Attachment in legal terminology means a preliminary legal seizure of property to force compliance with a decision which may be obtained in a pending suit. Before a final judgment is issued, the court may order the sheriff or other proper officer to seize any property; credit, or right, belonging to the defendant, in whatever hands the same may be found, to satisfy the claim which the plaintiff has against him. In some states, an order of attachment can only be issued when a debtor is shown to be fleeing or concealing themselves from the legal process, so that the attached property can satisfy a judgment that may be awarded in the complainant's favor. In criminal law practice, it may refer to a writ requiring a sheriff to apprehend a particular person, who has been guilty of a contempt of court, and to bring the offender before the court.

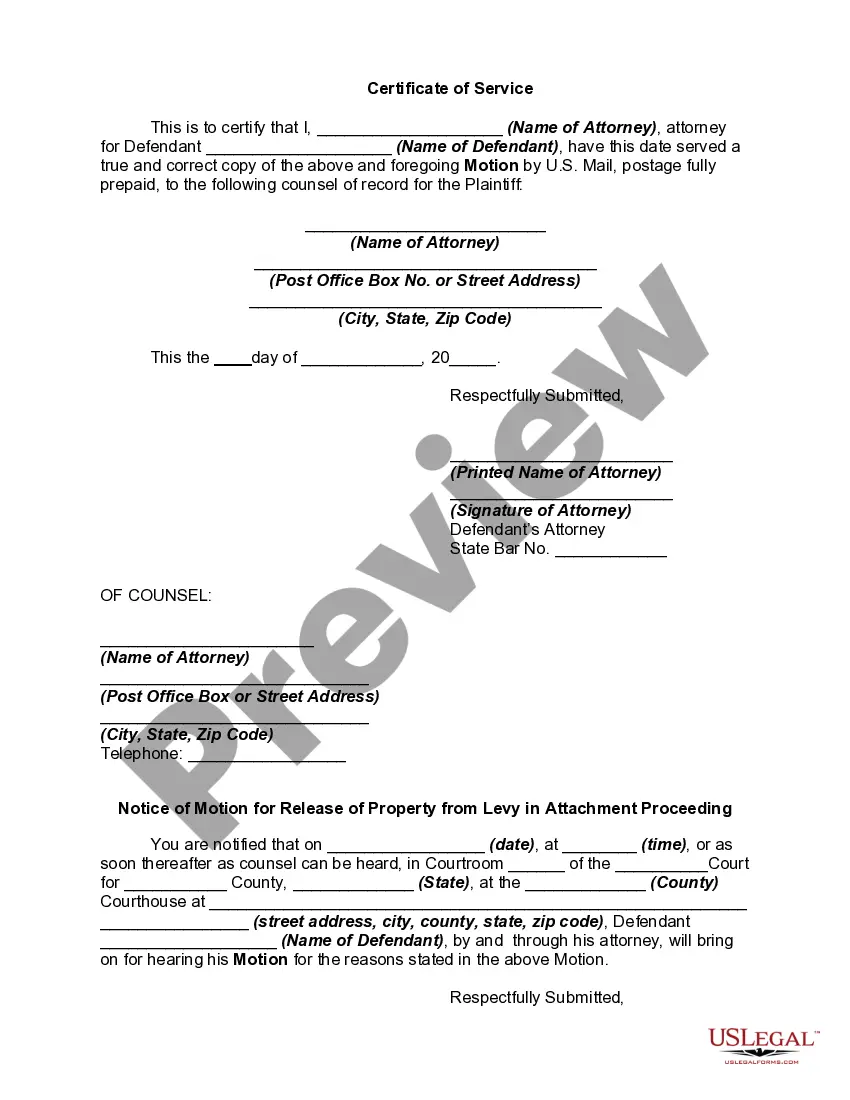

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

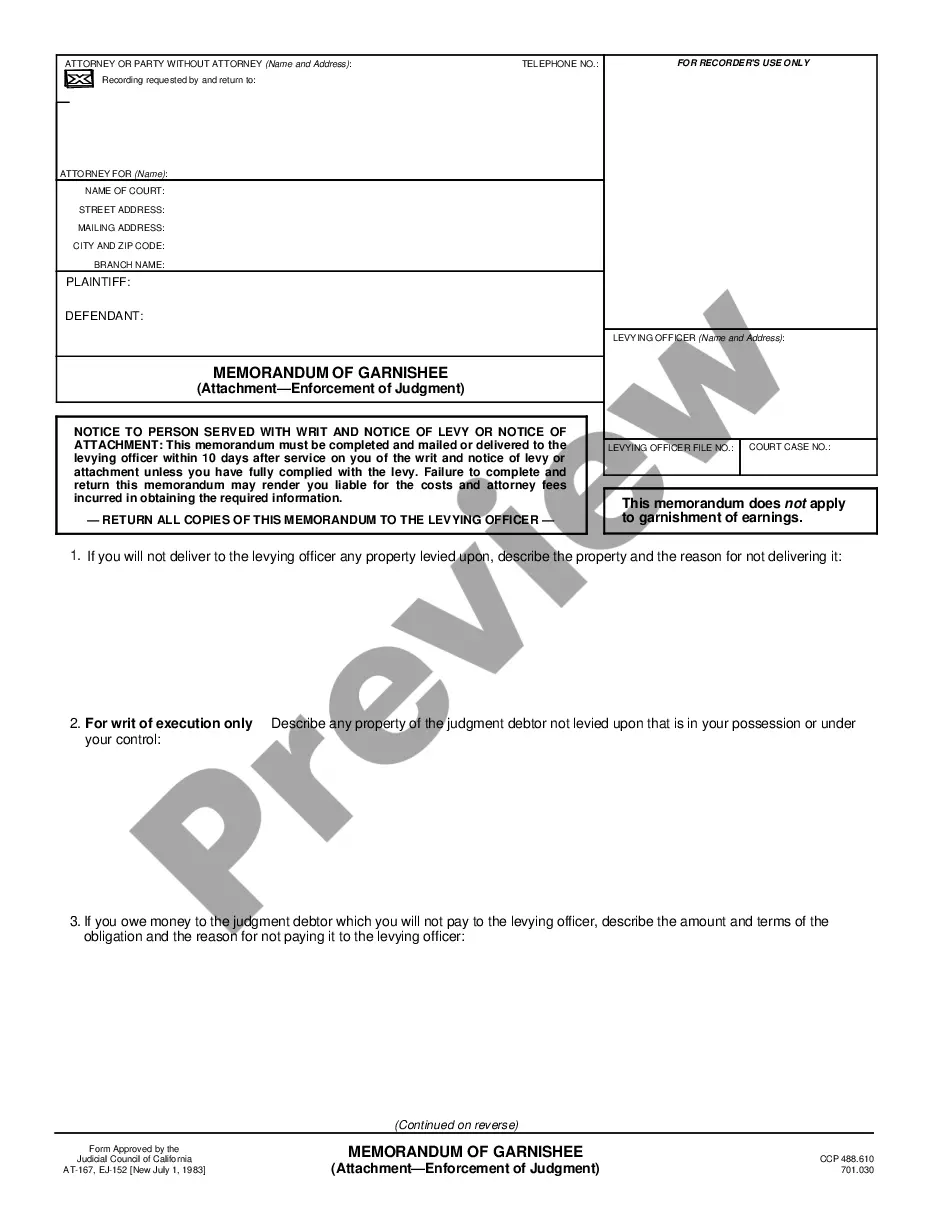

Hawaii Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached In the state of Hawaii, when a property is subject to a levy in an attachment proceeding, it is possible to file a Motion for Release of Property from Levy in cases where the amount attached exceeds the actual value of the property. This type of motion allows individuals or entities to seek the release of their property from the grasp of a levy, preventing unjust or excessive financial burdens. The excess amount attached refers to the situation when the property seized exceeds the value of the debt it is intended to secure. This can happen due to various reasons, such as an inaccurate valuation of the property, a miscalculation in determining the amount of judgment or debt owed, or if the property's value has significantly depreciated since the attachment proceeding commenced. This motion serves as a legal remedy that can be utilized by individuals, businesses, or organizations in order to protect their assets from being unjustly captured beyond the amount necessary to satisfy the debt. By filing this motion, the petitioner requests the court to release the portion of their property that exceeds the actual debt, allowing them to retain the fair value of their asset. Some common types of Hawaii Motions for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached include: 1. Motion for Release of Real Property: This type of motion is applicable when real estate or immovable property is involved in the attachment proceeding. It seeks to remove the excess amount claimed by the attachment from the property, preserving the rightful equity of the owner. 