Hawaii Loan Agreement for Family Member

Description

How to fill out Loan Agreement For Family Member?

Are you within a situation where you need to have documents for either organization or specific reasons just about every working day? There are a lot of lawful record layouts available online, but getting kinds you can rely on isn`t easy. US Legal Forms provides a large number of develop layouts, much like the Hawaii Loan Agreement for Family Member, which are published in order to meet state and federal requirements.

In case you are previously informed about US Legal Forms web site and have a free account, merely log in. Next, it is possible to download the Hawaii Loan Agreement for Family Member template.

If you do not offer an bank account and would like to start using US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for your proper area/area.

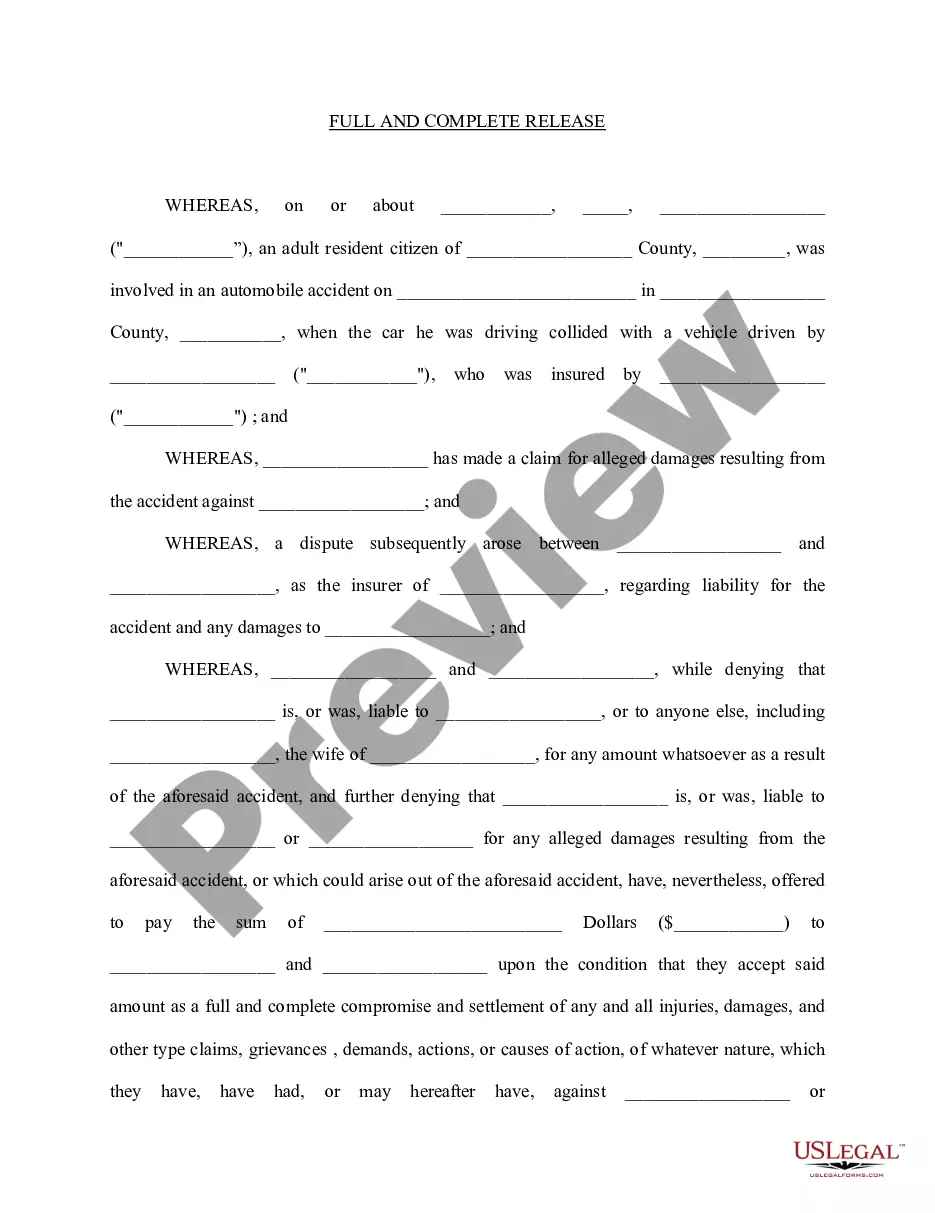

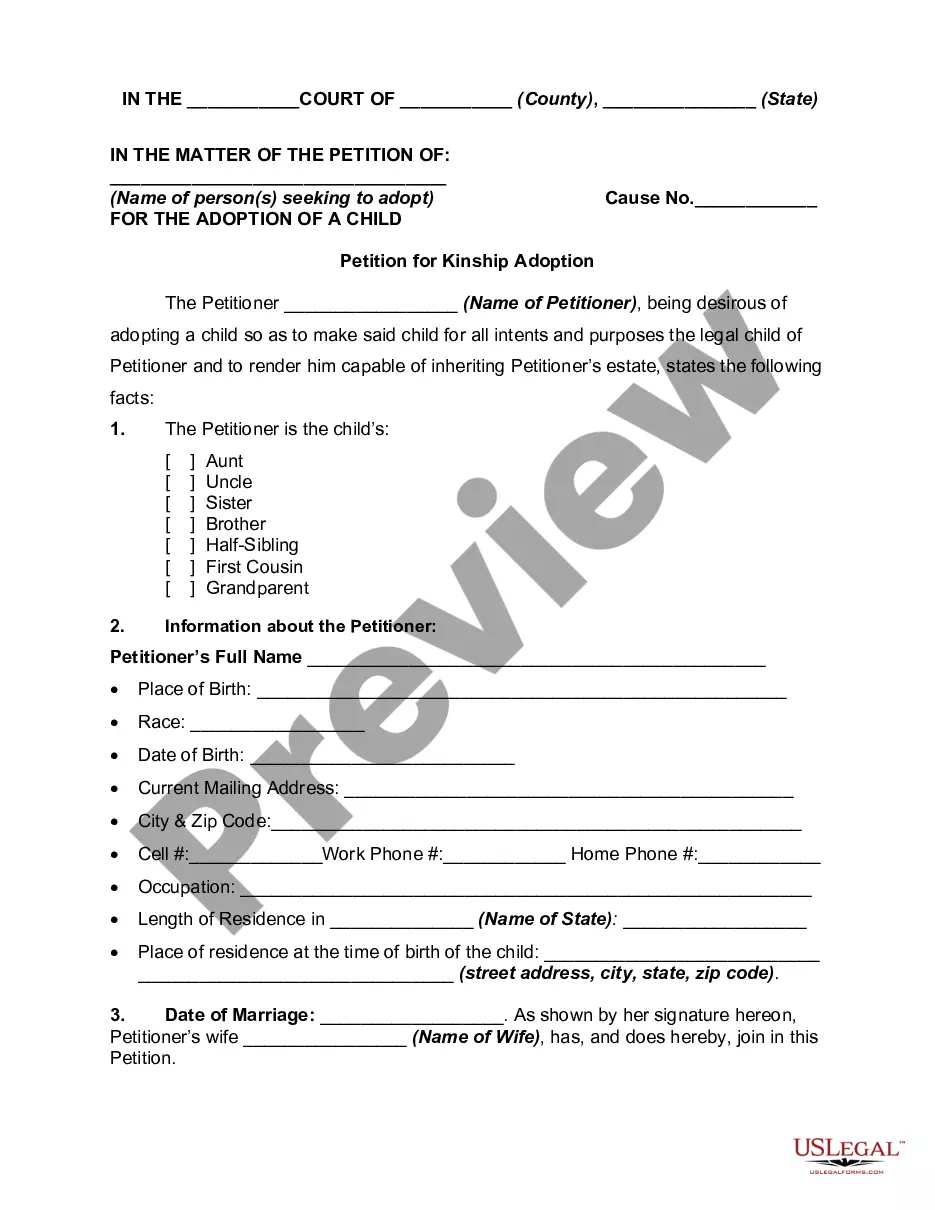

- Use the Preview option to analyze the form.

- See the outline to ensure that you have selected the proper develop.

- In case the develop isn`t what you`re seeking, utilize the Look for industry to find the develop that fits your needs and requirements.

- Whenever you find the proper develop, click on Get now.

- Pick the costs plan you would like, complete the required information and facts to make your bank account, and pay money for the order using your PayPal or charge card.

- Decide on a convenient data file formatting and download your duplicate.

Locate all of the record layouts you may have purchased in the My Forms menu. You can get a extra duplicate of Hawaii Loan Agreement for Family Member at any time, if necessary. Just select the required develop to download or printing the record template.

Use US Legal Forms, the most considerable assortment of lawful types, in order to save time and avoid faults. The support provides skillfully produced lawful record layouts which you can use for an array of reasons. Produce a free account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Once executed a loan agreement will be legally binding and in effect.

The $100,000 De Minimis Exception If the total sum of lending is less than $100,000, the IRS allows you to charge interest based on the lesser of either the AFR rate or the borrower's net investment income for the year. If their investment income was $1,000 or less, the IRS allows them to charge no interest.

Note that you will be responsible for repaying the debt if your family member defaults on their loan, so enter this financial arrangement with the same caution that you would in extending a personal loan.

A loan agreement between two individuals is more simplistic but similar to a standard bank promissory note. Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable)

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.