Hawaii Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Are you in a situation where you will require documents for either organizational or individual tasks almost every working day.

There are numerous official document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Hawaii Receipt and Withdrawal from Partnership, designed to meet federal and state requirements.

Once you find the correct form, click Acquire now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then you can download the Hawaii Receipt and Withdrawal from Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

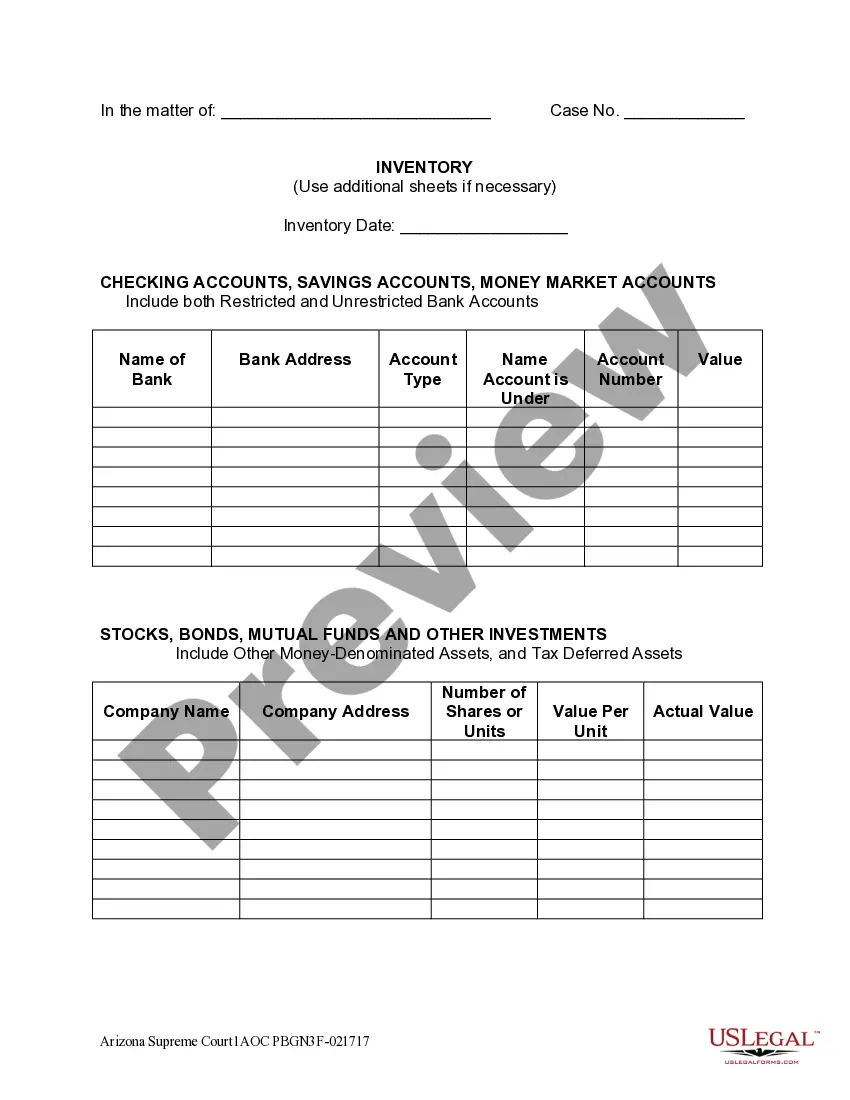

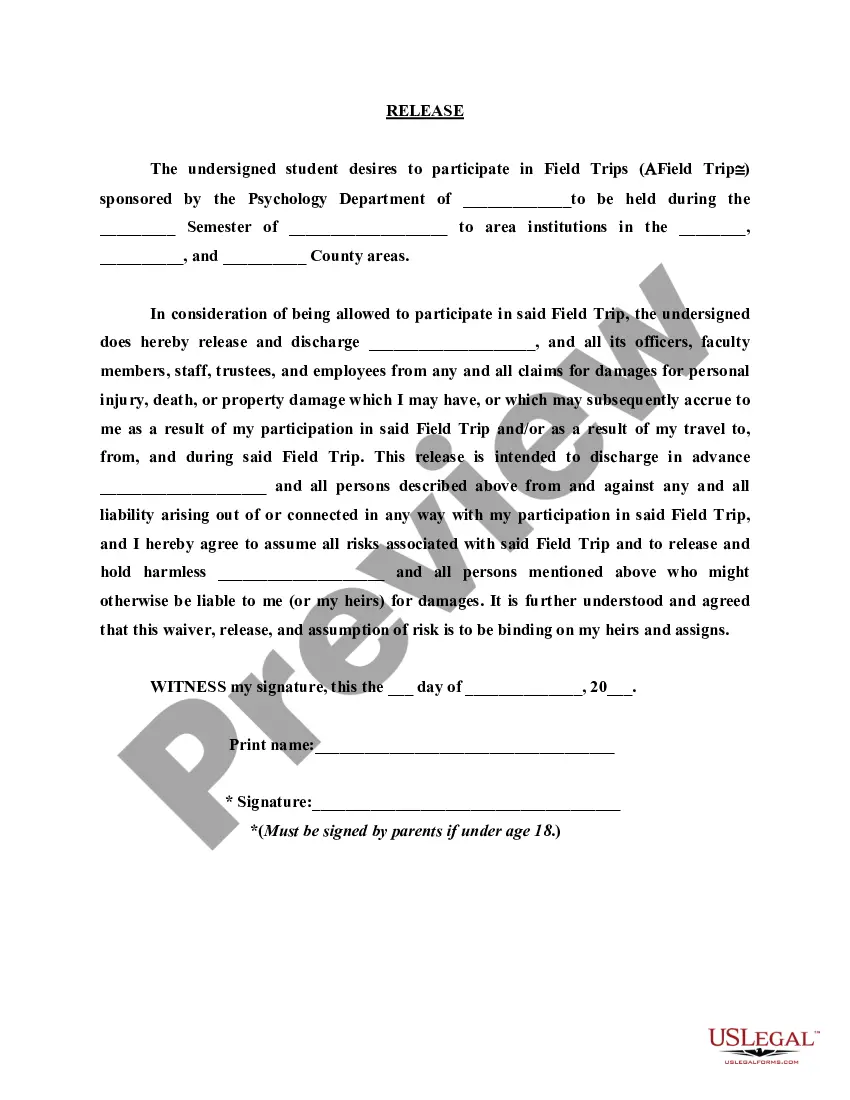

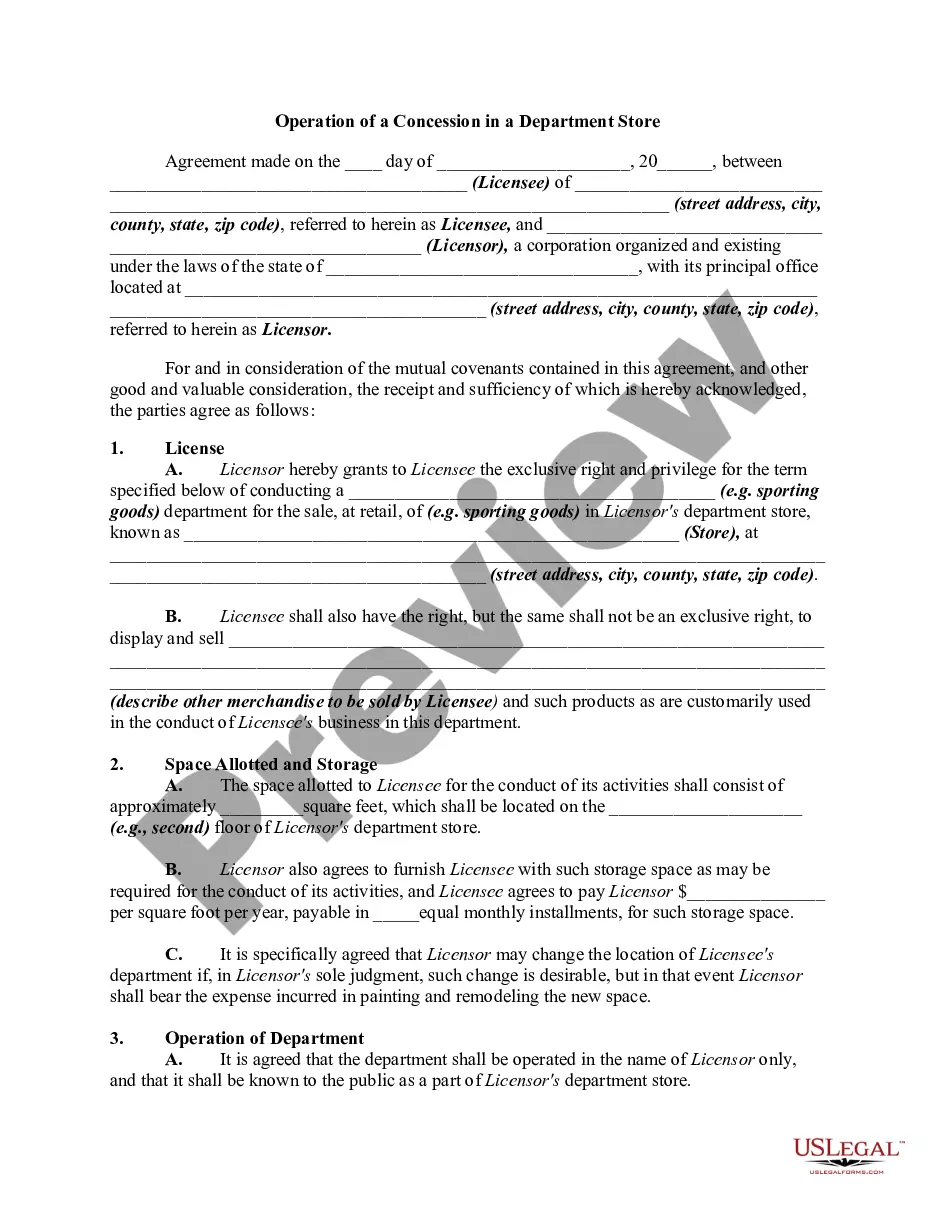

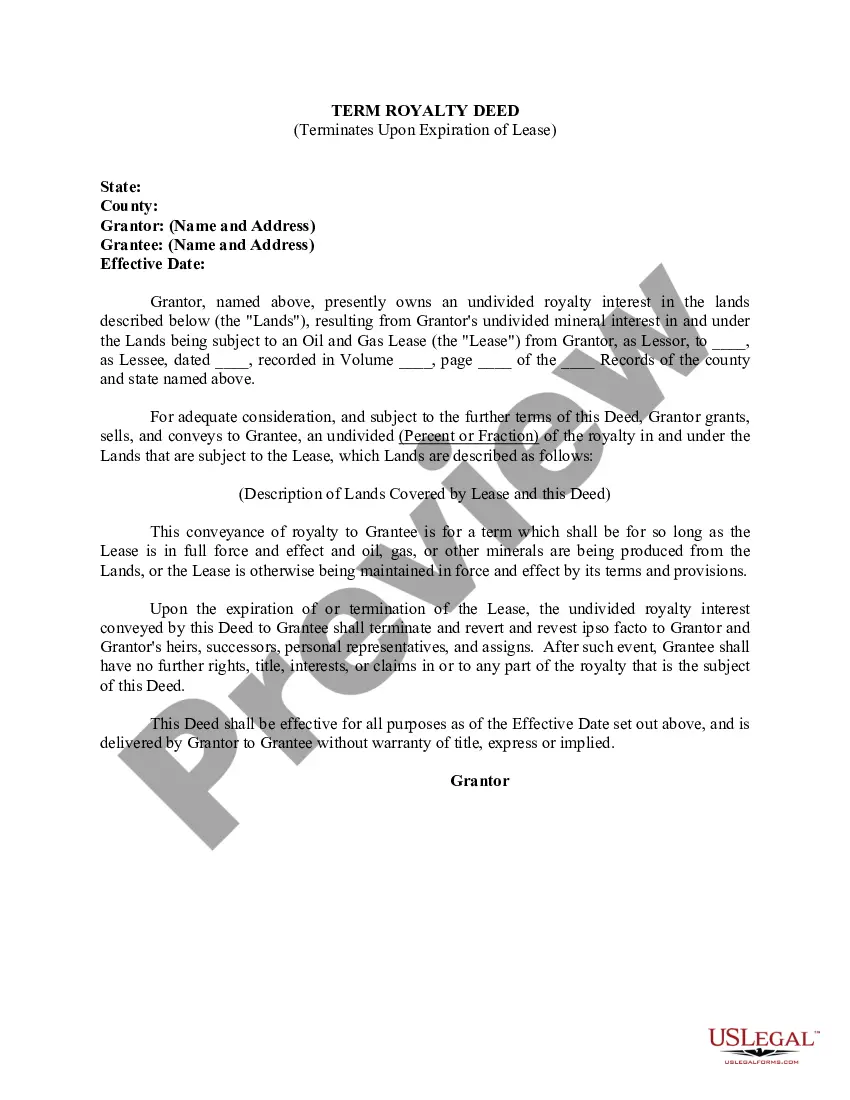

