A deed is an instrument by which an owner (the grantor) transfers an interest in land to a new owner (the grantee). No consideration is required to make the deed effective. The deed is necessary to transfer title to land even if it is a gift. It has no effect, and title does not pass until the deed has been delivered. The recording of the deed is not required to make the deed effective to pass title between the buyer and the seller. However, recording is necessary so that the public will know that the buyer is the present owner. Recording constitutes "notice to the world" of the transfer in title.

The grantor is the person selling the property. The grantee is the person buying the property. A grant deed is a deed containing an implied warranty that there are no encumbrances on the property not described in the deed and that the person transferring the property actually owns the title. It must describe the property by legal description of boundaries and/or parcel numbers, be signed by all people transferring the property, and be acknowledged before a notary public. It is in contrast to a quit claim deed, which only conveys the interest that the transferor actually owns, if any, without a warranty of ownership.

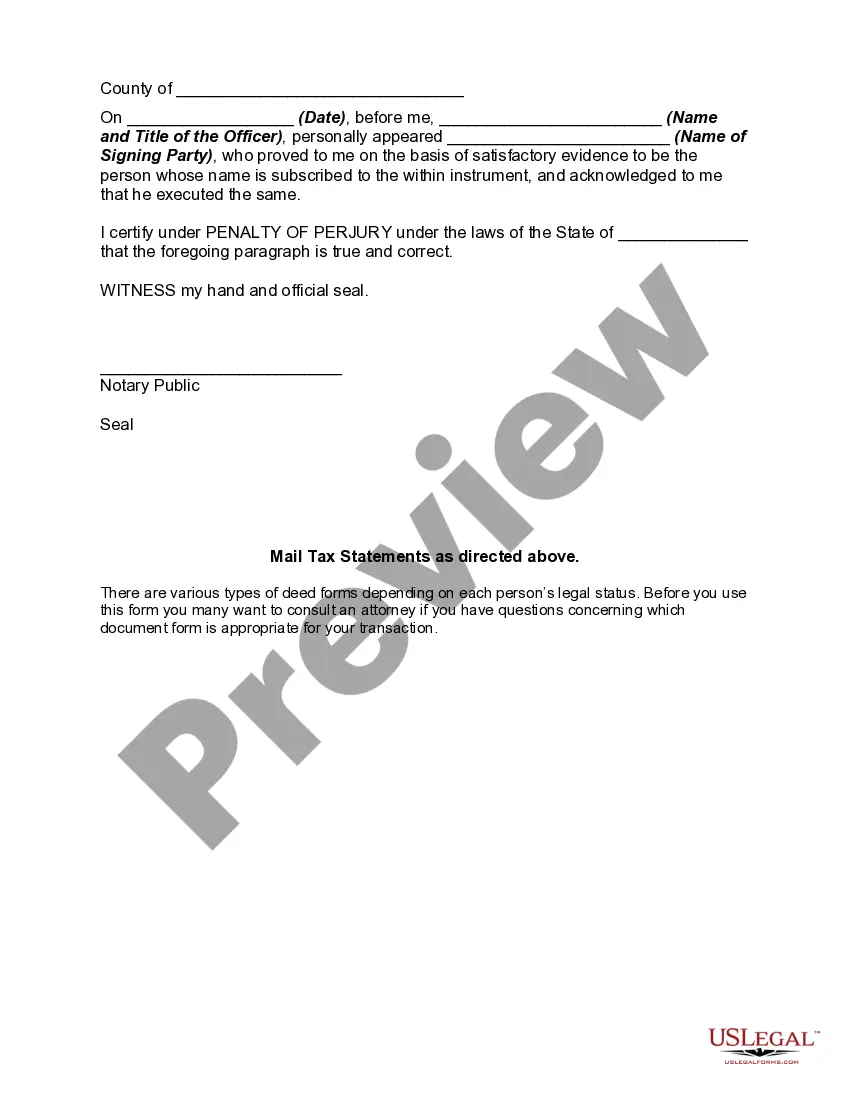

A Hawaii Grant Deed, also known as a warranty deed, is a legal document used to transfer ownership of real property in Hawaii from one party to another. It guarantees that the seller (granter) has the legal right to transfer the property title and guarantees that the property is free from any encumbrances or claims. This type of deed provides the highest level of protection to the buyer (grantee) as it implies that the granter holds an absolute and clear title to the property being transferred. It contains specific language implying warranties of clear title, meaning that the granter is responsible for defending against any claims that may arise to the title at any point in the future. The Hawaii Grant Deed must include certain elements to be valid. These elements typically include the names and addresses of the granter and grantee, a clear and concise property description, the granter's notarized signature, and proper acknowledgement by a notary public or other authorized official. In Hawaii, there are different types of grant deeds that serve specific purposes: 1. General Warranty Deed: This is the most common type of grant deed in Hawaii, providing the broadest protection to the grantee. The granter guarantees the title against any defects, even those that may have arisen before their ownership. 2. Special Warranty Deed: Unlike a general warranty deed, the special warranty deed limits the granter's warranties to only the defects or claims that occurred during their ownership. It does not offer protection against any issues that may have originated before the granter acquired the property. 3. Quitclaim Deed: Although not technically a type of grant deed, it is commonly used in Hawaii. A quitclaim deed transfers the granter's interest or claim to the property but does not guarantee a clear title or provide any warranties. It is often used in cases of transferring property between family members or in divorce settlements. When considering a Hawaii Grant Deed, it is crucial to consult with a real estate attorney or a title insurance professional who can ensure all the necessary legal aspects are addressed and that your interests are protected.