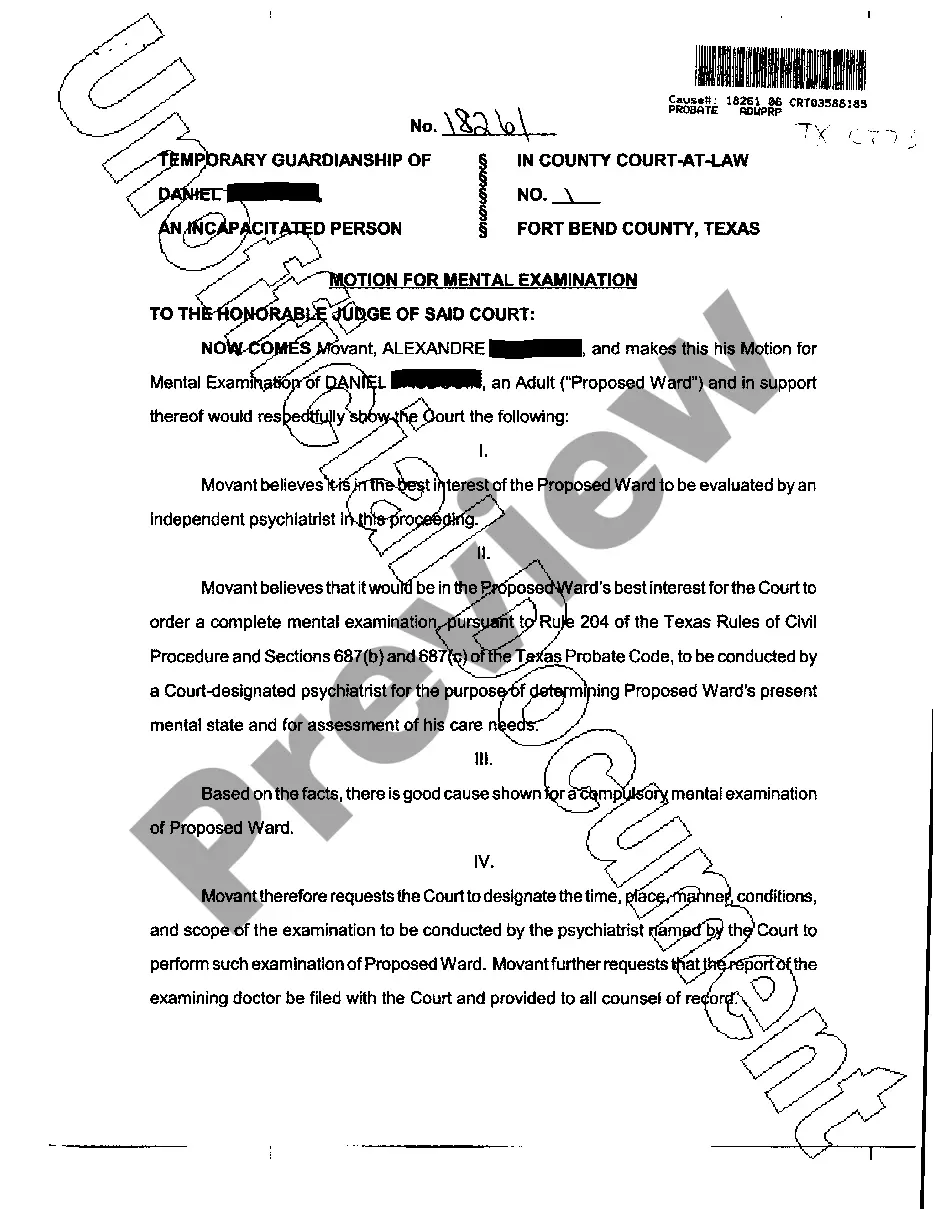

The Hawaii Notice of Redemption of Preferred Stock is a legal document that provides detailed information regarding the redemption process of preferred stock in the state of Hawaii. This document is essential for both the issuing company and the shareholders, as it outlines the terms and procedures involved in redeeming preferred stock. Keywords: Hawaii, Notice of Redemption, Preferred Stock, legal document, redemption process, issuing company, shareholders, terms, procedures. There are two main types of Hawaii Notice of Redemption of Preferred Stock that are commonly used: 1. Voluntary Redemption: This type of redemption occurs when the issuing company initiates the redemption process, typically to restructure its capital or fulfill certain provisions stated in the preferred stock agreement. The Hawaii Notice of Redemption in such cases provides specific details about the redemption date, redemption price, and any applicable notices or conditions to be met by the shareholders. 2. Mandatory Redemption: This type of redemption is triggered by predetermined conditions specified in the preferred stock agreement. For example, the agreement may stipulate that the preferred stock must be redeemed after a certain time period or upon the occurrence of specific events. In this case, the Hawaii Notice of Redemption of Preferred Stock would outline the mandatory redemption date, redemption price, and any other relevant instructions to be followed by the involved parties. Overall, the Hawaii Notice of Redemption of Preferred Stock serves as a crucial legal document that ensures transparency and clarity throughout the redemption process. It safeguards the rights of both the issuing company and the shareholders and prevents any misunderstandings or disputes that may arise during the redemption of preferred stock in the state of Hawaii.

Hawaii Notice of Redemption of Preferred Stock

Description

How to fill out Hawaii Notice Of Redemption Of Preferred Stock?

If you wish to comprehensive, acquire, or printing legal papers themes, use US Legal Forms, the biggest selection of legal varieties, which can be found on the Internet. Take advantage of the site`s simple and practical look for to obtain the documents you want. A variety of themes for enterprise and individual uses are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to obtain the Hawaii Notice of Redemption of Preferred Stock with a few clicks.

When you are presently a US Legal Forms client, log in for your bank account and then click the Acquire switch to find the Hawaii Notice of Redemption of Preferred Stock. Also you can access varieties you previously saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for that proper metropolis/nation.

