A Hawaii Partnership Agreement for Corporation is a legally binding document that outlines the terms, conditions, and guidelines governing the partnership between two or more corporations in the state of Hawaii. This agreement establishes the framework for collaboration, profit sharing, and decision-making among the participating corporations. It is crucial to have a comprehensive partnership agreement in place to prevent potential conflicts and ensure smooth operations. The Hawaii Partnership Agreement for Corporation covers various important aspects, such as the purpose and objectives of the partnership, allocation of profits and losses, decision-making procedures, contributions and capital, and dissolution procedures. It serves as a contract that binds all participating corporations to abide by the agreed-upon terms. Different types of Hawaii Partnership Agreements for Corporation may include: 1. General Partnership Agreement: This is the simplest and most common type of partnership agreement where all participating corporations equally contribute to the partnership's profits, losses, and decision-making. 2. Limited Partnership Agreement: In this type of partnership agreement, there are two types of partners: general partners and limited partners. General partners actively manage the partnership and have unlimited liability, while limited partners are passive investors with limited liability. 3. Limited Liability Partnership (LLP) Agreement: An LLP Agreement offers limited liability protection to all partners, shielding them from personal liability for the partnership's debts or actions. This type of agreement is typically favored by professional corporations, such as law firms or accounting firms. 4. Professional Corporation Partnership Agreement: This agreement is specific to professional service corporations, ensuring compliance with Hawaii's regulations and laws governing such entities. It outlines details related to licensing, professional practice, and ethical obligations. Each type of partnership agreement carries its own set of advantages and considerations, so it is crucial for corporations to carefully evaluate their needs and seek legal counsel to choose and customize the appropriate partnership agreement for their specific circumstances. By having a clear and well-drafted Hawaii Partnership Agreement for Corporation, businesses can establish a solid foundation for their collaborative ventures while minimizing risks and promoting mutual success.

Hawaii Partnership Agreement for Corporation

Description

How to fill out Hawaii Partnership Agreement For Corporation?

You are able to devote hours online looking for the legitimate papers template which fits the federal and state needs you will need. US Legal Forms offers 1000s of legitimate varieties that happen to be analyzed by professionals. It is possible to obtain or printing the Hawaii Partnership Agreement for Corporation from our support.

If you already have a US Legal Forms bank account, you can log in and click the Acquire switch. After that, you can total, modify, printing, or indicator the Hawaii Partnership Agreement for Corporation. Each and every legitimate papers template you purchase is yours forever. To have an additional backup for any acquired kind, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site the first time, stick to the basic directions beneath:

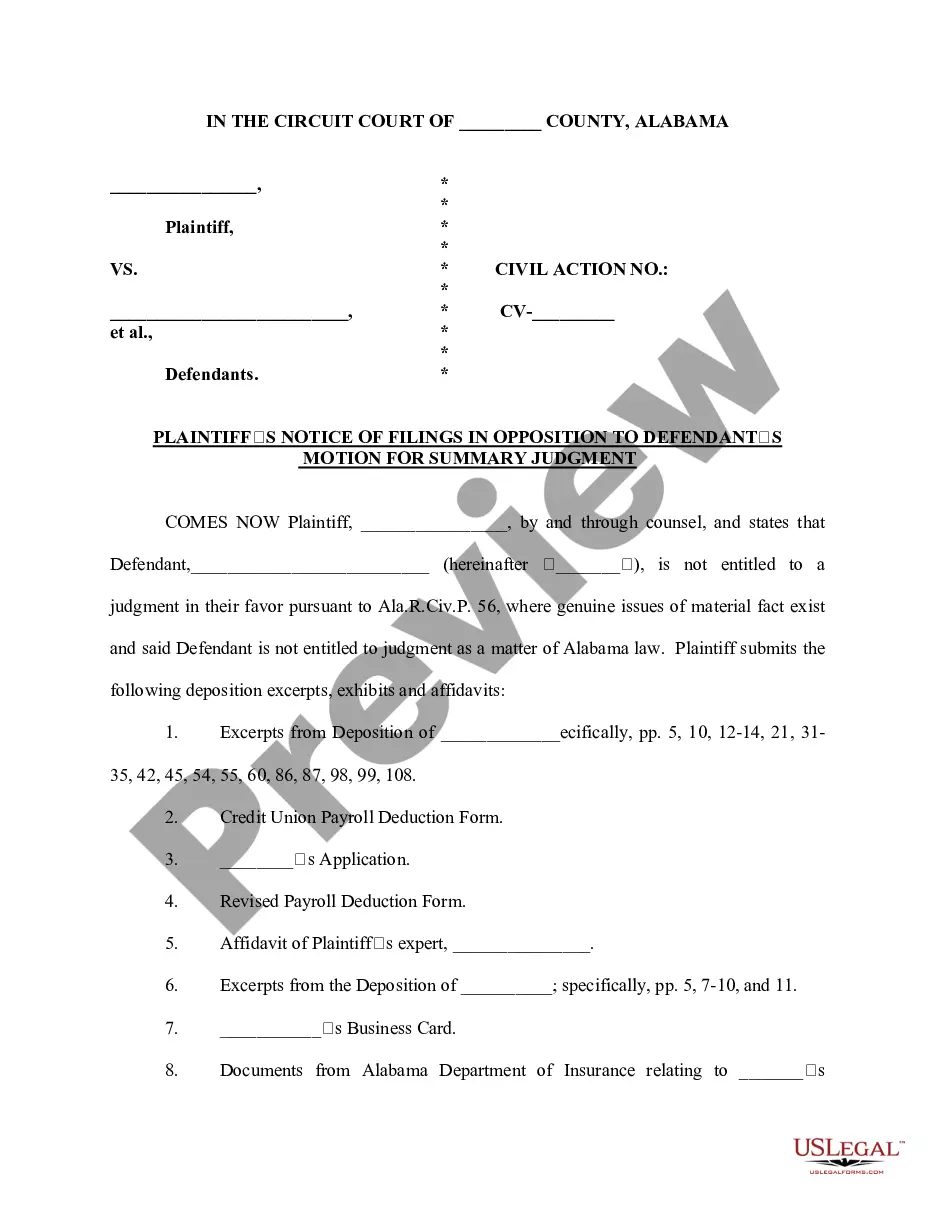

- Initially, be sure that you have selected the best papers template to the county/town of your choice. Look at the kind description to make sure you have chosen the correct kind. If offered, make use of the Review switch to appear throughout the papers template at the same time.

- If you wish to locate an additional variation from the kind, make use of the Lookup area to get the template that meets your needs and needs.

- Once you have identified the template you would like, click on Buy now to proceed.

- Choose the pricing program you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal bank account to pay for the legitimate kind.

- Choose the structure from the papers and obtain it in your product.

- Make adjustments in your papers if required. You are able to total, modify and indicator and printing Hawaii Partnership Agreement for Corporation.

Acquire and printing 1000s of papers templates using the US Legal Forms web site, which provides the largest collection of legitimate varieties. Use professional and state-particular templates to handle your small business or individual needs.