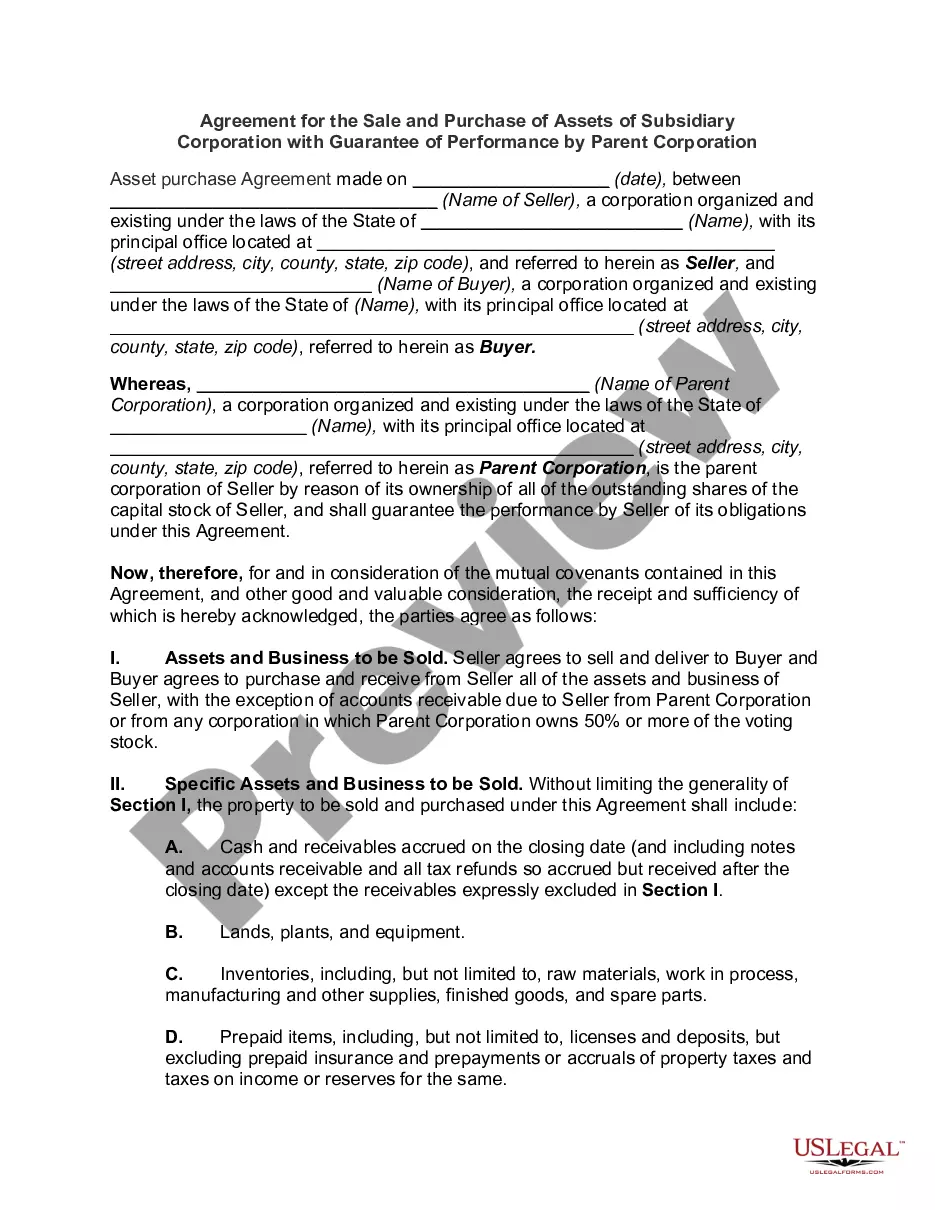

Hawaii Subsidiary Guaranty Agreement

Description

How to fill out Subsidiary Guaranty Agreement?

Selecting the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms platform.

This service offers a multitude of templates, such as the Hawaii Subsidiary Guaranty Agreement, that you can utilize for business and personal purposes.

You can preview the form using the Preview option and read the form description to confirm it is suitable for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Hawaii Subsidiary Guaranty Agreement.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and obtain another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

A guarantee is a contractual promise to: Ensure that a third party fulfils its obligations (pure guarantee); and/or. Pay an amount owed by a third party if it fails to do so itself (conditional payment guarantee).

Guaranty and Security Agreement means a guaranty and security agreement, dated as of even date with the Agreement, in form and substance reasonably satisfactory to Administrative Agent, executed and delivered by each of the Borrowers and each of the Guarantors to Administrative Agent.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.