The Hawaii Short Form Agreement to Dissolve and Wind up Partnership is a legal document that outlines the process of terminating a partnership in the state of Hawaii. This agreement serves as a concise and efficient tool for partners to dissolve their business relationship while ensuring a smooth and organized wind-up process. By incorporating relevant keywords, we can provide a detailed description of this agreement and mention any variants that may exist. In Hawaii, when partners decide to dissolve their partnership, they can opt for a Short Form Agreement. This document expedites the dissolution process by providing a simplified framework for partners to follow. It contains essential information and terms relevant to the winding up of the partnership affairs. The Hawaii Short Form Agreement to Dissolve and Wind up Partnership typically includes the following key elements: 1. Identification: Partners must begin the agreement by clearly identifying themselves, including their full legal names, addresses, and the name of the partnership. 2. Effective Date: The agreement specifies the effective date of the dissolution, which marks the official start of the wind-up process. 3. Dissolution Process: It describes the steps and procedures partners will undertake to dissolve the partnership. This may include settling outstanding obligations, liquidating assets, notifying clients and suppliers, and complying with state and federal regulations. 4. Asset Distribution: The agreement outlines how the partnership's assets and liabilities will be dealt with during the wind-up process. Partners may decide to distribute assets proportionally according to their ownership interests or through a different predetermined mechanism. 5. Debts and Obligations: Partners will define how the partnership's debts, loans, and contractual obligations will be settled. This includes addressing outstanding payments, loans, leases, and any outstanding legal matters. 6. Tax and Financial Obligations: Partners must address the filing of necessary tax returns, payment of any outstanding taxes, and the responsibility for any financial obligations that may arise during the wind-up process. 7. Dispute Resolution: This section may cover how disputes or disagreements between partners will be resolved, whether through mediation, arbitration, or another agreed-upon method. Different types of Short Form Agreement to Dissolve and Wind up Partnership in Hawaii may exist based on specific partnership structures or circumstances. For instance, there could be variants tailored to general partnerships, limited partnerships, or limited liability partnerships. These variants may contain additional clauses or provisions unique to each partnership type, highlighting the importance of consulting with legal professionals to ensure compliance with applicable laws and regulations. In conclusion, the Hawaii Short Form Agreement to Dissolve and Wind up Partnership is a vital legal document enabling partners to terminate their business relationship smoothly. It covers crucial aspects such as asset distribution, debts and obligations settlement, tax requirements, and more. Understanding the distinct partnership types and seeking appropriate legal guidance will help partners navigate the dissolution process effectively.

