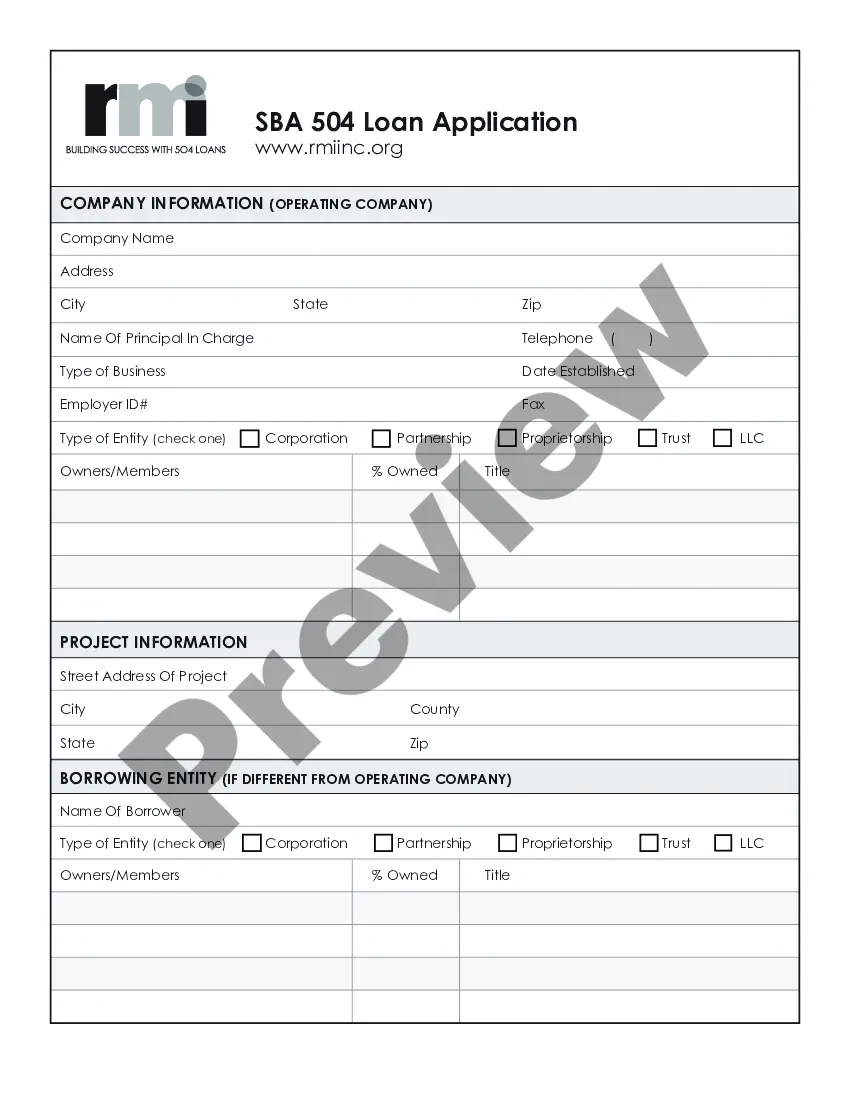

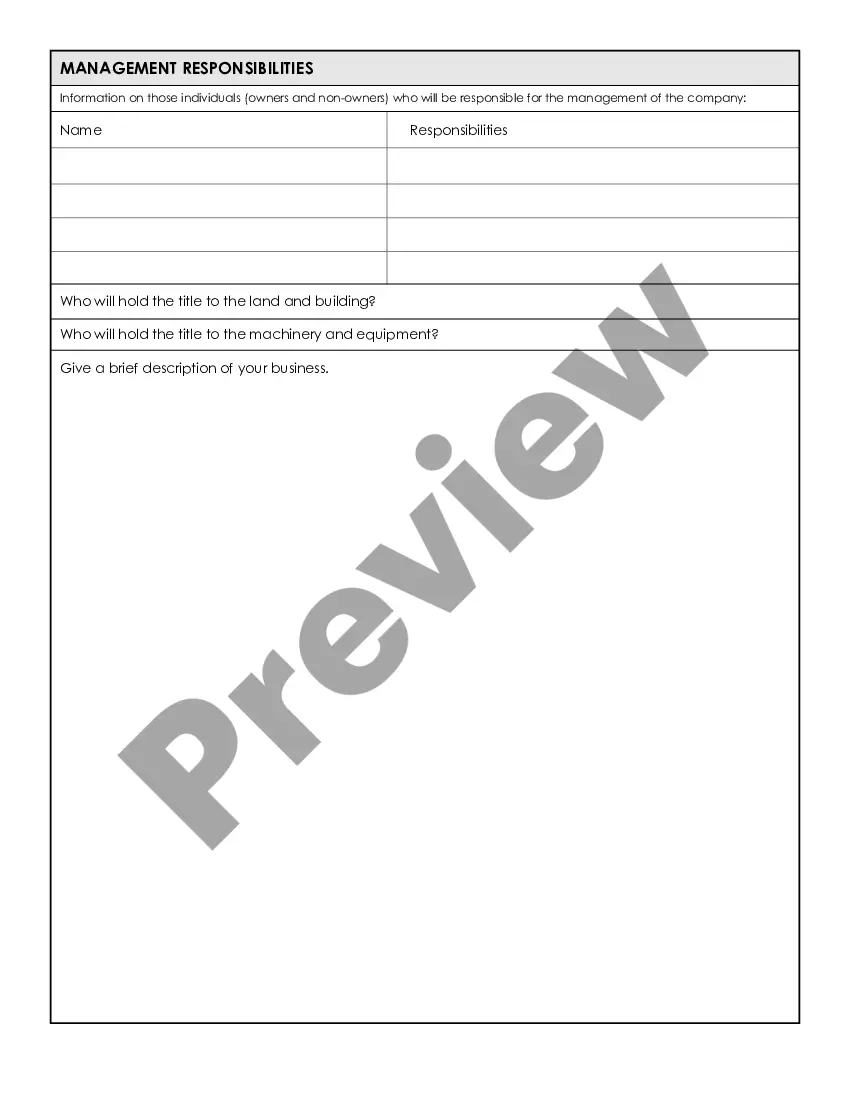

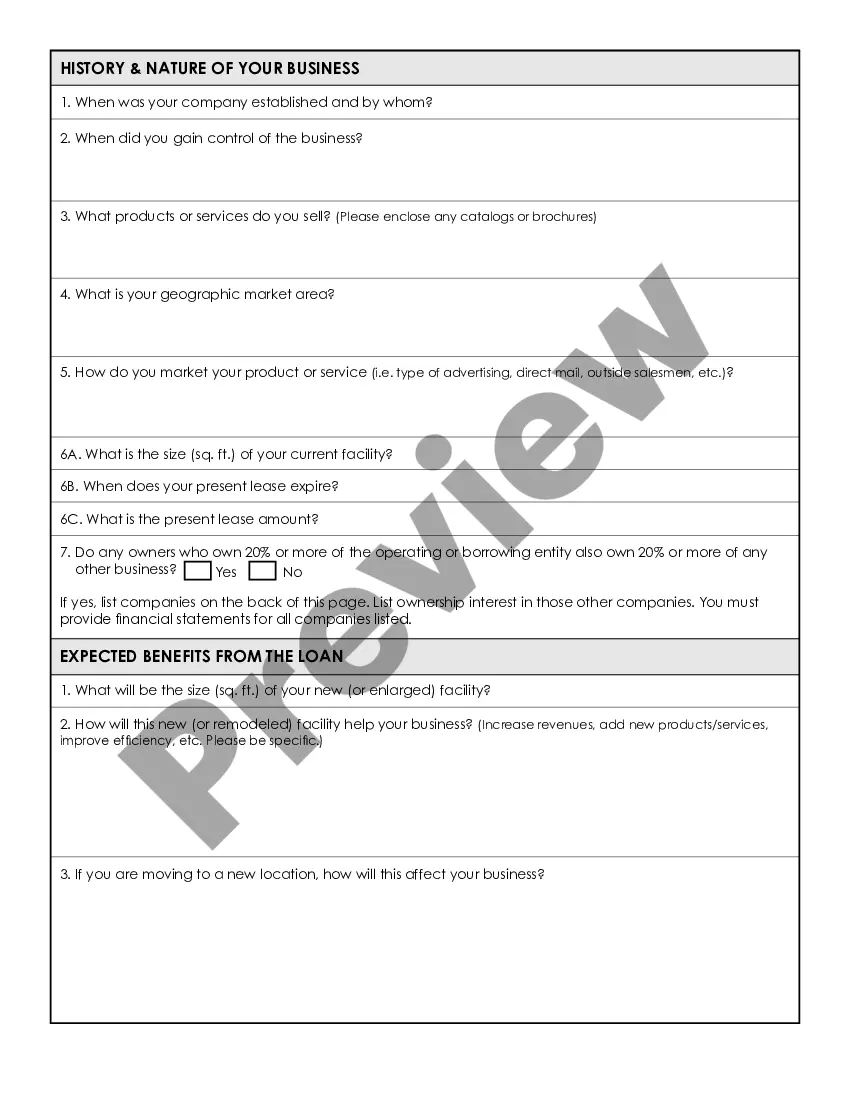

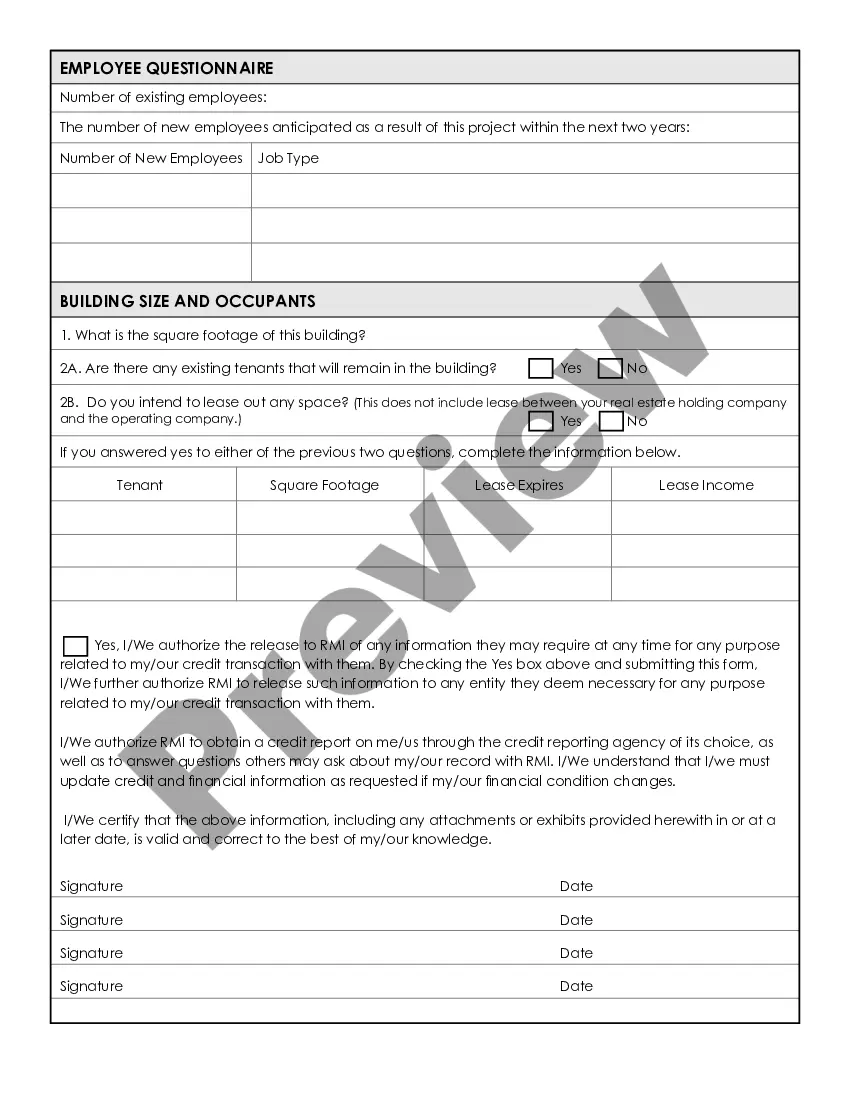

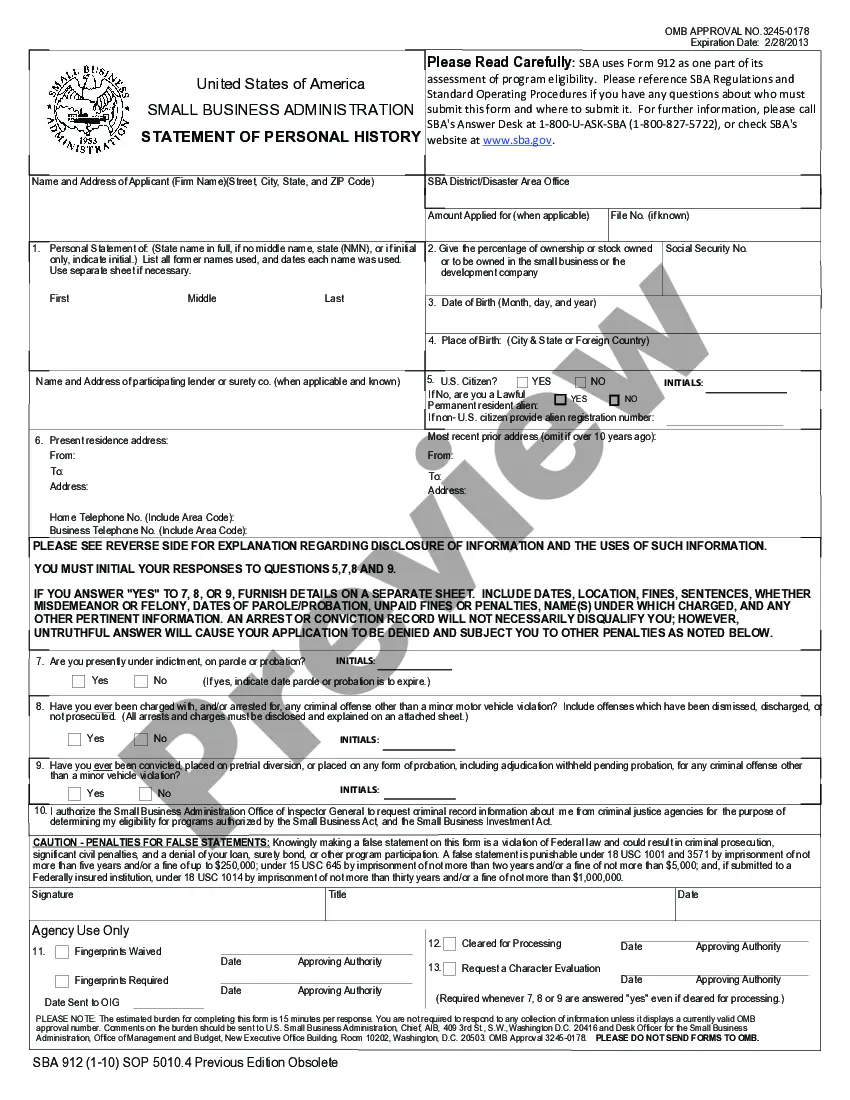

The Hawaii Small Business Administration (SBA) Loan Application Form is a comprehensive document that small business owners in Hawaii utilize to apply for SBA loans. This form serves as a crucial part of the loan application process and helps small business owners provide detailed information about their business, financials, and loan requirements to the SBA. The SBA Loan Application Form for Hawaii consists of several sections that require essential details about the business, including legal name, address, contact information, business structure, and employer identification number. The form also prompts applicants to provide a brief description of their business, outlining the products or services offered, target market, and competition. Moreover, the form includes sections dedicated to financial information, where applicants must furnish details regarding their current financial standing, assets, liabilities, and income statements. Small business owners are required to provide information about their personal financial history, including personal assets, outstanding debts, and other financial