Hawaii Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents accessible on the web.

Take advantage of the website's straightforward and convenient search to locate the documents you require.

A variety of templates for personal and business purposes are sorted by type and state, or by keywords. Use US Legal Forms to find the Hawaii Sample Letter for Refinancing of Loan with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to each form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Hawaii Sample Letter for Refinancing of Loan using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Hawaii Sample Letter for Refinancing of Loan.

- You can also access forms you have previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

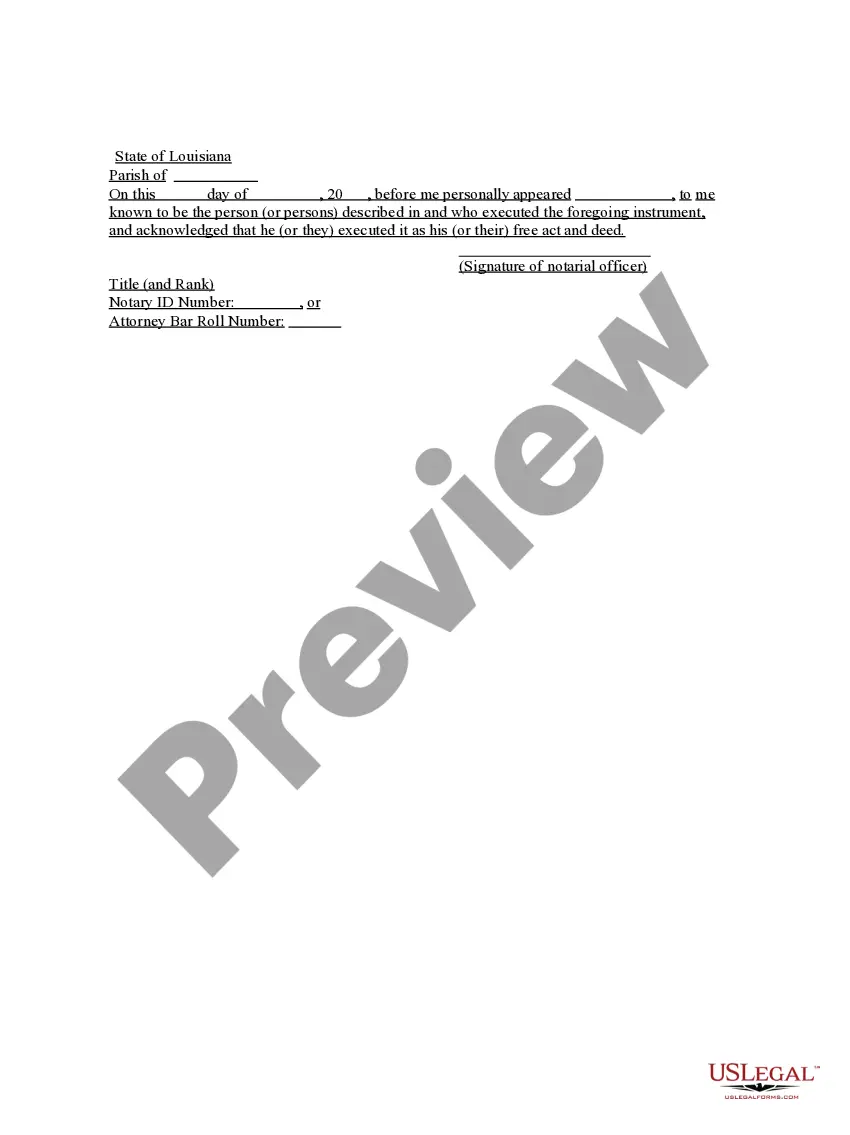

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, take advantage of the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you want, click on the Acquire now button. Select your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Hawaii Sample Letter for Refinancing of Loan.

Form popularity

FAQ

Cash-out letters tell the lender your intentions for tapping your home equity. These letters are oftentimes just a formality. But in some cases, they can also be the difference in getting approved for your new refinance or not. Lenders tend to be turned off by homeowners who frivolously use their equity.

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What to include in your letter of explanationLay out the letter as you would any other, with your full street address and phone number at the top.Date the letter with the date on which you're writing it.Put in the recipient (the lender's) name and full address.More items...?

When you get a cash-out refinance, you pay off your original mortgage and replace it with a new loan. This means your new loan may take longer to pay off, your monthly payments may be different or your interest rate may change. Be sure to look at the Closing Disclosure from your lender and analyze your new loan terms.

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

How to refinance your mortgageStep 1: Set a clear financial goal.Step 2: Check your credit score and history.Step 3: Determine how much home equity you have.Step 4: Shop multiple mortgage lenders.Step 5: Get your paperwork in order.Step 6: Prepare for the appraisal.Step 7: Come to the closing with cash, if needed.More items...?

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

What Documents Are Needed to Refinance a Mortgage?Pay Stubs.W-2s or 1099s.Tax Returns.Statement of Assets.Statement of Debts.Insurance.Additional Documents.