This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

Locating the appropriate authentic document template can be quite challenging. Clearly, there are numerous online templates accessible, but how will you find the authentic form you require.

Utilize the US Legal Forms website. The service offers an extensive collection of templates, including the Hawaii Equine or Horse Donation Contract, suitable for business and personal purposes.

All templates are reviewed by experts and comply with state and federal regulations.

Once you are sure that the form is suitable, click the Acquire now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the authentic document template to your device. Complete, edit, and print the acquired Hawaii Equine or Horse Donation Contract. US Legal Forms is the largest resource of authentic forms where you can find various document templates. Utilize the service to download professionally prepared documents that adhere to state requirements.

- If you are already registered, sign in to your account and click the Obtain button to download the Hawaii Equine or Horse Donation Contract.

- Use your account to browse through the authentic forms you have purchased previously.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, make sure you have selected the correct form for your city/state. You can view the form using the Preview button and check the form description to confirm it is the right one for you.

- If the form does not meet your needs, use the Search field to find the suitable form.

Form popularity

FAQ

To secure funding for a horse rescue, start by creating a clear and compelling proposal that outlines your mission and the needs of the horses. You can utilize a Hawaii Equine or Horse Donation Contract to formalize agreements with donors who may provide financial support. Additionally, consider connecting with local businesses and animal welfare organizations that share your passion, as they may offer grants or sponsorships. Building a solid network and showcasing the impact of your work will encourage funding opportunities.

If you have a horse that you can’t ride, consider options such as donating them to a rescue, finding a safe home, or even exploring the possibility of equine therapy. It is essential to document any transfer with a Hawaii Equine or Horse Donation Contract to ensure the process is straightforward and legal.

