The primary purpose of issuing a Notice to Creditors of an Insolvent Estate is to provide an opportunity for all creditors to come forward and submit their claims against the estate. — This notification allows the court to determine the validity of the claims and the order in which they will be paid, considering the available assets of the insolvent estate. — It aims to impart a sense of transparency and accountability in the probate process, protecting both the creditors and the estate. 3. Content and Requirements of the Notice: — The Notice to Creditors of an Insolvent Estate typically consists of detailed information, including the name and address of the deceased, the probate court, the appointed personal representative, and the estate's filing number. — The notice must clearly state the deadline for submitting claims, often referred to as the "claim period," which is usually within four months from the notice's first publication. — Creditors are also provided with instructions on how to submit their claims, ensuring compliance with the probate court's requirements. — Additionally, the notice is generally published in local newspapers to reach a wider audience and maximize creditor participation. 4. Unique Types of Hawaii Notice to Creditors of an Insolvent Estate: — Notice to Known Creditors: This type of notice is specifically served to creditors who are already known by the personal representative and are reasonably ascertainable. — Notice to Unknown Creditors: This notice is published to notify potential creditors who are not known or reasonably ascertainable by the personal representative. — Notice by Publication: As mentioned earlier, this notice is published in newspapers or other local publications to reach creditors who may not have direct knowledge of the insolvent estate. Conclusion: The Notice to Creditors of an Insolvent Estate plays a crucial role in ensuring a fair and transparent distribution of assets while protecting the interests of creditors. This document provides creditors with an opportunity to come forward and submit their claims, allowing the probate court to evaluate and prioritize payments. By complying with the established procedures, the affairs of an insolvent estate can be resolved with integrity and justice.Title: Hawaii Notice to Creditors of an Insolvent Estate: A Comprehensive Guide Introduction: In Hawaii, when an estate is deemed insolvent, it means that the deceased individual's liabilities exceed the value of their assets. To address the distribution of the remaining estate, the court issues a Notice to Creditors of an Insolvent Estate. In this article, we will delve into the details of what this notice entails, its purpose, and the different types related to it. 1. What is a Notice to Creditors of an Insolvent Estate? — A Notice to Creditors of an Insolvent Estate is a legally required document filed in probate court to inform all potential creditors of the deceased's estate that they must file their claims within a specified timeframe. — This notice safeguards the deceased's estate by ensuring fair distribution among creditors and prevents any fraudulent claims. 2. Purpose of the Notice: — The primary purpose of issuing a Notice to Creditors of an Insolvent Estate is to provide an opportunity for all creditors to come forward and submit their claims against the estate. — This notification allows the court to determine the validity of the claims and the order in which they will be paid, considering the available assets of the insolvent estate. — It aims to impart a sense of transparency and accountability in the probate process, protecting both the creditors and the estate. 3. Content and Requirements of the Notice: — The Notice to Creditors of an Insolvent Estate typically consists of detailed information, including the name and address of the deceased, the probate court, the appointed personal representative, and the estate's filing number. — The notice must clearly state the deadline for submitting claims, often referred to as the "claim period," which is usually within four months from the notice's first publication. — Creditors are also provided with instructions on how to submit their claims, ensuring compliance with the probate court's requirements. — Additionally, the notice is generally published in local newspapers to reach a wider audience and maximize creditor participation. 4. Unique Types of Hawaii Notice to Creditors of an Insolvent Estate: — Notice to Known Creditors: This type of notice is specifically served to creditors who are already known by the personal representative and are reasonably ascertainable. — Notice to Unknown Creditors: This notice is published to notify potential creditors who are not known or reasonably ascertainable by the personal representative. — Notice by Publication: As mentioned earlier, this notice is published in newspapers or other local publications to reach creditors who may not have direct knowledge of the insolvent estate. Conclusion: The Notice to Creditors of an Insolvent Estate plays a crucial role in ensuring a fair and transparent distribution of assets while protecting the interests of creditors. This document provides creditors with an opportunity to come forward and submit their claims, allowing the probate court to evaluate and prioritize payments. By complying with the established procedures, the affairs of an insolvent estate can be resolved with integrity and justice.