Hawaii Sample Letter for Exemption of Ad Valorem Taxes

Description

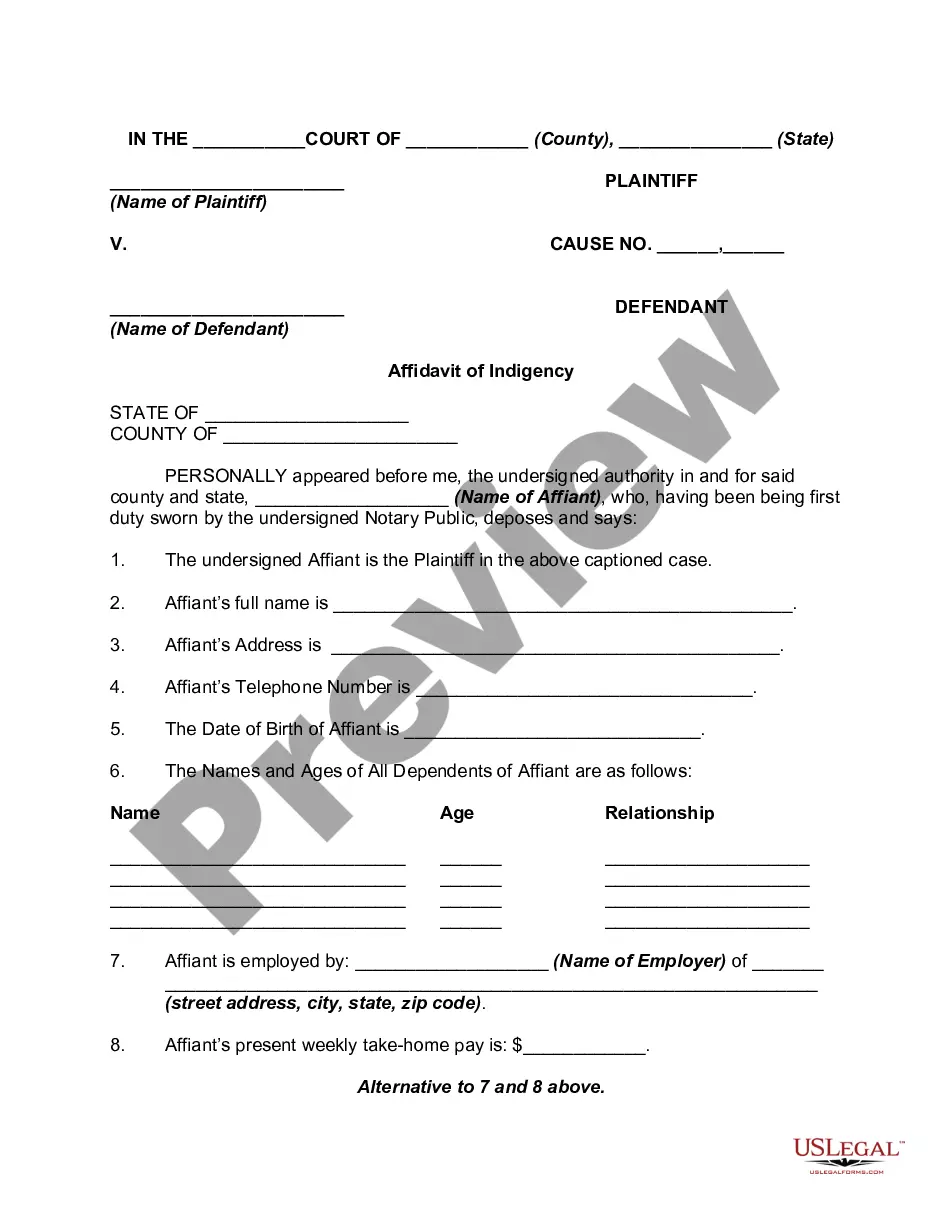

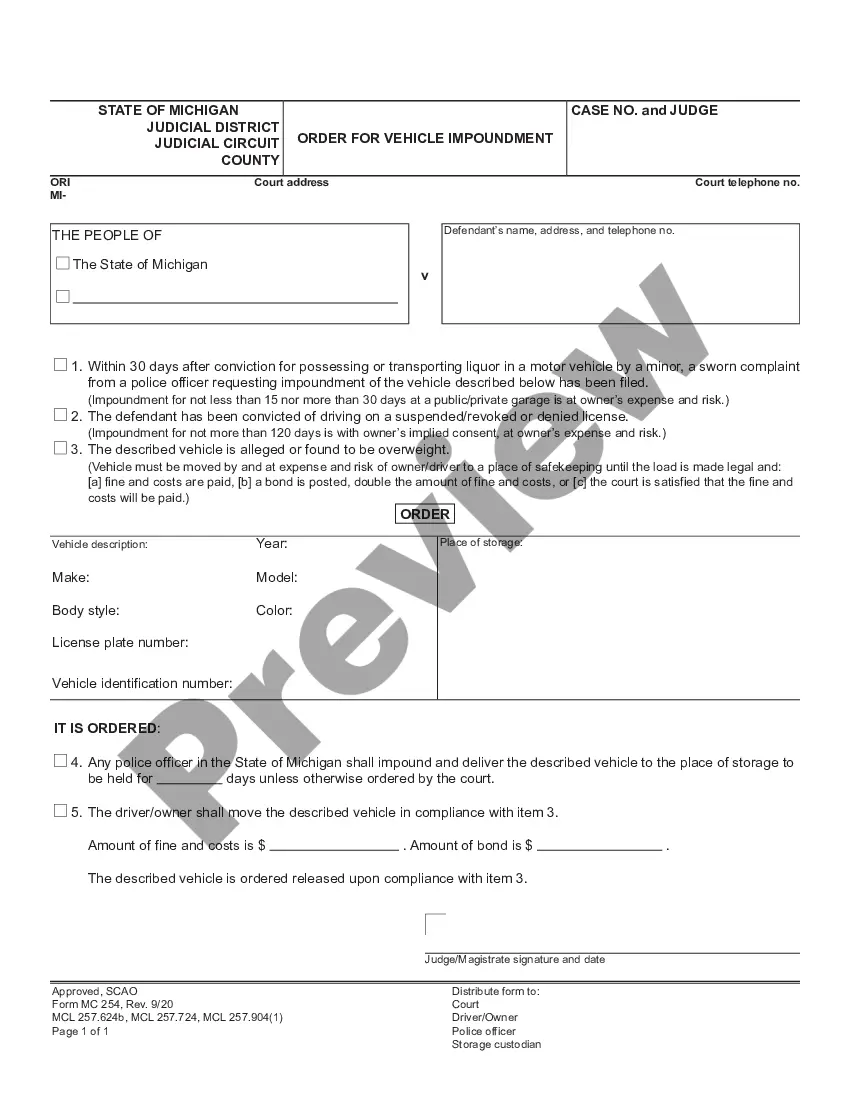

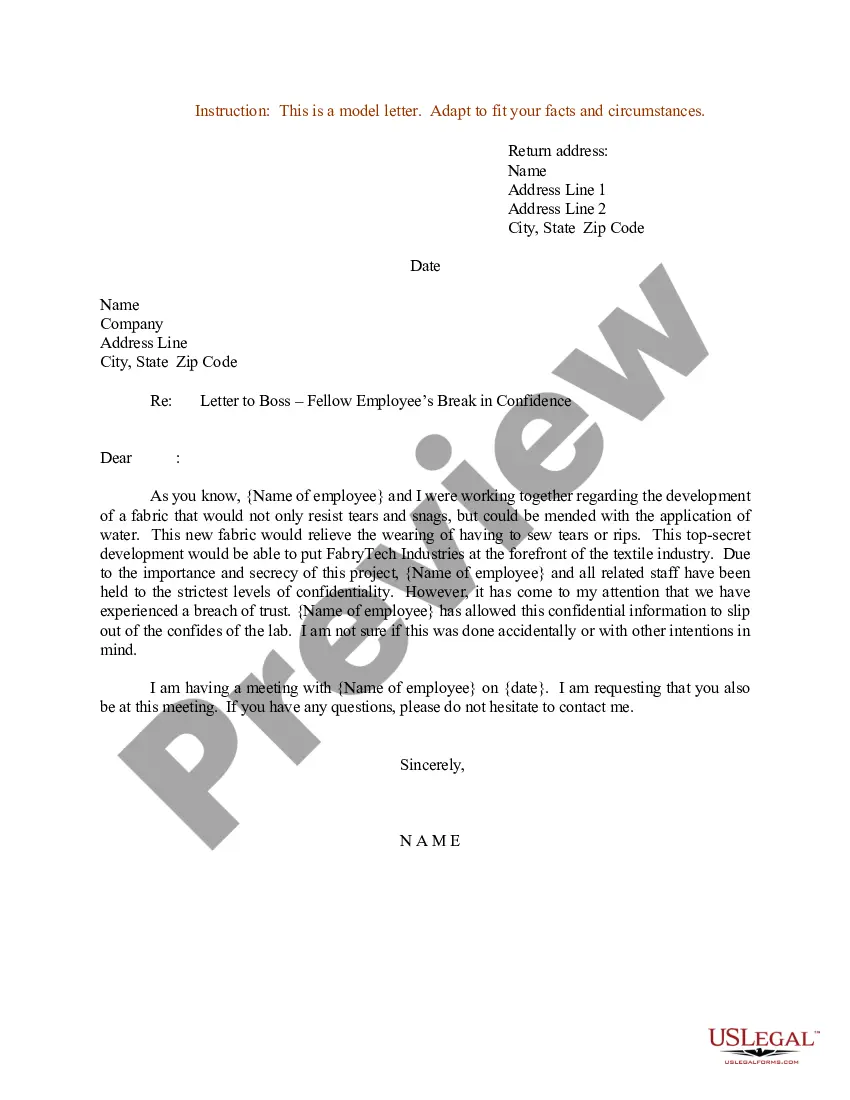

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

If you need to comprehensive, down load, or print out legitimate papers web templates, use US Legal Forms, the biggest selection of legitimate forms, which can be found online. Take advantage of the site`s simple and easy practical lookup to discover the paperwork you want. A variety of web templates for enterprise and personal reasons are sorted by classes and suggests, or key phrases. Use US Legal Forms to discover the Hawaii Sample Letter for Exemption of Ad Valorem Taxes with a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your bank account and then click the Obtain switch to have the Hawaii Sample Letter for Exemption of Ad Valorem Taxes. You can also access forms you formerly delivered electronically in the My Forms tab of your respective bank account.

