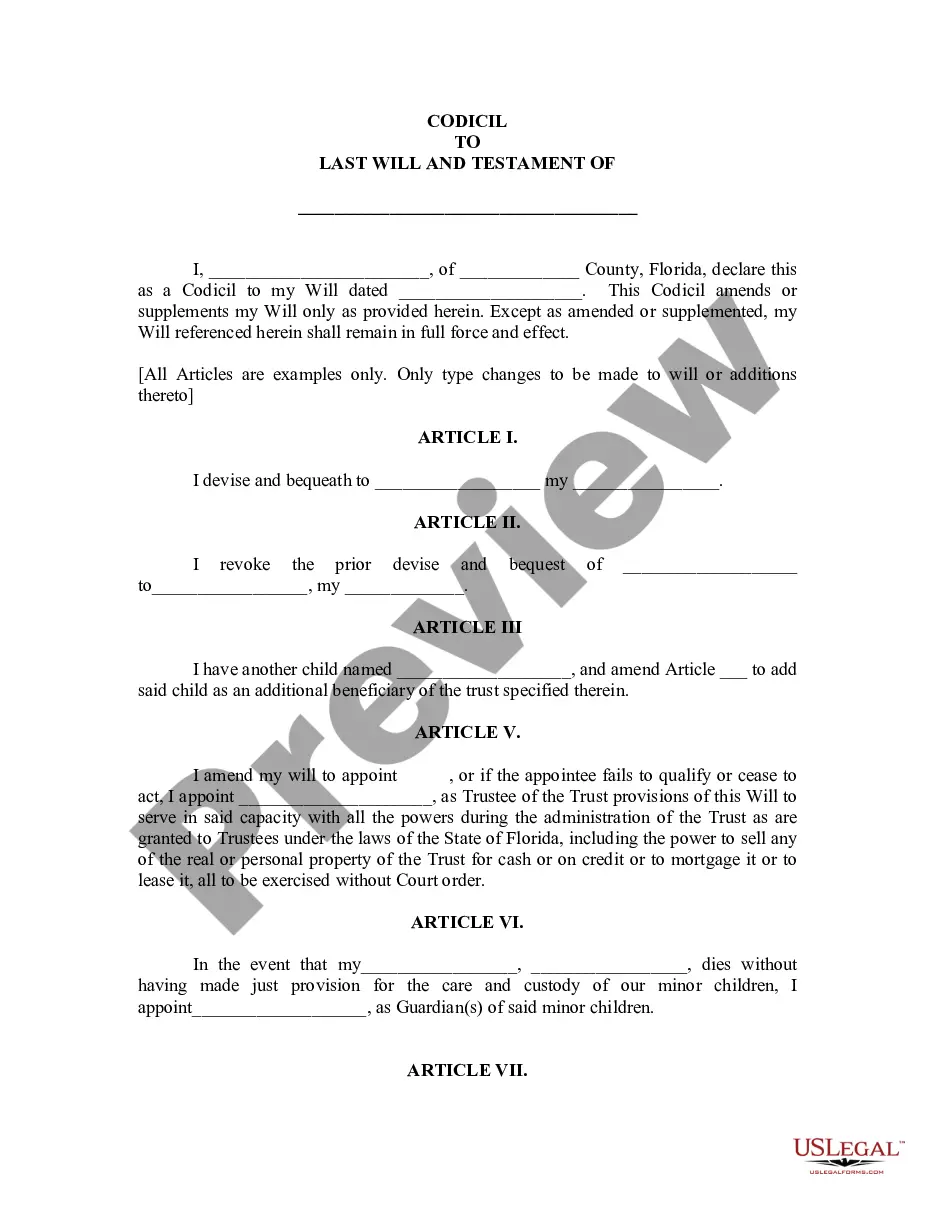

The Hawaii Return Authorization Form is an essential document used to streamline the return process and ensure proper handling of returned goods or items in Hawaii. This form serves as a formal request, allowing individuals or businesses to seek approval for returning merchandise to the original seller or manufacturer. Keywords: Hawaii, Return Authorization Form, merchandise, return process, approval, original seller, manufacturer. In Hawaii, there may be different types of Return Authorization Forms, catering to various scenarios. Some common types may include: 1. Consumer Return Authorization Form: This is typically used by individuals who wish to return a purchased product to the retailer or seller. It provides necessary details such as the product description, date of purchase, reason for return, and potentially any required documentation or condition guidelines. 2. Business Return Authorization Form: Businesses often need to return products or materials to their suppliers or manufacturers. This form enables them to request authorization by furnishing pertinent information like product name, quantity, invoice number, reason for return, and any other specific requirements imposed by the supplier. 3. Damaged Goods Return Authorization Form: In cases where goods arrive damaged or defective, this form helps document the issue and request return authorization. It may require descriptions of the damages, supporting evidence (e.g., photographs), purchase details, and the desired resolution (refund, replacement, etc.). 4. Supplier Return Authorization Form: Suppliers, on occasion, may need to retrieve products from their buyers, either due to product recalls, expired inventory, or other reasons. This form assists them in obtaining proper permission from the buyer, enabling them to schedule the return and process the necessary paperwork. 5. Warranty Return Authorization Form: When a product is under warranty and requires repairs or replacement, this form serves as an official request for the return of the defective item. It often demands specific information, such as the warranty details, product serial or model numbers, and a comprehensive description of the issue. Adhering to the correct Hawaii Return Authorization Form is crucial for individuals and businesses to ensure a smooth return process. By providing accurate and relevant information to the authorized party, these forms help minimize delays and misunderstandings, leading to efficient returns and resolutions.

