Hawaii Installment Promissory Note with Bank Deposit as Collateral

Description

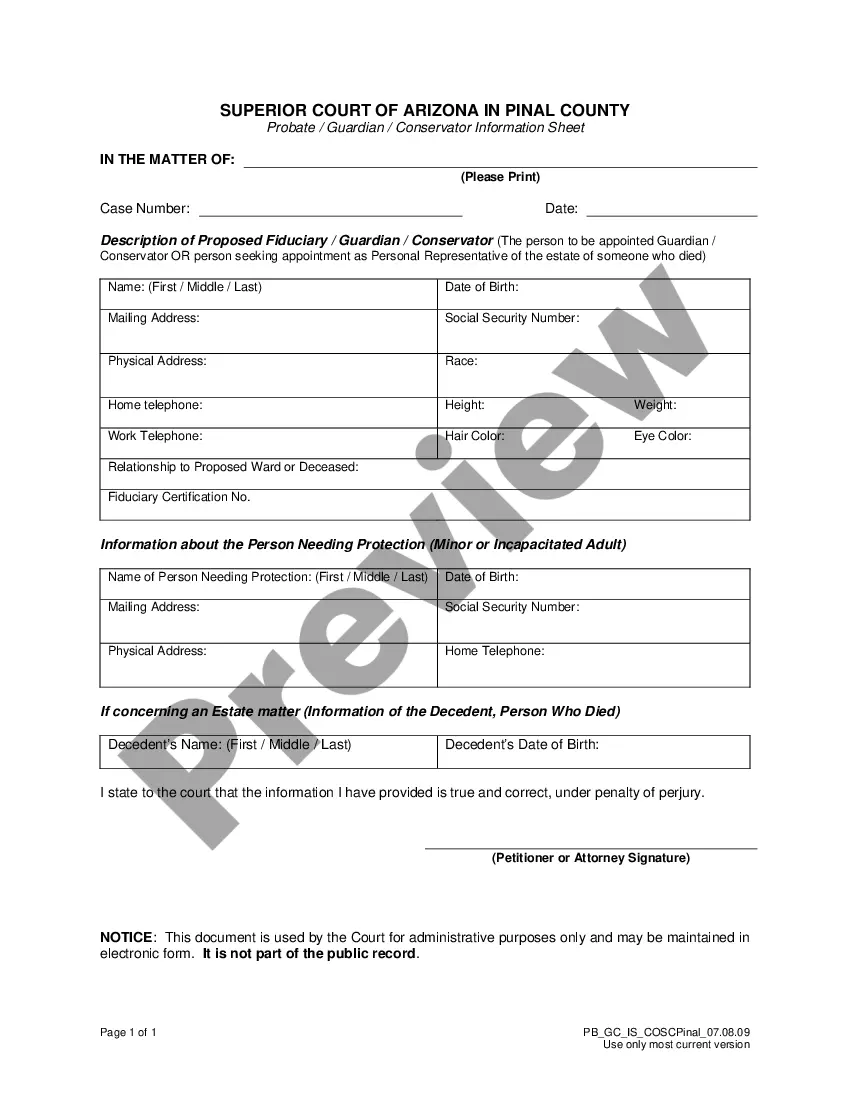

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Hawaii Installment Promissory Note with Bank Deposit as Collateral in a matter of seconds.

If the form does not meet your needs, use the Search section at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose the payment plan you prefer and provide your details to register for an account. Process the transaction. Utilize a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make modifications. Fill in, edit, print, and sign the downloaded Hawaii Installment Promissory Note with Bank Deposit as Collateral. Every template you add to your account does not have an expiration date and is yours forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Hawaii Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- If you already have a monthly subscription, sign in and download the Hawaii Installment Promissory Note with Bank Deposit as Collateral from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your region/state. Click on the Review button to examine the form's contents.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

To make a promissory note, such as a Hawaii Installment Promissory Note with Bank Deposit as Collateral, legally binding, it must include essential elements like the amount, interest rate, payment schedule, and signatures from both parties. You must also ensure it complies with state laws. Proper documentation and clear terms reduce misunderstandings and disputes. Utilizing uslegalforms can streamline the process, providing you with templates that meet legal requirements.

A Hawaii Installment Promissory Note with Bank Deposit as Collateral can indeed hold up in court, provided it meets the necessary legal requirements. Courts generally look for clear terms, signatures, and proper execution. If the document is well-drafted, it serves as solid evidence of the obligation between the parties involved. Using platforms like uslegalforms can help ensure your promissory note is legally sound.

For a promissory note to be valid, it must include certain essential elements, such as the amount owed, the interests rates, and the signatures of the involved parties. A Hawaii Installment Promissory Note with Bank Deposit as Collateral must also specify the collateral details, ensuring that all terms are clear and agreed upon by both parties. Ensuring these elements are in place helps avoid disputes later on.

To acquire a promissory note from a bank, start by discussing your needs with a bank representative. You will need to demonstrate your financial standing and collateral. By using a Hawaii Installment Promissory Note with Bank Deposit as Collateral, you provide the bank with assurance, making the process smoother and easier.

Yes, you can obtain a promissory note from a bank. Many banks offer these notes under specific conditions. When using a Hawaii Installment Promissory Note with Bank Deposit as Collateral, your chances of getting approval increase, as your deposit serves as security, presenting a lower risk to the bank.

Promissory notes must adhere to specific rules to remain enforceable. Important guidelines include the parties' legal names, clear payment terms, and signatures of both borrower and lender. Ensure compliance with state laws, including those pertinent to a Hawaii Installment Promissory Note with Bank Deposit as Collateral. By following these rules, you can create a robust and legally binding agreement.

Filling out a promissory note sample involves entering vital details correctly. You need to state the borrower's name, the lender's name, the principal amount, interest rate, and repayment terms. It's crucial to include information about any collateral, like a Hawaii Installment Promissory Note with Bank Deposit as Collateral, to provide clarity. Using templates from trusted platforms can simplify this process greatly.

Yes, a promissory note can indeed have collateral. Securing the note with collateral, such as a bank deposit, strengthens the agreement. This kind of arrangement not only protects the lender's interests but may also encourage the borrower to repay on time. A Hawaii Installment Promissory Note with Bank Deposit as Collateral exemplifies this beneficial practice.

A promissory note can be used as a form of payment in certain situations. However, its acceptance largely depends on the agreement between the parties involved. When aligned with a Hawaii Installment Promissory Note with Bank Deposit as Collateral, it can represent a workable solution for settling transactions. Always ensure both parties understand the terms.

Banks generally accept promissory notes as part of their lending processes. They often view these notes as reliable commitments to repay loans. When using a Hawaii Installment Promissory Note with Bank Deposit as Collateral, banks may find these agreements particularly attractive. Clear documentation increases the likelihood of acceptance.