Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

If you wish to finish, retrieve, or print lawful document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s user-friendly search feature to locate the documents you require.

A selection of templates for both business and personal reasons are organized by categories and states, or keywords. Use US Legal Forms to obtain the Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to each form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement.

- You may also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

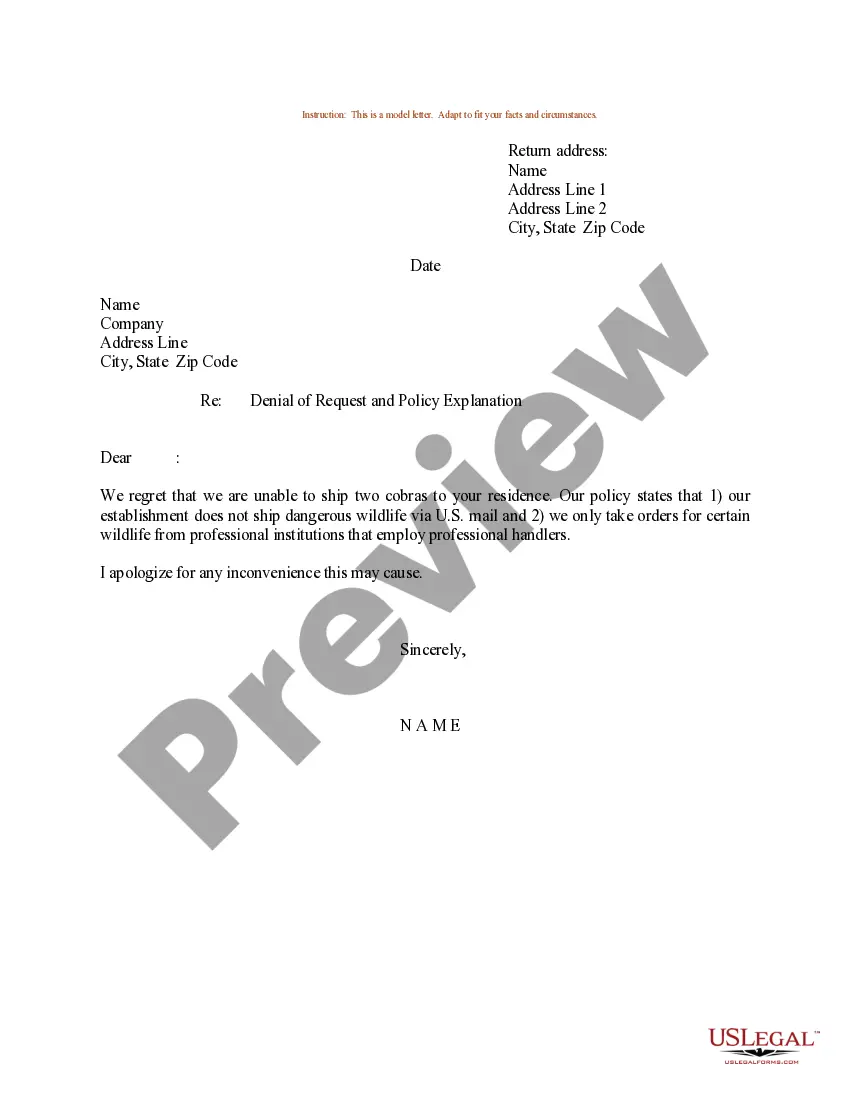

