Subject: Notification of Dissolution Finalized for Your Business in Hawaii Dear [Client's Name], We hope this letter finds you well. We are writing to inform you that the dissolution process for your business in Hawaii has been successfully finalized. We would like to provide you with a detailed description of what the dissolution process entails in Hawaii and provide you with all the necessary information related to this matter. Description: Dissolution of a business refers to the formal process of legally closing down a company, ensuring all legal requirements are met, and terminating its operations. It involves winding up the affairs of the business, settling any outstanding obligations, and distributing assets appropriately. Hawaii's law requires businesses to follow specific steps to dissolve properly. Process Overview: 1. Prepare Dissolution Documents: — Articles of Dissolution: This document contains essential information about your business, such as its name, date of incorporation, and reasons for dissolution. — Board Resolution: If required by your business's bylaws or operating agreement, a board resolution approving the dissolution may need to be adopted. 2. File Dissolution Documents: — Submit the completed Articles of Dissolution to the Hawaii Department of Commerce and Consumer Affairs (CCA) Business Registration Division. — Applicable fees for filing the dissolution documents will need to be paid. 3. Settle Outstanding Obligations: — Notify creditors, suppliers, and other parties associated with your business about the dissolution. — Settle any remaining debts or loans, including taxes, licenses, permits, leases, and outstanding invoices. 4. Asset Distribution: — Determine the appropriate distribution of remaining assets among shareholders, partners, or other stakeholders. — Comply with any specific instructions outlined in your business's articles of incorporation, bylaws, or operating agreement. 5. Termination Filings: — File a final tax return with the Internal Revenue Service (IRS) and state taxing authorities. — Cancel any licenses, permits, or registrations your business may hold. Once the dissolution process is complete, your business will cease to exist as a legal entity in Hawaii. Please note that there are specific types of Hawaii Sample Letters to Clients regarding Dissolution Finalized, depending on the nature of your business or the type of entity: 1. Hawaii Sample Letter to Client — Corporation Dissolution Finalized: This letter is specifically designed for corporations operating in Hawaii. 2. Hawaii Sample Letter to Client — Limited Liability Company (LLC) Dissolution Finalized: This letter is tailored for LCS operating in Hawaii. 3. Hawaii Sample Letter to Client — Partnership Dissolution Finalized: This letter is aimed at partnerships, including general partnerships or limited partnerships, dissolving in Hawaii. 4. Hawaii Sample Letter to Client — Sole Proprietorship Dissolution Finalized: This letter is dedicated to the dissolution of sole proprietorship in Hawaii. We strongly advise consulting with your legal and tax advisors to ensure compliance with Hawaii state laws, as the requirements for each business entity type may differ. If you have any further questions or need assistance regarding the dissolution process or related matters, please do not hesitate to reach out to us. We are here to guide you through this transition and ensure a smooth conclusion to your business's affairs. Thank you for your continued trust and support. Sincerely, [Your Name] [Your Title/Position] [Company Name] [Contact Information]

Hawaii Sample Letter to Client regarding Dissolution Finalized

Description

How to fill out Hawaii Sample Letter To Client Regarding Dissolution Finalized?

