The Hawaii Aging of Accounts Payable is a financial management tool used by businesses to analyze and track the payment status of outstanding invoices or bills owed to vendors or creditors. It provides a detailed view of the unpaid balances, age of the debts, and the overall health of a company's accounts payable. Keywords: Hawaii Aging of Accounts Payable, payment status, outstanding invoices, bills owed, vendors, creditors, financial management tool, unpaid balances, age of debts, accounts payable. The Hawaii Aging of Accounts Payable categorizes outstanding debts into different time periods based on their age, providing a clearer picture of which bills are overdue and need immediate attention. This tool aids businesses in identifying potential cash flow issues, managing vendor relationships, and forecasting financial obligations. Here are the types of Hawaii Aging of Accounts Payable commonly used: 1. Current: This category represents invoices or bills that are due within the current payment period. Typically, payments for these outstanding balances are expected to be made promptly and are considered up-to-date. 2. 30 Days: In this category, invoices or bills that are overdue by 30 days from the due date are grouped together. Businesses should give priority to paying these balances to avoid late payment penalties and maintain good relationships with vendors or creditors. 3. 60 Days: This group consists of invoices or bills that have remained unpaid for 60 days beyond the due date. It implies a longer delinquency period and requires immediate attention to prevent further consequences such as damaged credit ratings or legal actions from creditors. 4. 90 Days or more: Accounts payable that have reached a 90-day or more overdue period fall into this category. These prolonged delinquent debts can significantly impact a company's financial stability and may require more aggressive actions, such as negotiations, payment plans, or debt collections strategies. Businesses utilize the Hawaii Aging of Accounts Payable as a powerful tool to manage their finances effectively and maintain positive relationships with vendors and creditors. By regularly analyzing this report, companies can identify trends, spot potential bottlenecks in payment processes, implement necessary adjustments, and stay on top of outstanding debts, ultimately improving their overall financial health. In conclusion, the Hawaii Aging of Accounts Payable is an essential financial management tool that enables businesses to monitor and analyze their outstanding invoices or bills. By using this tool and differentiating debts into various time periods such as current, 30 days, 60 days, and 90 days or more, businesses can efficiently manage their accounts payable and ensure timely payments to vendors and creditors.