2. Motion for Release of Personal Property: When personal assets like vehicles, jewelry, or any movable possessions are subjected to a levy, this motion can be filed to release the excess amount held beyond the value necessary to satisfy the debt. It helps individuals protect their cherished belongings and ensures fairness in the attachment process. 3. Motion for Release of Bank Accounts or Financial Assets: In cases where bank accounts, stocks, or financial assets are targeted for attachment, individuals or entities can file this motion to prevent the exceeding amount from being seized. It aims to safeguard the rightful funds that are not required to satisfy the debt. 4. Motion for Release of Business Assets: This particular motion is relevant in attachment proceedings involving business assets or properties. It allows businesses to retain the necessary assets required for their operations while seeking the release of the excess amount levied. By filing a Hawaii Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached, individuals and businesses can protect their assets and preserve their financial well-being in cases where the attachment amount exceeds the actual debt. This legal recourse ensures fairness and prevents undue burdens caused by an imbalance between the value of the property and the attached amount.

Hawaii Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached In the state of Hawaii, when a property is subject to a levy in an attachment proceeding, it is possible to file a Motion for Release of Property from Levy in cases where the amount attached exceeds the actual value of the property. This type of motion allows individuals or entities to seek the release of their property from the grasp of a levy, preventing unjust or excessive financial burdens. The excess amount attached refers to the situation when the property seized exceeds the value of the debt it is intended to secure. This can happen due to various reasons, such as an inaccurate