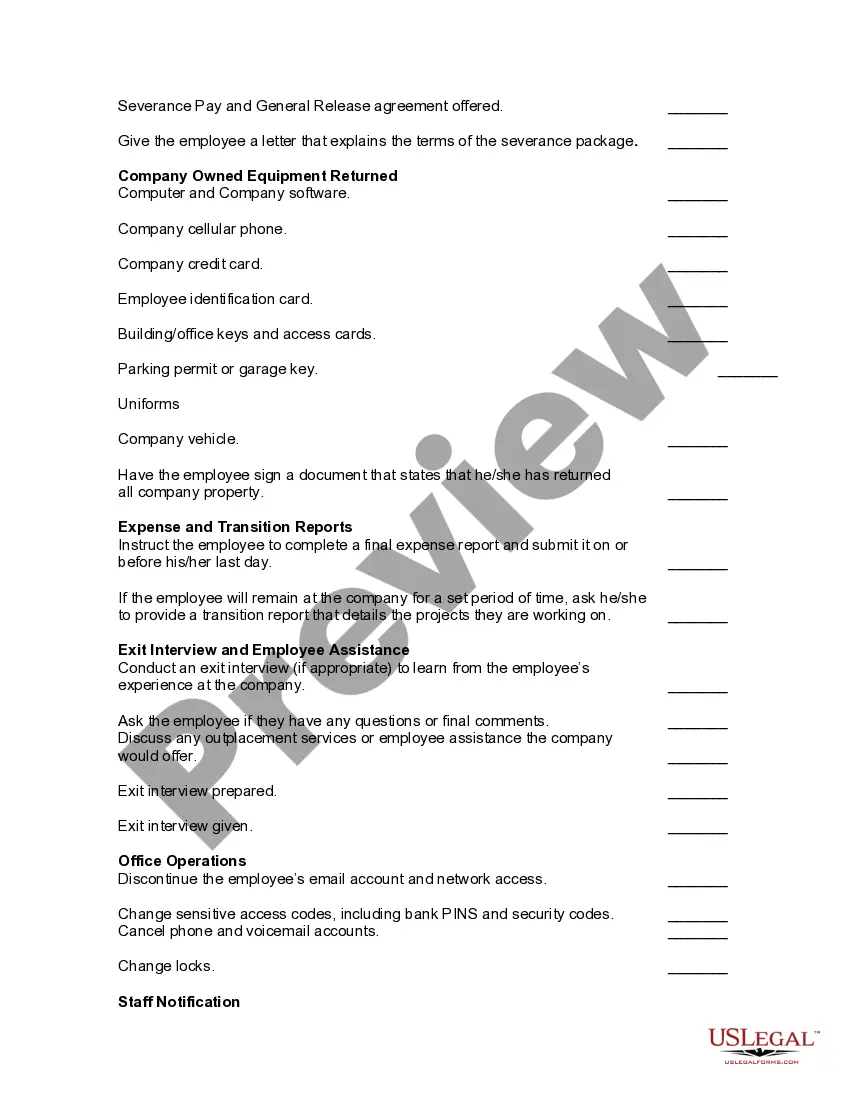

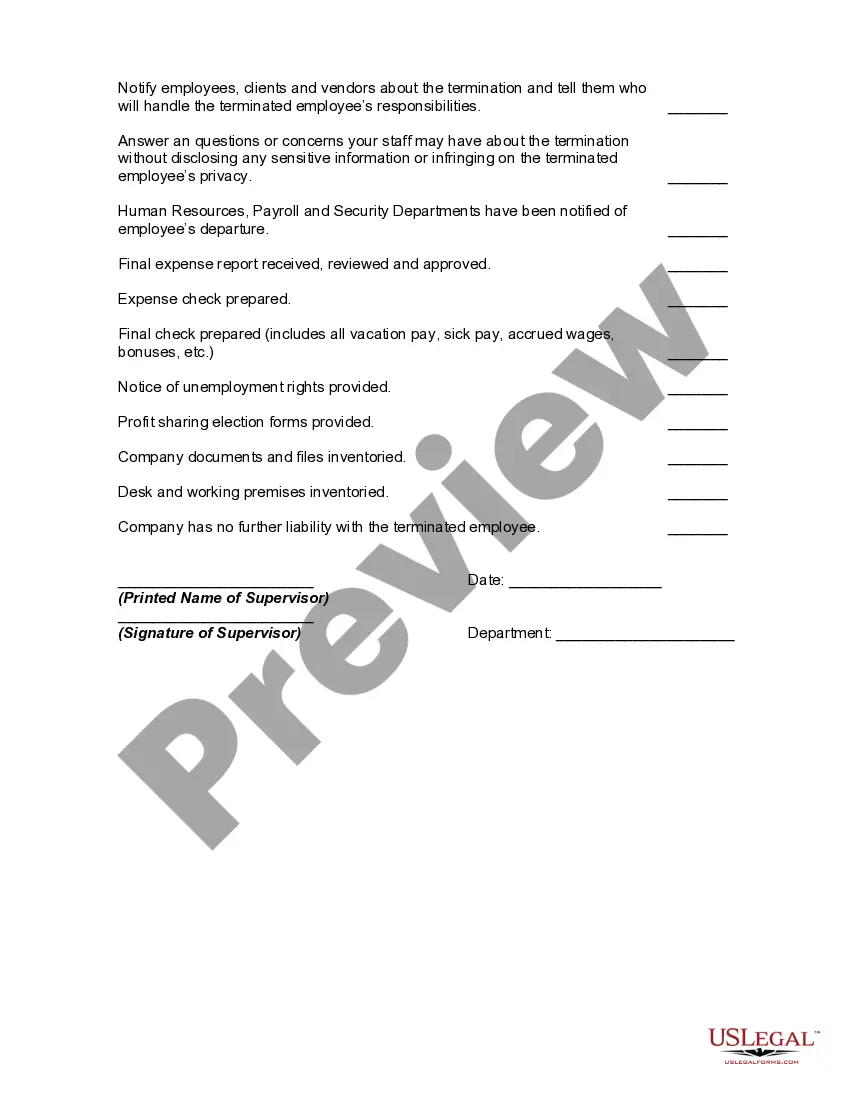

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Title: Hawaii Worksheet — Termination of Employment: A Comprehensive Guide Introduction: The Hawaii Worksheet — Termination of Employment is a valuable tool designed to assist employers and employees in understanding the termination process in the state of Hawaii. This document provides crucial information, legal requirements, and essential considerations for employers and employees when terminating an employment relationship in Hawaii. Below, we will delve into the key components of this worksheet, as well as outline various types of Hawaii Worksheets — Termination of Employment. 1. Hawaii Worksheet — Termination Process: The Hawaii Worksheet — Termination of Employment is aimed at guiding both employers and employees through the proper steps involved in effectively terminating an employment arrangement in compliance with Hawaii labor laws. Topics covered in this worksheet include the required termination notice period, final pay requirements, termination reasons, and any severance obligations. 2. Hawaii Worksheet — Termination Notice Period: This section of the worksheet highlights the precise notice period that employers are legally obliged to provide their employees before terminating their employment in Hawaii. It covers different scenarios based on the number of employees affected, ensuring compliance with Hawaii labor regulations. 3. Hawaii Worksheet — Final Pay Requirements: Understanding the correct final pay calculations and the timeline for payment is essential for employers. This segment of the worksheet outlines how employees should be compensated for all the work performed, unused vacation or sick leave, and/or accrued bonuses or commissions, ensuring compliance with Hawaii labor laws. 4. Hawaii Worksheet — Termination Reasons: This part of the worksheet addresses the acceptable grounds for termination, such as poor performance, misconduct, redundancies, etc. Employers can find guidance on providing clear, documented reasons for termination to minimize potential legal disputes in the future. 