Subject: Comprehensive Guide to Understanding Hawaii Sample Letter for Review of Form 1210 Dear [Recipient's Name], I hope this letter finds you well. As a resident or a business entity in the beautiful state of Hawaii, you may come across various legal processes and documentation requirements. One such crucial document is the Hawaii Sample Letter for Review of Form 1210. In this detailed description, we will shed light on its purpose, significance, and the different types it may have. Form 1210 serves as a vital tool in the state's legal system, enabling individuals and organizations to submit a request for review and analysis of their specific circumstances. This form plays a crucial role in ensuring compliance with Hawaii's tax laws and helping taxpayers efficiently address any concerns or disputes they may have regarding their tax filings. The Hawaii Sample Letter for Review of Form 1210 is primarily utilized to request a reassessment, review, or reconsideration of a previously submitted tax return or assessment issued by the Hawaii Department of Taxation. By employing this letter of review, taxpayers can present their case, outline their position, and provide supporting evidence to substantiate their claims. Different types of Hawaii Sample Letters for Review of Form 1210 may vary based on the scope and nature of the taxation issue, such as: 1. Income Tax Review Letters: These letters focus on contested income tax filings and are typically used when disputing the accuracy of reported income, deductions, exemptions, or credits. 2. Sales and Use Tax Review Letters: These letters specifically address disputes related to sales and use taxes, such as discrepancies in reported sales figures, taxable purchases, or exemptions claimed. 3. Property Tax Review Letters: Property owners or businesses challenging property tax assessments can utilize this letter to request a review of their property's appraised value, exemptions, or classifications. 4. Corporate/Partnership Tax Review Letters: Primarily applicable to businesses, these letters are used to contest corporate or partnership tax assessments, deductions, or other tax-related matters. To ensure a successful review process, individuals or businesses filing a Hawaii Sample Letter for Review of Form 1210 should impart vital details, including their contact information, taxpayer identification number, specific tax periods under review, the reason for the dispute, and a summary of supporting evidence. It is crucial to submit the letter within the designated timeline, adhering to the guidelines provided by the Department of Taxation, to avoid potential delays or the rejection of your request due to procedural issues. In conclusion, the Hawaii Sample Letter for Review of Form 1210 is an essential tool for taxpayers seeking to address taxation concerns and resolve disputes in an effective and prompt manner. By providing a comprehensive overview, outlining the various types of review letters, and highlighting crucial submission guidelines, we aim to assist individuals and businesses in navigating the process with ease and maximizing the chances of a favorable outcome. Thank you for taking the time to read this detailed description. Should you require any further assistance or clarification regarding the Hawaii Sample Letter for Review of Form 1210, please feel free to contact our dedicated team of experts. Best regards, [Your Name]

Hawaii Sample Letter for Review of Form 1210

Description

How to fill out Hawaii Sample Letter For Review Of Form 1210?

