Hawaii Agreement to Partition Real Property Between Children of Decedent

Description

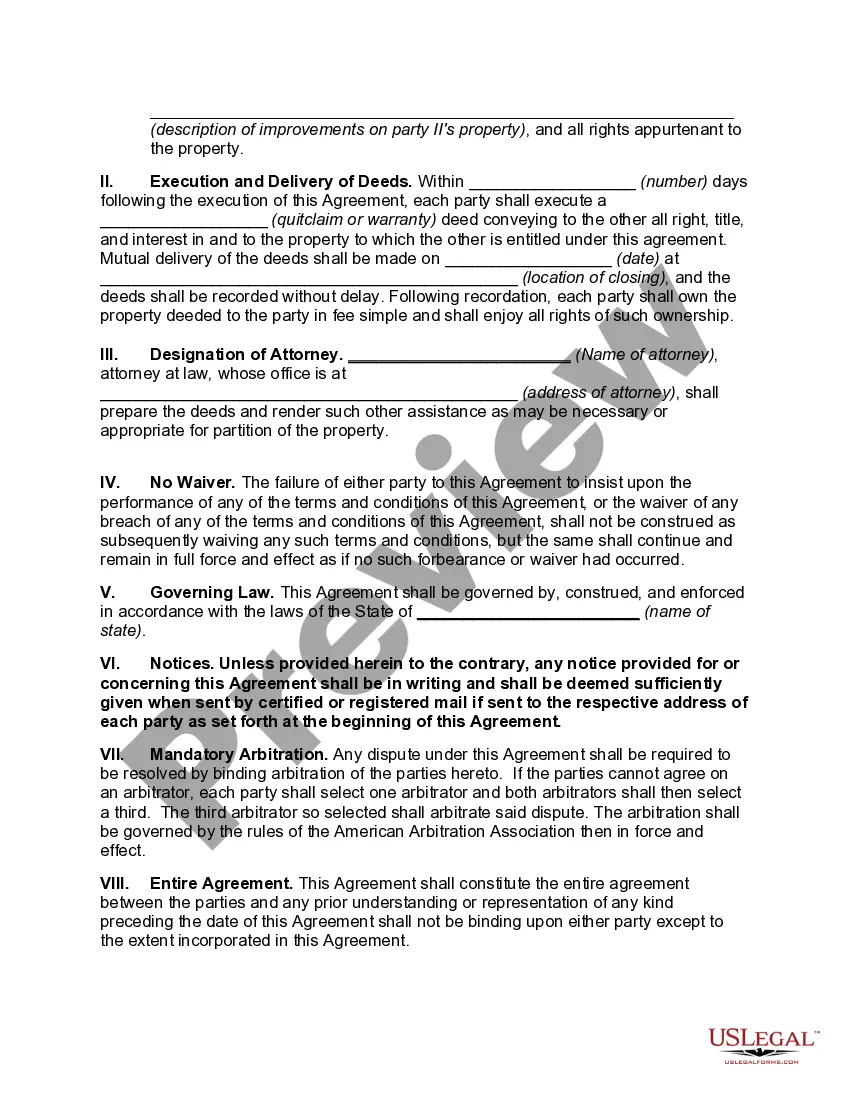

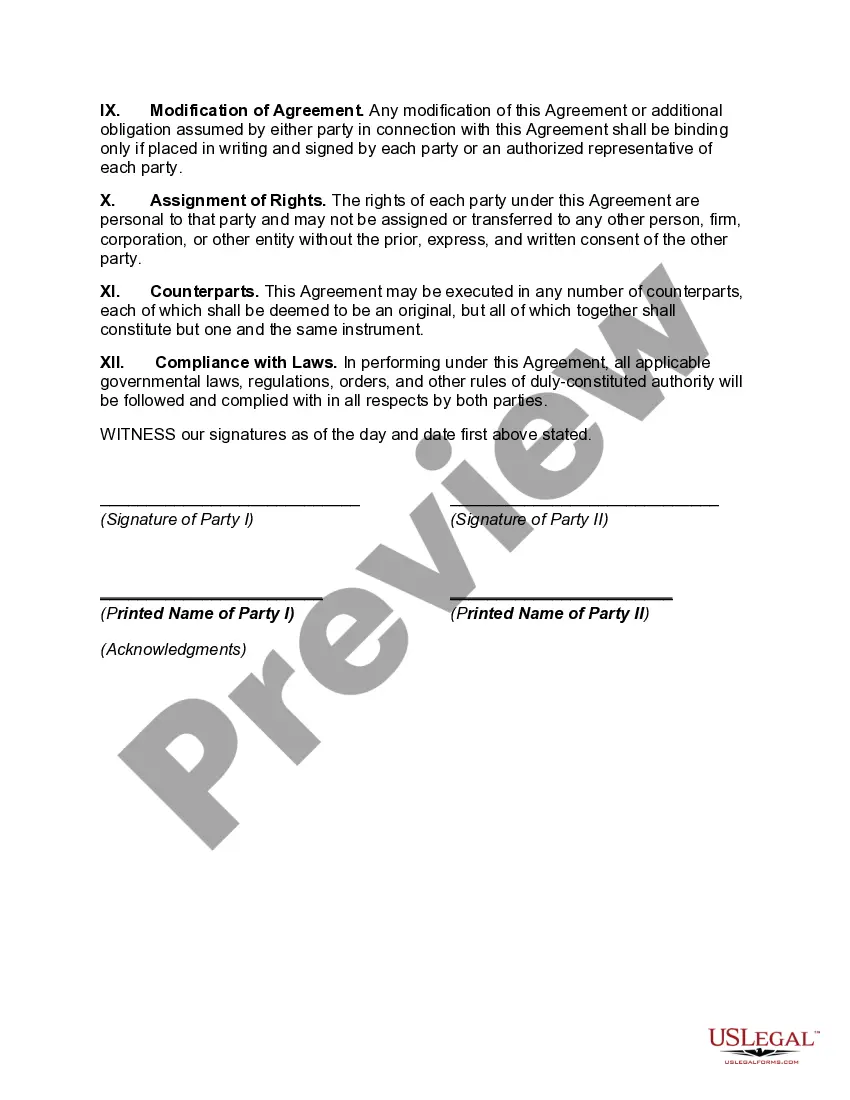

How to fill out Agreement To Partition Real Property Between Children Of Decedent?

If you have to total, obtain, or produce authorized file layouts, use US Legal Forms, the biggest collection of authorized kinds, that can be found on-line. Make use of the site`s easy and hassle-free look for to obtain the papers you will need. A variety of layouts for business and person functions are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Hawaii Agreement to Partition Real Property Between Children of Decedent in a handful of clicks.

In case you are previously a US Legal Forms customer, log in for your accounts and then click the Down load key to find the Hawaii Agreement to Partition Real Property Between Children of Decedent. Also you can gain access to kinds you formerly saved in the My Forms tab of your accounts.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that correct town/nation.

- Step 2. Take advantage of the Review method to examine the form`s content material. Do not forget about to read through the explanation.

- Step 3. In case you are not satisfied with all the form, utilize the Lookup discipline on top of the screen to find other versions of your authorized form format.

- Step 4. Upon having identified the shape you will need, go through the Purchase now key. Select the costs prepare you choose and put your qualifications to sign up to have an accounts.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the formatting of your authorized form and obtain it on your own system.

- Step 7. Full, modify and produce or indicator the Hawaii Agreement to Partition Real Property Between Children of Decedent.

Each authorized file format you get is the one you have forever. You may have acces to every form you saved inside your acccount. Select the My Forms section and pick a form to produce or obtain again.

Remain competitive and obtain, and produce the Hawaii Agreement to Partition Real Property Between Children of Decedent with US Legal Forms. There are many professional and express-specific kinds you may use for your personal business or person requires.

