Hawaii Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Selecting the finest valid documents template can be a challenge.

Clearly, there are numerous templates accessible online, but how do you find the valid format you require.

Utilize the US Legal Forms website.

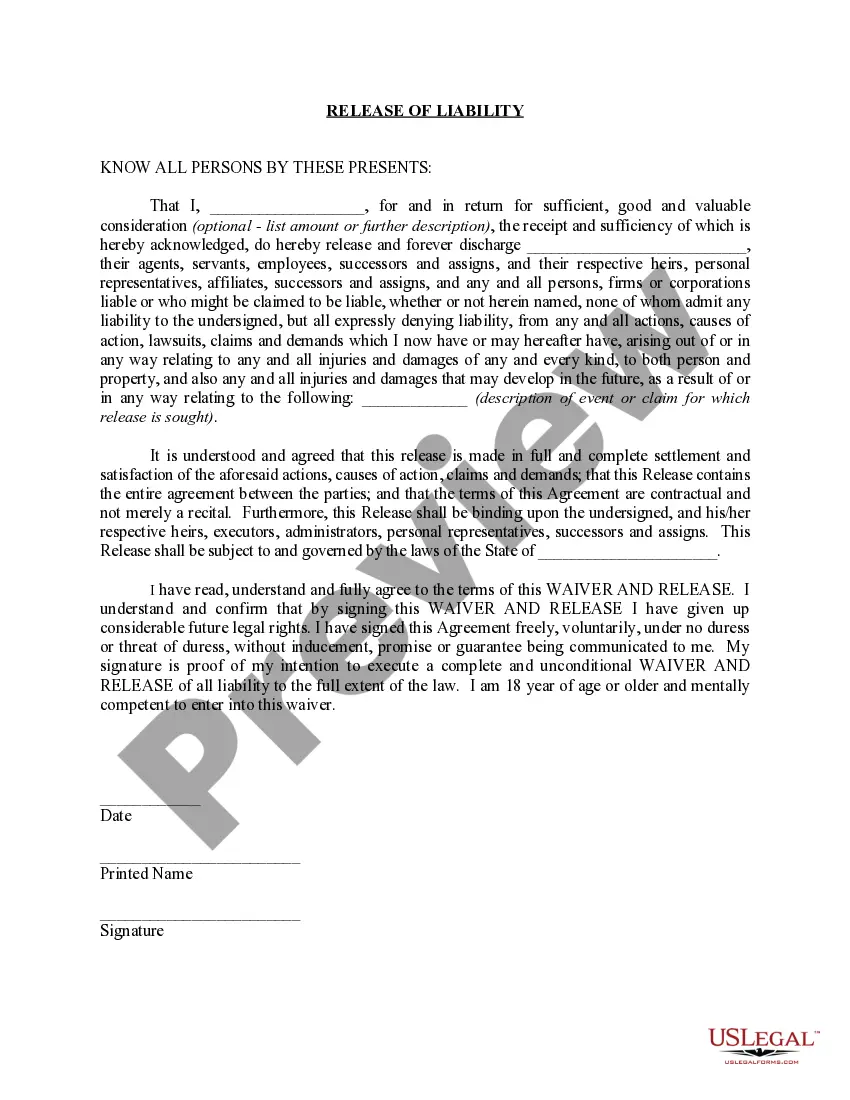

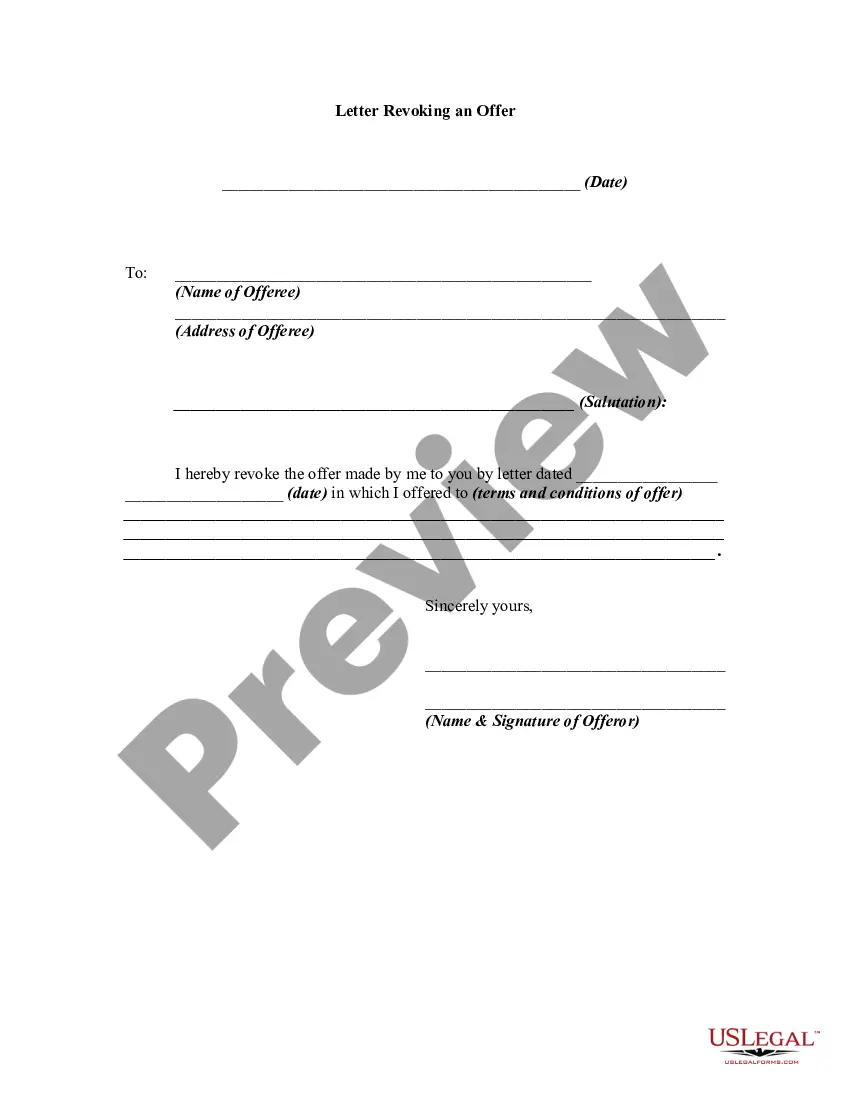

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. When you are certain that the form is accurate, click the Buy now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Hawaii Private Annuity Agreement. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download properly drafted documents that adhere to state requirements.

- The service offers thousands of templates, such as the Hawaii Private Annuity Agreement, which can be utilized for business and personal purposes.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Hawaii Private Annuity Agreement.

- Use your account to search through the legal forms you have purchased previously.

- Go to the My documents tab of your account and retrieve another copy of the document you need.

Form popularity

FAQ

SCHEDULE JAIDS.Angina Pectoris.Appendicitis.Arteriosclerosis.Baldness.Blindness.Bronchial Asthma.Cancer and Benign tumour.More items...?01-Apr-2012

More In Forms and Instructions Use Schedule J (Form 1040) to elect to figure your income tax by averaging, over the previous 3 years (base years), all or part of your taxable income from your trade or business of farming or fishing.

Annuity payments you or your survivors receive after the total cost in the plan has been recovered are generally fully taxable.

The money invested in an annuity grows tax-deferred. When the money is withdrawn, the amount contributed to the annuity will not be taxed, but earnings will be taxed as regular income. There is no contribution limit for an annuity.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Use Schedule J (Form 1040) to elect to figure your income tax by averaging, over the previous 3 years (base years), all or part of your taxable income from your trade or business of farming or fishing.