Hawaii Short Form Agreement to Dissolve and Wind up Partnership

Description

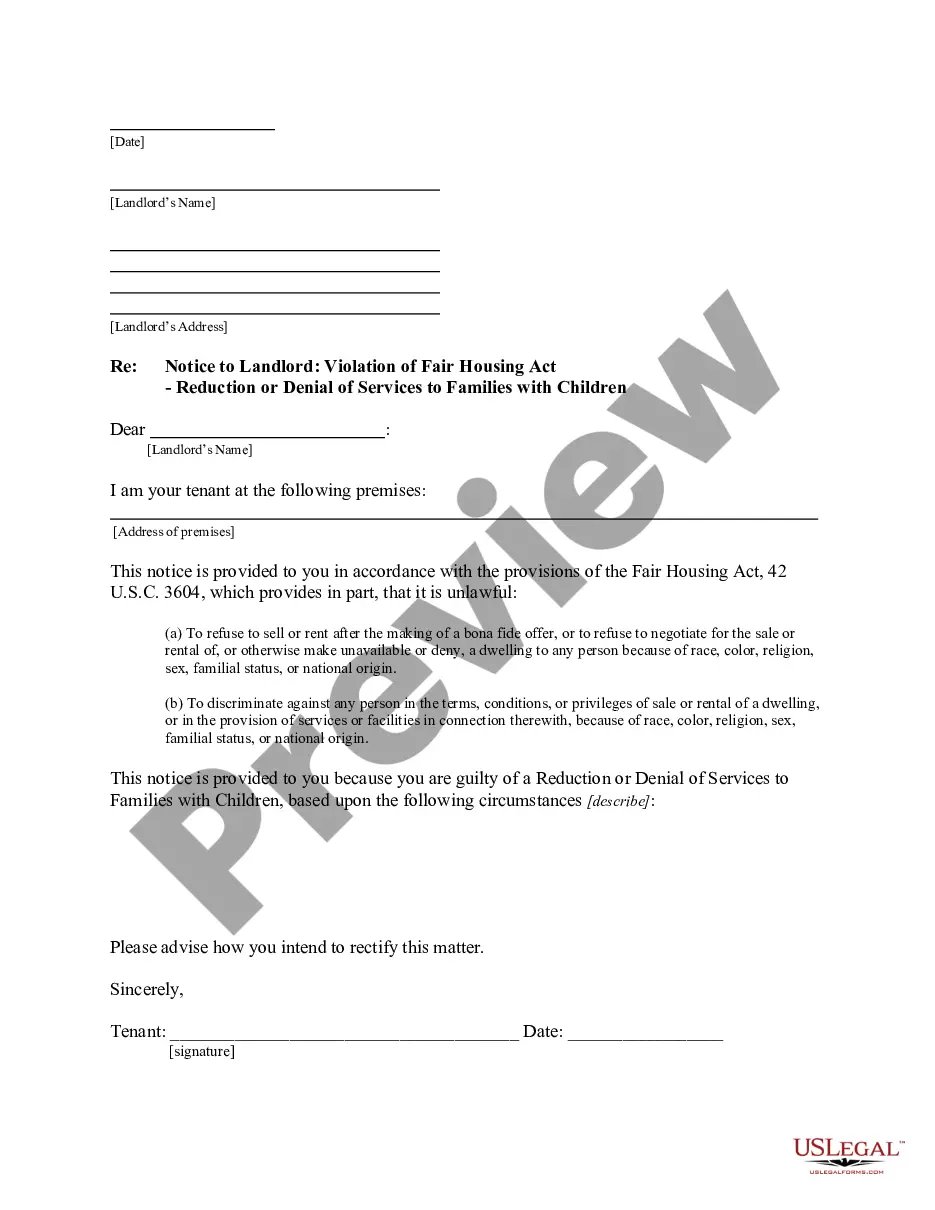

How to fill out Hawaii Short Form Agreement To Dissolve And Wind Up Partnership?

If you wish to total, obtain, or print out authorized document templates, use US Legal Forms, the most important selection of authorized varieties, that can be found on-line. Use the site`s simple and practical lookup to discover the files you will need. A variety of templates for company and individual purposes are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the Hawaii Short Form Agreement to Dissolve and Wind up Partnership in a number of clicks.

If you are currently a US Legal Forms customer, log in to your bank account and click on the Download key to get the Hawaii Short Form Agreement to Dissolve and Wind up Partnership. You can even gain access to varieties you in the past downloaded in the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the proper area/country.

- Step 2. Take advantage of the Preview choice to look through the form`s articles. Do not overlook to see the outline.

- Step 3. If you are not satisfied using the type, take advantage of the Look for industry on top of the screen to discover other variations from the authorized type design.

- Step 4. When you have discovered the shape you will need, click the Get now key. Opt for the costs prepare you prefer and put your references to sign up for an bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the format from the authorized type and obtain it on your gadget.

- Step 7. Total, modify and print out or indicator the Hawaii Short Form Agreement to Dissolve and Wind up Partnership.

Each authorized document design you purchase is the one you have forever. You have acces to every type you downloaded with your acccount. Click on the My Forms section and pick a type to print out or obtain again.

Remain competitive and obtain, and print out the Hawaii Short Form Agreement to Dissolve and Wind up Partnership with US Legal Forms. There are many expert and status-certain varieties you can utilize for your personal company or individual requires.