valuation of the property, a miscalculation in determining the amount of judgment or debt owed, or if the property's value has significantly depreciated since the attachment proceeding commenced. This motion serves as a legal remedy that can be utilized by individuals, businesses, or organizations in order to protect their assets from being unjustly captured beyond the amount necessary to satisfy the debt. By filing this motion, the petitioner requests the court to release the portion of their property that exceeds the actual debt, allowing them to retain the fair value of their asset. Some common types of Hawaii Motions for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached include: 1. Motion for Release of Real Property: This type of motion is applicable when real estate or immovable property is involved in the attachment proceeding. It seeks to remove the excess amount claimed by the attachment from the property, preserving the rightful equity of the owner. 2. Motion for Release of Personal Property: When personal assets like vehicles, jewelry, or any movable possessions are subjected to a levy, this motion can be filed to release the excess amount held beyond the value necessary to satisfy the debt. It helps individuals protect their cherished belongings and ensures fairness in the attachment process. 3. Motion for Release of Bank Accounts or Financial Assets: In cases where bank accounts, stocks, or financial assets are targeted for attachment, individuals or entities can file this motion to prevent the exceeding amount from being seized. It aims to safeguard the rightful funds that are not required to satisfy the debt. 4. Motion for Release of Business Assets: This particular motion is relevant in attachment proceedings involving business assets or properties. It allows businesses to retain the necessary assets required for their operations while seeking the release of the excess amount levied. By filing a Hawaii Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached, individuals and businesses can protect their assets and preserve their financial well-being in cases where the attachment amount exceeds the actual debt. This legal recourse ensures fairness and prevents undue burdens caused by an imbalance between the value of the property and the attached amount.