Hawaii Invoice Template for Accountant is a professionally designed document that assists accountants in creating accurate and organized invoices for clients based in Hawaii. This template is specifically tailored to comply with the taxation and accounting regulations of the state, providing a comprehensive solution for invoicing services rendered. The Hawaii Invoice Template for Accountant incorporates various essential sections to ensure a complete and detailed invoice. It includes spaces to input the accountant's contact information such as their name, address, phone number, and email address, allowing easy communication and identification. Additionally, this template includes sections to provide the client's details, allowing the accountant to include the client's name, address, and contact information. This promotes seamless interaction and establishes a professional relationship between the accountant and the client. The template also contains fields to specify invoice details, including an invoice number, invoice date, payment terms, and due date. It ensures that the client receives clear and concise information, facilitating timely payments and minimizing confusion. Furthermore, the Hawaii Invoice Template for Accountant features a comprehensive breakdown of the services provided. It allows the accountant to describe the services in detail, including the scope of work, hourly rates, or itemized pricing. This transparency ensures that the client understands the services rendered and the corresponding costs. In addition to the general template, there may be different types of Hawaii Invoice Templates for Accountants based on specific accounting requirements. Some variations may include: 1. Hawaii Sales Invoice Template for Accountant: This template is tailored for accountants dealing with businesses that require sales invoices to track revenue and sales tax accurately. 2. Hawaii Hourly Invoice Template for Accountant: Specifically designed for accountants who charge their clients based on an hourly rate, this template includes sections to log the number of hours worked, the hourly rate, and the total amount due. 3. Hawaii Itemized Invoice Template for Accountant: Perfect for accountants who provide a variety of services or items to their clients, this template enables the accountant to itemize each service or item, along with individual prices, quantities, and totals. 4. Hawaii Tax Invoice Template for Accountant: This template is ideal for accountants who need to calculate and include Hawaii's specific taxes, such as the General Excise Tax (GET), on their invoices. It ensures compliance with the state's tax regulations. Overall, the Hawaii Invoice Template for Accountant streamlines the invoicing process, providing a professional and accurate representation of the services provided. It helps accountants effectively communicate their charges to clients while adhering to Hawaii's accounting and taxation standards.

Hawaii Invoice Template for Accountant

Description

How to fill out Hawaii Invoice Template For Accountant?

Are you presently in a circumstance where you require documentation for both commercial or personal purposes almost every day.

There are countless legal document templates accessible online, but locating ones you can rely on isn't simple.

