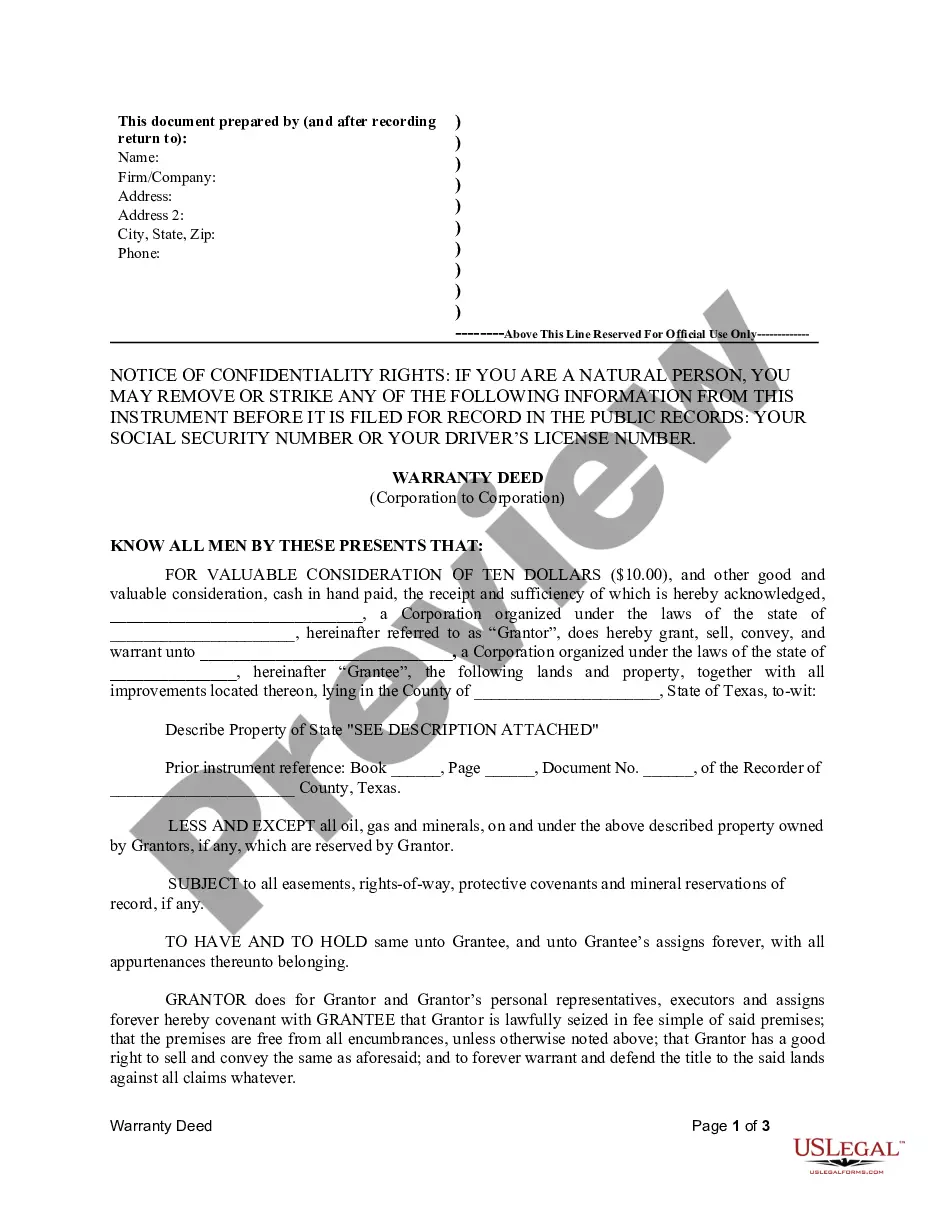

Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Hawaii Resolution to Incorporate as Nonprofit Corporation by Members of a Church Operating as an Unincorporated Association: A Comprehensive Guide In the beautiful state of Hawaii, a resolution to incorporate as a nonprofit corporation by members of a church operating as an unincorporated association can provide numerous benefits and legal protections. This comprehensive guide aims to explain the process, requirements, and different types of resolutions involved in this significant endeavor. 1. Understanding the Church Operating as an Unincorporated Association Before delving into the specifics of incorporating as a nonprofit corporation, it is essential to comprehend the concept of a church operating as an unincorporated association. In Hawaii, churches often function as unincorporated associations, typically formed by individuals who join together for religious activities without adopting a formal legal structure. 2. Importance of Incorporating as a Nonprofit Corporation There are many advantages to incorporating a church as a nonprofit corporation, including limited liability protection, eligibility for tax-exempt status, enhanced credibility, and the ability to own property in the church’s name. By incorporating, the church becomes a separate legal entity, distinct from its members, thus providing increased stability and legal safeguards. 3. Types of Hawaii Resolutions to Incorporate as a Nonprofit Corporation There are primarily two types of resolutions involved in incorporating a church as a nonprofit corporation — the Initial Resolution and the Final or Approval Resolution. a) Initial Resolution: The Initial Resolution is the first step towards incorporation. This resolution is typically drafted and approved by the church members, outlining their intent to incorporate as a nonprofit corporation. It identifies the church's name, states the purpose of incorporation, and identifies the initial board of directors who will oversee the incorporation process. b) Final or Approval Resolution: The Final or Approval Resolution is the second resolution required in the process of incorporating a church as a nonprofit corporation. Once the necessary legal steps, including drafting articles of incorporation and filing with the appropriate authorities, are completed, the church members must hold a formal meeting to adopt the Final or Approval Resolution. This resolution signifies the official consent of the members to incorporate as a nonprofit corporation and ratifies the articles of incorporation. 4. Requirements for Incorporating as a Nonprofit Corporation To incorporate as a nonprofit corporation under Hawaiian law, certain requirements must be met. These include: a) Choosing a Church Name: Selecting a unique and suitable name for the nonprofit corporation that adheres to the rules set forth by the State of Hawaii. The name must accurately reflect the church's purpose and avoid any confusion with existing entities. b) Drafting and Filing Articles of Incorporation: Preparing and filing articles of incorporation with the Hawaii Business Registration Division, providing information about the church's purpose, registered agent, and initial directors. c) Obtaining Tax-Exempt Status: Applying for tax-exempt status with the Internal Revenue Service (IRS) to enjoy the benefits of being recognized as a nonprofit organization. d) Complying with State and Federal Regulations: Meeting state and federal regulations relating to nonprofit corporations, such as annual reporting requirements, maintaining proper financial records, and adhering to governance and operational standards. 5. Importance of Seeking Legal Advice Given the complexity and legal implications involved in incorporating as a nonprofit corporation, it is highly advisable to consult with an experienced attorney specializing in nonprofit law. This legal expert can guide the church members through the process, ensuring compliance with all legal requirements and providing assistance with tax-exempt status applications and ongoing legal and regulatory matters. In conclusion, the Hawaii Resolution to Incorporate as a Nonprofit Corporation by Members of a Church operating as an Unincorporated Association can be a transformative step towards providing legal protection, enhanced credibility, and eligibility for tax-exempt status. It is crucial for church members to understand the process, types of resolutions, and requirements involved in this journey towards incorporation, ensuring a smooth transition to a legally recognized nonprofit corporation.