A Hawaii Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that establishes a pension plan for employees in the state of Hawaii, with a corporate trustee appointed to oversee and administer the plan. This trust agreement provides a framework for managing the pension funds and ensuring their proper distribution to plan participants upon retirement. One type of Hawaii Trust Agreement for Pension Plan with Corporate Trustee is the Defined Benefit Plan. This type of plan guarantees a specific amount of retirement benefits to the plan participants, usually based on factors such as the employee's salary, years of service, and age at retirement. The corporate trustee ensures that the pension fund is adequately funded and manages the investments to generate sufficient returns to meet the plan's obligations. Another type is the Defined Contribution Plan, such as a 401(k) or a 403(b) plan. In this type of plan, both the employer and the employee contribute to the pension fund, typically through regular payroll deductions. The corporate trustee oversees the investment options available to the plan participants and ensures that the contributions are invested wisely. The retirement benefits in such plans are based on the contributions made and the investment performance over time. The Hawaii Trust Agreement for Pension Plan with Corporate Trustee outlines the responsibilities and duties of the corporate trustee, including the management of the pension fund, record-keeping, communication with plan participants, and compliance with applicable laws and regulations. It ensures that the trustee acts in the best interests of plan participants and fulfills its fiduciary duties. The agreement also includes provisions for plan amendments, termination, and the process for selecting and replacing the corporate trustee. It may specify the compensation structure for the trustee and define the rights and obligations of plan participants. In summary, a Hawaii Trust Agreement for Pension Plan with Corporate Trustee is a crucial document that establishes the framework for managing and distributing retirement benefits to employees in Hawaii. Whether it is a Defined Benefit or a Defined Contribution Plan, the trustee plays a pivotal role in safeguarding the pension fund and ensuring the financial security of plan participants.

