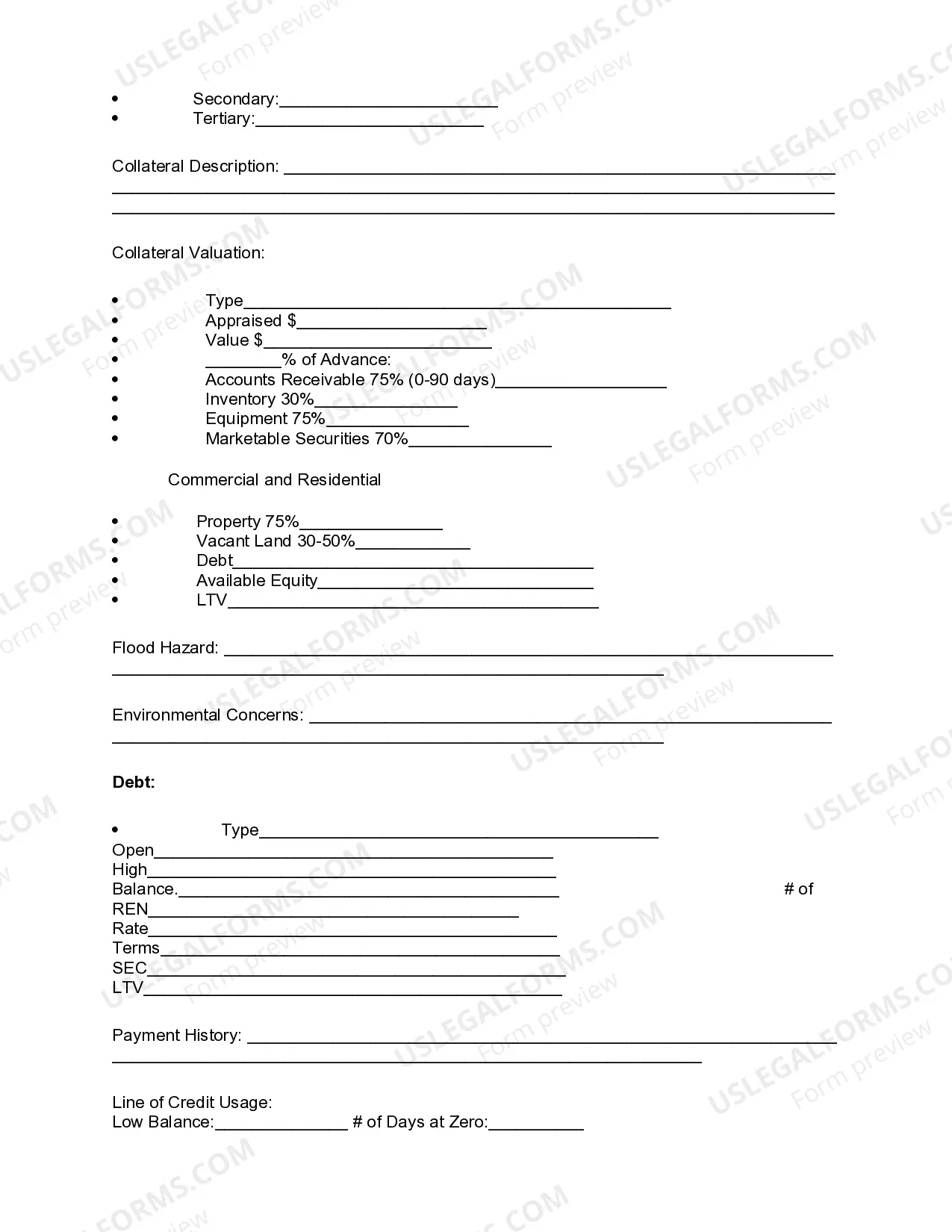

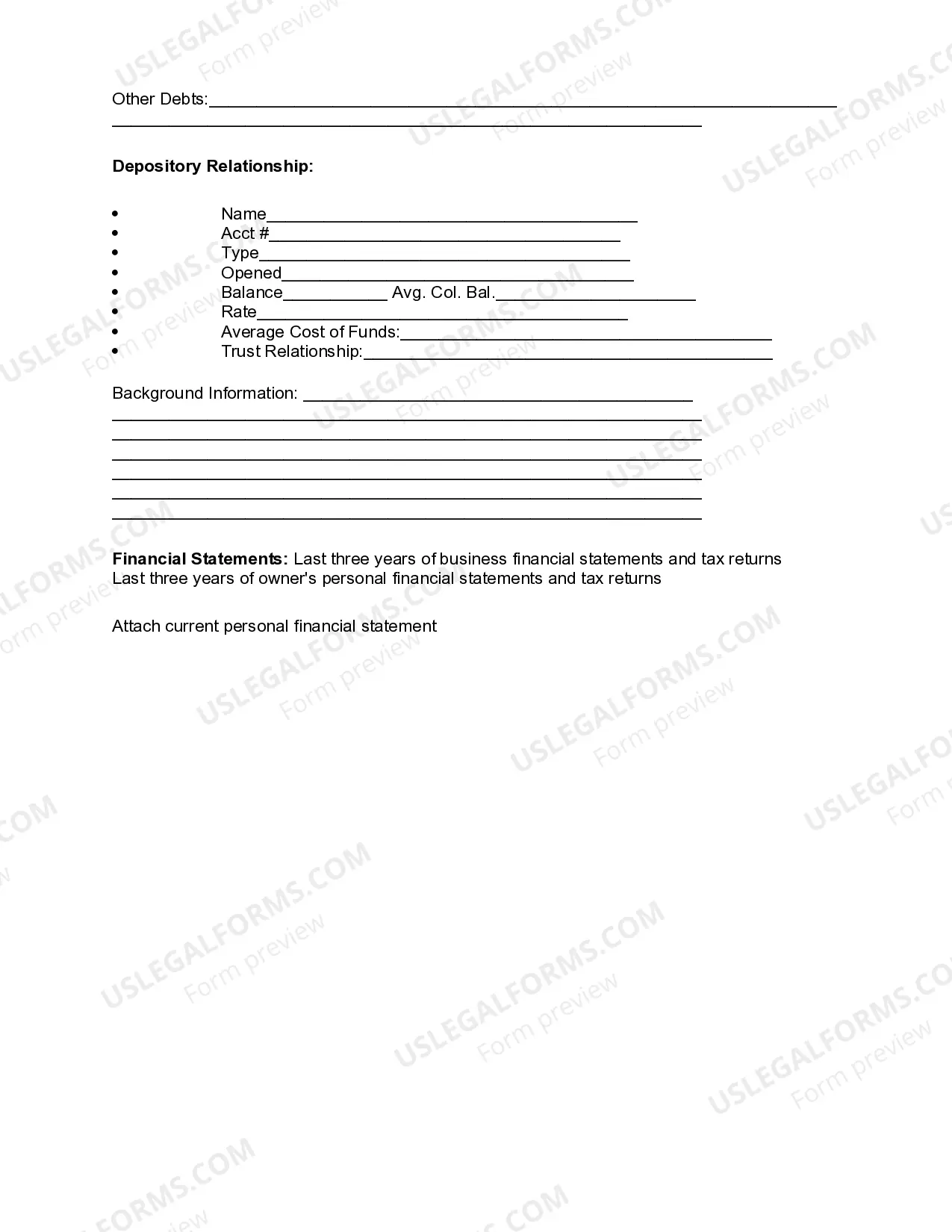

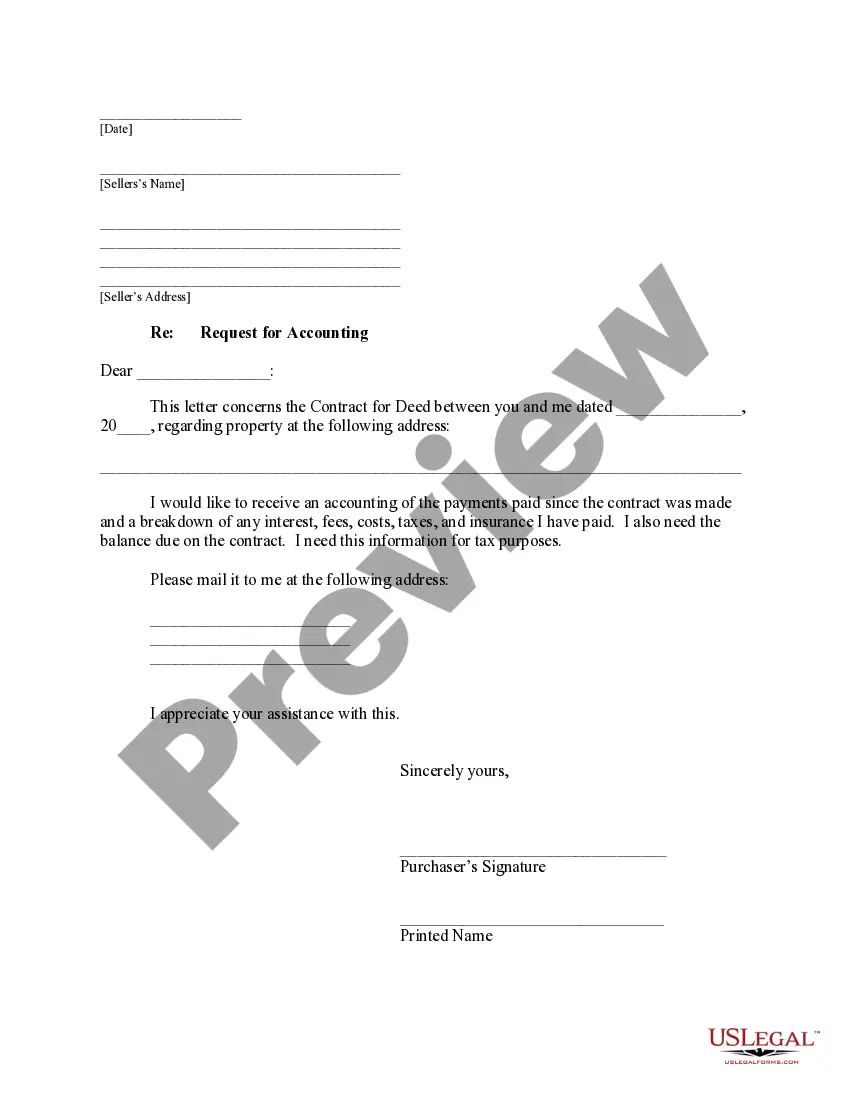

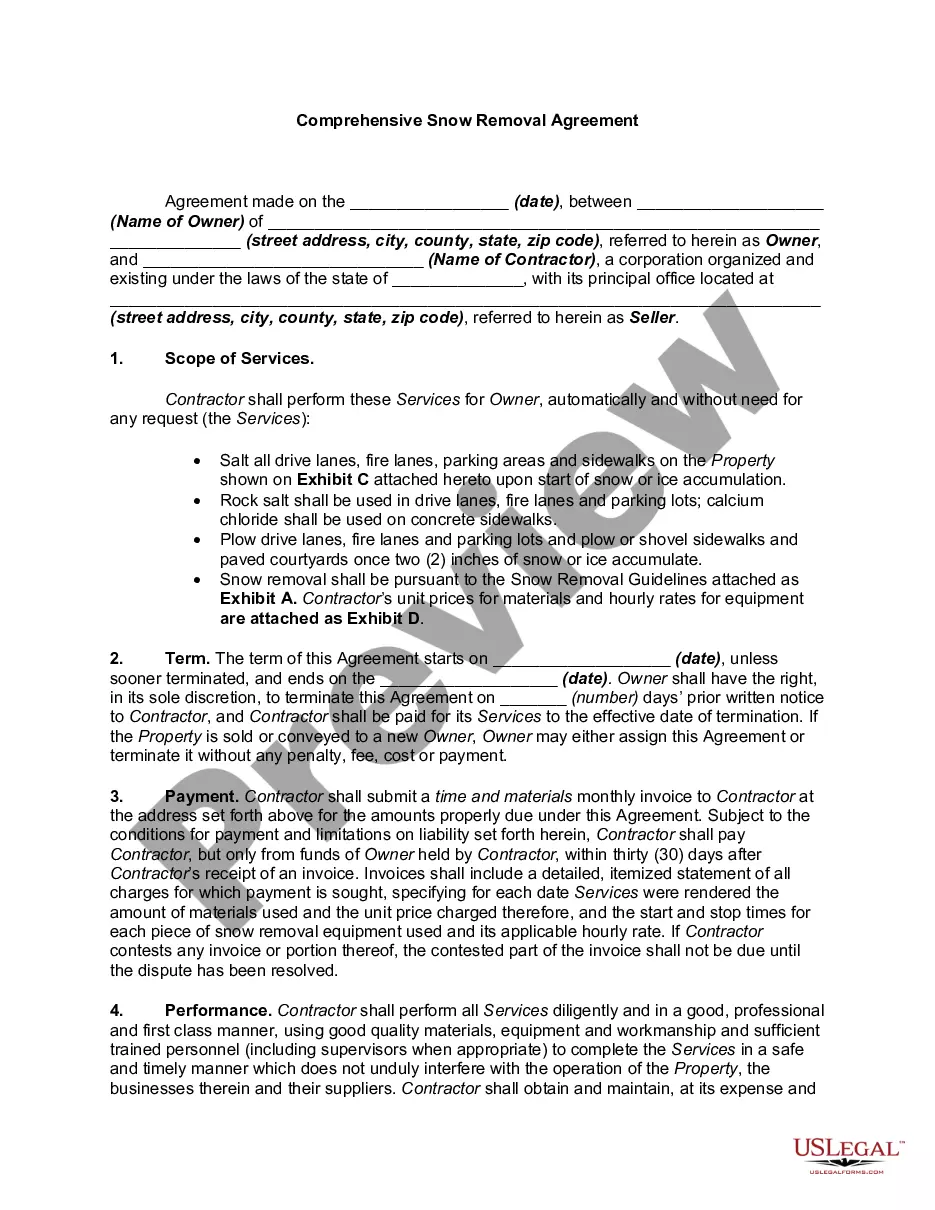

Title: Hawaii Review of Loan Application: A Detailed Description of the Process and Types of Application Reviews Introduction: When applying for a loan in Hawaii, a thorough review of the loan application is conducted to ensure compliance with federal and state regulations, as well as the lender's specific requirements. This review process plays a crucial role in determining the approval or denial of a loan. In this article, we will explore the Hawaii Review of Loan Application in detail, covering its process, key factors, and various types of application reviews. Process of Hawaii Review of Loan Application: 1. Application Submission: Borrowers submit their loan applications, including personal details, financial information, credit history, and collateral (if applicable). 2. Initial Documentation Review: Lenders assess the submitted documentation to confirm its completion, accuracy, and adherence to required formats. 3. Information Verification: Lenders verify the applicant's personal and financial details, such as employment, income, and assets, through reliable sources, including third-party databases and credit bureaus. 4. Credit Check: Credit reports from major credit bureaus are obtained to evaluate the applicant's creditworthiness based on their credit score, payment history, outstanding debts, and credit utilization. 