Hawaii Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

If you wish to obtain, download, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and requests, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternative templates in the legal form style.

Step 4. Once you have found the form you desire, click the Buy now button. Select the pricing plan you prefer and input your details to register for the account.

- Use US Legal Forms to locate the Hawaii Sale of Assets of Corporation without the Necessity to Adhere to Bulk Sales Laws in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Hawaii Sale of Assets of Corporation without the Necessity to Comply with Bulk Sales Laws.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

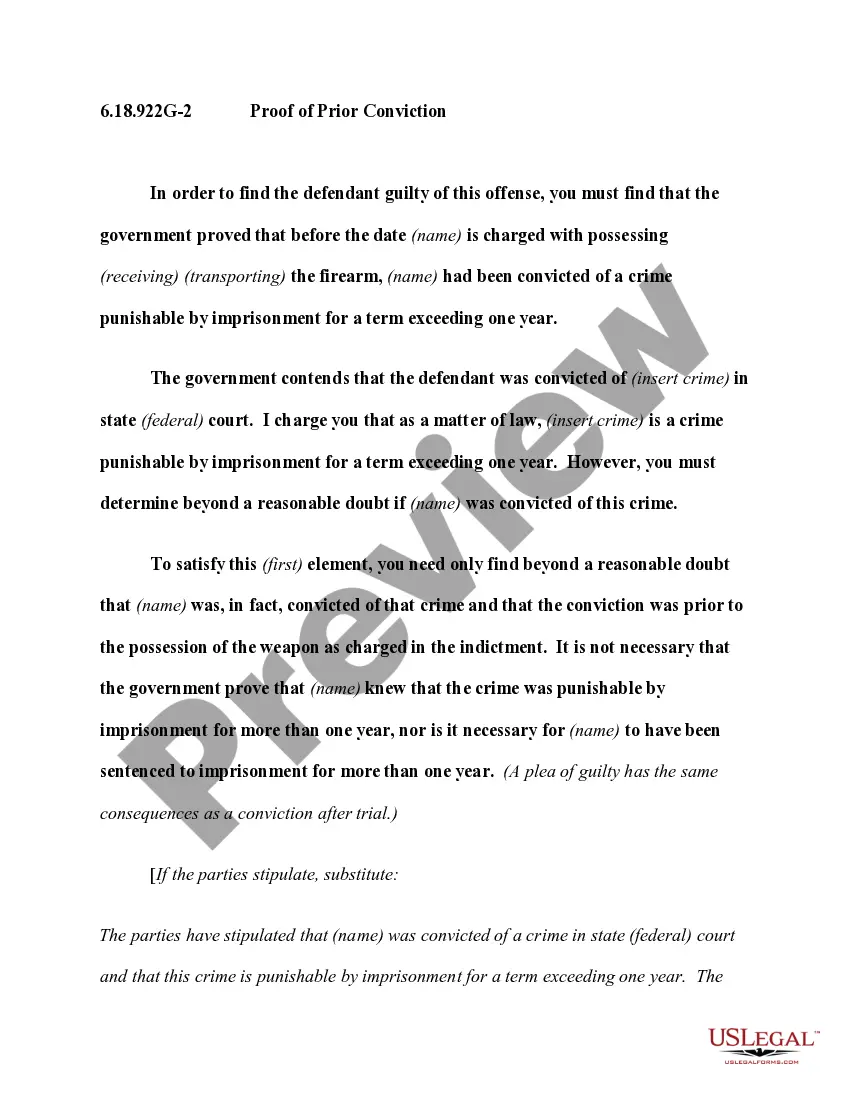

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

Form popularity

FAQ

'Bulk' in selling refers to the transfer of significant quantities of goods or assets in a single transaction. Such sales often involve entire inventories or substantial portions of a business's assets. The terms are important for understanding your legal obligations, especially regarding creditor protection. In Hawaii, streamlined asset sales are available through the Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, simplifying the process for businesses.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

There are several formalities required by the Bulk Sales Law: The sale in bulk to be accompanied by sworn statement of the vendor/mortgagor listing the names and addresses of, and amounts owing to, creditors; The sworn statement shall be furnished to the buyer, the seller is required to prepare an inventory of stocks

In general, a bulk sale is a sale to a buyer of all or most of the assets of the business outside the ordinary course of business.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

The key elements of a Bulk Sale are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (Agreement).

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

Bulk sales legislation was enacted to protect creditors where a sale of assets has the effect of putting the debtor out of business.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

The Bulk Sale law places the responsibility squarely upon the Buyer's shoulders to comply with the provisions of the statutes, unless the transaction is handled through an escrow in which event the Escrow Holder becomes responsible to comply with certain provisions of the Act Section 6106.2(b).