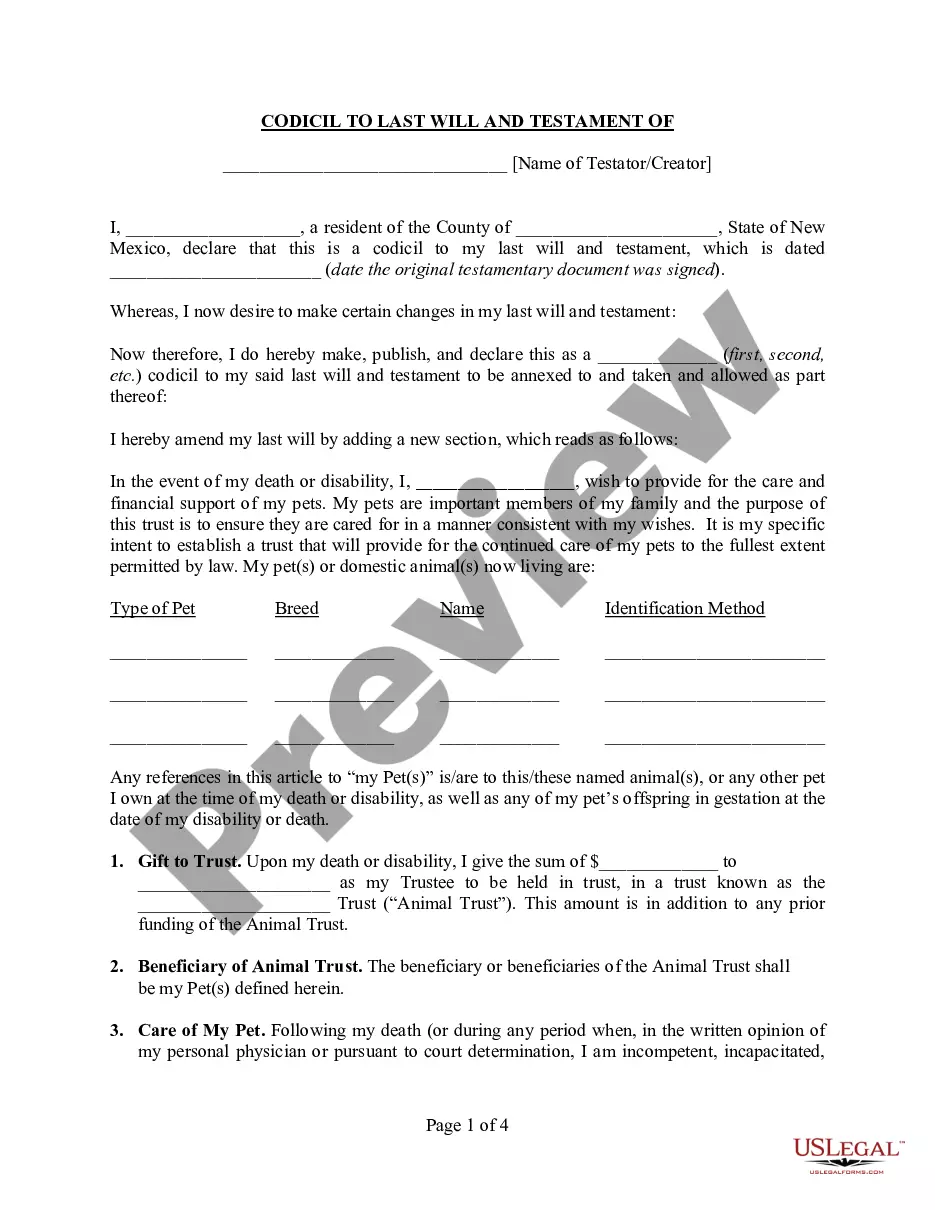

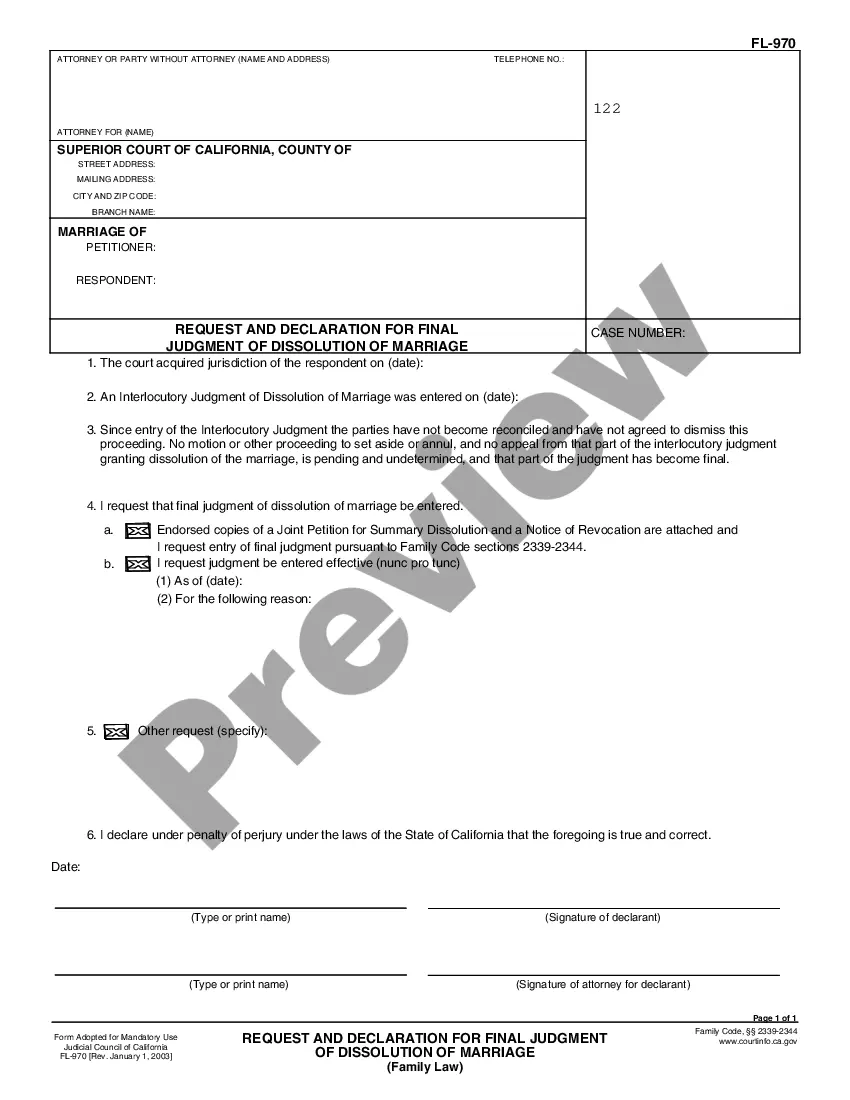

Are you presently in a situation that you require documents for sometimes enterprise or individual reasons almost every day? There are a variety of legal papers layouts available online, but getting ones you can rely isn`t easy. US Legal Forms offers thousands of develop layouts, like the Hawaii Sample Letter to Client regarding Dissolution Finalized, that are created in order to meet state and federal requirements.

Should you be currently informed about US Legal Forms website and also have your account, merely log in. Afterward, you are able to acquire the Hawaii Sample Letter to Client regarding Dissolution Finalized format.

If you do not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for the correct area/county.

- Make use of the Review option to check the form.

- See the description to actually have chosen the appropriate develop.

- In the event the develop isn`t what you`re trying to find, take advantage of the Search field to discover the develop that suits you and requirements.

- Whenever you discover the correct develop, click Acquire now.

- Pick the prices plan you desire, fill in the required information to generate your account, and purchase the transaction with your PayPal or charge card.

- Decide on a practical file formatting and acquire your copy.

Get all of the papers layouts you might have bought in the My Forms menus. You can get a more copy of Hawaii Sample Letter to Client regarding Dissolution Finalized any time, if necessary. Just click the required develop to acquire or print out the papers format.

Use US Legal Forms, one of the most considerable assortment of legal kinds, to conserve time as well as steer clear of blunders. The assistance offers expertly manufactured legal papers layouts that you can use for a variety of reasons. Make your account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

Firstly, start by addressing the recipient in a professional manner using their full name or company name. Be clear and concise about your intentions for writing the letter, stating that you intend to dissolve the partnership. Next, provide context for why you've made this decision.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

Please be advised that the [corporation] [the partnership between (insert partner names)] [limited liability company between (insert member names)] known as (insert name of business), doing business at (insert address) will be dissolved by [shareholder and director resolution] [mutual consent of the partners] [[mutual ...