Hawaii Return Authorization Form

Description

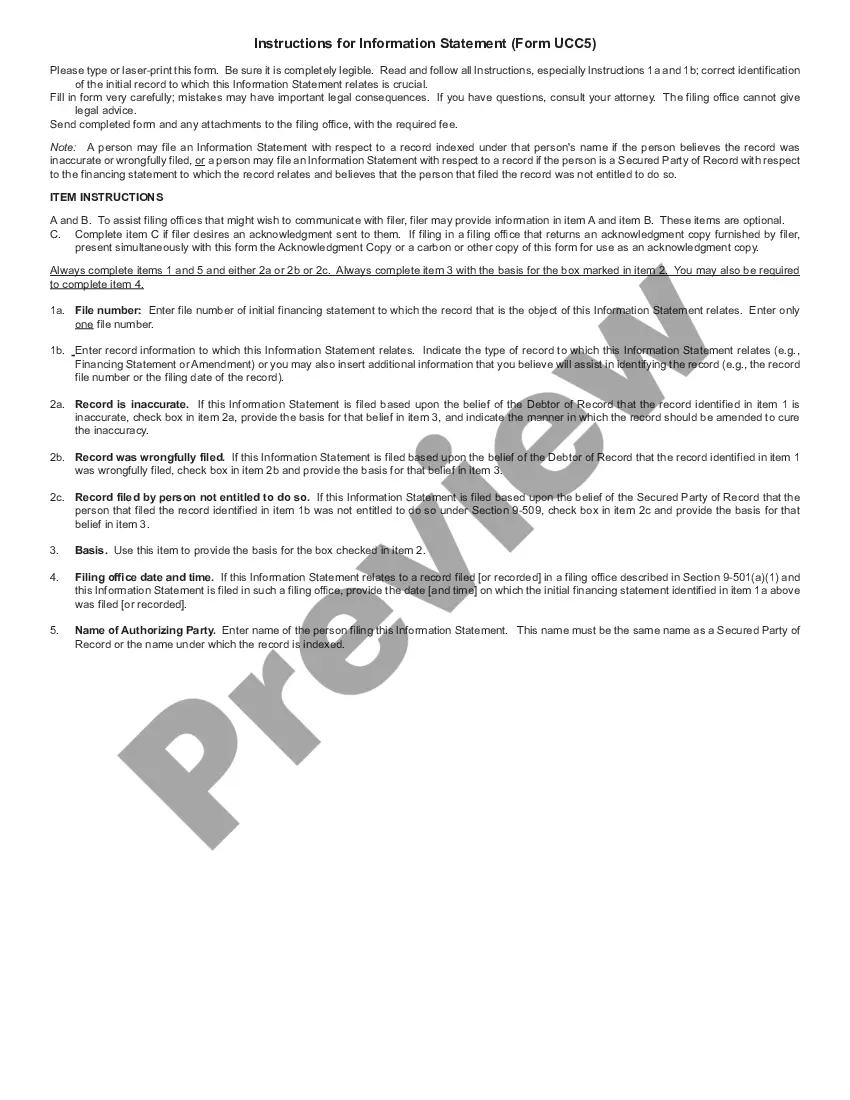

How to fill out Hawaii Return Authorization Form?

Discovering the right authorized papers format can be quite a struggle. Obviously, there are a lot of layouts accessible on the Internet, but how do you discover the authorized develop you need? Take advantage of the US Legal Forms internet site. The service offers 1000s of layouts, including the Hawaii Return Authorization Form, which can be used for enterprise and private requires. Every one of the varieties are checked by specialists and satisfy federal and state needs.

If you are already signed up, log in to your profile and click on the Obtain button to find the Hawaii Return Authorization Form. Use your profile to look from the authorized varieties you possess bought previously. Check out the My Forms tab of your respective profile and have one more version in the papers you need.

If you are a whole new user of US Legal Forms, listed here are simple recommendations that you should stick to:

- First, be sure you have chosen the right develop to your metropolis/area. It is possible to look through the form using the Review button and browse the form explanation to make certain this is the right one for you.

- If the develop fails to satisfy your preferences, use the Seach industry to get the appropriate develop.

- When you are certain the form is proper, click the Purchase now button to find the develop.

- Choose the rates plan you desire and enter in the essential information. Create your profile and purchase an order with your PayPal profile or charge card.

- Select the document file format and download the authorized papers format to your system.

- Complete, revise and produce and indication the attained Hawaii Return Authorization Form.

US Legal Forms is definitely the largest collection of authorized varieties in which you will find various papers layouts. Take advantage of the service to download expertly-manufactured paperwork that stick to status needs.

