Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

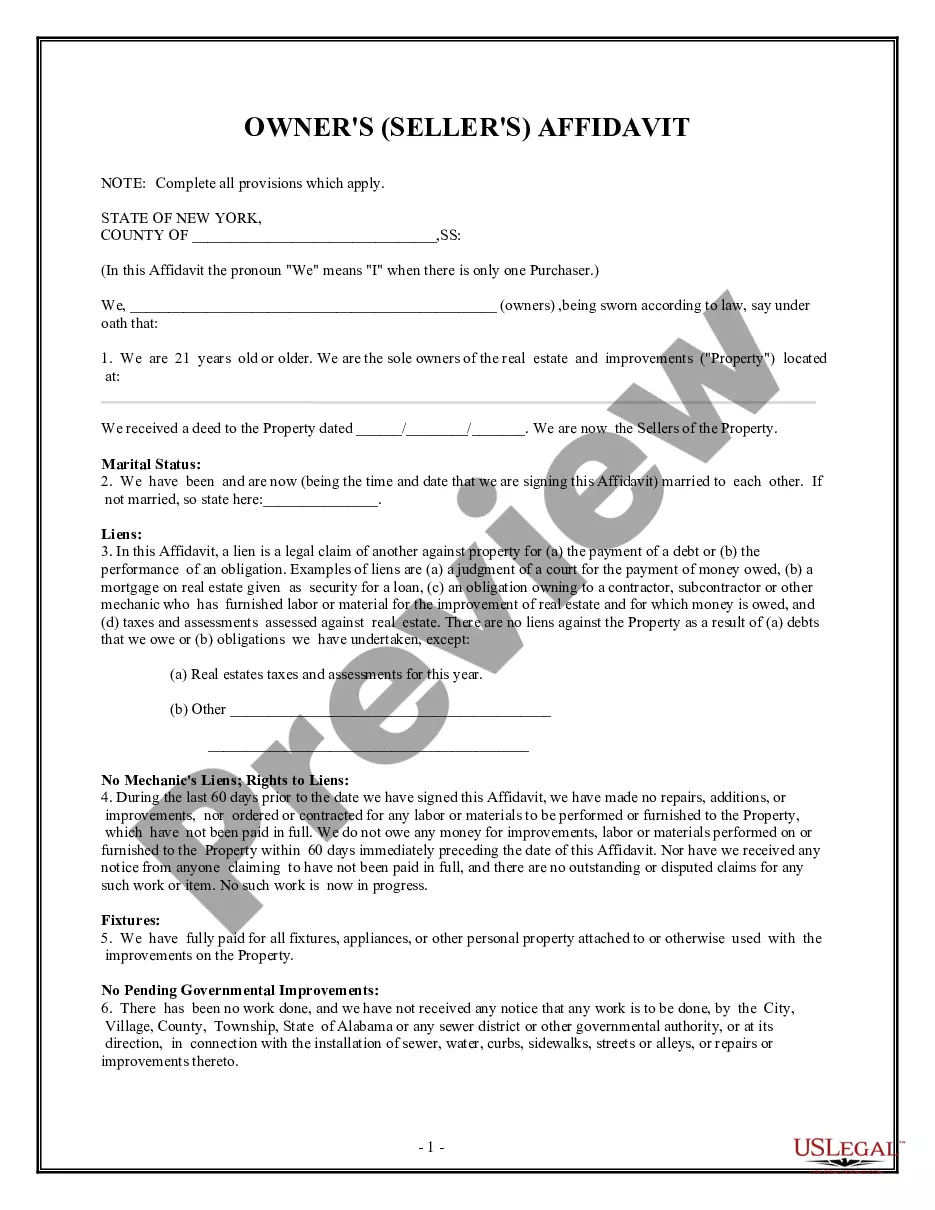

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

Are you in a situation where you require documentation for possibly business or specific tasks almost every day.

There are numerous legal document templates accessible online, but locating reliable ones is not simple.

US Legal Forms offers thousands of template documents, including the Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, that are crafted to comply with state and federal regulations.

Once you locate the correct form, click Purchase now.

Select the payment plan you prefer, complete the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Review option to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the template that fits your needs and requirements.

Form popularity

FAQ

Filling out a revocable living trust involves several steps to ensure it meets your needs. Begin by carefully drafting your Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, clearly naming your assets and beneficiaries. Utilizing resources from platforms like US Legal Forms can simplify this process, offering templates and guidance to ensure accuracy and compliance with state laws.

Yes, it is possible for both a trust and a beneficiary to be taxed on the same income. When dealing with a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, the trust might retain some income while distributing other income to the beneficiaries. This dual taxation can lead to complexities, so seeking advice from a financial expert is wise to ensure compliance and optimize your tax situation.

Yes, income from a trust is generally taxable to the beneficiary. When you create a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, the income generated by the trust is usually reported on the beneficiary's tax return. It’s important to consult a tax professional to understand specific tax implications, as the rules can vary based on individual circumstances and state laws.

Whether husband and wife should have separate revocable trusts depends on their specific financial situations and goals. A Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to may benefit from joint management if they have consolidated assets and mutual intentions. However, separate trusts could provide more control and flexibility for each spouse to address individual needs. Consulting with a legal expert can illuminate the best option tailored to your circumstances.

Net income in a trust refers to the total income earned by the trust, minus any allowable deductions, such as expenses related to trust management. For a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, understanding net income is vital for accurate tax reporting and distribution planning. Properly calculating net income ensures the grantors can make informed decisions regarding their financial legacy. Engaging with a qualified tax advisor can simplify this process significantly.

Income distributions from a marital trust usually depend on the specific terms set forth in the trust agreement. The Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to may dictate how often and in what form income is distributed, whether quarterly or annually. Often, these distributions aim to meet the financial needs of the spouse or beneficiaries involved. Therefore, working with a legal professional ensures that you set the right conditions for income distribution.

In a trust account, income generally refers to any earnings generated by the assets held within the trust, such as interest, dividends, and capital gains. When establishing a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, it is crucial to analyze the trust’s investments to ensure accurate income reporting. The terms of the trust may specify how this income is to be distributed among beneficiaries. Having clarity on income types will help optimize your trust's financial management.

In a marital trust, income typically includes interest, dividends, and rental income generated by the trust’s assets. For a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, it is essential to define these income types clearly to ensure proper tax treatment. Additionally, income may also encompass gains from the sale of trust property. Understanding what constitutes income helps you manage distributions effectively.

Yes, Hawaii does tax trust income, which can impact the returns generated from your trust. It's essential to plan for these taxes when creating your estate plan. The Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to is designed to help minimize tax liabilities while ensuring your trust operates effectively.

Certain states like Florida and Texas do not impose a state income tax on trust income. This means trusts in these states may offer tax benefits that are not available in others. When establishing a Hawaii Revocable Trust Agreement with Husband and Wife as Trustors and Income to, it’s important to consider Hawaii’s specific laws compared to other states for optimal planning.