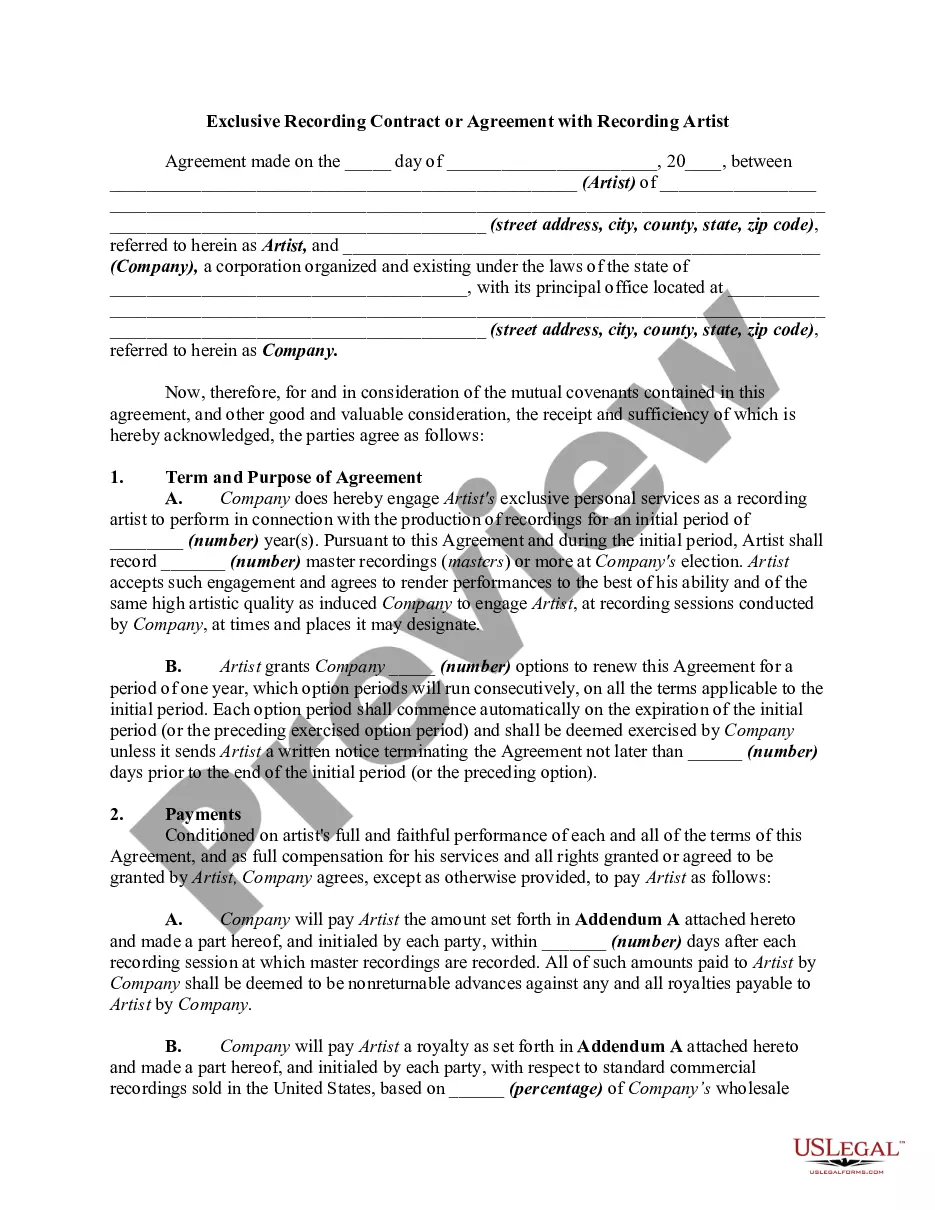

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After identifying the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement.

Form popularity

FAQ

An example of reimbursement can include an employee submitting a claim for travel expenses after attending a conference. The claim would include costs for transportation, lodging, and meals. For detailed examples and templates, you can explore resources like the 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement' on the US Legal Forms site to help clarify the process.

