A Hawaii Purchase Agreement by a Corporation of Assets of a Partnership refers to a legally binding contract that outlines the details of a transaction where a corporation purchases the assets of a partnership. In this arrangement, the corporation acquires the tangible and intangible assets owned by the partnership in exchange for agreed-upon consideration. The purpose of this agreement is to ensure a smooth transfer of assets, rights, and liabilities from the partnership to the corporation, while protecting the interests of all parties involved. It serves as a crucial document in facilitating the transition of ownership and provides a framework for the terms and conditions of the transaction. The content of a Hawaii Purchase Agreement by a Corporation of Assets of a Partnership generally includes the following key components: 1. Identification of the Parties: The agreement begins with the identification of the corporation and partnership involved in the transaction. This section includes their legal names, addresses, and any relevant details needed for legal clarity. 2. Asset Description: A detailed description of the assets being transferred to the corporation is essential. This encompasses tangible assets such as property, equipment, inventory, and intangible assets like intellectual property, licenses, contracts, and goodwill. The agreement should specify the exact assets being transferred and their respective conditions, if applicable. 3. Purchase Price and Consideration: A Hawaii Purchase Agreement explicitly states the purchase price or consideration for the assets. This may be a lump sum, installment payments, assumption of liabilities, or a combination of these. Both the corporation and partnership must agree on the valuation method, payment terms, and any contingencies related to the purchase price. 4. Representations and Warranties: This section outlines the promises made by both the partnership and the corporation regarding the accuracy and completeness of the information provided. Representations and warranties cover various aspects such as ownership rights, absence of claims or encumbrances, compliance with laws, and financial statements. 5. Assumption of Liabilities: The agreement should address the treatment of the partnership's existing liabilities, such as debts, outstanding contracts, and legal obligations. It specifies whether the corporation assumes these liabilities or if they remain the responsibility of the partnership after the asset transfer. 6. Closing and Delivery: The process and timeline for closing the transaction should be clearly stated, including the necessary documentation, inspections, and approvals required for the transfer of assets. The agreement might also outline how the partnership will deliver possession and control of the assets to the corporation. Different types of Hawaii Purchase Agreements by a Corporation of Assets of a Partnership may depend on the specific nature or industry of the partnership or the assets being acquired. Some examples include: 1. Real Estate Purchase Agreement: This type of purchase agreement specifically focuses on the acquisition of real property assets owned by a partnership by a corporation. It may include additional provisions related to title searches, property inspections, zoning compliance, and other real estate-specific considerations. 2. Intellectual Property Purchase Agreement: In cases where the partnership owns valuable intellectual property assets, this type of purchase agreement would be tailored to address the transfer of patents, trademarks, copyrights, trade secrets, or licenses. The agreement may outline any restrictions, royalty arrangements, or future obligations related to the intellectual property rights. 3. Stock Purchase Agreement: If the partnership operates as a corporation and the transaction involves the acquisition of partnership shares, a stock purchase agreement might be used instead. This agreement focuses on the transfer of ownership interests through the purchase of shares or equity in the partnership. It is important for both the partnership and the corporation to consult legal professionals to draft a Hawaii Purchase Agreement that aligns with their specific circumstances, complies with relevant laws, and adequately safeguards their rights and responsibilities.