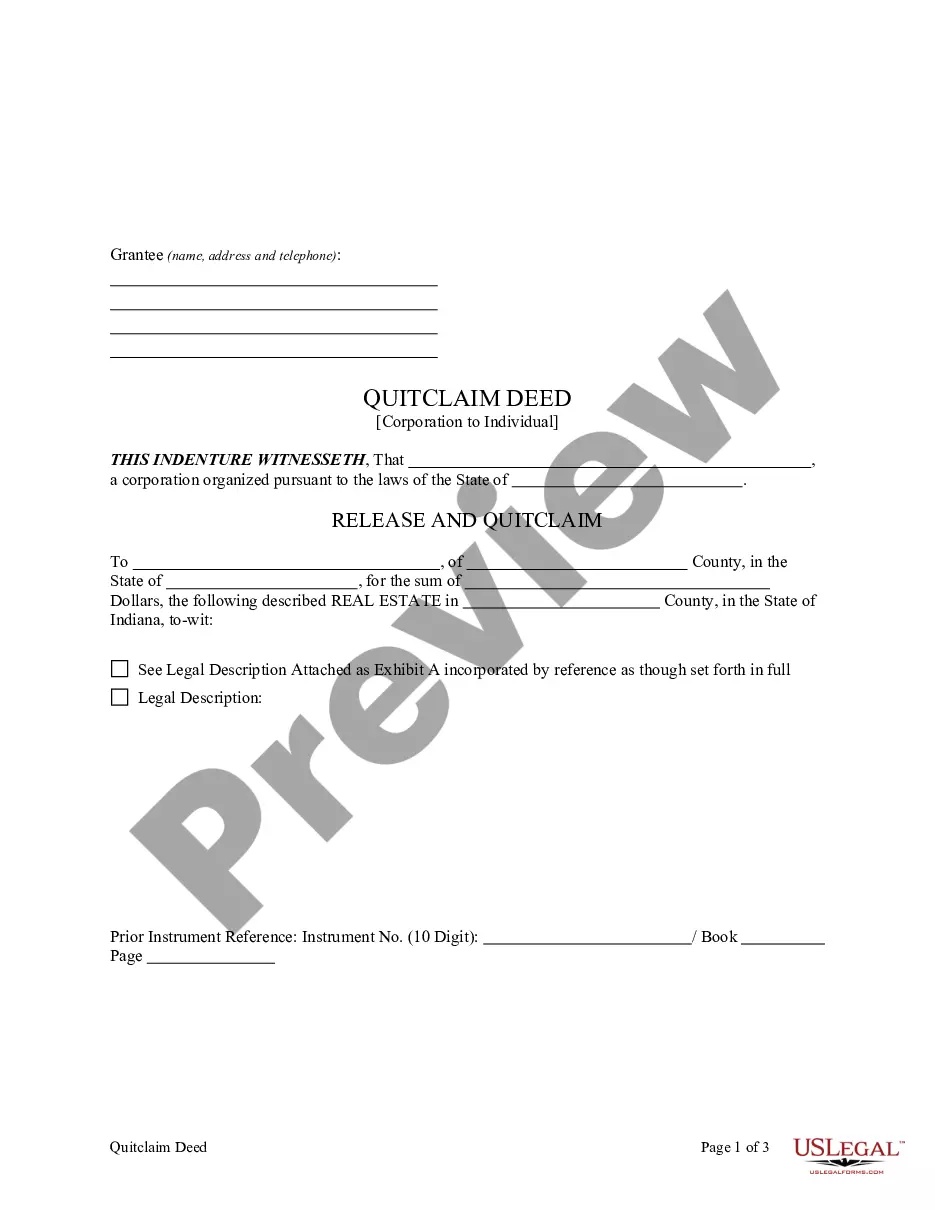

Discovering the right legitimate record format might be a battle. Of course, there are a variety of layouts available on the net, but how do you discover the legitimate kind you require? Utilize the US Legal Forms web site. The assistance offers thousands of layouts, like the Hawaii Sample Letter for Review of Form 1210, that you can use for organization and personal needs. Each of the types are examined by pros and satisfy federal and state requirements.

In case you are already signed up, log in for your profile and then click the Obtain button to get the Hawaii Sample Letter for Review of Form 1210. Make use of your profile to check through the legitimate types you have bought previously. Proceed to the My Forms tab of your profile and get another backup of your record you require.

In case you are a brand new consumer of US Legal Forms, listed below are easy instructions so that you can follow:

- First, be sure you have chosen the right kind to your town/region. It is possible to examine the form while using Preview button and study the form outline to ensure this is basically the right one for you.

- In the event the kind fails to satisfy your expectations, utilize the Seach field to get the correct kind.

- Once you are sure that the form is acceptable, click the Buy now button to get the kind.

- Opt for the prices prepare you need and enter the needed information. Make your profile and pay for the transaction making use of your PayPal profile or Visa or Mastercard.

- Opt for the submit file format and acquire the legitimate record format for your product.

- Complete, change and printing and indication the attained Hawaii Sample Letter for Review of Form 1210.

US Legal Forms is the most significant library of legitimate types in which you can find numerous record layouts. Utilize the service to acquire expertly-made paperwork that follow express requirements.