A Hawaii Agreement to Devise or Bequeath Property to Granters Who Convey Property to Testator, also known as a "Devise or Bequeath Property" agreement, is a legally binding document that outlines the transfer of property from granters who have conveyed property to the testator. This agreement is specifically designed to ensure that the granters' property is devised or bequeathed back to them should the testator pass away. In Hawaii, there are different types of Agreement to Devise or Bequeath Property to Granters Who Convey Property to Testator agreements, namely: 1. Simple Agreement to Devise or Bequeath Property: This agreement is a straightforward document that states the testator's intention to devise or bequeath the property back to the granters. It usually includes details such as the legal description of the property, granter's and testator's names, and their respective addresses. 2. Joint Tenancy Agreement to Devise or Bequeath Property: This type of agreement is used when there are multiple granters and the testator wishes to transfer the property equally among them. It establishes joint tenancy between the testator and the granters, outlining the rights and responsibilities of all parties involved. 3. Revocable Living Trust Agreement to Devise or Bequeath Property: This agreement involves the creation of a revocable living trust, where the testator becomes the granter and also the trustee of the trust. The trust then holds the property, and upon the testator's death, the property is devised or bequeathed back to the granters according to the terms of the trust. 4. Irrevocable Trust Agreement to Devise or Bequeath Property: In certain cases, the testator may opt for an irrevocable trust to devise or bequeath the property to the granters. This type of agreement permanently transfers ownership of the property to the trust, and the testator cannot change or revoke the terms. Upon the testator's death, the property is distributed to the granters as specified in the trust document. These agreements serve to protect the granters' interest in the property they have conveyed to the testator while also ensuring that the testator's wishes regarding the property are fulfilled. It is crucial to consult with a qualified attorney or estate planning professional to draft and execute these agreements properly, as they involve complex legal considerations and potential tax implications. The agreement is subject to Hawaii's laws and regulations governing estate planning and property transfer.

Hawaii Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

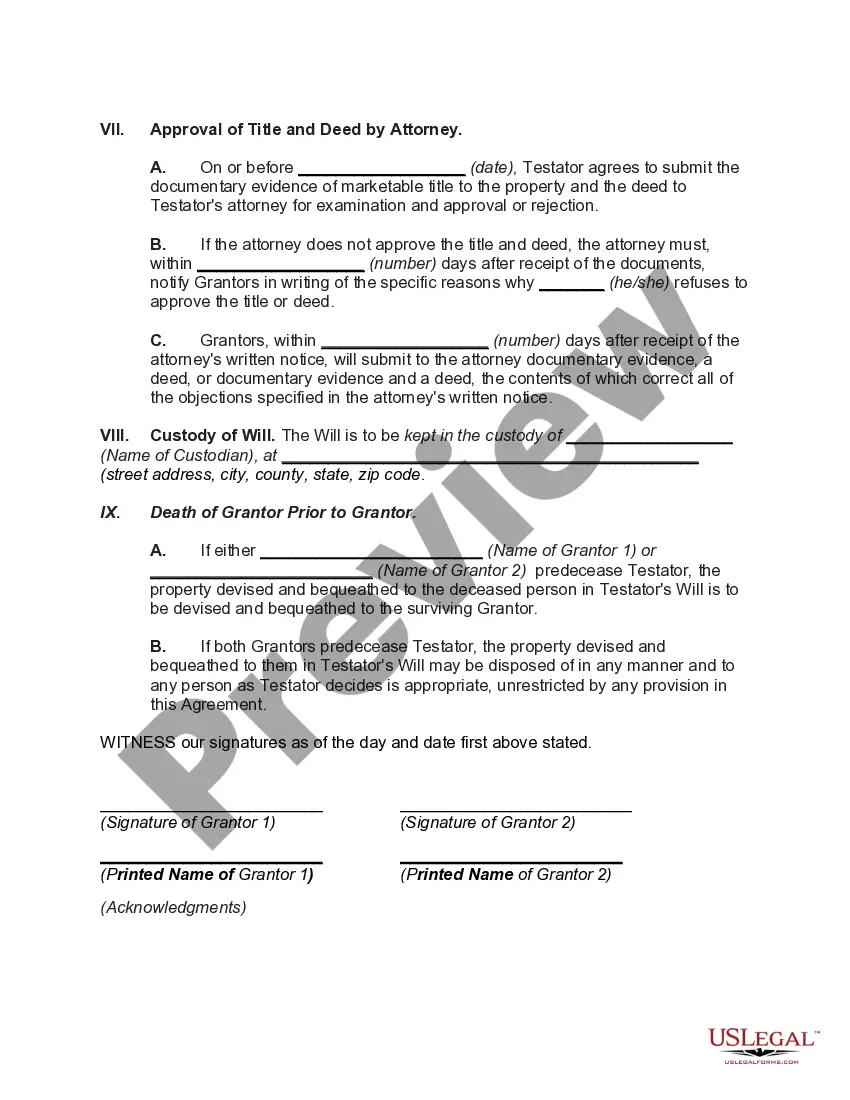

How to fill out Hawaii Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

US Legal Forms - one of several most significant libraries of lawful forms in the USA - gives a variety of lawful record templates you can download or printing. While using website, you can find a huge number of forms for enterprise and person uses, sorted by types, says, or search phrases.You will discover the newest versions of forms just like the Hawaii Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator within minutes.

If you already possess a membership, log in and download Hawaii Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator through the US Legal Forms collection. The Obtain key will appear on each and every develop you view. You get access to all formerly saved forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms for the first time, here are easy recommendations to obtain started off:

- Be sure you have chosen the correct develop for your personal metropolis/region. Click the Review key to examine the form`s content material. Browse the develop explanation to ensure that you have selected the right develop.

- When the develop does not suit your specifications, use the Research discipline near the top of the screen to get the the one that does.

- When you are content with the shape, verify your choice by clicking the Get now key. Then, opt for the prices strategy you favor and supply your references to register on an accounts.

- Method the financial transaction. Utilize your bank card or PayPal accounts to finish the financial transaction.

- Select the file format and download the shape on the system.

- Make modifications. Fill up, edit and printing and signal the saved Hawaii Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

Each design you added to your account lacks an expiration particular date which is your own property for a long time. So, if you wish to download or printing another duplicate, just check out the My Forms section and click on in the develop you will need.

Get access to the Hawaii Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator with US Legal Forms, the most considerable collection of lawful record templates. Use a huge number of specialist and status-distinct templates that meet your small business or person demands and specifications.