Hawaii Sample Letter for Deed of Trust and Promissory Note: Explained and Types Deed of Trust and Promissory Note are crucial legal documents when it comes to real estate transactions in Hawaii. They describe the terms and conditions of a loan agreement, ensuring that all parties involved understand their obligations and rights. A Hawaii Sample Letter for Deed of Trust and Promissory Note typically includes the following sections: 1. Introduction: The letter starts with formal greetings and identifies the parties involved in the agreement — the lender (also known as the beneficiary) and the borrower (also known as the trust or). 2. Loan Information: Explicit details about the loan are included, such as the loan amount, interest rate, repayment terms, and the property securing the loan. 3. Promissory Note Terms: This section outlines the terms of repayment, including the repayment schedule, interest calculation method, and any provisions regarding late payment or default. 4. Deed of Trust Terms: Describes the legal mechanism by which the borrower (trust or) conveys the property title to a neutral third party (trustee) as security for the loan. It includes a detailed legal description of the property, trustee rights, foreclosure procedures, and event of default provisions. 5. Signatures and Notarization: All parties involved (the lender, borrower, and witness) must sign and date the document, which normally requires notarization. Notarization ensures the agreement's authenticity and helps prevent fraudulent activities. Different Types of Hawaii Sample Letter for Deed of Trust and Promissory Note: 1. Fixed-Rate Deed of Trust and Promissory Note: This type of agreement sets a consistent interest rate over the loan term, ensuring stable monthly payments for the borrower. 2. Adjustable-Rate Deed of Trust and Promissory Note: The interest rate on this type of loan may fluctuate periodically based on a specified index. The payments can vary accordingly, which may benefit the borrower if rates decrease but can pose a risk if rates increase significantly. 3. Balloon Payment Deed of Trust and Promissory Note: This agreement involves regular payments for a specific period, generally less than the loan term, with a final lump-sum payment (balloon payment) due at the end. Borrowers must prepare for this large payment by either refinancing or selling the property. 4. Construction Loan Deed of Trust and Promissory Note: Designed for construction projects, this type of agreement releases funds in installments or draws based on construction milestones. It includes additional clauses to govern the construction process and disbursement of funds. 5. Home Equity Line of Credit (HELOT) Deed of Trust and Promissory Note: Helots allow homeowners to borrow against their home equity, using it as collateral. This type of agreement provides borrowers with flexible borrowing, repayment, and interest-only payment options. Remember, these are sample documents that, while comprehensive, may need customizing to suit your specific situation. It's crucial to consult a competent attorney to ensure all legal requirements are met and to fully understand the terms and implications of the agreement. Keywords: Hawaii, sample letter, deed of trust, promissory note, loan agreement, real estate transactions, lender, beneficiary, borrower, trust or, loan amount, interest rate, repayment terms, loan security, promissory note terms, deed of trust terms, legal description, trustee, foreclosure procedures, fixed-rate, adjustable-rate, balloon payment, construction loan, home equity line of credit (HELOT), attorney.

