Hawaii Sample Letter for Buyer's Guide

Description

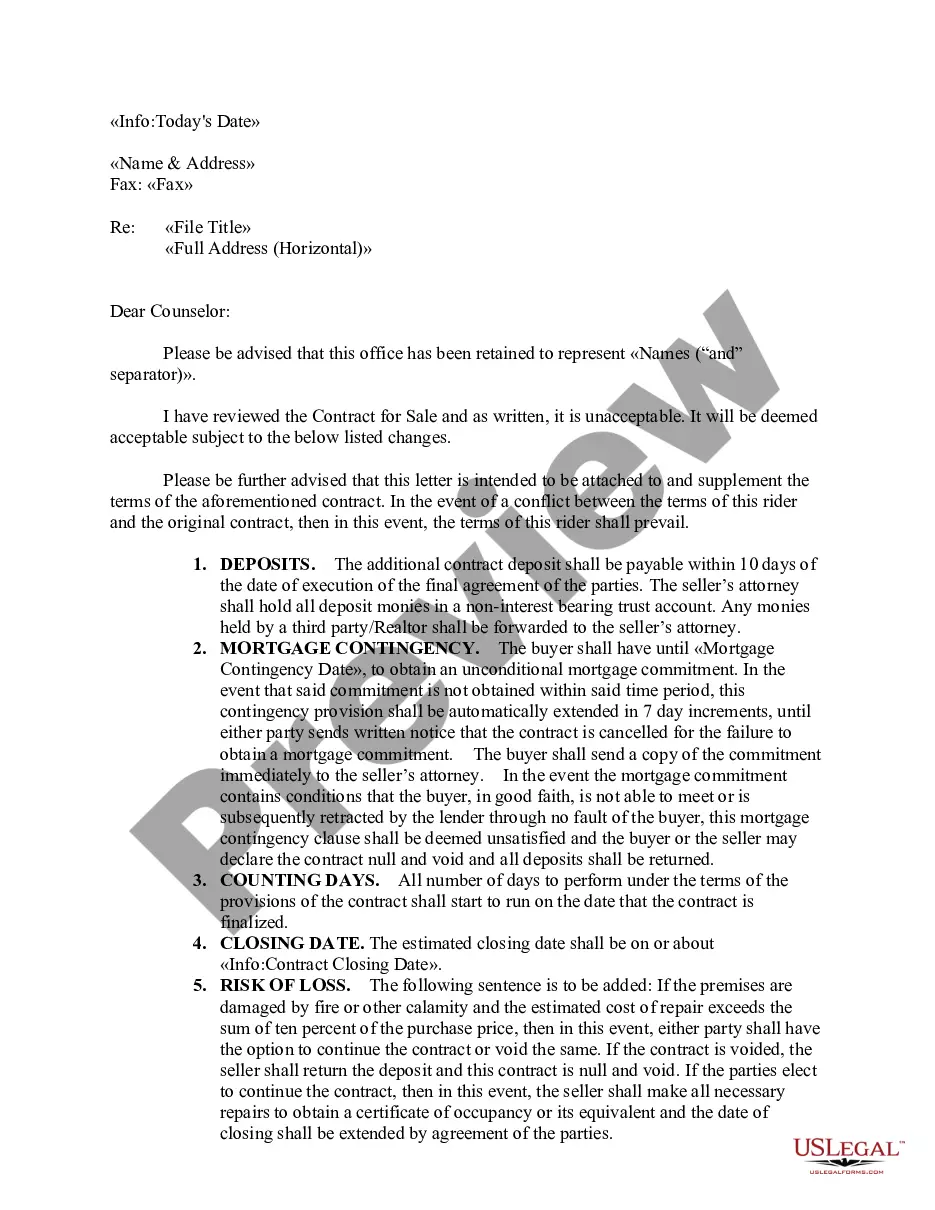

How to fill out Sample Letter For Buyer's Guide?

You can dedicate numerous hours online searching for the legal document template that meets the federal and state requirements you have. US Legal Forms offers thousands of legal forms that are verified by experts.

You can download or print the Hawaii Sample Letter for Buyer's Guide from their service.

If you already possess a US Legal Forms account, you can Log In and click the Obtain button. Then, you can complete, revise, print, or sign the Hawaii Sample Letter for Buyer's Guide. Every legal document template you purchase becomes your property for an indefinite period. To obtain an additional copy of any purchased form, visit the My documents section and click the respective button.

Make modifications to the document if possible. You can fill out, revise, and sign and print the Hawaii Sample Letter for Buyer's Guide. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice. Review the form summary to confirm you have chosen the right template. If available, utilize the Review button to preview the document template as well.

- To find another version of the form, use the Search field to locate the template that fits your needs.

- Once you find the template you need, click on Purchase now to proceed.

- Select the pricing plan you prefer, enter your information, and create an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

Form popularity

FAQ

On average, closing costs in Hawaii come to $4,154 for a home priced at $549,496, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That figure makes up 0.76 percent of the home's price tag. In comparison, the national average is $6,087.

How to Write a Homebuyer's Letter to a Seller7 tips to write a letter that will make you stand out to a seller. By.Build a Connection. Look for something you and the buyer have in common and build on that connection.Keep It Short.Stay Positive.Show, Don't Tell.Leave Out Your Remodeling Plans.Finish Strong.Proofread It.

They are usually anywhere from 1-4% of the purchase price. Closing costs are different for buyers and sellers in every transaction. You can try to negotiate and ask the seller to pay for a portion of your closing costs, but it's unlikely you'll get out of paying them altogether.

The standard Hawaii Real Estate Sales Contract divides the cost of the owner's policy this way: the seller pays 60% and the buyer pays 40%. And just like with other types of insurance, there are premium or gold or some other name for a policy that provides more benefits.

Escrow fee (40%, Seller pays 60%)

The letter of intent should include both a purchase price and an explanation of the assumptions that the purchase price is based upon. During the due diligence process, it may turn out that many of the early assumptions used in calculating the purchase price will turn out not to be true.

Closing costs are the expenses over and above the property's price that buyers and sellers usually incur to complete a real estate transaction. Those costs may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed recording fees, and credit report charges.

Things to include in a letter of intent to purchaseThe full names of the buyer and the seller.The complete address of the property.The agreed-upon purchase price.The agreed-upon earnest deposit.The date of signing the SPA.The terms and conditions that surround the earnest deposit.More items...?

A Letter of Intent is a document that outlines the general terms and conditions of an agreement between parties before the agreement is finalized. In real estate deals, a Letter of Intent are typical before entering large leases or an agreement to buy or sell commercial real estate.

Here are some basic steps to compose a letter that will help you stand out from other potential buyers.Introduce yourself. Start your cover letter with a friendly greeting and a little bit about who you are.Tell them what you like about the home. Be specific.Explain your offer.Be sincere.Don't get too personal.