5. Hawaii Worksheet — Severance Obligations: In some cases, employers may have to provide severance benefits to terminated employees. This section outlines the circumstances where severance pay is required by law or based on contractual agreements, detailing the applicable calculations and exemptions for different employment scenarios. Types of Hawaii Worksheets — Termination of Employment: 1. Hawaii Worksheet — Voluntary Termination: This worksheet is specifically designed for employees who have decided to resign from their position. It provides assistance on employee responsibilities, notice periods, and last-day procedures, ensuring a smooth transition for both parties. 2. Hawaii Worksheet — Involuntary Termination Without Cause: This worksheet caters to situations where employers need to terminate employees without a specific cause. It provides guidance on adhering to legal requirements, calculating final pay, and offering severance benefits when applicable. 3. Hawaii Worksheet — Involuntary Termination With Cause: This worksheet focuses on situations where employers need to terminate employment based on employee misconduct, violation of company policies, or unsatisfactory performance. It offers guidance on providing proper notice, conducting investigations, and assembling relevant documentation to support the termination decision. Conclusion: The Hawaii Worksheet — Termination of Employment offers a comprehensive resource for employers and employees navigating the complex process of termination in Hawaii. By leveraging this document, all parties involved can ensure compliance with state labor laws, minimize disputes, and conduct terminations in a fair and legally sound manner.