- Step 2. Make use of the Preview solution to look over the form`s information. Do not overlook to read through the explanation.

- Step 3. When you are unsatisfied with the develop, use the Lookup discipline towards the top of the monitor to locate other versions of the legal develop web template.

- Step 4. Upon having found the form you want, click on the Purchase now switch. Pick the rates prepare you like and put your accreditations to register on an bank account.

- Step 5. Process the transaction. You should use your bank card or PayPal bank account to perform the transaction.

- Step 6. Find the file format of the legal develop and acquire it on the product.

- Step 7. Complete, revise and printing or indicator the Hawaii Notice of Redemption of Preferred Stock.

Every legal papers web template you purchase is your own property for a long time. You may have acces to each and every develop you saved in your acccount. Select the My Forms area and pick a develop to printing or acquire again.

Remain competitive and acquire, and printing the Hawaii Notice of Redemption of Preferred Stock with US Legal Forms. There are millions of skilled and status-distinct varieties you may use for your enterprise or individual needs.

Form popularity

FAQ

Redemption Value of the Company Preferred Stock means the aggregate amount of all payments that would be required to be made by the Company if the Company were to redeem the Company Preferred Stock effective as of the Closing Date.

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock.

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving it the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

The redemption feature essentially places redeemable preferred stock somewhere on the continuum between equity and debt. It pays dividends, as do other forms of equity, but it may also be bought back by the issuer, which is a characteristic of debt.

Redemption or Repurchase of Preferred Stock: If a company repurchases its preferred stock, it would debit (decrease) the ?preferred stock? account and credit (decrease) the cash account for the repurchase price.

Redemption rights are sometimes referred to ?put rights,? meaning the preferred stock investors have the right to ?put? its shares to the company. A ?put? in finance is the right to sell a security (usually stock) to another party at a certain price.

The liquidation value of preferred stock can depend on several factors, including the total value of the company at the time of liquidation. An important factor to remember is that owners of preferred stock must be the first paid upon liquidation of a company.

Series E Preferred Shares means the Series E redeemable convertible preferred shares, par value of US$0.001 per share, issued by the Company pursuant to the Series E Share Purchase Agreement.