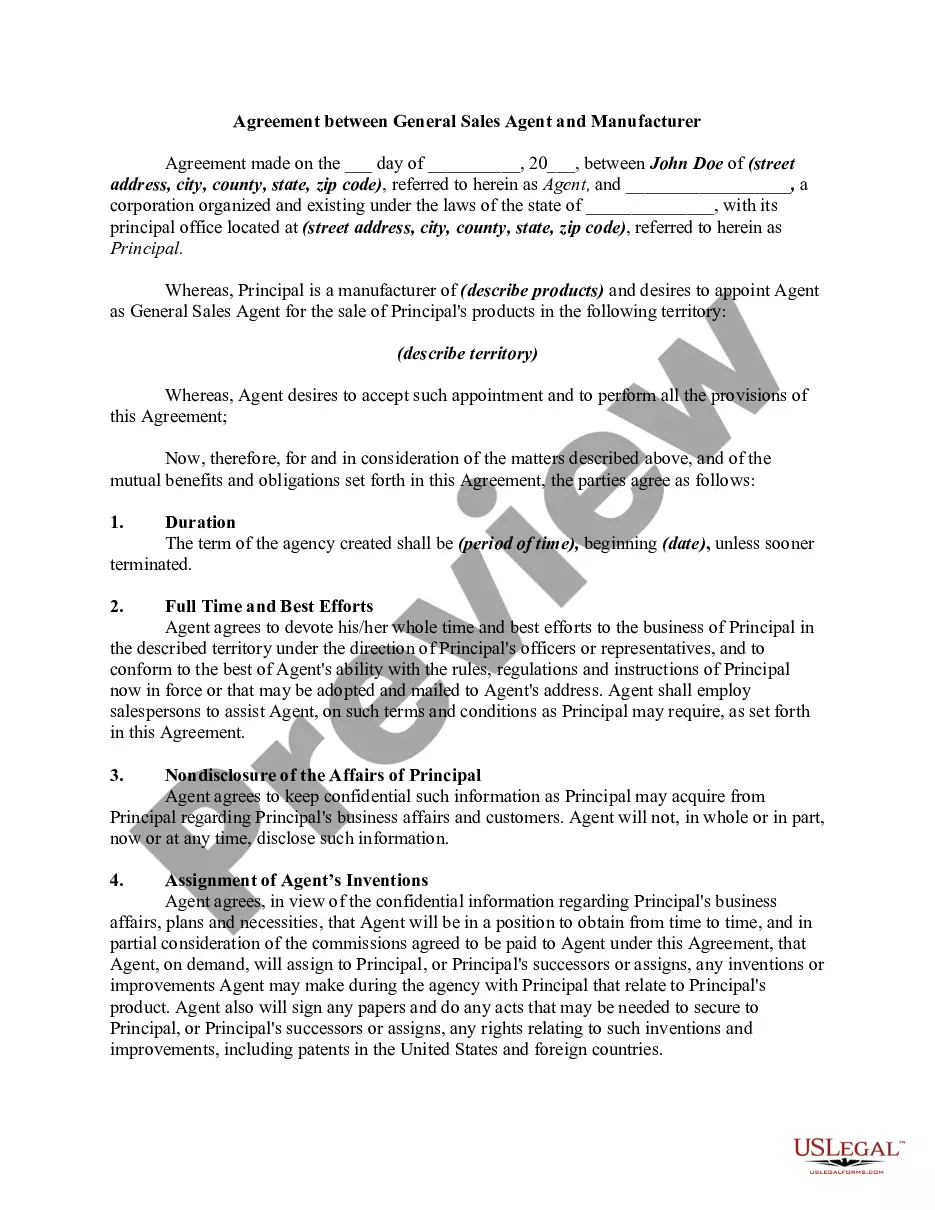

A mileage reimbursement policy typically outlines how employees can claim for vehicle expenses incurred during work-related travel. For example, a policy might state that employees can be reimbursed at a specific rate per mile driven. Implementing a clear policy, like a 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement,' can streamline the reimbursement process and ensure transparency.

When crafting a letter to request reimbursement, begin with a polite greeting. Clearly outline the incurred expenses, specify the amount you wish to be reimbursed, and include any necessary receipts or invoices as attachments. Using a 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement' can guide you in achieving a professional tone and format.

To write a reimbursement request, start by clearly stating the purpose of your letter or email. Include essential details such as the amount you are requesting, the reason for the expense, and any relevant documentation to support your claim. For insights on structuring your request, consider referencing a 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement' available on the US Legal Forms platform.

The short form for reimbursement is often written as 'Rmbrsmnt' or simply as 'Reimb.' This abbreviation captures the essence of the term, making it easier to communicate in contexts such as documents or letters. If you are drafting a 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement,' using the abbreviation can save space while maintaining clarity.

To submit mileage for reimbursement, first, document your business trips accurately. You can utilize the 'Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement' as a guideline. Be sure to include the dates, destinations, and purpose of each trip. Then, complete your company’s reimbursement form and attach the necessary documentation to ensure a smooth reimbursement process.

When writing mail for reimbursement of expenses, start with a polite greeting and a clear subject line. Specify the expenses you are claiming, including any necessary proof, and state the total amount you seek. For clarity and structure, refer to our Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement as a practical resource.

To write a formal letter for reimbursement, open with your contact information, followed by the recipient’s details. Clearly state your purpose in the first paragraph, providing context for the reimbursement request. Incorporating elements from our Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement can enhance the professionalism of your letter.

Writing a reimbursement form involves stating your claim clearly and concisely. List all relevant expenses, including receipts and any supporting documentation. You may find it beneficial to follow the structure provided in our Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement to ensure you include all required information.

Politely asking for reimbursement starts with a respectful tone in your communication. Clearly express your request and provide necessary details to support your claim. Consider using our Hawaii Sample Letter for Policy on Vehicle Expense Reimbursement to frame your request in a professional manner that emphasizes your expectations.