A Hawaii Independent Contractor Services Agreement with Accountant is a legally binding contract that outlines the terms and conditions between an independent contractor and an accountant in the state of Hawaii. This agreement governs the working relationship and ensures that both parties understand their rights and responsibilities. In this agreement, the independent contractor is a professional accountant who provides accounting services to clients on a contract basis. The agreement establishes the scope of work, duration of the contract, compensation terms, and other important provisions to protect both parties' interests. Some common provisions typically included in a Hawaii Independent Contractor Services Agreement with Accountant are: 1. Identification of the Parties: The agreement will state the legal names and addresses of both the independent contractor and the accountant. 2. Services Provided: The agreement will specify the accounting services that the independent contractor will provide to the accountant's clients. This may include bookkeeping, tax preparation, financial statement creation, audit assistance, and other related services. 3. Compensation: The agreement will outline the payment terms, such as the hourly rate or a flat fee, based on the services provided. It may also include provisions for reimbursement of any approved expenses incurred during the course of work. 4. Duration and Termination: The agreement will specify the start and end date of the contract, along with the terms for early termination, including any notice periods required by either party. 5. Confidentiality: The agreement may include confidentiality clauses to protect sensitive financial information obtained during the contract period. 6. Intellectual Property: If the independent contractor creates any intellectual property during the engagement, ownership rights should be clearly defined in the agreement. 7. Independent Contractor Status: The agreement will clarify that the independent contractor is not an employee but an independent contractor. This is crucial for tax and liability purposes. 8. Indemnification and Liability: The agreement may include provisions outlining the extent of liability and the responsibility for any damages caused by negligence or breach of agreement. 9. Governing Law and Dispute Resolution: The agreement will specify that it is governed by the laws of Hawaii and outline procedures for resolving any potential disputes, such as mediation or arbitration. Types of Hawaii Independent Contractor Services Agreements with Accountant may vary depending on the specific accounting services provided or the nature of the engagement. Some examples include: 1. Tax Preparation Agreement: This agreement specifically focuses on tax-related services, such as preparing and filing income tax returns for individuals or businesses. 2. Bookkeeping Services Agreement: This agreement focuses on providing bookkeeping services, such as maintaining financial records, reconciling accounts, and generating financial reports. 3. Financial Statement Preparation Agreement: This agreement is centered around the development and review of financial statements, including balance sheets, income statements, and cash flow statements. 4. Audit and Assurance Services Agreement: This agreement pertains to engagements where the independent contractor assists in auditing and providing assurance to financial statements or internal controls. It is important for both parties to carefully review and understand the terms of the Hawaii Independent Contractor Services Agreement with Accountant before signing. Consulting with legal or accounting professionals is advised to ensure compliance with all applicable laws and regulations.

Hawaii Independent Contractor Services Agreement with Accountant

Description

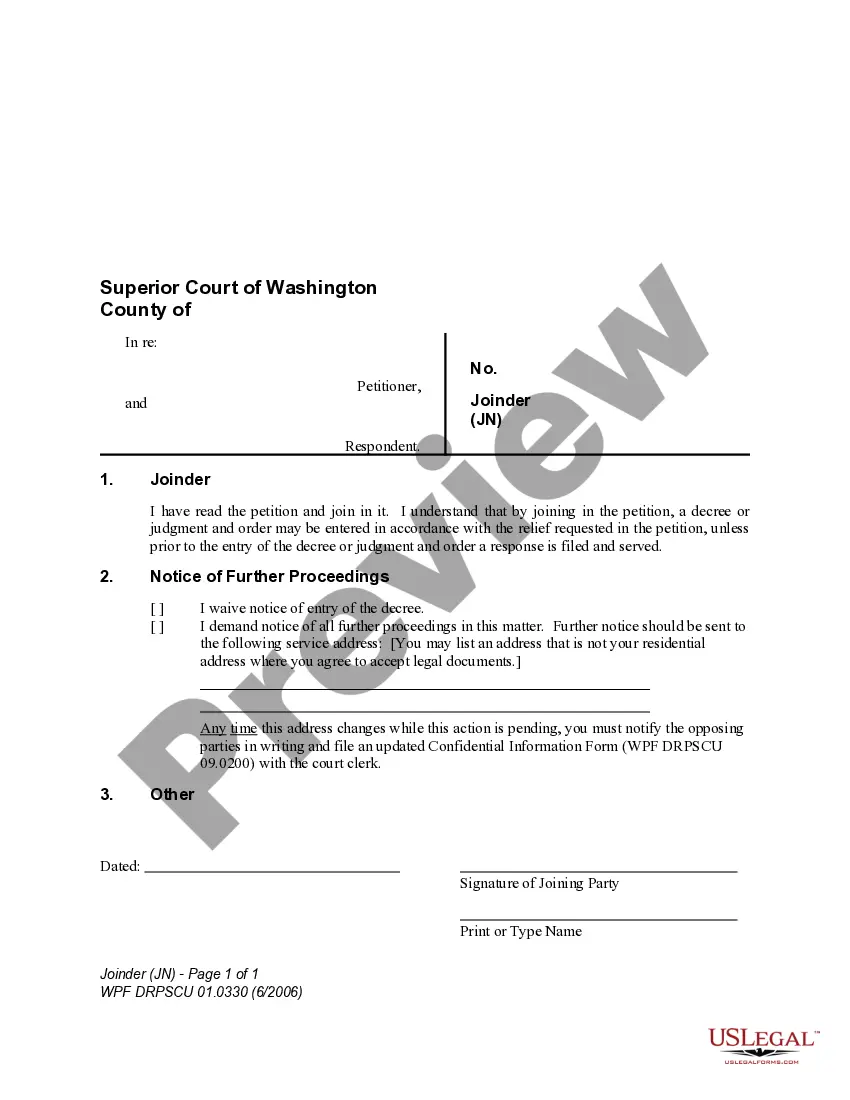

How to fill out Hawaii Independent Contractor Services Agreement With Accountant?

Choosing the right authorized record web template might be a battle. Obviously, there are plenty of templates available on the net, but how will you discover the authorized kind you will need? Use the US Legal Forms website. The service delivers thousands of templates, for example the Hawaii Independent Contractor Services Agreement with Accountant, which can be used for company and private requirements. All the types are examined by experts and meet federal and state demands.

Should you be currently signed up, log in to the account and click the Download switch to obtain the Hawaii Independent Contractor Services Agreement with Accountant. Utilize your account to look with the authorized types you might have ordered in the past. Go to the My Forms tab of your respective account and have an additional version of the record you will need.

Should you be a fresh user of US Legal Forms, here are straightforward guidelines for you to adhere to:

- Initially, ensure you have selected the right kind for the area/area. You can examine the shape utilizing the Preview switch and browse the shape outline to guarantee this is the right one for you.

- In case the kind does not meet your preferences, use the Seach industry to find the right kind.

- When you are certain that the shape is suitable, go through the Buy now switch to obtain the kind.

- Opt for the prices program you desire and enter the required details. Design your account and pay money for the transaction utilizing your PayPal account or charge card.

- Pick the document file format and obtain the authorized record web template to the device.

- Total, change and produce and sign the received Hawaii Independent Contractor Services Agreement with Accountant.

US Legal Forms will be the most significant local library of authorized types for which you can see numerous record templates. Use the company to obtain appropriately-produced files that adhere to express demands.