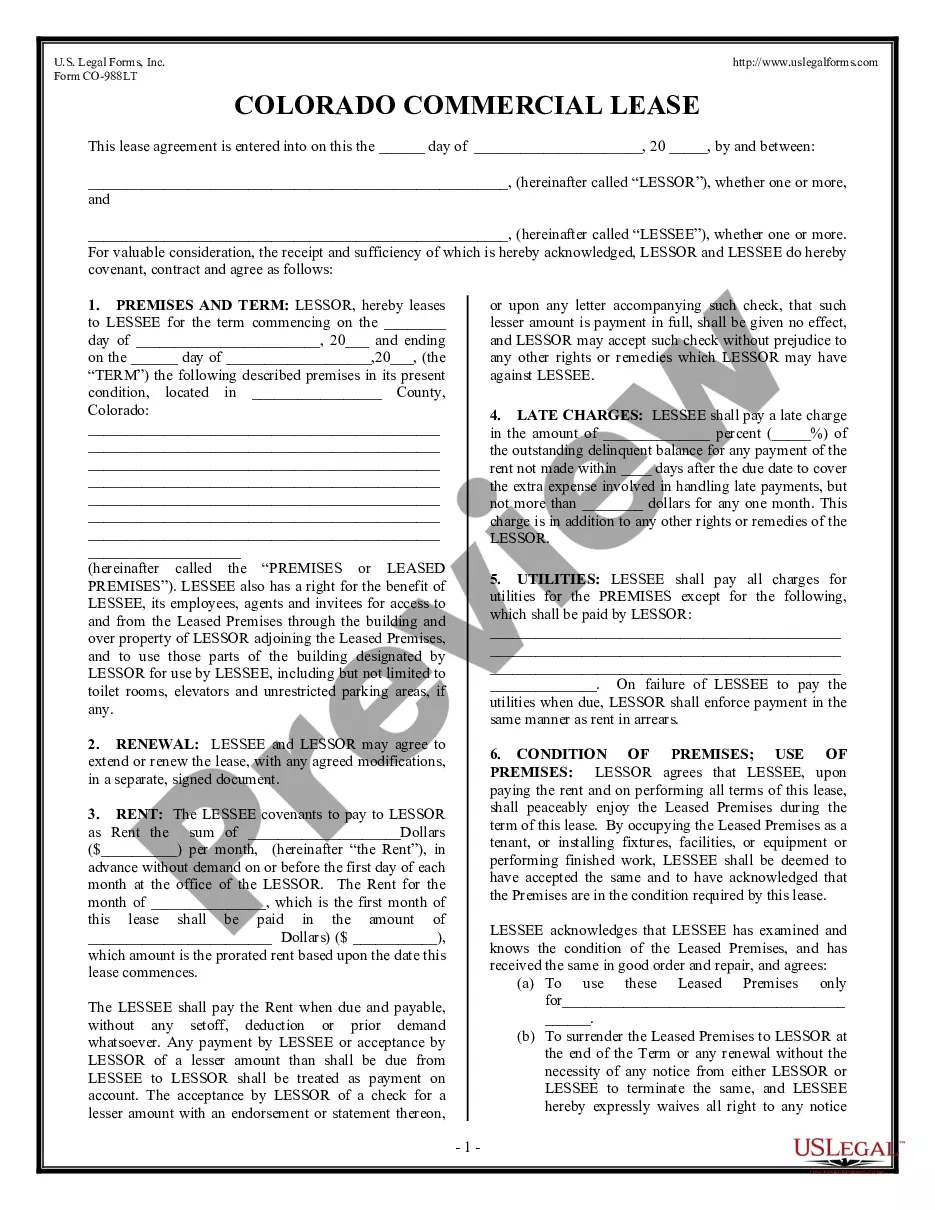

A Hawaii customer invoice is a document that serves as a detailed summary of a transaction between a business and its customer in the state of Hawaii. It outlines the products or services purchased, the quantity or duration thereof, the unit price, and the total amount due. This invoice is usually issued by businesses operating within Hawaii and is an important financial record for both parties involved. The Hawaii customer invoice includes essential information such as the business name, address, contact details, and the customer's name and address. It also includes a unique invoice number, issue date, and the payment due date to ensure proper documentation and timely payment. In addition to the basic billing information, a Hawaii customer invoice may also include other relevant details such as any applicable taxes or fees imposed by the state or local authorities. For example, Hawaii has a General Excise Tax (GET) that businesses are required to charge and report on their invoices. Depending on the nature of the business and industry, there may be several types of Hawaii customer invoices. Some common variations include: 1. Retail Invoice: This type of invoice is used by retailers in Hawaii to bill customers for the purchase of goods. It includes details such as the description of each item, quantity, price per unit, and any applicable taxes. 2. Service Invoice: Service providers, such as freelancers or professional service firms, use this invoice type to bill clients for services rendered. It includes a breakdown of the services provided, hourly rates (if applicable), and the total cost of the services. 3. Recurring Invoice: For businesses offering subscription-based services or recurring billing cycles, recurring invoices are used. These invoices are issued at regular intervals, such as monthly or annually, to notify customers of the ongoing charges. 4. Contractor Invoice: Contractors, including construction or repair services, use this type of invoice to bill their clients for labor, materials, and other project-related expenses. It includes itemized details of work completed, hours worked, and any additional costs incurred. 5. Proforma Invoice: This is a preliminary invoice issued by a business to provide an estimated cost or quote for goods or services before the actual transaction takes place. It helps facilitate negotiations and allows customers to have an idea of the total cost involved. In conclusion, a Hawaii customer invoice is a detailed document that records the transaction between a business and its customers. By including all the necessary information and utilizing relevant keywords, businesses can ensure accurate billing and proper financial record-keeping within the state of Hawaii.

Hawaii Customer Invoice

Description

How to fill out Hawaii Customer Invoice?

Are you currently inside a position where you need documents for possibly enterprise or specific reasons just about every working day? There are a lot of legitimate record layouts available on the net, but locating kinds you can rely is not effortless. US Legal Forms delivers a large number of type layouts, like the Hawaii Customer Invoice, which are created in order to meet state and federal needs.

Should you be presently acquainted with US Legal Forms internet site and possess your account, simply log in. Next, you can download the Hawaii Customer Invoice web template.

If you do not offer an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for that proper town/state.

