Hawaii Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal use, sorted by categories, states, or keywords. You can find the latest versions of documents such as the Hawaii Living Trust with Provisions for Disability in minutes.

If you have a subscription, Log In to download the Hawaii Living Trust with Provisions for Disability from the US Legal Forms library. The Download option will be available for every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the document onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Hawaii Living Trust with Provisions for Disability. Every template you save in your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply check the My documents section and click on the form you want. Gain access to the Hawaii Living Trust with Provisions for Disability with US Legal Forms, the most extensive library of legal document templates. Utilize a wide variety of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure to select the correct form for your area.

- Click the Preview option to review the content of the form.

- Check the form description to confirm that you have picked the right document.

- If the form does not meet your requirements, utilize the Search function at the top of the page to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Buy now button.

- Afterward, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

How to Create a Living Trust in HawaiiChoose the type of trust you want. If you're single, a single trust is the natural choice.Decide which of your assets you'd like to place in the living trust.Choose a trustee.Create your trust document.Sign the document.Place your assets into the trust.

If you opt for a DIY trust, your costs will vary depending on which service you use, if you use an online service at all. Total costs can range as high as a few hundred dollars, or they may be less than $200. If you enlist the help of an attorney, you'll have the peace of mind that an expert is on the case.

A trust can stipulate, for example, that until age 25, the trust assets are held for the benefit of the beneficiary but that he is not automatically entitled to any distributions unless the trustee believes that a distribution is advisable. At age 25, the beneficiary becomes entitled to one third of the trust assets.

Terms of the Trust means the settlor's wishes expressed in the Trust Instrument. Trust deed: A trust deed is a legal document that defines the trust such as the trustee, beneficiaries, settlor and appointer, and the terms and conditions of the agreement.

As part of its definition, a trust is composed of three parties - the trustor, trustee and beneficiary.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

There are five key elements of trust that drive our philosophy:Reliability: Being reliable creates trust.Honesty: Telling the truth creates trust.Good Will: Acting in good faith creates trust.Competency: Doing your job well creates trust.Open: Being vulnerable creates trust.