Form popularity

FAQ

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

File your general excise and use tax returns with: Hawaii Department of Taxation P.O. Box 1425 Honolulu, HI 96806-1425. The general excise tax is a tax imposed on the gross income you receive from any business activ- ity you have in Hawaii.

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.

Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Form G-45. Schedule GE (Form G-45/G-49) - If you are claiming exemptions on Forms G-45 and G-49, you must complete and attach Schedule GE (Form G-45/G-49) to Forms G-45 and G-49.

Pay individual income tax. Pay a balance due on your Individual Income Tax Return for the current tax year, and prior years through tax year 2003.

Form EF-3 must be completed for each indi- vidual who is an authorized representative of the taxpayer. Authorized representatives MUST register for a Hawaii VPID number online at hitax.hawaii.gov. There is no fee for this registration.

Pay individual income tax. Pay a balance due on your Individual Income Tax Return for the current tax year, and prior years through tax year 2003.

45. Periodic eneral Excise / Use Tax Return. Use Rev. 2019 form for taxable periods beginning on or after January 1, 2020.

Your application may be submitted online through our website at hitax.hawaii.gov or through the Hawaii Business Express website at hbe.ehawaii.gov, by mail, or in person at any district tax office. You may also file your application with one of the Department of Commerce and Consumer Affairs' Business Action Centers.

Form G-45 is due on or before the 20th day of the calendar month following the end of the filing period. For example, if your filing period ends on January 31st, then your return will be due on February 20th. Form G-49 is due on or before the 20th day of the fourth month following the close of the tax year.