- Use the Review option to check the form.

- Browse the description to actually have chosen the right type.

- When the type is not what you`re seeking, use the Research area to find the type that meets your needs and needs.

- If you discover the proper type, click on Acquire now.

- Pick the prices program you want, complete the desired details to produce your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Decide on a handy document file format and download your copy.

Find each of the record layouts you possess bought in the My Forms menu. You may get a additional copy of Hawaii Customer Invoice any time, if necessary. Just click the needed type to download or printing the record web template.

Use US Legal Forms, probably the most extensive variety of legitimate forms, to save lots of time as well as steer clear of blunders. The service delivers appropriately made legitimate record layouts which can be used for an array of reasons. Generate your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

These are the five steps to writing an invoice effectively and professionally.Personalize and make your invoice professional.Fill-out the appropriate contact information on your invoice.Select a due date on your invoice.Fill in the projects/ tasks you are invoicing the client for.Add payment information.

Invoices serve as legally enforceable agreements between a business and its clients, as they provide documentation of services rendered and payment owed. Invoices also help businesses track their sales and manage their finances.

An invoice is a time-stamped commercial document that itemizes and records a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal and provides information on the available methods of payment.

How to create an invoice: step-by-stepMake your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

An invoice is an itemized list that records the products or services you provided to your customers, the total amount due, and a method for them to pay you for those items or services. You can send electronic invoices or paper invoices. Invoices can be paid in one payment or in installments.

Automatic Creation of Customer Invoice (from Logistics) After the created billing is released to accounting, a respective accounts receivable invoice is automatically generated simultaneously. The billing document generated during this process creates two different documents: A sales and distribution invoice (the bill)

When a company receives a bill or invoice from a supplier or vendor for goods or service credit, it is often referred to as a vendor invoice. These invoices are entered as credits in the Accounts Payable account, increasing the credit balance in Accounts Payable.

An invoice is a document used to itemize and record a transaction between a vendor and a buyer. Typically, a business sends an invoice to a client after they deliver the product or service. The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction.

An invoice is a way to bill your customers for their purchases. You can request payment when the customer receives the goods or services, or allow them to pay their bill at a later date. Different types of businesses can be paid in a variety of time frames.

Invoices - what they must includea unique identification number.your company name, address and contact information.the company name and address of the customer you're invoicing.a clear description of what you're charging for.the date the goods or service were provided (supply date)the date of the invoice.More items...