Hawaii Accounts Receivable Write-Off Approval Form

Description

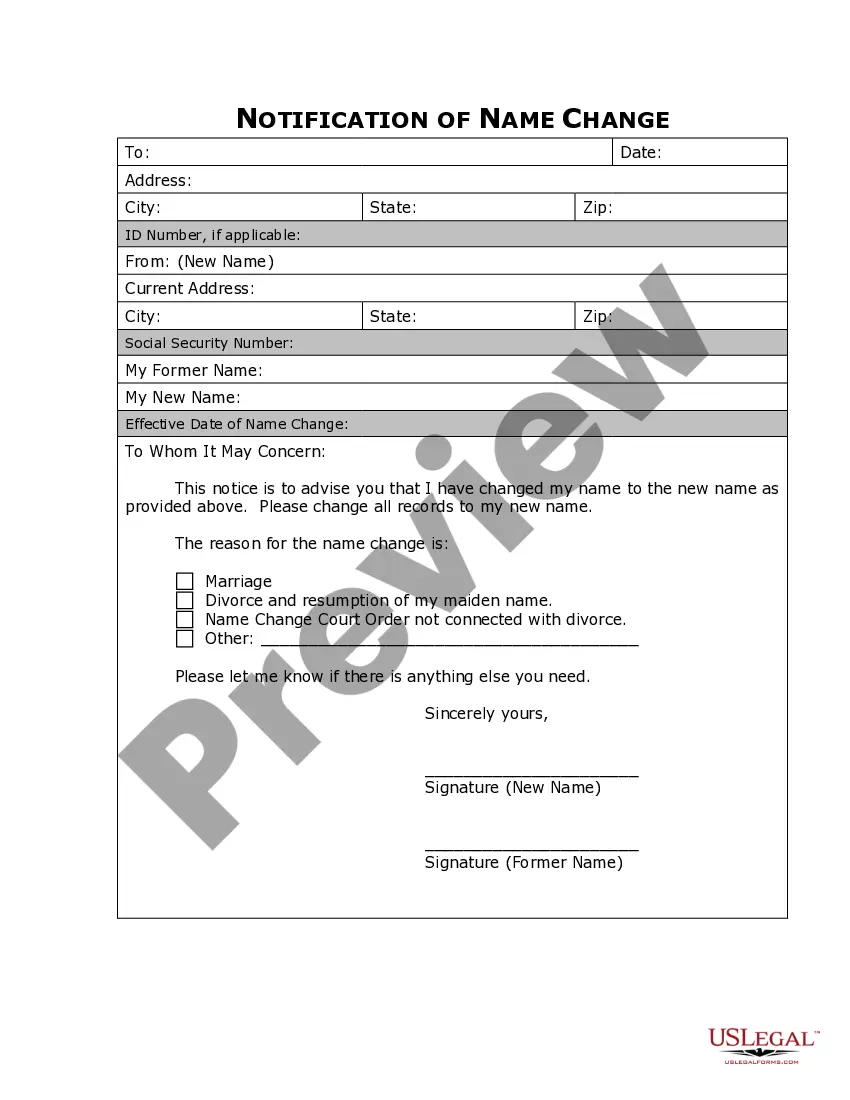

How to fill out Accounts Receivable Write-Off Approval Form?

You can invest hours online searching for the official document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can effortlessly download or print the Hawaii Accounts Receivable Write-Off Approval Form from our platform.

If available, utilize the Preview button to browse through the document template as well. If you wish to acquire an additional version of the form, use the Search field to find the template that suits your needs.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, edit, print, or sign the Hawaii Accounts Receivable Write-Off Approval Form.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Read the form details to make sure you have selected the correct template.

Form popularity

FAQ

To remove bad debt from accounts receivable, you must first assess the collectibility of the debts in question. If they are deemed uncollectible, proceed to write them off using a journal entry that reflects the loss. The Hawaii Accounts Receivable Write-Off Approval Form can facilitate this process, ensuring that you maintain accurate financial records while adhering to relevant guidelines.

To write off unpaid accounts receivable, start by confirming that all collection efforts have been exhausted. Then, prepare a journal entry that debits bad debt expense and credits accounts receivable. Using the Hawaii Accounts Receivable Write-Off Approval Form can simplify your documentation process and ensure that you meet the necessary legal and accounting standards.

Yes, a write-off of accounts receivable does affect your net income. When you write off a bad debt, it reduces your total revenue, as it's recorded as an expense. Understanding this impact is critical, and the Hawaii Accounts Receivable Write-Off Approval Form can serve as an essential tool to manage this financial activity effectively.

Yes, you can write off unpaid accounts receivable when they are deemed uncollectible. Writing off accounts receivable helps to keep your financial statements accurate, reflecting only amounts expected to be collected. Utilizing the Hawaii Accounts Receivable Write-Off Approval Form can streamline this process and ensure compliance with relevant regulations.

In Hawaii, the G49 form should be filed with the Department of Taxation. You can submit the form online or via traditional mail, ensuring all necessary information is included. For assistance and additional resources, consider visiting the uslegalforms platform where you can find step-by-step guidance on filing G49 and related documents.

To record a write-off of accounts receivable as uncollectible, first ensure you have documented the efforts made to collect the debt. You then create a journal entry that reduces accounts receivable and recognizes bad debt expense. This process can be simplified with the Hawaii Accounts Receivable Write-Off Approval Form, which helps to formalize your write-off procedure.

The direct write-off method for uncollectible accounts receivable involves removing a bad debt from your accounts as soon as you recognize it as uncollectible. This method does not allow for estimates, requiring that accounts be confirmed as uncollectible before they can be written off. It is important for maintaining accurate financial records. Using the Hawaii Accounts Receivable Write-Off Approval Form can further facilitate this process.

Hawaii form G-49, which relates to miscellaneous tax returns, should be mailed to the specified address provided on the form itself. Ensure to review the instructions carefully, as mailing addresses may vary depending on your needs. To make your financial management easier, consider using the Hawaii Accounts Receivable Write-Off Approval Form to organize your tax documents.

Writing off an uncollectible account involves a few straightforward steps. Start by confirming that the account is genuinely uncollectible after exhausting collection efforts. Then, record the write-off in your accounting system, which will adjust your financial records. The Hawaii Accounts Receivable Write-Off Approval Form can assist you in documenting this action effectively.

To write off uncollectible accounts receivable, you first need to identify debts that are unlikely to be collected. Documentation of efforts to collect the debt is essential. After that, complete the necessary accounting entries to reflect the write-off in your financial statements. Utilizing the Hawaii Accounts Receivable Write-Off Approval Form can simplify this process.