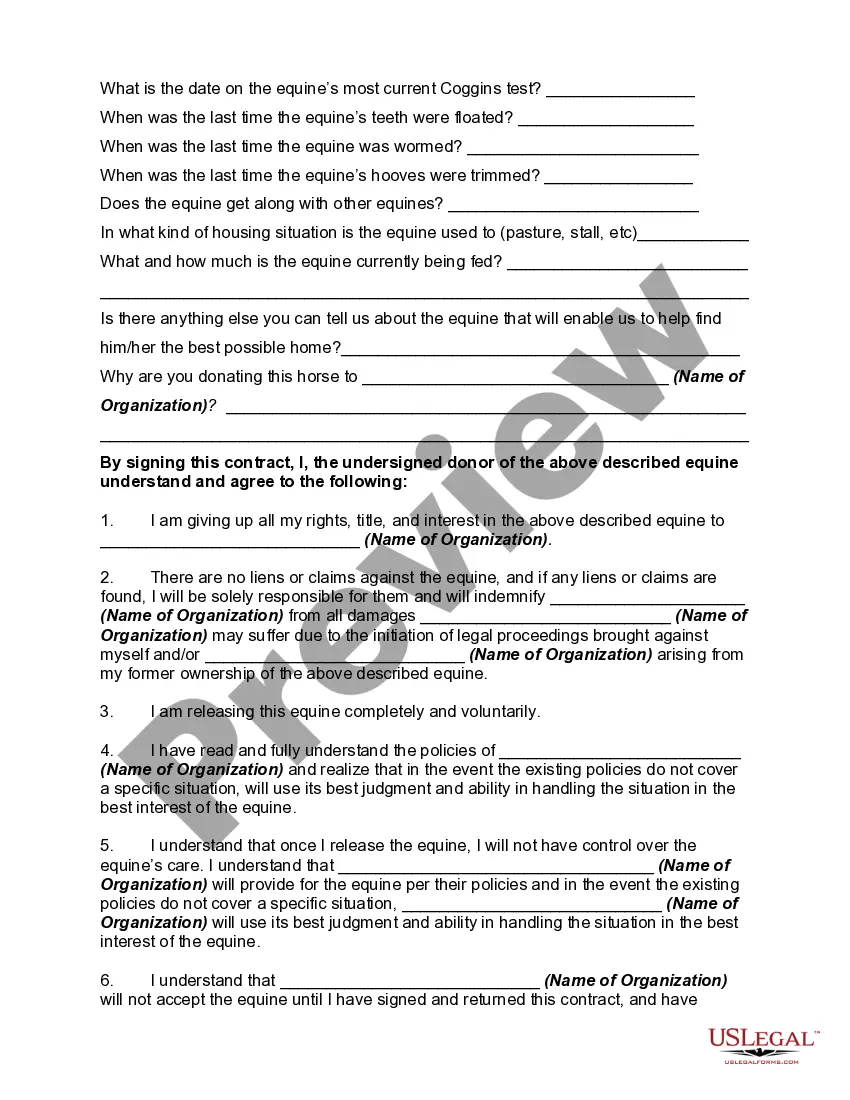

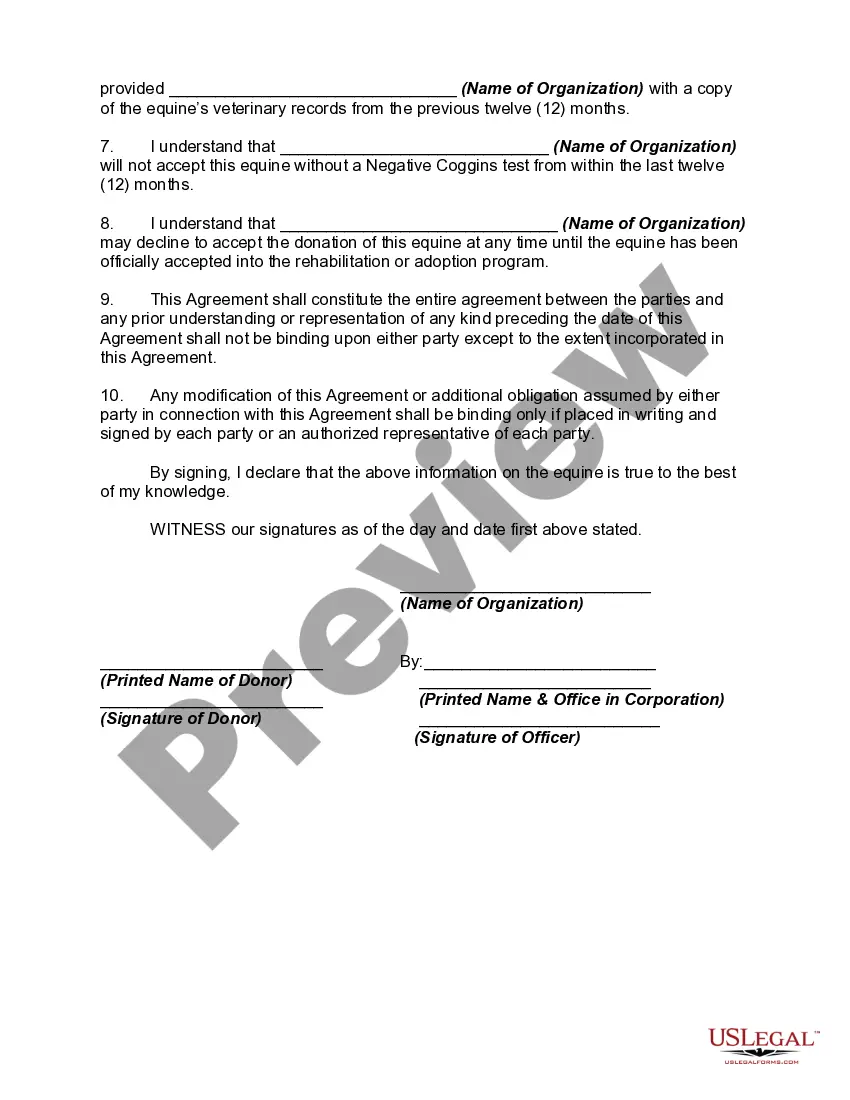

A donation agreement is a legal document that outlines the terms of a donation, in this case, a horse. It protects both the donor and the recipient, ensuring that all parties understand the responsibilities involved. Utilizing a Hawaii Equine or Horse Donation Contract can provide an efficient way to create this agreement.

Yes, donating a horse to a qualified charity can be tax-deductible. To qualify for the deduction, the transfer must be documented properly, often requiring a Hawaii Equine or Horse Donation Contract. Engaging with a tax professional can provide insights on maximizing this opportunity.

The 123 rule refers to a guideline used in horse training and management. It highlights the importance of providing three key elements: love, care, and training. Incorporating principles like the 123 rule can enhance your experience when entering into a Hawaii Equine or Horse Donation Contract.

For tax purposes, a horse is typically considered personal property. As such, its value may be eligible for tax deduction if donated to a qualified organization. Utilizing a Hawaii Equine or Horse Donation Contract can provide clarity and support in ensuring your donation is tax deductible.

The amount needed to qualify for a tax write-off can vary based on your tax situation and the value of the donation. For horses, the donation value often reflects the fair market value of the animal. To maximize your tax benefits, consider drafting a Hawaii Equine or Horse Donation Contract to clearly outline the donation details.

The 20% rule generally refers to a guideline for maintaining a horse’s feed intake, where no more than 20% of their total diet should come from non-fiber sources. Understanding this rule helps ensure a healthy horse diet and can simplify decisions about what to feed your horse. Adopting this rule may also benefit those involved in a Hawaii Equine or Horse Donation Contract by demonstrating responsible horse care.

If you have an unwanted horse, consider options like rehoming, donating to a rescue or sanctuary, or exploring sale through trusted networks. Make sure any transfer is formalized with a Hawaii Equine or Horse Donation Contract. This ensures that both you and the recipient are protected legally.

To donate a horse to UC Davis, start by contacting their veterinary program to express your intent. They will guide you through their specific donation process, which often includes filling out a donation form and possibly signing a Hawaii Equine or Horse Donation Contract to formalize the transaction.