Hawaii Partnership Agreement for Corporation

Description

How to fill out Partnership Agreement For Corporation?

You are able to devote hours online looking for the legitimate papers template which fits the federal and state needs you will need. US Legal Forms offers 1000s of legitimate varieties that happen to be analyzed by professionals. It is possible to obtain or printing the Hawaii Partnership Agreement for Corporation from our support.

If you already have a US Legal Forms bank account, you can log in and click the Acquire switch. After that, you can total, modify, printing, or indicator the Hawaii Partnership Agreement for Corporation. Each and every legitimate papers template you purchase is yours forever. To have an additional backup for any acquired kind, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site the first time, stick to the basic directions beneath:

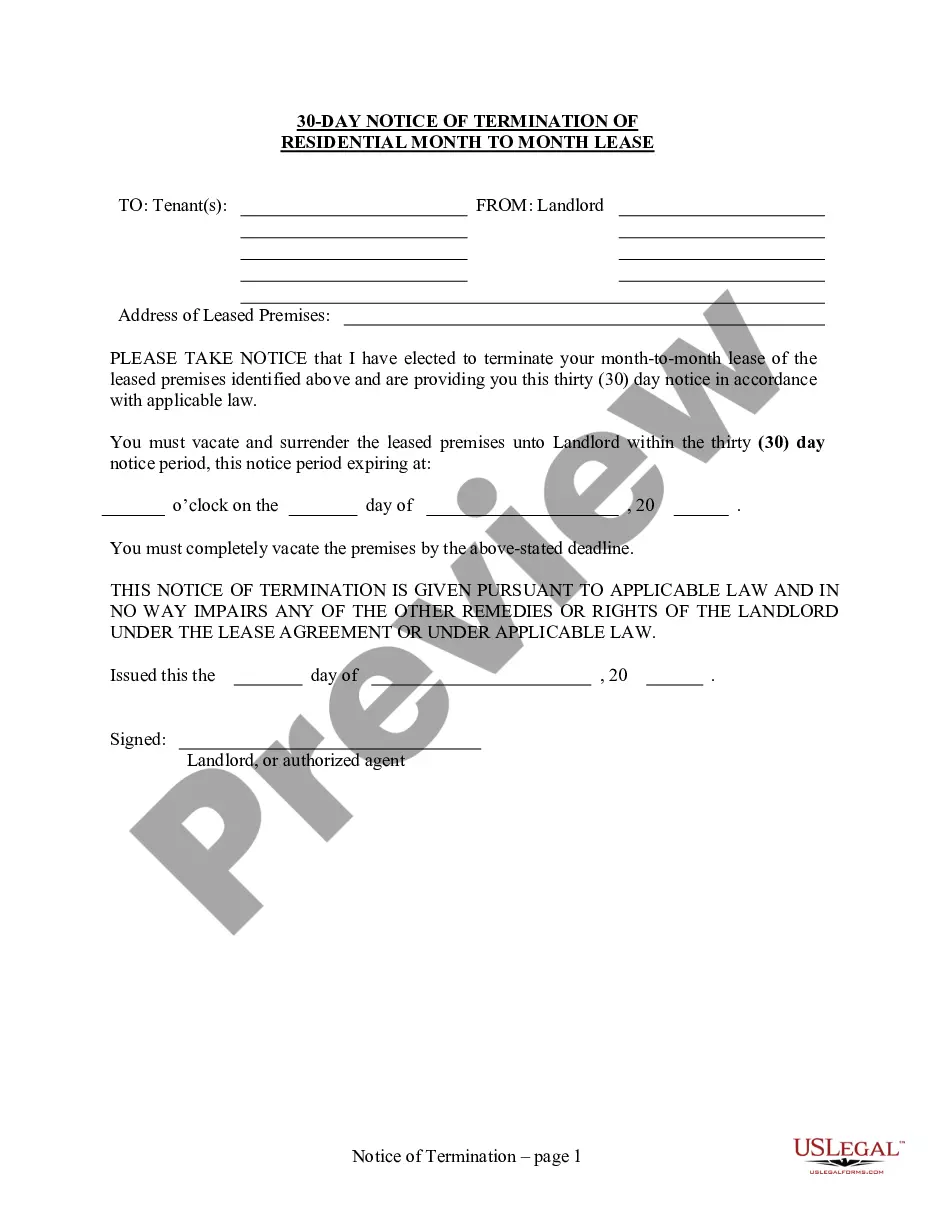

- Initially, be sure that you have selected the best papers template to the county/town of your choice. Look at the kind description to make sure you have chosen the correct kind. If offered, make use of the Review switch to appear throughout the papers template at the same time.

- If you wish to locate an additional variation from the kind, make use of the Lookup area to get the template that meets your needs and needs.

- Once you have identified the template you would like, click on Buy now to proceed.

- Choose the pricing program you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal bank account to pay for the legitimate kind.

- Choose the structure from the papers and obtain it in your product.

- Make adjustments in your papers if required. You are able to total, modify and indicator and printing Hawaii Partnership Agreement for Corporation.

Acquire and printing 1000s of papers templates using the US Legal Forms web site, which provides the largest collection of legitimate varieties. Use professional and state-particular templates to handle your small business or individual needs.