Form popularity

FAQ

Iowa is the only Midwest state with this law, which passed in 2018. Other states that have passed the UPHPA are Alabama, Arkansas, Connecticut, Georgia, Hawaii, Montana, Nevada, New Mexico, Texas and South Carolina.

Pursuant to §668 of Title 36 of the Hawaii Code, a co-owner may file a partition action with the circuit court in the county where the property is located. Both joint tenants and tenants in common have the right to pursue partition, which essentially terminates the co-owner relationship.

The law allows for three types of partition: (1) Partition by Physical Division, (2) Partition by Sale, and (3) Partition by Appraisal. A Partition by Physical Division, also known as a ?Partition in Kind,? requires the Court to divide the land proportionally based on its value.

A partition suit is an effective remedy for resolving real estate ownership disputes, particularly ones in which co-owners cannot agree on whether to sell or keep a piece of property.

The Uniform Partition of Heirs Property Act (UPHPA) helps preserve family wealth passed to the next generation in the form of real property. If a landowner dies intestate, the real estate passes to the landowner's heirs as tenants-in-common under state law.

Parties who jointly own acres of farmland, for example, can seek partition so that each winds up with an equal number of acres separately owned. Parties who own land have an absolute right to seek partition of the property unless that right has been restricted by law, written waiver, or a provision in a will.

A California partition action happens when one co-owner of real property wants to sell but other co-owners do not want to sell their ownership rights. Partition means division. The opposing co-owners have the absolute right by law to divide the property and sell their portion with the legal remedy of ?Partition?.

The key to winning a partition action is to get as organized as possible. Maintain all relevant documentation. Having all your ducks in a row can more likely help win a partition action. Stay Organized: Stay organized keeping all documents that pertain to the ownership of land or business.