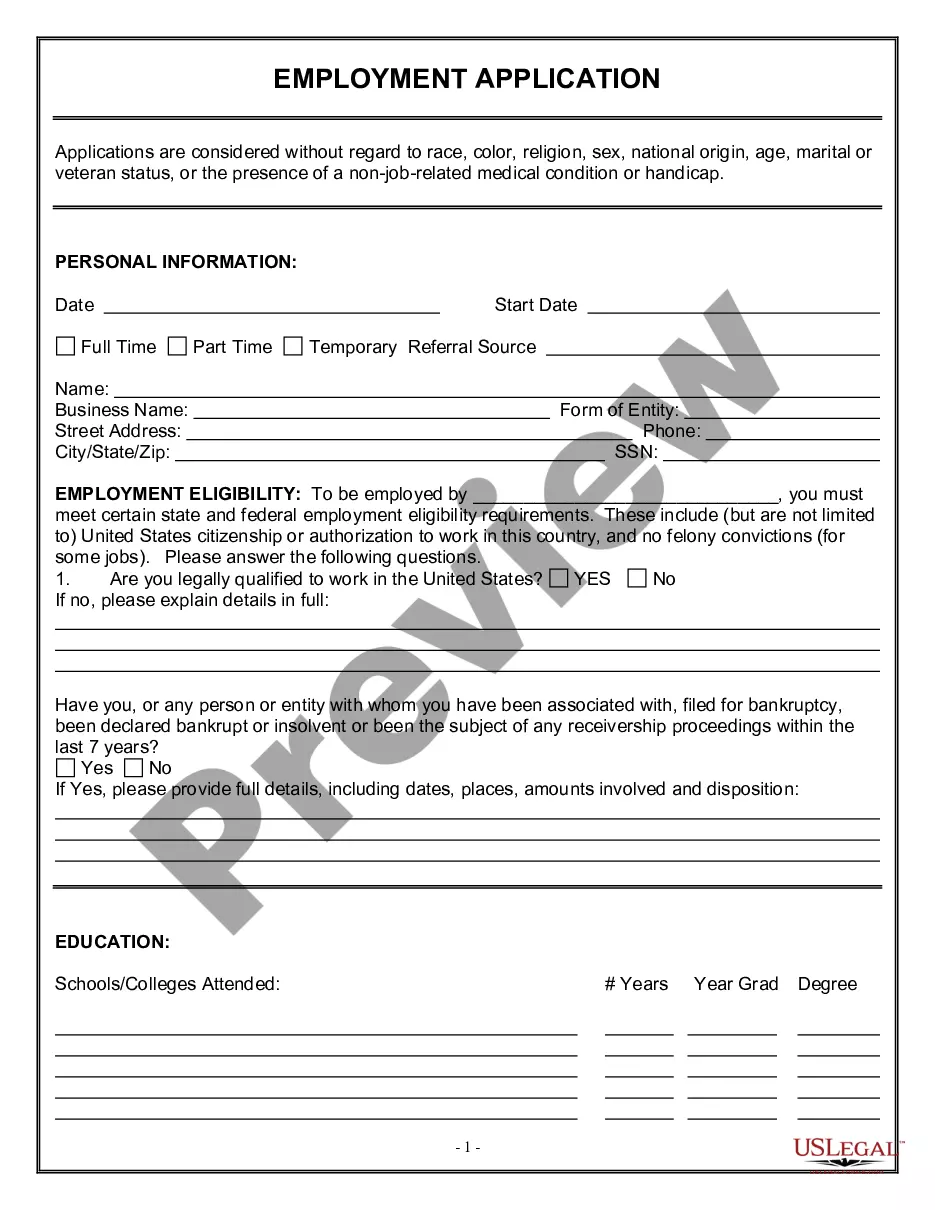

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate area/country.

- Step 2. Take advantage of the Preview option to examine the form`s content. Never forget about to read the explanation.

- Step 3. Should you be unsatisfied with all the form, utilize the Research area at the top of the display screen to discover other variations from the legitimate form format.

- Step 4. After you have discovered the form you want, go through the Buy now switch. Select the pricing program you like and include your accreditations to sign up to have an bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to perform the financial transaction.

- Step 6. Find the file format from the legitimate form and down load it on your system.

- Step 7. Comprehensive, change and print out or indicator the Hawaii Sample Letter for Exemption of Ad Valorem Taxes.

Each and every legitimate papers format you acquire is the one you have forever. You possess acces to every form you delivered electronically inside your acccount. Click on the My Forms section and pick a form to print out or down load again.

Remain competitive and down load, and print out the Hawaii Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms. There are many specialist and condition-distinct forms you may use for your personal enterprise or personal requirements.

Form popularity

FAQ

PURPOSE OF FORM Use Form N-358 to figure and claim the health- care preceptor income tax credit under section 235-110.25, Hawaii Revised Statutes (HRS).

All leases must be for a term of ten years or more and recorded at the Bureau of Conveyances in order for the lessee to qualify for the home exemption. In the case of a lease of Hawaiian homestead land, either lessee and/or spouse shall be entitled to the home exemption.

What is a G-49 tax return? Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Periodic General Excise/Use Tax Return (Form G-45).

Any person who is in Hawai?i for a temporary or transient purpose and whose permanent residence is not Hawai?i is considered a Hawai?i nonresident. Each year, a nonresident who earns income from Hawai?i sources must file a State of Hawai?i tax return and will be taxed only on income from Hawai?i sources.

A partnership return shall be filed in the first year the partners formally agree to engage in joint operation, or in the absence of a formal agreement, the first taxable year in which the organization receives income or makes or incurs any expenditures treated as deductions for Hawaii income tax purposes.

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

The refundable food/excise tax credit may be claimed for each individual who: ? Was physically present in Hawaii for more than nine months during the taxable year; ? Is not claimed and is not eligible to be claimed as a dependent by any taxpayer for federal or Hawaii individual income tax purposes; and ? Was not ...

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person engaging in the business activity. Your ?gross income? is the total of all your business income before you deduct your business expenses.