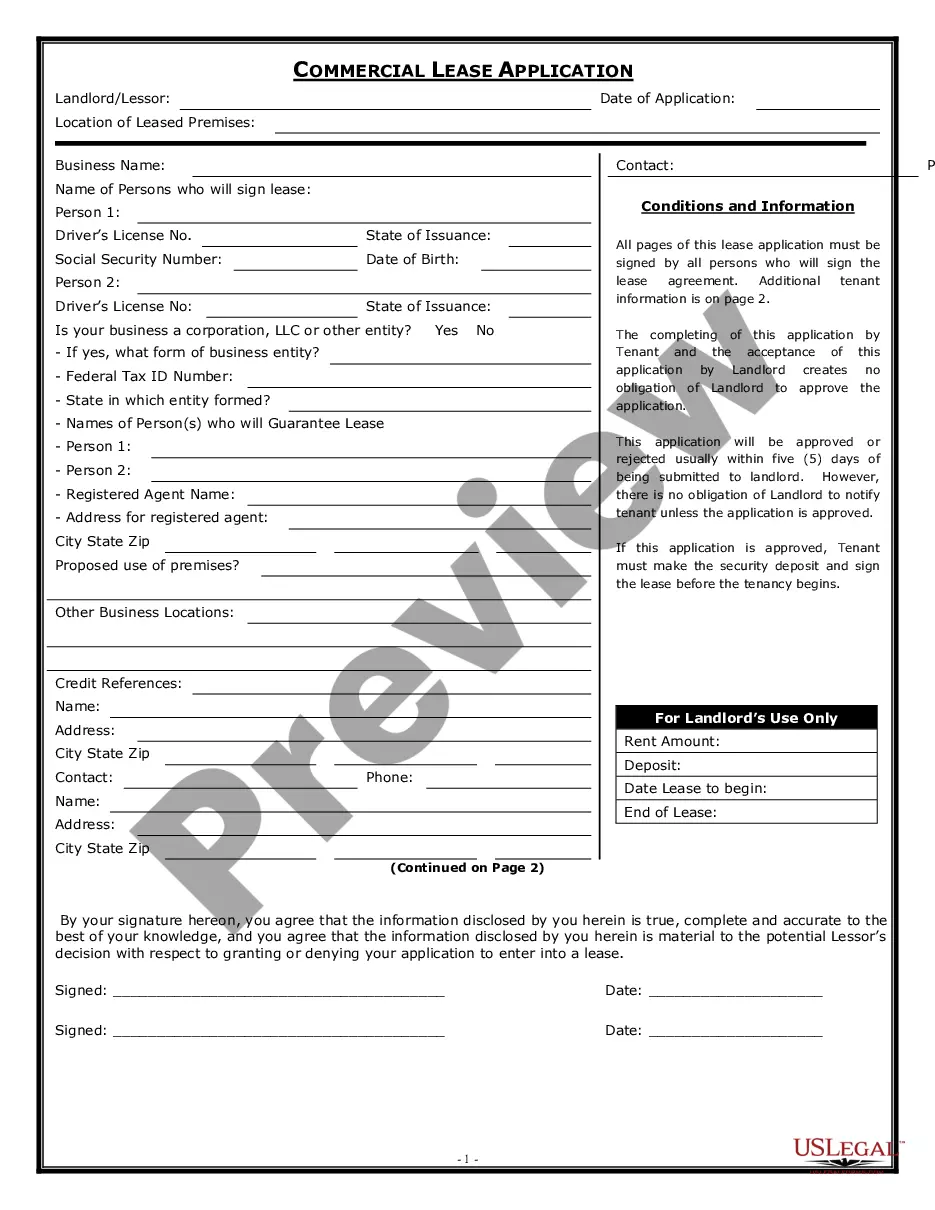

US Legal Forms offers thousands of form templates, such as the Hawaii Invoice Template for Accountant, which are designed to meet national and state requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you want, fill in the required information to create your account, and complete your purchase using PayPal or your credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you may download the Hawaii Invoice Template for Accountant template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Preview option to review the form.

- Check the outline to ensure that you have selected the correct document.

- If the form isn't what you are looking for, utilize the Search section to find the template that suits your needs.

Form popularity

FAQ

Preparing an invoice begins with selecting a platform, such as using a Hawaii Invoice Template for Accountant. Start by including your name and contact details, followed by your client's information. Clearly list the services or products provided, along with their prices. Finally, determine the payment terms and total amount, ensuring accuracy and professionalism.

To fill out a simple invoice, utilize a Hawaii Invoice Template for Accountant for ease. Start by entering your business name, followed by the client's information. List the service or goods provided, supplying corresponding costs and quantities. Ensure to include a total amount and terms of payment to finalize the invoice properly.

Using a Hawaii Invoice Template for Accountant makes filling an invoice template straightforward. Begin by entering your business details at the top, then include your client's name and address. After listing the services rendered or products sold, input the quantities and costs. Once completed, add the total amount due and any applicable terms to complete the invoice.

To record an invoice in accounting, first determine the service or product provided and note the amount due using a Hawaii Invoice Template for Accountant. You then make the appropriate entries in your accounting system, often involving debiting accounts receivable and crediting sales revenue. This method keeps your financial reports precise and up to date while ensuring you track all outstanding payments.

When you issue an invoice, the journal entry generally includes a debit to accounts receivable and a credit to sales revenue. For those using a Hawaii Invoice Template for Accountant, this process simplifies tracking. By recording these entries accurately, you ensure your financial records reflect the income earned. Regular updates to your journal help maintain correct accounting practices.

To fill out an invoice sheet using a Hawaii Invoice Template for Accountant, start by entering your business name and contact information at the top. Next, include the client's details, such as their name and address. After that, list the services or products provided, along with their quantities, prices, and any relevant dates. Finally, calculate the total amount due and specify the payment terms.

Absolutely, you can customize QuickBooks invoices to match your company's unique style. You can modify elements like colors, fonts, and logos, letting you create a Hawaii Invoice Template for Accountant that reflects your brand identity. Customization enhances your professional image and can improve client communication. This flexibility ensures your invoices are not only functional but visually appealing.

Yes, QuickBooks includes several pre-designed invoice templates. These templates are helpful for accountants looking for a Hawaii Invoice Template for Accountant. With quick access to these templates, you can create invoices that align with your brand and meet local requirements. This feature saves you time, allowing you to focus on providing quality services to your clients.

To locate invoice templates in QuickBooks Desktop, you should go to the 'Lists' menu, then select 'Templates.' Here, you will find a range of invoice designs, including the Hawaii Invoice Template for Accountant. This organized layout makes it simple to choose and customize the template that best fits your business. You can also create a new template if you want a more tailored design.

Yes, QuickBooks does provide a variety of invoice templates. You can easily navigate through the options to find a Hawaii Invoice Template for Accountant that meets your needs. These templates help streamline your billing process and ensure professional presentation. They are designed to cater to the specific requirements of accountants in Hawaii.

Interesting Questions

More info

Era time savers MPD tax returns tax preparers tax accounting free tax returns tax preparer tax return preparer.