Hawaii Borrowers Certification of Inventory

Description

How to fill out Borrowers Certification Of Inventory?

Have you been within a situation that you need to have paperwork for both business or personal purposes just about every day time? There are tons of authorized document themes available online, but discovering kinds you can rely on is not effortless. US Legal Forms offers 1000s of form themes, much like the Hawaii Borrowers Certification of Inventory, that happen to be created to fulfill federal and state demands.

If you are presently informed about US Legal Forms website and have your account, simply log in. Afterward, you can download the Hawaii Borrowers Certification of Inventory format.

If you do not have an account and would like to start using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is for the proper metropolis/county.

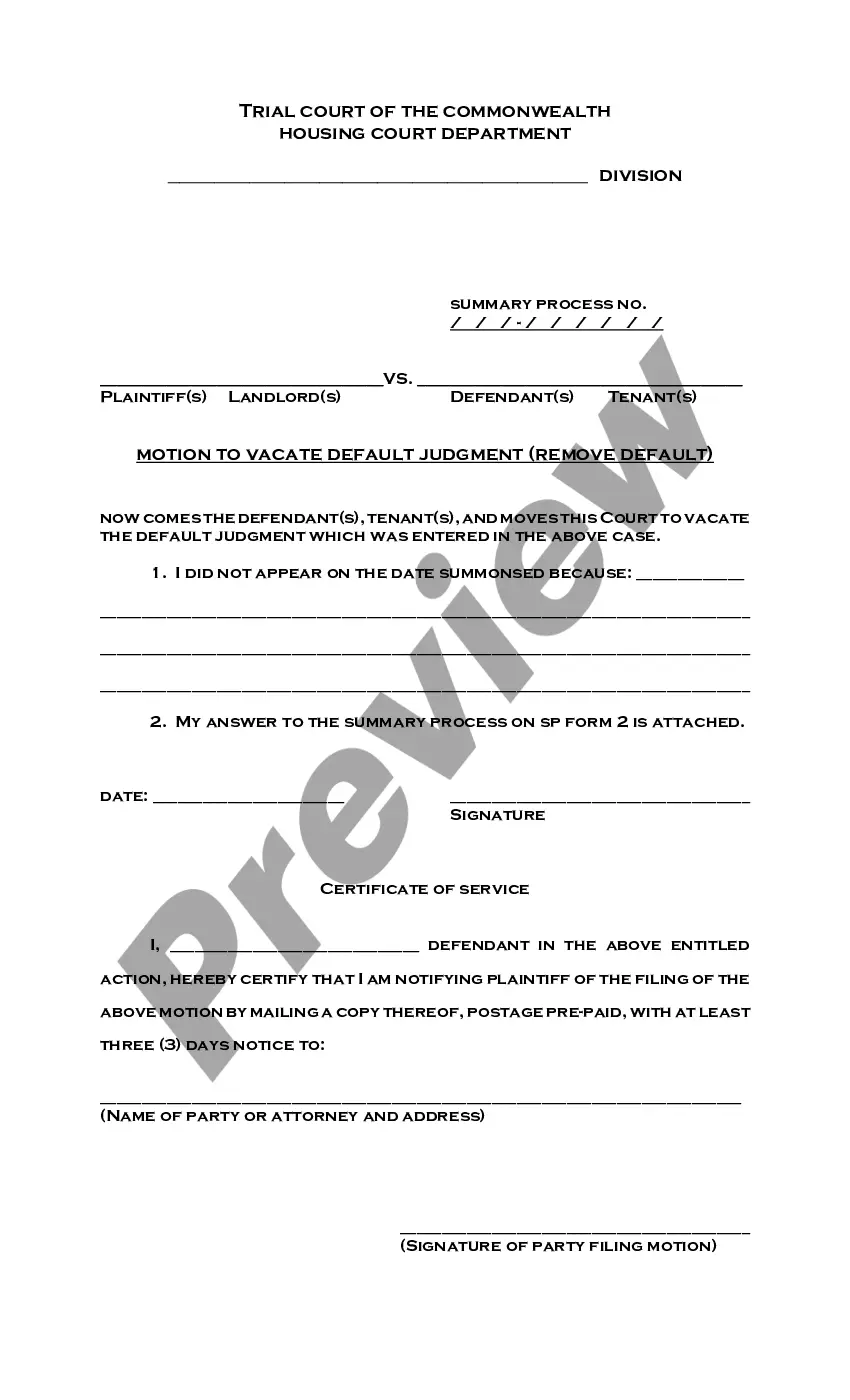

- Take advantage of the Review button to check the form.

- Read the outline to actually have chosen the appropriate form.

- In the event the form is not what you are trying to find, take advantage of the Lookup discipline to obtain the form that suits you and demands.

- Once you obtain the proper form, click on Purchase now.

- Pick the rates strategy you desire, complete the necessary details to produce your money, and purchase the transaction making use of your PayPal or credit card.

- Select a hassle-free file format and download your copy.

Get all the document themes you have purchased in the My Forms menu. You can obtain a further copy of Hawaii Borrowers Certification of Inventory any time, if required. Just click on the essential form to download or produce the document format.

Use US Legal Forms, the most substantial collection of authorized forms, to conserve time as well as prevent blunders. The service offers expertly manufactured authorized document themes that you can use for a range of purposes. Produce your account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

If you're interested in manually tracking inventory, you'll need to physically take inventory at least twice. Once to establish baseline stock levels and again to determine usage. These two inventories are usually taken on the first and last days of the month.

There are several types of inventory management systems that businesses use depending on how they operate. Three examples are manual inventory, periodic inventory and perpetual inventory. Manual methods are the least sophisticated and least accurate, and perpetual systems are the most sophisticated and most accurate.

A manual inventory management system is one where data must be updated and exported manually. Examples of this might be a pen and paper tracking system or an Excel spreadsheet.

Four major inventory management methods include just-in-time management (JIT), materials requirement planning (MRP), economic order quantity (EOQ) , and days sales of inventory (DSI).

What is a manual inventory system? With a manual inventory system, your team will manually update stock levels and inventory whereabouts. That means that as inventory comes and goes, your team will update the company's inventory list by hand. Alternatively, your company may not even track inventory perpetually.