Hawaii Purchase Agreement by a Corporation of Assets of a Partnership

Description

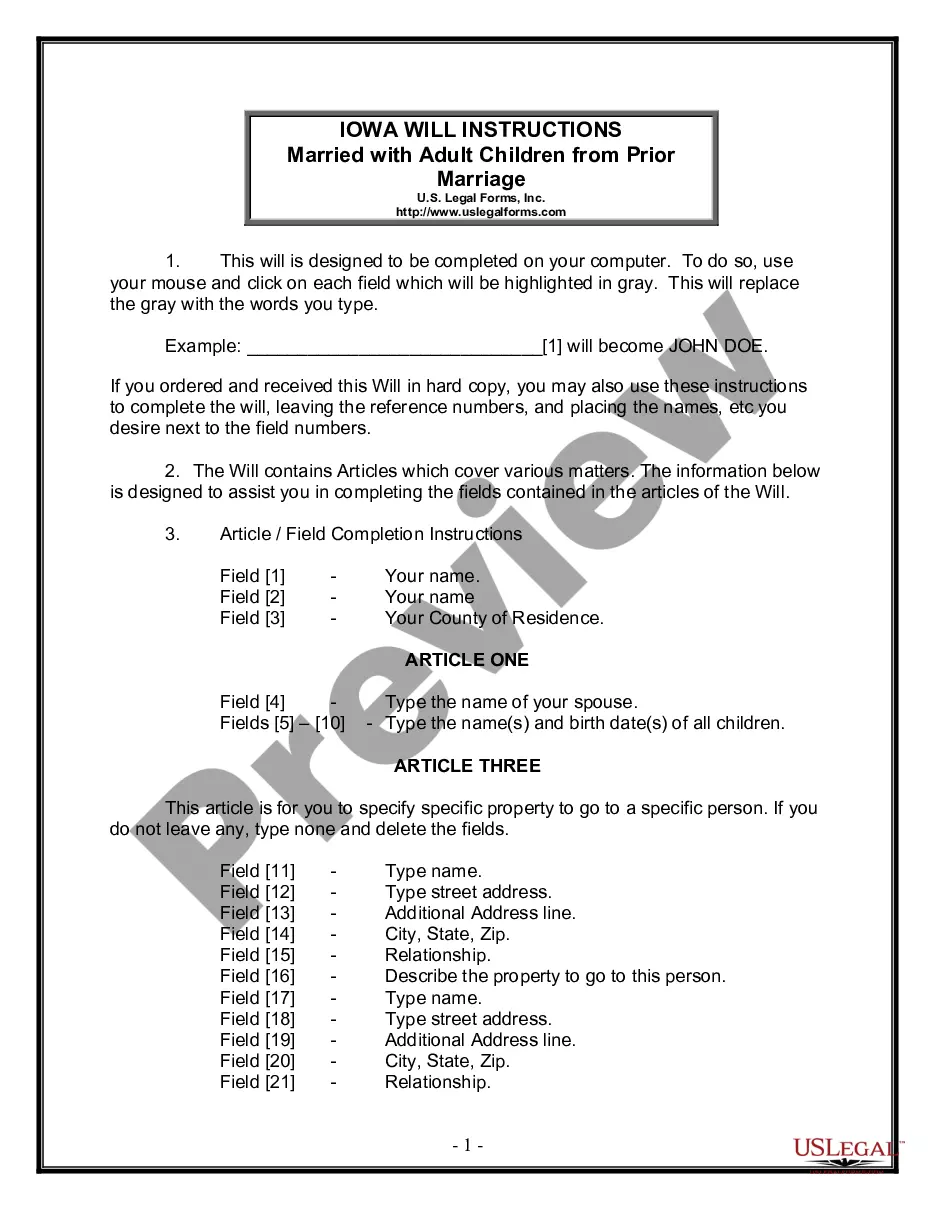

How to fill out Hawaii Purchase Agreement By A Corporation Of Assets Of A Partnership?

Discovering the right lawful record design can be quite a have difficulties. Naturally, there are tons of layouts available on the Internet, but how can you discover the lawful type you require? Use the US Legal Forms internet site. The assistance provides a large number of layouts, such as the Hawaii Purchase Agreement by a Corporation of Assets of a Partnership, that can be used for business and personal needs. All of the kinds are checked by specialists and meet up with state and federal requirements.

Should you be presently signed up, log in in your profile and then click the Acquire switch to obtain the Hawaii Purchase Agreement by a Corporation of Assets of a Partnership. Utilize your profile to appear with the lawful kinds you possess acquired in the past. Go to the My Forms tab of your profile and acquire yet another duplicate in the record you require.

Should you be a fresh customer of US Legal Forms, listed here are simple instructions that you should follow:

- Very first, be sure you have chosen the right type to your metropolis/state. You are able to look through the shape using the Preview switch and read the shape explanation to make sure this is basically the best for you.

- If the type fails to meet up with your requirements, use the Seach area to obtain the right type.

- Once you are positive that the shape would work, select the Purchase now switch to obtain the type.

- Choose the costs strategy you would like and type in the essential info. Design your profile and purchase an order making use of your PayPal profile or charge card.

- Pick the file formatting and obtain the lawful record design in your system.

- Total, modify and produce and indicator the acquired Hawaii Purchase Agreement by a Corporation of Assets of a Partnership.

US Legal Forms will be the biggest local library of lawful kinds where you can see a variety of record layouts. Use the service to obtain expertly-produced paperwork that follow express requirements.

Form popularity

FAQ

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

What is an asset purchase? This is an agreement between a buyer and seller to acquire a company's assets. The buyer can cherry pick which assets it wants and leave the rest behind. Assets can be both tangible, such as offices and equipment, and intangible, such as intellectual property and corporate name.

Purchasing shares is generally considered to benefit the seller, while purchasing assets is considered a benefit to the buyer. Asset transactions can allow the purchaser to be sheltered from any unforeseen liabilities. In share purchases, the buyer takes on these liabilities, and the transaction is inherently riskier.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.