Hawaii Trust Agreement for Pension Plan with Corporate Trustee

Description

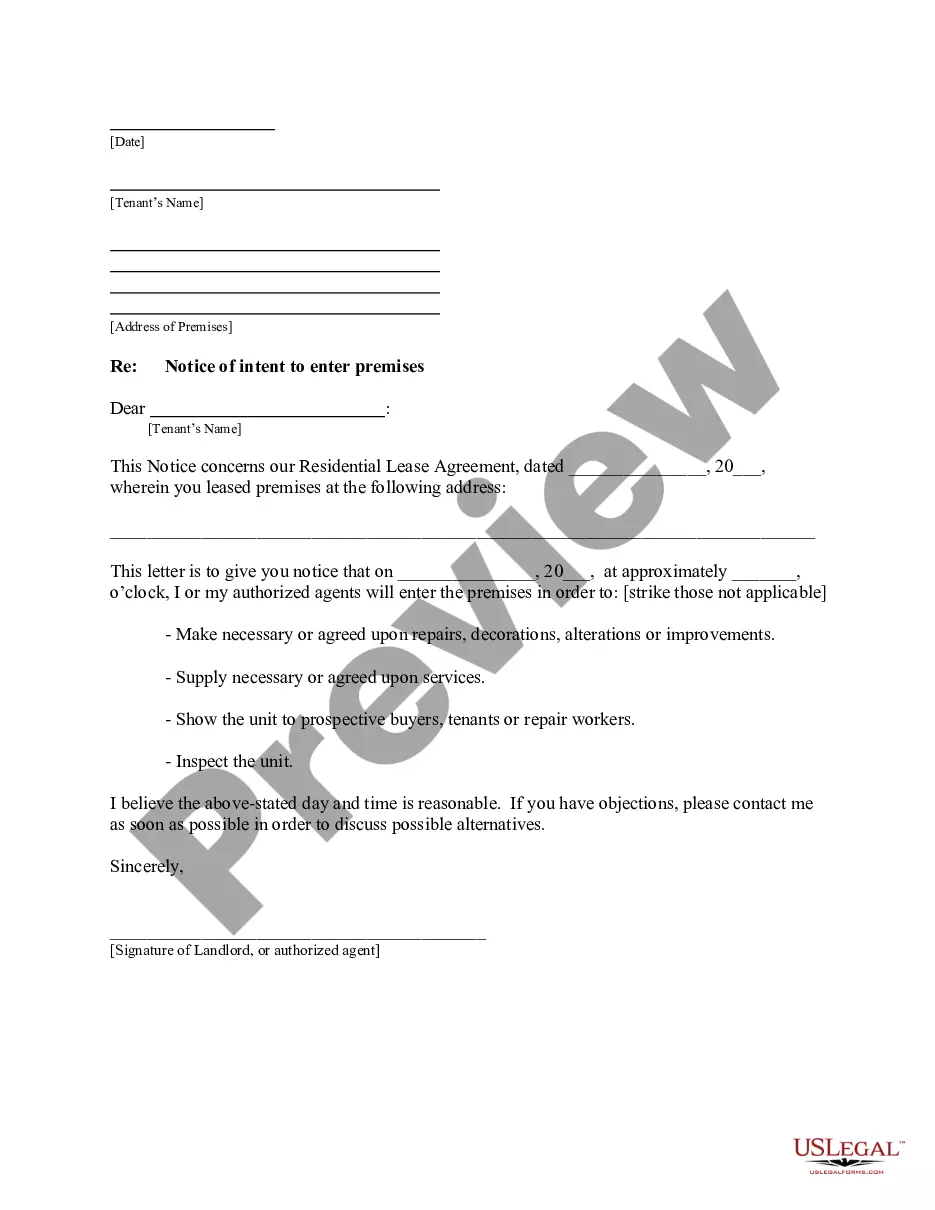

How to fill out Hawaii Trust Agreement For Pension Plan With Corporate Trustee?

US Legal Forms - one of many largest libraries of lawful varieties in the United States - delivers a wide array of lawful document templates you can obtain or produce. Utilizing the site, you will get a large number of varieties for enterprise and person uses, categorized by groups, states, or key phrases.You can find the most recent models of varieties just like the Hawaii Trust Agreement for Pension Plan with Corporate Trustee in seconds.

If you currently have a subscription, log in and obtain Hawaii Trust Agreement for Pension Plan with Corporate Trustee from your US Legal Forms library. The Download switch can look on every single form you look at. You have access to all in the past delivered electronically varieties from the My Forms tab of your respective profile.

If you wish to use US Legal Forms the first time, listed here are basic directions to obtain started out:

- Ensure you have picked the proper form for your personal metropolis/county. Click the Preview switch to review the form`s information. Read the form information to actually have chosen the proper form.

- In the event the form doesn`t match your requirements, take advantage of the Look for area near the top of the display to find the one that does.

- Should you be pleased with the form, affirm your choice by clicking on the Get now switch. Then, choose the pricing program you favor and offer your qualifications to register for an profile.

- Method the purchase. Make use of your charge card or PayPal profile to perform the purchase.

- Pick the file format and obtain the form on the gadget.

- Make adjustments. Load, change and produce and sign the delivered electronically Hawaii Trust Agreement for Pension Plan with Corporate Trustee.

Each design you put into your bank account lacks an expiration date and is your own forever. So, if you would like obtain or produce another version, just check out the My Forms section and click about the form you want.

Gain access to the Hawaii Trust Agreement for Pension Plan with Corporate Trustee with US Legal Forms, one of the most extensive library of lawful document templates. Use a large number of professional and status-particular templates that meet up with your business or person requirements and requirements.

Form popularity

FAQ

Corporate trust services can provide assistance with both the issuance and administration of corporate debt. Corporate trusts might distribute the interest payments from the corporation to the bondholders and ensure that the issuer is adhering to the covenants of the bond agreement.

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

As trusteeEven if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire or investment experience to manage your trust yourself. Or perhaps you just feel that someone with more time and experience could do a better job than you.

The negatives for appointing a relative as a trustee are lack of expertise investing money. This could lead to losses if the person tries to beat index funds by day trading or moves all assets into one investment like gold. Family conflict is another risk.

What is a corporate trustee?Gain the advantage of years of experience.Enjoy the potential of even greater investment returns.Protect your wealth.Receive reliable, professional service.Benefit from their objectivity.Tap into their rich sources of advice and referrals.Enjoy peace of mind.

Advantages of a Trust include that: limited liability is possible if a corporate trustee is appointed. the structure provides more privacy than a company. there can be flexibility in distributions among beneficiaries.

trustee is a person or entity that serves as a legal owner of trust property. They hold and administers the property for the advantage of named beneficiaries. Trusts are created by property owners, aka grantor, trustor, or settlor. A property owner can be one individual or many, in the case of joint ownership.

More info

Estate planning is not the primary focus of our business, but our services will keep you safe and protected throughout your long life, as your heirs will require a good estate plan. You may be able to save tens, hundreds or thousands of dollars by choosing to have a professional estate planner. Having us serve as your legal representative may be able to save your money when you may be passing. You may also be able to protect the estate by providing for your heirs what is really important for your care, not to mention the benefits of having a good estate plan. Our estate planning services will also enhance your legacy by insuring that your loved ones are protected from harm and provide financial stability when passing. Our family estate planning service can be provided by a family member if you wish to transfer control and control for the purpose of estate planning. The Family Estate Planning Services are to be provided by another person, not your partner.