Hawaii Cash Receipts Control Log

Description

How to fill out Cash Receipts Control Log?

It is feasible to invest hours online searching for the accurate document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that have been evaluated by experts.

You can easily download or print the Hawaii Cash Receipts Control Log from their services.

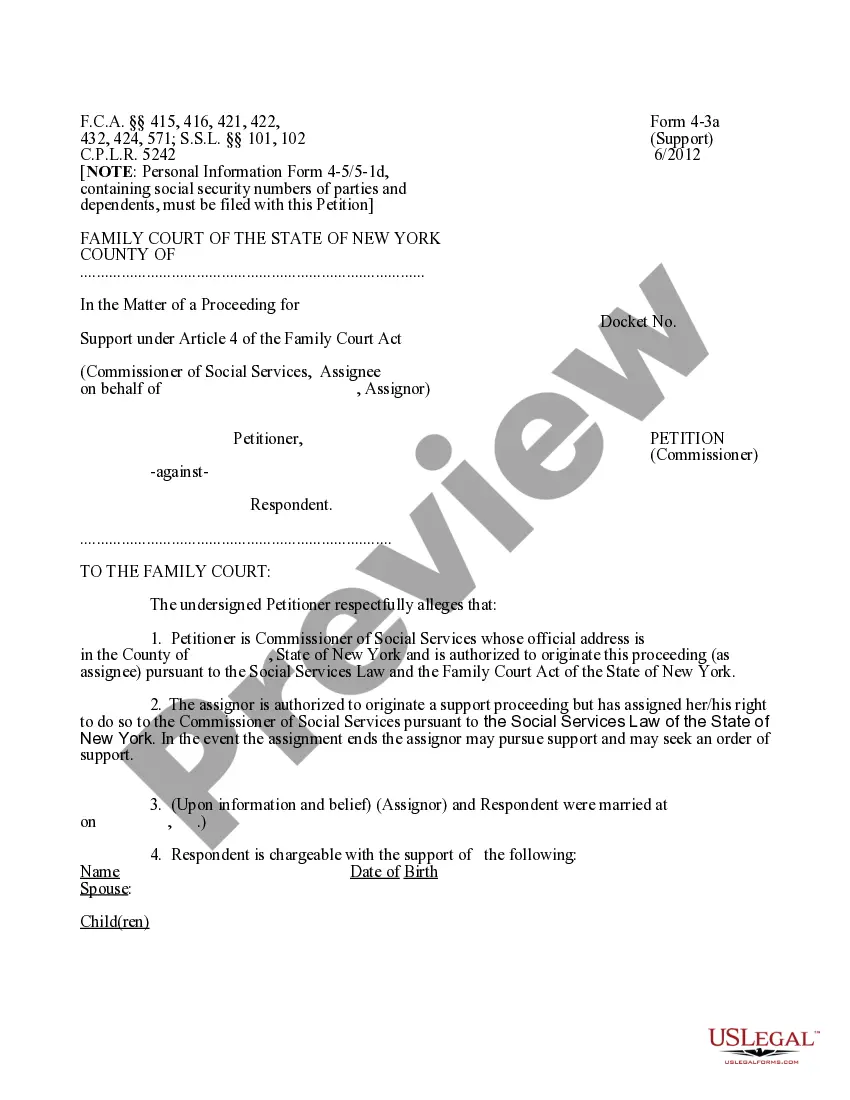

Review the document information to ensure you have chosen the right form. If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Hawaii Cash Receipts Control Log.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased document, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your region/area of interest.

Form popularity

FAQ

The Glock G49 typically refers to a fictional or wrongly stated model name, as Glock pistols include various models like the G19 and G17. It’s important to note that this does not relate to tax forms or business matters. However, if you have questions about legal forms and requirements, our platform can guide you through those complexities seamlessly, regardless of the topic at hand.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

How to Process Cash ReceiptsApply Cash to Invoices. Access the accounting software, call up the unpaid invoices for the relevant customer, and apply the cash to the invoices indicated on the remittance advice that accompanies each payment from the customer.Record Other Cash (Optional)Deposit Cash.Match to Bank Receipt.

Businesses that take in significant amounts of cash are vulnerable to theft, robbery and fraud. Companies establish systems of internal controls to minimize the risk of such incidents. The inherent vulnerability of cash and negotiable instruments such as checks and credit cards require healthy internal controls.

Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. They protect both the University and the employees handling the cash.

5 Important Internal Controls for Cash DisbursementsSegregate duties. The foundation of a good internal control system is segregation of duties.Review authorized signors.Consider requiring dual signatures.Remember the wire transfers.Reconcile bank accounts in a timely manner.

Separation of dutiesReceive and deposit cash.Record cash payments to receivable records.Reconcile cash receipts to deposits and the general ledger.Bill for goods and services.Follow up on collection of returned checks.Distribute payroll or other checks.

Cash Control is an important part of business as it is required for proper cash management, monitoring and recording of cash flow and analyzing cash balance. Cash is the most important liquid asset of the business. A business concern cannot prosper and survive without proper control over cash.

Since cash is the most liquid of all assets, a business cannot survive and prosper if it does not have adequate control over its cash. Cash is the asset that has the greatest chance of going missing and this is why we must ensure that we have strong internal controls build around the cash process.

Because cash is negotiable, readily spendable, and easily transported, it is important for proper internal controls to be in place to protect this asset.