Hawaii Sample Letter for Deed of Trust and Promissory Note

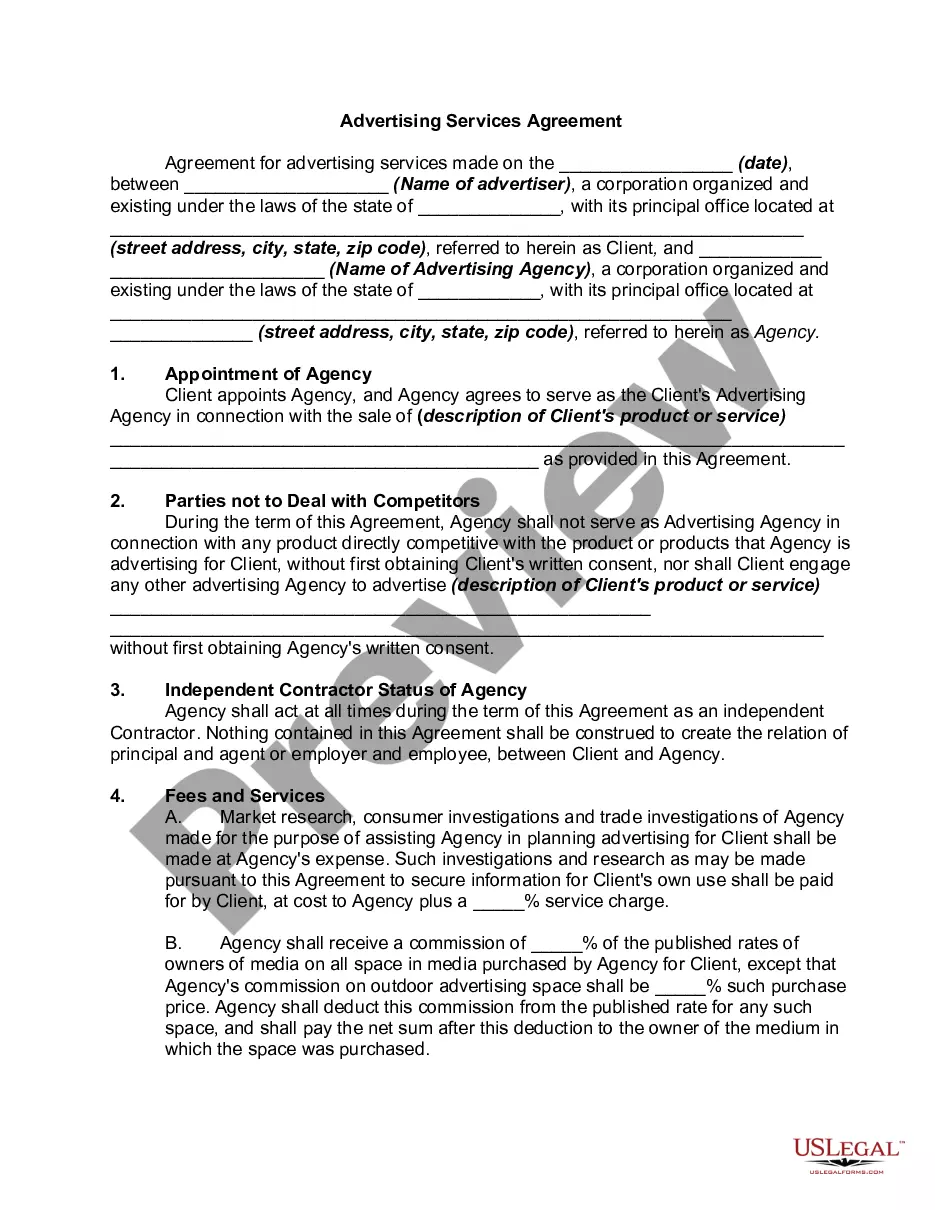

Description

How to fill out Hawaii Sample Letter For Deed Of Trust And Promissory Note?

You are able to invest time on-line attempting to find the lawful record web template which fits the federal and state requirements you want. US Legal Forms supplies 1000s of lawful types that happen to be reviewed by pros. It is possible to obtain or printing the Hawaii Sample Letter for Deed of Trust and Promissory Note from our support.

If you already have a US Legal Forms profile, you are able to log in and then click the Download option. Afterward, you are able to total, modify, printing, or signal the Hawaii Sample Letter for Deed of Trust and Promissory Note. Every lawful record web template you get is yours eternally. To obtain yet another backup of any acquired type, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms web site the very first time, stick to the simple guidelines listed below:

- Initially, ensure that you have chosen the proper record web template for your region/area of your liking. Look at the type description to make sure you have selected the proper type. If readily available, take advantage of the Preview option to check through the record web template at the same time.

- If you wish to find yet another version of your type, take advantage of the Lookup discipline to find the web template that fits your needs and requirements.

- When you have discovered the web template you desire, click Acquire now to carry on.

- Pick the costs plan you desire, type in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to purchase the lawful type.

- Pick the formatting of your record and obtain it in your gadget.

- Make modifications in your record if required. You are able to total, modify and signal and printing Hawaii Sample Letter for Deed of Trust and Promissory Note.

Download and printing 1000s of record themes using the US Legal Forms web site, that offers the biggest variety of lawful types. Use expert and condition-specific themes to take on your company or specific requires.