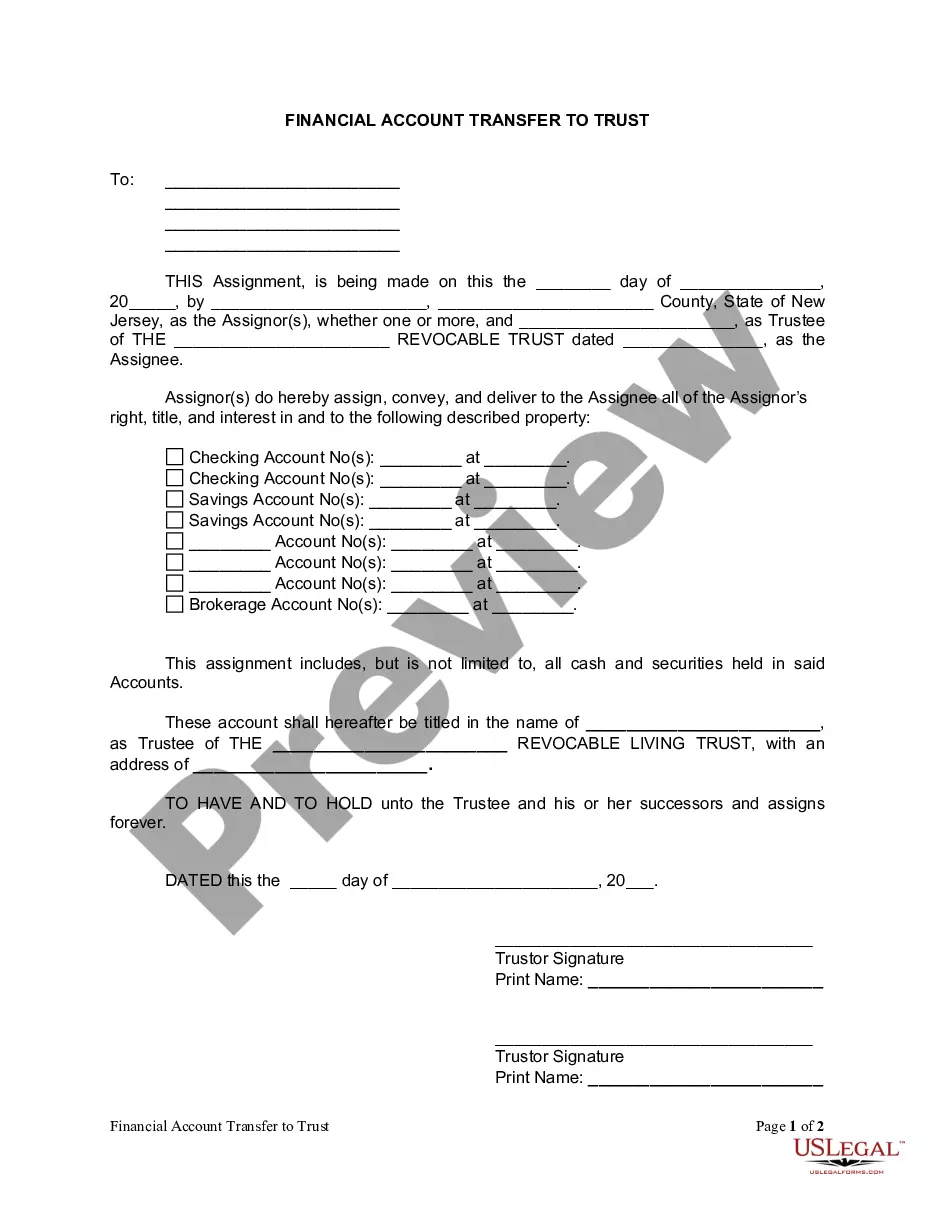

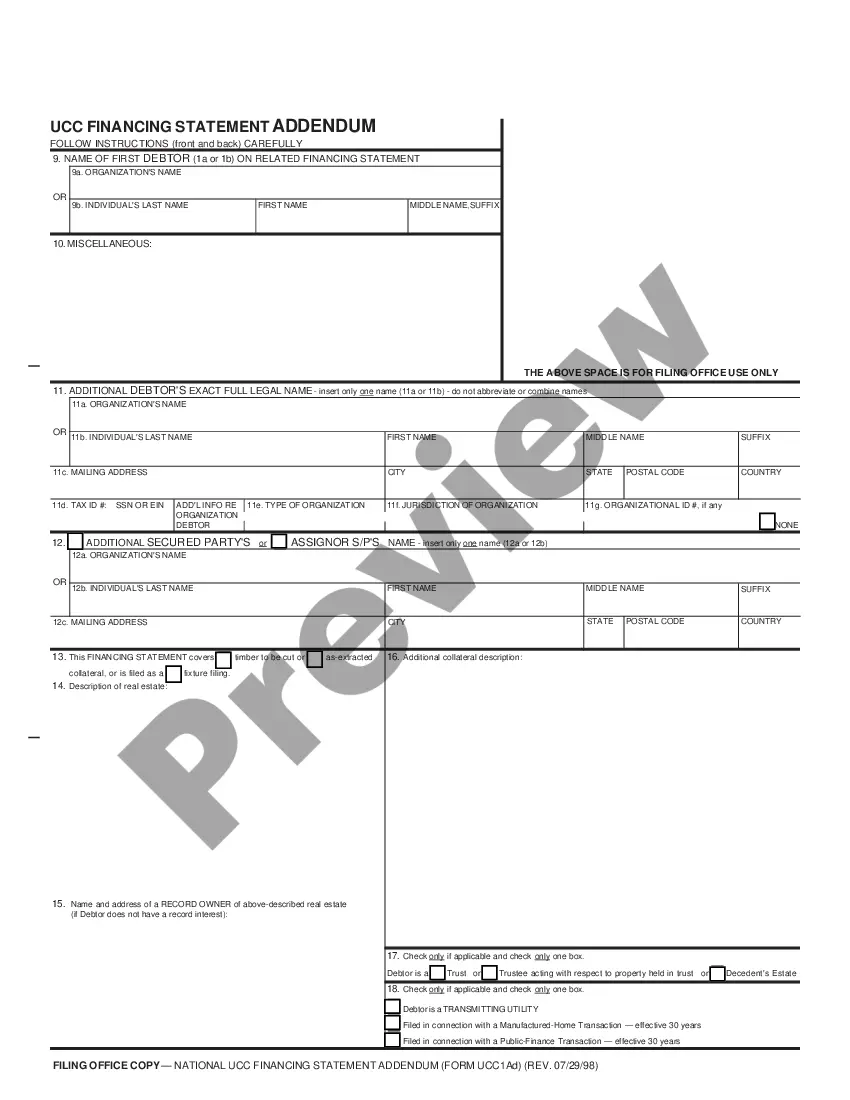

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

How to Create a Living Trust in HawaiiChoose the type of trust you want. If you're single, a single trust is the natural choice.Decide which of your assets you'd like to place in the living trust.Choose a trustee.Create your trust document.Sign the document.Place your assets into the trust.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay more than $1,000, and fees will be higher for couples. You can also use online software to create trust documents at a cheaper rate.