Title: Understanding Hawaii Employment Agreement with Chief Financial Officer: Types and Important Points Introduction: Hawaii Employment Agreements with Chief Financial Officers (CFOs) are legally binding documents that establish the terms and conditions of employment between a company based in Hawaii and a CFO. This article aims to provide a detailed description of the various types of Hawaii Employment Agreements with CFOs, covering the essential elements, key provisions, and noteworthy considerations. Types of Hawaii Employment Agreements with Chief Financial Officers: 1. Fixed-term Employment Agreement: This type of agreement sets a specific duration for the CFO's employment, after which it may be renewed or terminated depending on performance and mutual agreement. 2. At-will Employment Agreement: In this agreement, either party, the CFO or the company, may terminate the employment relationship at any time, without prior notice or cause. 3. Executive Employment Agreement: This specialized agreement is applicable to high-level CFO roles, outlining additional provisions such as compensation packages, performance-based bonuses, equity-based incentives, and fringe benefits. Important Factors to Consider: 1. Compensation and Benefits: Hawaii CFO Employment Agreements often include clauses specifying the CFO's base salary, bonuses, retirement plans, health insurance, vacation days, reimbursement policies, and other compensatory elements. 2. Roles and Responsibilities: Clearly defining the CFO's job description, duties, and reporting structure is vital to ensure clarity and avoid any potential conflicts. 3. Non-Disclosure and Non-Compete Clauses: Confidentiality agreements play a significant role in protecting a company's sensitive information, proprietary data, trade secrets, and intellectual property. Non-compete clauses prevent CFOs from engaging in competitive activities directly after leaving the company. 4. Termination and Severance: This section delineates the process, conditions, and consequences for terminating the CFO's employment, including obligations during the notice period, severance pay, garden leave, and post-employment restrictive covenants. 5. Dispute Resolution: Establishing a method for settling potential conflicts, such as mediation or arbitration, can help resolve any disagreements efficiently, minimizing potential litigation costs. 6. Governing Law: Clearly specifying that the agreement will be governed by the laws of the State of Hawaii ensures consistency and provides a legal framework for the agreement. Conclusion: Hawaii Employment Agreements with Chief Financial Officers are crucial for both companies and CFOs, as they lay the foundation for a successful professional relationship. By incorporating the essential elements mentioned above, these agreements promote transparency, protect the interests of both parties, and provide a clear understanding of the terms and conditions of employment.

Hawaii Employment Agreement with Chief Financial Officer

Description

How to fill out Hawaii Employment Agreement With Chief Financial Officer?

You may spend hours on the web trying to find the legal document design that suits the federal and state requirements you need. US Legal Forms offers a large number of legal types which can be examined by pros. You can easily obtain or produce the Hawaii Employment Agreement with Chief Financial Officer from the assistance.

If you already have a US Legal Forms profile, it is possible to log in and then click the Acquire option. After that, it is possible to complete, modify, produce, or signal the Hawaii Employment Agreement with Chief Financial Officer. Every legal document design you buy is your own property permanently. To get one more version for any acquired type, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms site the very first time, keep to the straightforward instructions listed below:

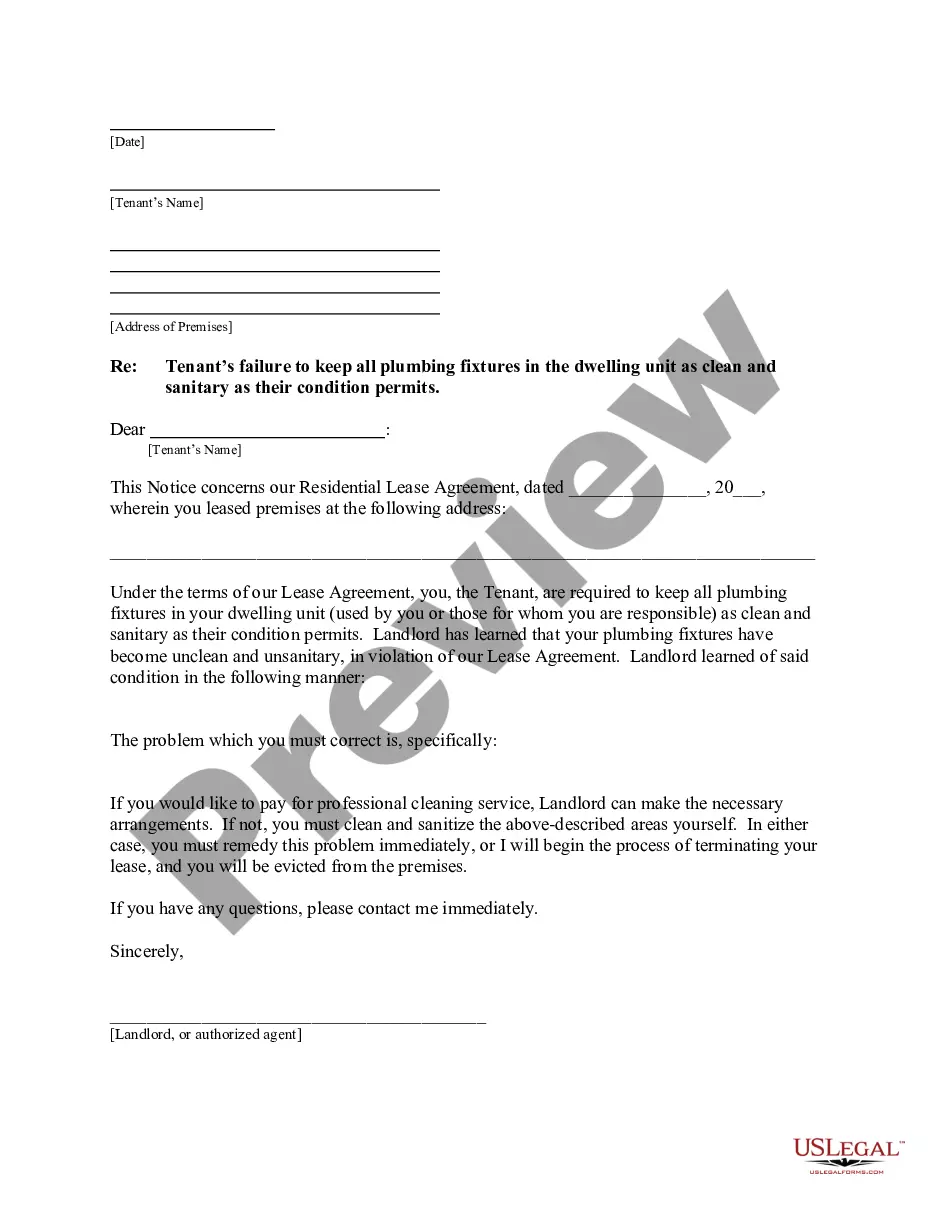

- Initially, make certain you have chosen the right document design for your state/area that you pick. Read the type outline to ensure you have picked out the appropriate type. If accessible, utilize the Preview option to search with the document design as well.

- If you would like discover one more version of the type, utilize the Search industry to get the design that suits you and requirements.

- When you have discovered the design you want, simply click Purchase now to continue.

- Choose the pricing program you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal profile to fund the legal type.

- Choose the file format of the document and obtain it to the gadget.

- Make modifications to the document if needed. You may complete, modify and signal and produce Hawaii Employment Agreement with Chief Financial Officer.

Acquire and produce a large number of document web templates utilizing the US Legal Forms Internet site, that offers the most important collection of legal types. Use specialist and state-particular web templates to handle your organization or specific requires.