Hawaii Renunciation of Legacy

Description

How to fill out Renunciation Of Legacy?

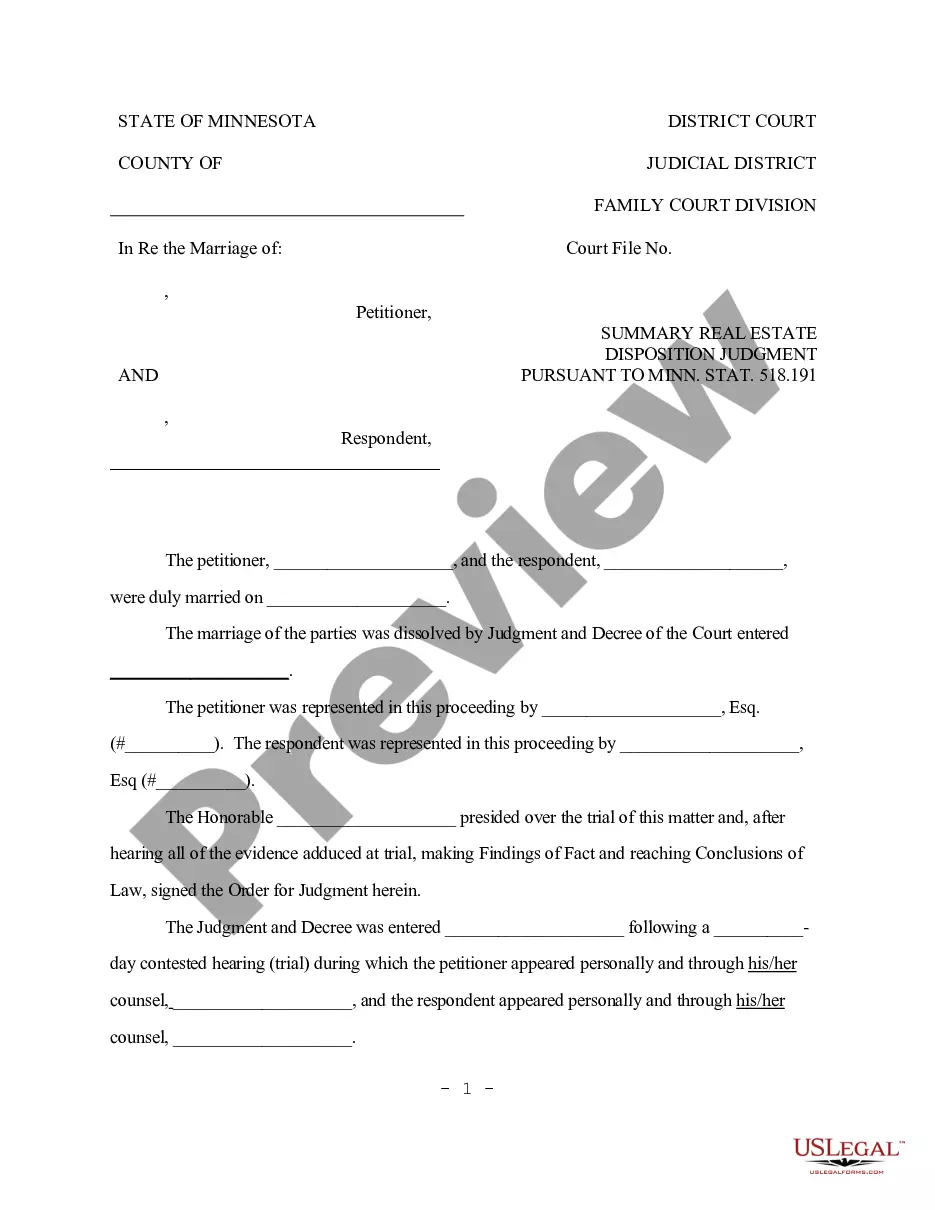

Choosing the best lawful document format might be a battle. Obviously, there are tons of web templates available on the net, but how can you obtain the lawful develop you require? Make use of the US Legal Forms web site. The support delivers thousands of web templates, for example the Hawaii Renunciation of Legacy, which can be used for enterprise and private demands. All the varieties are inspected by professionals and fulfill state and federal specifications.

Should you be currently listed, log in to the bank account and click the Down load switch to find the Hawaii Renunciation of Legacy. Use your bank account to search with the lawful varieties you possess purchased previously. Proceed to the My Forms tab of your own bank account and have one more backup from the document you require.

Should you be a brand new consumer of US Legal Forms, allow me to share straightforward recommendations that you can follow:

- Very first, make sure you have selected the appropriate develop to your area/area. It is possible to check out the form using the Review switch and read the form outline to make certain it will be the best for you.

- In the event the develop does not fulfill your requirements, utilize the Seach industry to find the appropriate develop.

- When you are positive that the form is acceptable, select the Buy now switch to find the develop.

- Choose the pricing prepare you desire and enter the required information and facts. Design your bank account and pay money for the transaction utilizing your PayPal bank account or bank card.

- Opt for the data file format and download the lawful document format to the system.

- Full, revise and print out and indicator the obtained Hawaii Renunciation of Legacy.

US Legal Forms is the largest library of lawful varieties for which you can discover various document web templates. Make use of the company to download appropriately-produced documents that follow status specifications.

Form popularity

FAQ

17. Rule 17 - Withdrawal of Pleading (a) Procedure. A party may withdraw a petition or objection that has been scheduled for hearing by giving immediate notice of the withdrawal to the court and requesting that the hearing be stricken from the calendar.

126. Rule 126 - Trust Proceedings (a) Petition. A trustee or interested person shall commence any proceeding relating to a trust by filing a petition complying with Rule 3.

If the client's consent cannot be obtained or if the attorney finds it necessary to withdraw because of a conflict of interest under Rule 42(b) or (c), an attorney may withdraw as counsel only upon filing a petition to withdraw, giving notice to the client, and receiving the approval of the court.

Rule 15 - Amended and Supplemental Pleadings (a) Amendments. A party may amend its pleading once as a matter of course at any time before a responsive pleading is served or oral answer made.

Rule 20 of the Hawaii Probate Rules allows the probate court to assign a contested matter to the civil trial calendar in circuit court, where formal discovery can begin.

If any party objects to the form of a proposed order, that person shall within 5 days serve upon the prevailing party and deliver to the court a statement of that party's objections and the reasons for failing to approve, if any, the form of the party's proposed order. Thereafter, the court shall settle the order.

Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.