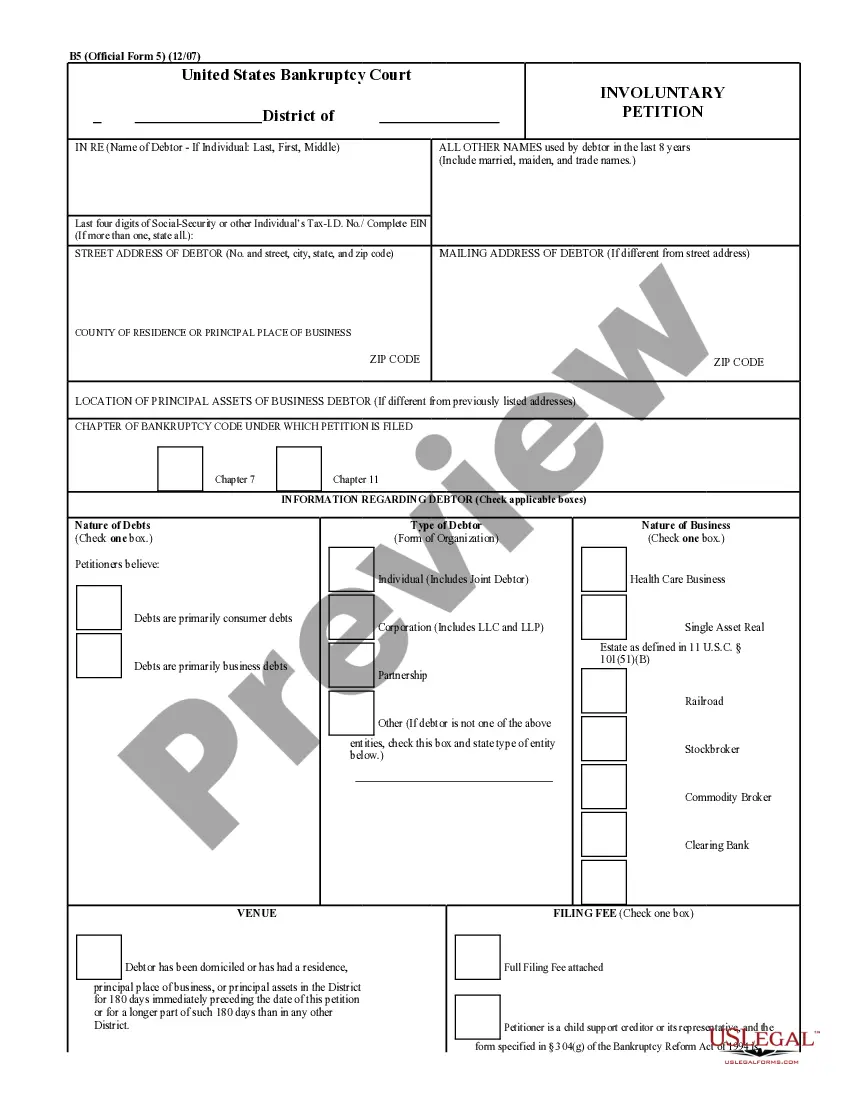

- Use the Preview option to examine the form.

- Read the description to make sure you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search field to find a form that fits your needs.

Form popularity

FAQ

Corporations in Hawaii are liable to the corporate income tax of Hawaii at marginal rates, between 4.4 percent and 6.4 percent. More specifically, it is broken down as follows: Income as much as $25,000 is taxed at a rate of 4.4 percent.

When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts.

Unlike the default pass-through tax situation, when an LLC elects to be taxed as a corporation, the company itself must file a separate tax return. The State of Hawaii, like almost every other state, taxes corporation income.

When that income is paid out to partners in cash, they aren't taxed on the cash if they have sufficient basis. Instead, partners just reduce their basis by the amount of the distribution. If a cash distribution exceeds a partner's basis, then the excess is taxed to the partner as a gain, which often is a capital gain.

Hawaii Amended Business Returns cannot be e-filed. Corporation - Taxpayers must mark the Hawaii Form N-30 as amended and mail it to the appropriate mailing address. (See Mailing Addresses below). To mark the Form N-30 as amended select Heading Information > Amended Return.

When that income is paid out to partners in cash, they aren't taxed on the cash if they have sufficient basis. Instead, partners just reduce their basis by the amount of the distribution. If a cash distribution exceeds a partner's basis, then the excess is taxed to the partner as a gain, which often is a capital gain.

A partnership distribution is not taken into account in determining the partner's distributive share of partnership income or loss. If any gain or loss from the distribution is recognized by the partner, it must be reported on their return for the tax year in which the distribution is received.

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.

11. Individual Income Tax Return (Resident Form)

The return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the Hawaii Department of Taxation, P.O. Box 3559, Honolulu, Hawaii 96811-3559.