Hawaii Provisions for Testamentary Charitable Remainder Unit rust for One Life: Explained A Testamentary Charitable Remainder Unit rust (CRT) is a powerful estate planning tool that allows individuals to provide for their loved ones while making a significant charitable contribution. In the state of Hawaii, there are specific provisions that govern the establishment and operation of a testamentary charitable remainder unit rust for one life. A testamentary charitable remainder unit rust is created through a well-thought-out estate plan in which the individual, referred to as the granter, allocates a portion of their assets to fund a trust. The trust will provide annual income to one non-charitable beneficiary, typically a family member, for their lifetime or a specified term. Upon the death of the non-charitable beneficiary or the designated term's expiration, the remaining trust assets are transferred to one or more charitable organizations. This allows individuals to support causes they care about while benefiting their loved ones during their lifetime. In Hawaii, the provisions for a testamentary charitable remainder unit rust for one life revolve around specific requirements and guidelines. These provisions ensure compliance with state laws and maximize the tax benefits associated with charitable giving. One of the essential considerations is the selection of a qualified trustee to manage the trust. In Hawaii, a trustee must be a resident individual or a trust company duly authorized to conduct business in the state. It is crucial to choose a trustee who is knowledgeable about charitable trusts and can diligently fulfill their fiduciary duties. Additionally, the trust document must include specific language that conforms to the Hawaii Revised Statutes (HRS). The HRS include regulations pertaining to charitable trusts and guidelines for their administration. Complying with these provisions will ensure the validity and enforceability of the trust and prevent potential legal challenges. It is vital to consult with an experienced estate planning attorney who can navigate the intricacies of naming charitable organizations as beneficiaries and provide guidance on selecting suitable charitable recipients. The attorney can also assist in determining the appropriate payout rate for the non-charitable beneficiary and help explore various charitable organizations' eligibility. There are variations to the Hawaii Provisions for Testamentary Charitable Remainder Unit rust for One Life based on the granter's specific goals and needs. These include the Net Income Charitable Remainder Unit rust (NICEST) and the Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT). The NICEST pays the non-charitable beneficiary a variable income based on the trust's net income, while the TIMEOUT allows for adjusting income payments in subsequent years if they fall below the stated percentage. In conclusion, the Hawaii Provisions for Testamentary Charitable Remainder Unit rust for One Life establishes the framework for individuals aiming to create a testamentary charitable remainder unit rust to provide for their loved ones and leave a charitable legacy. The provisions encompass trustee selection, compliance with state laws, and strategies to optimize tax benefits. By understanding these provisions and seeking professional guidance, individuals can effectively incorporate philanthropy into their estate plans and make a lasting impact on charitable causes.