obligations. Furthermore, the SBA Loan Application Form for Hawaii requests a thorough business plan, highlighting the business's goals, marketing strategies, operational processes, and sales projections. This section is crucial as it demonstrates the feasibility and potential success of the business, aiding the SBA in assessing the loan application. The form also encompasses a section dedicated to the loan application itself, where small business owners must specify the loan amount they are seeking, the purpose of the loan, and the collateral they are willing to offer. Additionally, applicants must disclose any previous government financing or loans received. In terms of checklists, the SBA provides detailed instructions for small business owners to ensure they have all the necessary documents and information before submitting the loan application. These checklists often include items such as business financial statements, tax returns, personal financial statements, business licenses, legal documents, resumes, and business leases. Although there might not be different types of SBA Loan Application Form and Checklist exclusively for Hawaii, there could be variations based on the type of SBA loan being sought. For example, there could be specific forms and checklists for SBA 7(a) loans, SBA CDC/504 loans, or SBA microloans. Each loan type may require additional supporting documentation and information specific to the loan program. In summary, the Hawaii Small Business Administration Loan Application Form is an essential document for small business owners seeking SBA loans. It collects comprehensive details about the business, financials, and loan requirements. By diligently completing the form and adhering to the provided checklist, small business owners can improve their chances of securing the necessary funding for their ventures.

Hawaii Small Business Administration Loan Application Form and Checklist

Description

How to fill out Hawaii Small Business Administration Loan Application Form And Checklist?

Are you in a situation the place you need papers for possibly enterprise or individual uses virtually every day? There are a lot of legitimate document templates available on the Internet, but getting kinds you can trust isn`t simple. US Legal Forms provides a large number of form templates, such as the Hawaii Small Business Administration Loan Application Form and Checklist, that happen to be written to meet state and federal needs.

If you are presently familiar with US Legal Forms site and get an account, just log in. Afterward, it is possible to down load the Hawaii Small Business Administration Loan Application Form and Checklist design.

If you do not have an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the form you require and ensure it is to the correct area/county.

- Make use of the Review button to review the shape.

- Browse the description to actually have chosen the proper form.

- In case the form isn`t what you`re searching for, use the Research area to find the form that meets your requirements and needs.

- If you find the correct form, click on Buy now.

- Opt for the rates program you would like, fill in the specified details to generate your money, and pay money for the order with your PayPal or charge card.

- Select a convenient file format and down load your backup.

Discover all the document templates you might have bought in the My Forms menus. You can aquire a extra backup of Hawaii Small Business Administration Loan Application Form and Checklist at any time, if required. Just click on the needed form to down load or print out the document design.

Use US Legal Forms, the most considerable variety of legitimate kinds, in order to save efforts and steer clear of errors. The services provides appropriately manufactured legitimate document templates that can be used for a selection of uses. Create an account on US Legal Forms and initiate creating your daily life a little easier.