The proper form and necessary content of a certificate of incorporation depend largely on the requirements of individual state statutes, which in many instances designate the appropriate form and content. While the certificate must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the certificate may usually be drafted so as to meet the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

Hawaii Certificate of Incorporation - General Form

Description

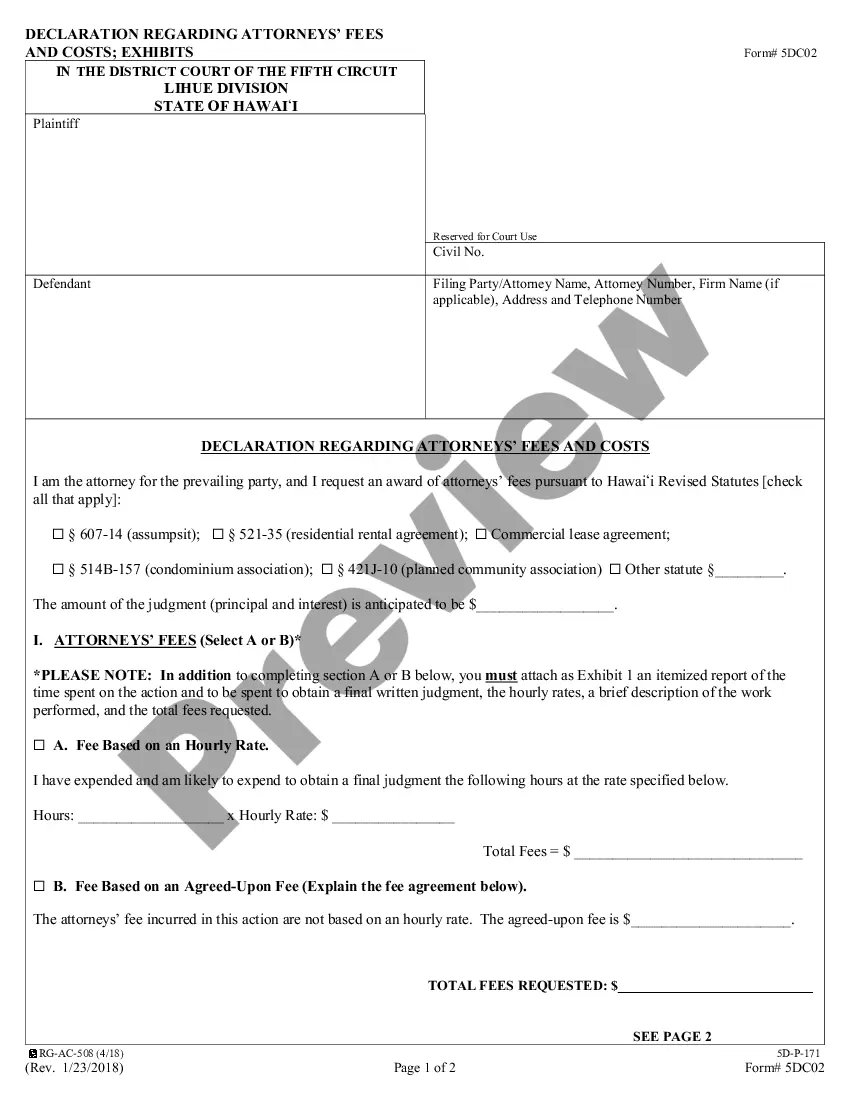

How to fill out Certificate Of Incorporation - General Form?

Are you currently inside a place where you need files for both business or specific uses almost every day time? There are tons of legitimate file themes available online, but finding types you can rely on is not simple. US Legal Forms provides 1000s of kind themes, just like the Hawaii Certificate of Incorporation - General Form, that are published in order to meet federal and state demands.

When you are currently informed about US Legal Forms site and also have a free account, just log in. Next, it is possible to down load the Hawaii Certificate of Incorporation - General Form design.

If you do not come with an profile and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and ensure it is for your right metropolis/state.

- Take advantage of the Review option to review the shape.

- Read the description to actually have selected the correct kind.

- When the kind is not what you are seeking, take advantage of the Research industry to get the kind that fits your needs and demands.

- Once you get the right kind, click on Buy now.

- Select the costs strategy you need, complete the desired information and facts to create your bank account, and buy the order with your PayPal or bank card.

- Choose a convenient paper format and down load your backup.

Locate each of the file themes you have purchased in the My Forms menus. You can aquire a further backup of Hawaii Certificate of Incorporation - General Form at any time, if necessary. Just go through the essential kind to down load or print out the file design.

Use US Legal Forms, by far the most considerable selection of legitimate forms, to conserve some time and avoid faults. The support provides appropriately made legitimate file themes which can be used for a range of uses. Generate a free account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Even a sole proprietor is required to obtain a General Excise Tax License in Hawaii. Any business engaged in commercial activities must get one.

To register a Domestic Profit Corporation in Hawaii, you must file the Articles of Incorporation (Form DC-1), along with the appropriate filing fee(s) with the Department of Commerce and Consumer Affairs (DCCA), Business Registration Division. Registrations can be filed online, or by email, mail, or fax.

Here's an overview of the key steps you'll need to take to start your own business in Hawaii. Choose a Business Idea. ... Decide on a Legal Structure. ... Choose a Name. ... Create Your Business Entity. ... Apply for Licenses and Permits. ... Pick a Business Location and Check Zoning. ... File and Report Taxes. ... Obtain Insurance.

To form a Hawaii S corp, you'll need to ensure your company has a Hawaii formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

You will file your Hawaii DBA on the state level with the Department of Commerce and Consumer Affairs. You can file online using the Hawaii Business Express website. Or, you can file by mail, fax, or in-person by downloading the Application for Registration of Trade Name and submitting the hardcopy.

You will file your Hawaii DBA on the state level with the Department of Commerce and Consumer Affairs. You can file online using the Hawaii Business Express website. Or, you can file by mail, fax, or in person by downloading the Application for Registration of Trade Name and submitting the hard copy.

Hawaii doesn't have a general business license at the state level, so there are no fees there. But your required Hawaii Tax ID Number registration with the Department of Taxation has a $20 filing fee.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone or in person, but we recommend faxing. Normal processing takes up to 5 days, plus additional time for mailing, and costs $10.