Hawaii Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

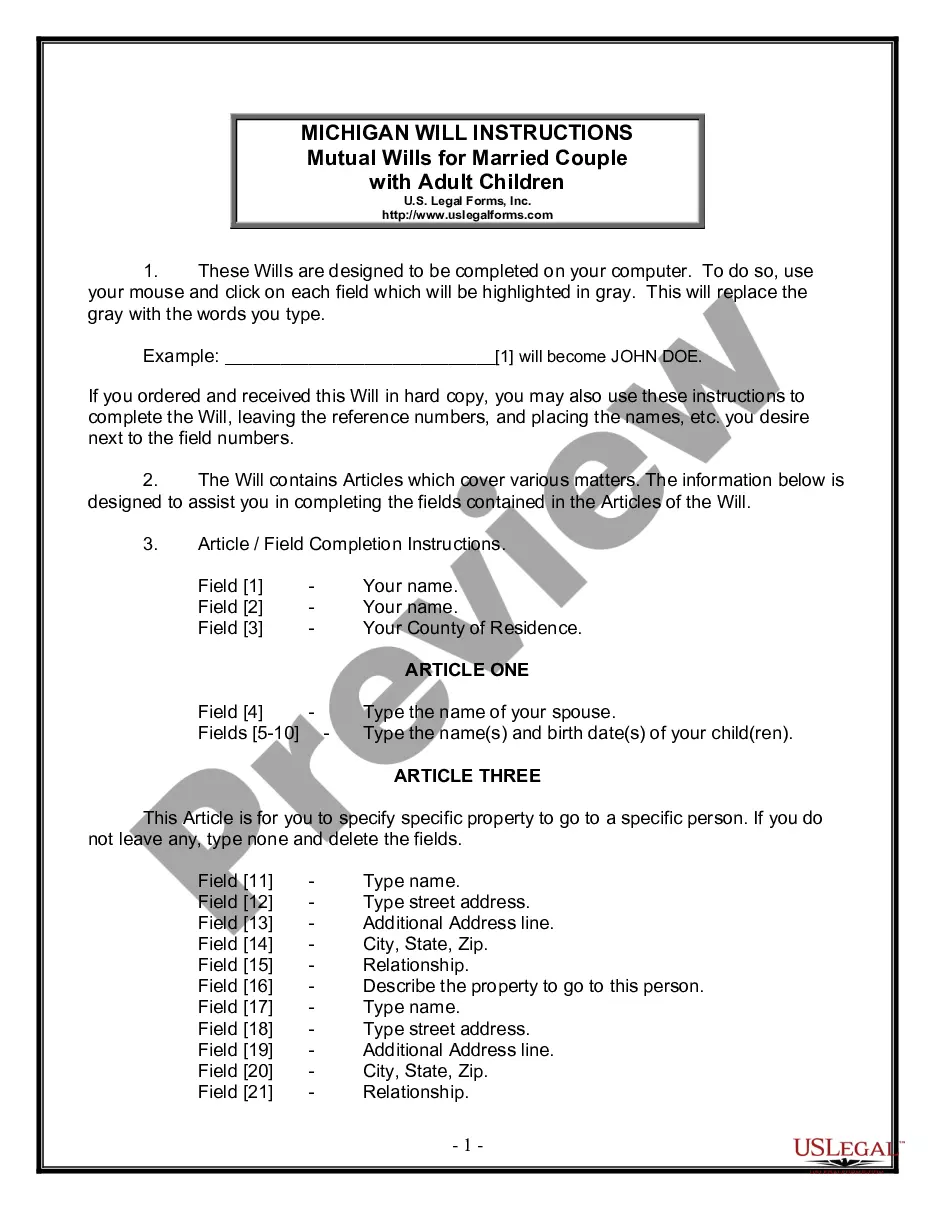

How to fill out Hawaii Provisions For Testamentary Charitable Remainder Unitrust For One Life?

US Legal Forms - one of many greatest libraries of authorized varieties in the States - offers an array of authorized file layouts it is possible to down load or produce. Using the web site, you can get thousands of varieties for enterprise and personal functions, sorted by types, claims, or keywords.You will find the newest versions of varieties much like the Hawaii Provisions for Testamentary Charitable Remainder Unitrust for One Life within minutes.

If you have a subscription, log in and down load Hawaii Provisions for Testamentary Charitable Remainder Unitrust for One Life through the US Legal Forms library. The Download button can look on each and every kind you view. You have access to all in the past acquired varieties in the My Forms tab of the accounts.

In order to use US Legal Forms the first time, here are straightforward recommendations to help you started off:

- Be sure to have picked out the best kind to your city/area. Go through the Preview button to analyze the form`s information. See the kind explanation to actually have chosen the appropriate kind.

- When the kind doesn`t fit your needs, utilize the Lookup discipline on top of the monitor to discover the one which does.

- Should you be pleased with the form, verify your option by clicking on the Acquire now button. Then, opt for the costs strategy you like and offer your credentials to sign up for an accounts.

- Approach the financial transaction. Make use of credit card or PayPal accounts to accomplish the financial transaction.

- Choose the format and down load the form on your system.

- Make changes. Complete, edit and produce and sign the acquired Hawaii Provisions for Testamentary Charitable Remainder Unitrust for One Life.

Each web template you included with your bank account does not have an expiration time which is your own property for a long time. So, if you would like down load or produce one more backup, just proceed to the My Forms segment and then click in the kind you require.

Get access to the Hawaii Provisions for Testamentary Charitable Remainder Unitrust for One Life with US Legal Forms, by far the most comprehensive library of authorized file layouts. Use thousands of expert and condition-distinct layouts that meet your small business or personal demands and needs.

Form popularity

FAQ

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

CRUT lie in what the trust pays out on a yearly basis and whether additional contributions are permitted once the trust has been created. With a CRAT, the annuity amount paid each year is fixed. Once you establish a CRAT and make the initial contribution, no further contributions are allowed.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.