5. Financial Analysis: Lenders analyze the applicant's income, debt-to-income ratio, and financial stability to determine their ability to repay the loan. 6. Collateral Inspection (if applicable): For secured loans, the lender may evaluate the condition, value, and legal ownership of the proposed collateral, such as real estate or vehicles. 7. Underwriting: Lenders review all information gathered during the previous steps to assess the overall risk associated with the loan application and make an informed decision on approval or denial. Types of Hawaii Review of Loan Application: 1. Personal Loans: Designed for personal expenses, such as medical bills, home renovations, or education, personal loan applications undergo a comprehensive review process, assessing the borrower's creditworthiness, income, and financial stability. 2. Mortgage Loans: Sought for purchasing or refinancing properties, mortgage applications involve a detailed review that includes credit checks, income verification, and property appraisal. 3. Business Loans: For entrepreneurs seeking capital to start or expand a business, business loan applications undergo a thorough review process to evaluate the business plan, financial projections, collateral, and the owner's personal credit history. 4. Auto Loans: Individuals applying for auto loans are subjected to a customized review process that analyzes their credit score, income, and the vehicle's value to ensure the borrower's ability to make timely payments. 5. Student Loans: Designed for educational expenses, student loan applications are reviewed based on the applicant's credit history, academic pursuits, and the chosen educational institution. 6. Construction Loans: These loans are for financing construction projects, and their application review involves assessing the borrower's financial capacity, construction plans, timeline, and projected returns. Conclusion: Applying for a loan in Hawaii entails a comprehensive and meticulous review process to mitigate financial risks. Understanding the different types of loan application reviews and their respective requirements can help borrowers better prepare and increase their chances of obtaining the desired loan successfully. Lenders in Hawaii prioritize complete and accurate information, financial stability, and strong creditworthiness when making decisions regarding loan approvals, ensuring the borrower's ability to service the loan effectively.

Hawaii Review of Loan Application

Description

How to fill out Hawaii Review Of Loan Application?

If you have to complete, down load, or print lawful document web templates, use US Legal Forms, the biggest collection of lawful varieties, which can be found on the Internet. Take advantage of the site`s simple and easy practical research to get the documents you require. Numerous web templates for organization and individual uses are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the Hawaii Review of Loan Application with a number of clicks.