Hawaii Aging of Accounts Payable

Description

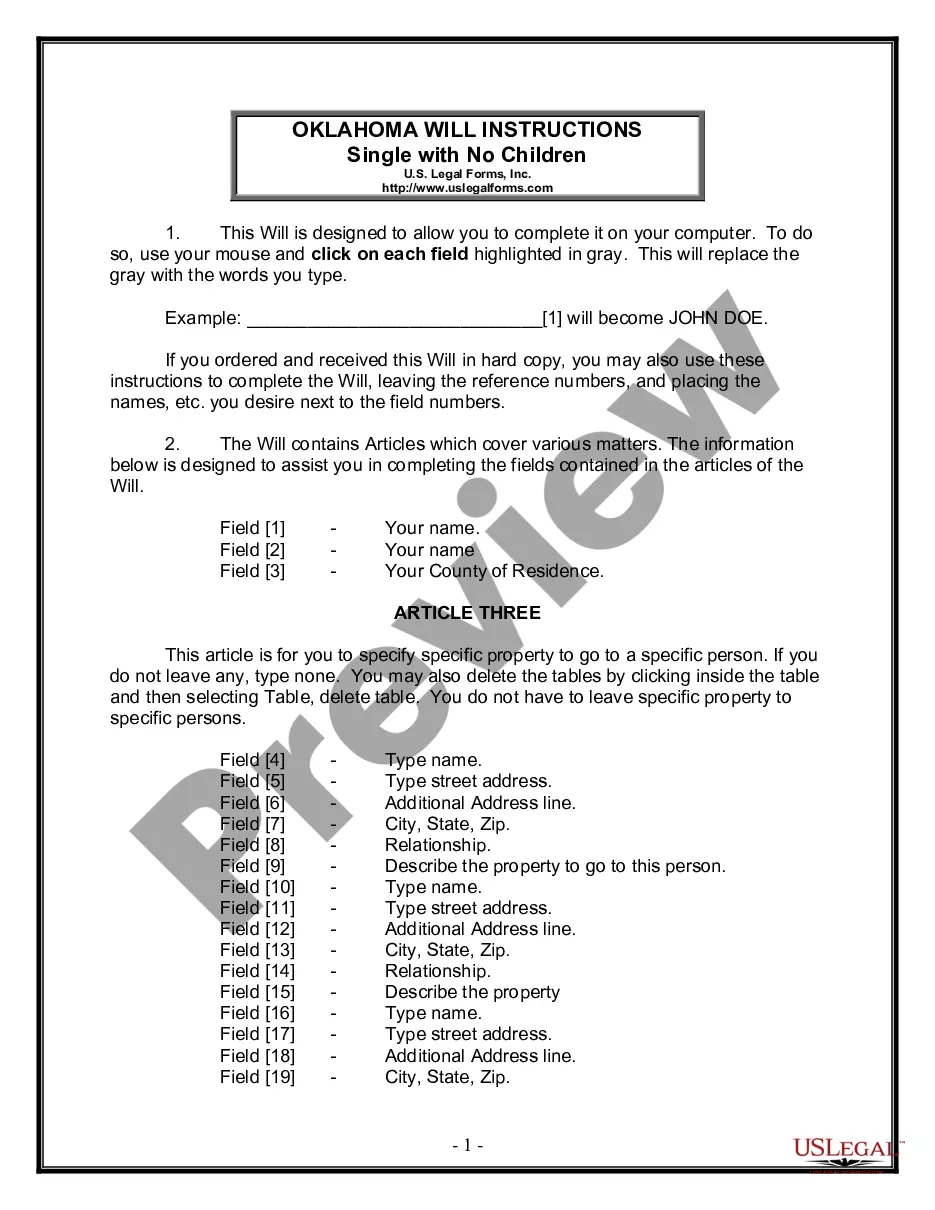

How to fill out Hawaii Aging Of Accounts Payable?

You can devote several hours online searching for the lawful document web template that meets the state and federal needs you want. US Legal Forms supplies a huge number of lawful kinds which are examined by specialists. You can easily obtain or print the Hawaii Aging of Accounts Payable from your services.

If you have a US Legal Forms bank account, you may log in and click on the Down load option. Next, you may complete, modify, print, or indicator the Hawaii Aging of Accounts Payable. Each lawful document web template you acquire is your own property for a long time. To acquire another backup of any acquired kind, proceed to the My Forms tab and click on the related option.

Should you use the US Legal Forms web site initially, stick to the easy instructions below:

- Very first, be sure that you have selected the best document web template for your county/area of your liking. Look at the kind description to make sure you have picked out the correct kind. If accessible, take advantage of the Review option to check from the document web template also.

- If you want to get another version of your kind, take advantage of the Lookup discipline to find the web template that meets your requirements and needs.

- Upon having found the web template you want, click on Get now to move forward.

- Find the pricing strategy you want, type your references, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal bank account to cover the lawful kind.

- Find the formatting of your document and obtain it to your product.

- Make modifications to your document if possible. You can complete, modify and indicator and print Hawaii Aging of Accounts Payable.

Down load and print a huge number of document themes using the US Legal Forms Internet site, that provides the biggest collection of lawful kinds. Use specialist and state-particular themes to handle your company or personal needs.

Form popularity

FAQ

What is the standard deduction amount for Hawaii? The standard deduction amounts are as follows: Single or Married filing separately $2,200; Married filing jointly, or Qualifying widow(er) $4,400; Head of Household $3,212.

File your general excise and use tax returns with: Hawaii Department of Taxation P.O. Box 1425 Honolulu, HI 96806-1425. The general excise tax is a tax imposed on the gross income you receive from any business activ- ity you have in Hawaii.

Complete Form BB-1, State of Hawaii Basic Business Application, and select GE One-Time Event to register for a one-time event. Use Form G-45, Periodic General Excise/ Use Tax Return, to report and pay the tax due from your one-time event.

You can file you GE Tax Returns electronically, in person or by mail. To file online, go to the Hawaii Department of Taxation's E-Services Page. You can also get the form on this site, fill it out on your computer, print it, and mail it in.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

Hawaii has a 4.00 percent state sales tax rate, a 0.50 percent max local sales tax rate, and an average combined state and local sales tax rate of 4.44 percent. Hawaii's tax system ranks 41st overall on our 2022 State Business Tax Climate Index.

11. Individual Income Tax Return (Resident Form)

What is Hawaii's sales tax rate? Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

2. What is subject to the GET? Activities subject to GET include wholesaling, retailing, farming, services, construction contracting, rental of personal or real property, business interest income, and royalties. This is not a complete list of activities.

The landed value of a new or used vehicle purchased out-of-state and imported into Hawaii is subject to use tax at the rate of 4% (4.5% if applicable to the county surcharge). The sales or use tax you paid to another state for your vehicle purchase may be claimed as a credit against your Hawaii use tax.