Should you be currently a US Legal Forms customer, log in for your profile and then click the Download button to obtain the Hawaii Review of Loan Application. You can also access varieties you formerly delivered electronically within the My Forms tab of your own profile.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for your appropriate metropolis/nation.

- Step 2. Make use of the Preview solution to look over the form`s articles. Don`t forget about to read the description.

- Step 3. Should you be not happy using the develop, use the Research discipline towards the top of the display to locate other versions of your lawful develop template.

- Step 4. Once you have located the form you require, click on the Buy now button. Select the rates program you prefer and add your credentials to sign up to have an profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to accomplish the purchase.

- Step 6. Pick the formatting of your lawful develop and down load it on your product.

- Step 7. Full, edit and print or indicator the Hawaii Review of Loan Application.

Each lawful document template you get is yours for a long time. You have acces to every develop you delivered electronically within your acccount. Click the My Forms segment and pick a develop to print or down load again.

Compete and down load, and print the Hawaii Review of Loan Application with US Legal Forms. There are millions of specialist and status-specific varieties you can utilize for your personal organization or individual demands.

Form popularity

FAQ

By understanding the different types of loans available, reviewing the loan terms and conditions, and working with a financial advisor, you can ensure that you're getting the best loan for your needs. Remember to review your credit report and prepare the necessary documents before applying for a loan.

When reviewing a bank loan, there are several factors you need to consider to ensure that the loan is suitable for you. Interest Rates - The interest rate is the amount of money the lender charges for borrowing the funds. ... Repayment Terms - The repayment term is the length of time you have to repay the loan.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

What Should I Look for When Reviewing Loan Documents? Principal loan Amount. ... Loan duration. ... Interest rate. ... Repayment terms : Every loan agreement should have a repayment schedule that provides the borrower with clear instructions on how to repay the loan. ... Fees and charges. ... Collateral. ... Default. ... Collection procedures.

The loan review will consist of meetings with lending staff including loan administration to understand the lending process and procedures from intake to closing. The loan review team will also be reviewing underwriting and collateral files to ascertain the underwriting, monitoring, and documentation practices.